South_agency

Anheuser-Busch InBev (BUD) is one of the world’s largest alcoholic beverage companies by market capitalization. The company owns a diverse group of brands, allowing it to appeal to different consumer subsets. The company operates across the globe, with significant exposure to regions such as North America, South America, Europe, and South Africa.

Despite Anheuser-Busch’s illustrious operational setup, we believe the company is starting to lag behind the broader sectors’ growth and doesn’t provide full value to its investors. We are not bearish on the stock; however, we assign a hold rating until we feel shareholders’ residual value reaches a desirable level.

Here are a few things we picked up while analyzing Anheuser-Bush’s stock.

Anheuser-Bush InBev

Industry Growth Rate Disparity

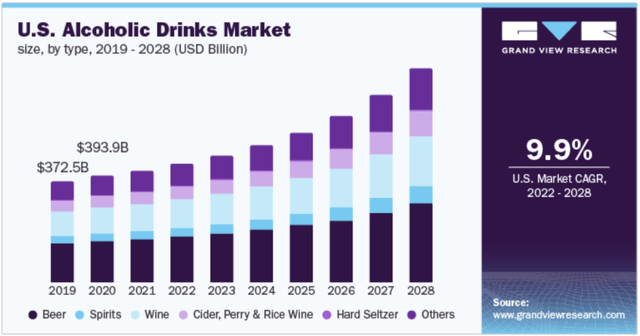

The global alcoholic beverage market is set to proliferate at a compound annual growth rate of 10.3% until 2028. Additionally, the U.S. market is forecasted to grow at an annual rate of 9.9%, indicating that the world’s largest economy supports the sector.

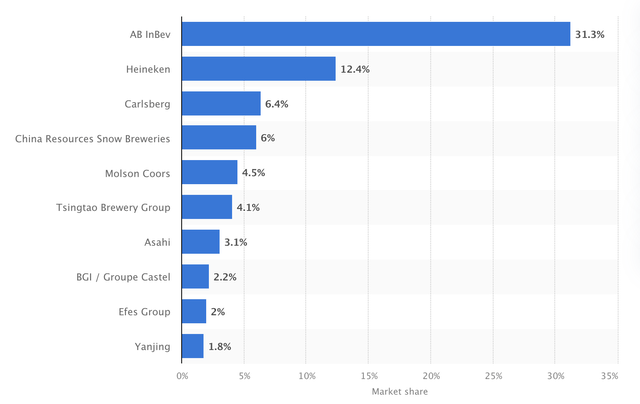

Anheuser-Busch’s growth trajectory does not mimic that of the industry, with its short and long-term annual growth rates lagging behind the industry. Despite the company’s 31.3% market share in the beer market, which is growing at 7% per year, Anheuser’s growth remains underwhelming.

| 3-Y CAGR | 2.95% |

| 5-Y CAGR | 1.51% |

| 10-Y CAGR | 3.70% |

Source: Seeking Alpha

It might seem counterintuitive that a market leader within an industry would grow slower than the broader industry. However, in our opinion, there is a simple explanation for this.

Companies often build up inefficiencies whenever they enter “empire-building mode”. At times, firms will develop inefficiencies when they become overly diversified, especially when they acquire horizontally or traverse into a conglomerate.

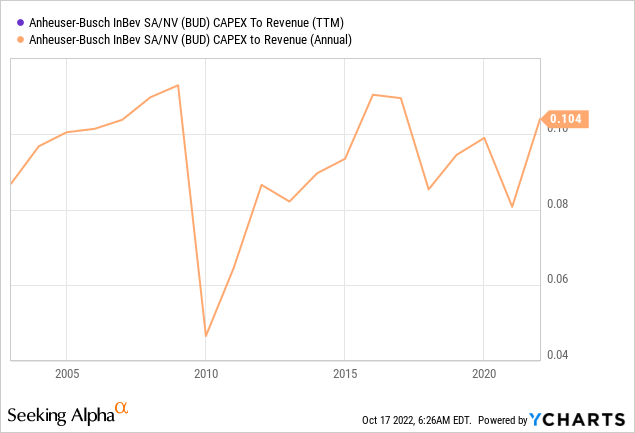

We are not fully sure that the above is the reason why Anheuser-Busch’s growth has slowed. However, Anheuser-Busch’s CapEx-to-revenue growth (past 10 years) and its questionable return on invested capital of (5.62%), suggests that we may well be correct.

Although Anheuser-Busch exhibits a slowing long-term trajectory, the company produced stellar second-quarter results, likely driven by the pandemic’s reopening effect.

During its second quarter, Anheuser-Busch delivered year-over-year revenue growth of 9.2%, backed by strong B2B digital platform development. Approximately 55% of the company’s sales are digitally-driven B2B; we believe increasing digitalization adds efficiency to the company’s supply chain.

The company’s global brand sales are doing well, with 9.7% growth, led by rising demand for Stella Artois, Budweiser, and Corona. The following opinion is anecdotal, but I’ve definitely realized Stella and Corona’s rise in popularity in recent years; will it continue? I don’t know, but I can only say that they are good products that don’t necessarily break the bank.

Anheuser-Busch’s short-term results have been impressive. Nonetheless, our concern lies within its long-term trajectory as we feel it could deliver better growth than it recently has.

Valuation Concerns And Slow Dividends

Anheuser-Busch’s valuation metrics don’t make for good reading if you’re a value investor. In our opinion, the stock’s price-to-book and price-to-cash flow ratios are both at unfavorable levels. Although the stock’s price-to-earnings ratio is at a 24.66% discount to its 5-year average, we don’t see this as being enough to change our opinion about the stock’s relative value.

| Price-to-Earnings | 16.33x |

| Price-to-Book (fwd) | 1.25x |

| Price-to-Cash Flow | 11.19x |

Source: Seeking Alpha

Furthermore, we believe that Anheuser-Busch’s dividend profile is underwhelming. For example, Anheuser-Busch’s dividend payout of 20.38% can be considered low for a company that possesses a dividend coverage ratio of 4.45x.

| Dividend Yield | 1.16% |

| Payout Ratio | 20.38% |

| Dividend Coverage Ratio | 4.45x |

Source: Seeking Alpha

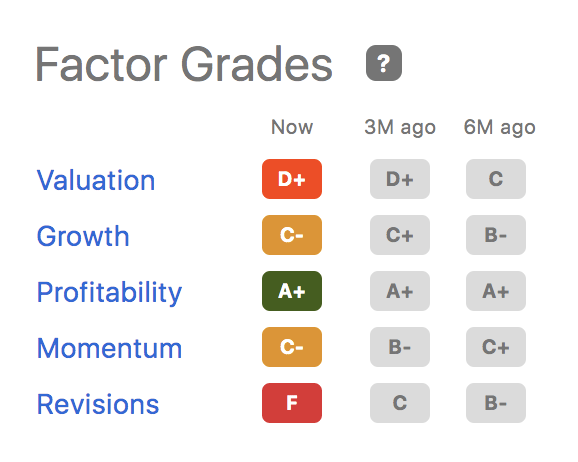

Factor Analysis

Factor grades provide an interesting juxtaposition as Anheuser-Busch is considered a poor-value asset; however, its profitability is ranked highly. Quality (highly profitable companies) stocks could be favorable in today’s market as risk-off sentiment is prevalent.

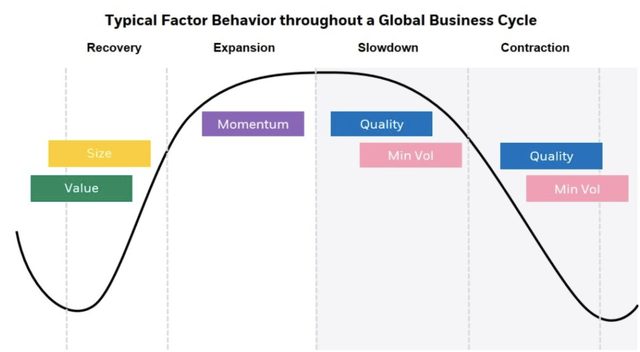

Profitability reveals robustness, and robustness/quality is favored whenever the market’s in trying conditions (see the succeeding diagram). Thus, we think Anheuser-Busch’s profitability ranking could be a tremendous value-add in today’s market environment.

Seeking Alpha BlackRock; Harvest

Concluding Thoughts

Based on our analysis, Anheuser-Busch does not provide the necessary value to its shareholders for it to be classified as a buy. We are not overly pessimistic about the company’s stock; however, we are firm on our stance that sub-industry standard growth, moderate valuation metrics, and a poor dividend package provide cause for concern.

Be the first to comment