Kwarkot/iStock via Getty Images

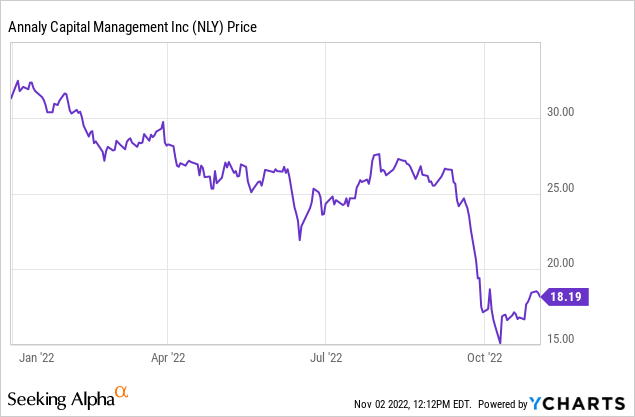

Buffeted by rapidly rising mortgage rates, Annaly’s (NLY) stock price and book value have been falling this year as the market value of securities held on the books have declined. The company suffered a GAAP loss of $0.70 a share in the September quarter, and had to execute a 1-for-4 reverse split to keep its stock price in double digits.

However, the underlying assets, mostly mortgage loans guaranteed by government agencies, are still good. Earnings available for distribution rose to $1.06 in the September quarter, providing 1.2 times coverage of the dividend. That sparked a relief rally in the stock.

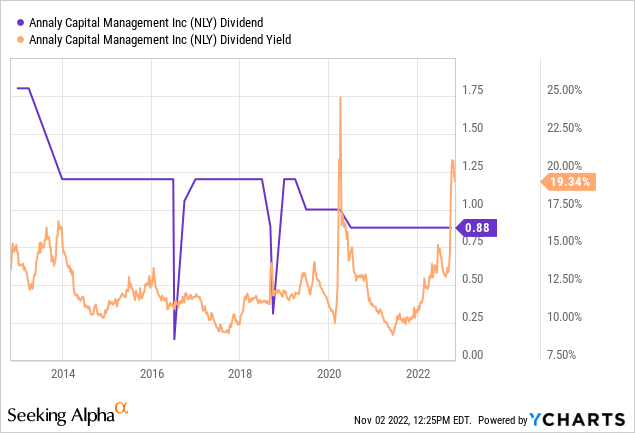

The dividend yield is a sky-high 19%. However, leverage has been creeping up, there is credit risk on the relatively small non-agency portion of the portfolio, and as with any stock yielding close to 20% there is a risk of a dividend cut. As the chart shows, Annaly is subject to vertigo-inducing fluctuations in its dividend and dividend yield, but the overall trend has been down.

More my speed as a retired investor are the preferred issues. I’ve owned various series, some of which have been called, since before the 2008 financial crisis. They have never stopped paying dividends and aren’t likely to, since the common dividend would have to be cut to zero first.

Currently, there are three preferred series trading, all of which are cumulative and are converting from fixed- to floating-rate payments according to the terms under which they were issued. Annaly Capital Management 6.95% Series F (NYSE:NLY.PF) was first to make the switch, on September 30. Before that, it paid a 6.95% coupon rate at the $25 liquidation preference price.

The prospectus states:

On and after September 30, 2022 (the “Floating Rate Period”), dividends on the Series F Preferred Stock will accumulate at a percentage of the $25.00 liquidation preference equal to an annual floating rate of the Three-Month LIBOR Rate plus a spread of 4.993%. Dividends on the Series F Preferred Stock will accumulate daily and be cumulative from, and including, the date of original issue and will be payable quarterly in arrears on the last day of each March, June, September and December.”

A year ago, with short-term rates stuck near zero, it looked like the floating payment would be a dud. But since then the three-month LIBOR rate has jumped to 4.36%, which if it was the quarterly average would mean a yield of 9.35% at the reference price of $25.

It gets even better because the stock is under $25, so new investors would be in line for a small capital gain if the company decides to call it. At the recent price of $24, the forward yield would be 9.75%. That figure won’t show up on stock screens, though, since no floating dividends have been paid yet. The first payment under the new system is set for December 30.

A negative for taxable accounts is that REIT preferred dividends do not qualify for reduced-rate tax treatment. (I hold mine in a tax-deferred account).

The other two issues are:

Series G, which pays 6.5%, converting to LIBOR plus 4.172% on March 31, 2023.

Series I, which pays 6.75%, converting to LIBOR plus 4.989% on June 30, 2024.

| Original Coupon | Recent Price | Dividend | Fwd. yield | Notes | |

| NLY.PF | 6.95% | 24 | 2.34* | 0.0975 | Converted 9/30/22 to LIBOR plus 4.993% |

| NLY.PG | 6.50% | 20.87 | 1.63 | 0.0781 | Converts 3/31/23 to LIBOR plus 4.172% |

| NLY.PI | 6.75% | 20.63 | 1.69 | 0.0819 | Converts 6/30/24 to LIBOR plus 4.989% |

| *Floating dividend calculated using recent LIBOR rate. | |||||

Source: Author’s spreadsheet

As you can see, the estimated yield on the F series is more than 150 basis points higher than the other two. As series G and I reach their conversion dates, their prices should rise, all other factors staying the same.

LIBOR is in the process of being discontinued by authorities in the United Kingdom, and financial instruments based on it most likely will be switched by regulators to the New York Fed’s Secured Overnight Finance Rate (SOFR), which is usually close to Fed funds.

Conclusion

NLY.PF provides a good way to earn a nearly 10% yield that puts investors on the side of the Fed as it raises rates.

Be the first to comment