Alfio Manciagli

It’s been a rough year thus far for the Gold Miners Index (GDX), and the sector-wide selling pressure has not spared AngloGold Ashanti (NYSE:AU). This is evidenced by a 30% decline year-to-date, following a 7% decline last year, attributed to a temporary shut down at its Obuasi Mine after a tragic geotechnical accident in Q2 2021. Unfortunately, AngloGold recently received what could be an additional dose of negative news, with the potential for a cloudier permitting outlook for its Colombia development portfolio. While it’s unclear how a new presidency will affect its advanced assets in the country, a hardline stance on new mine construction would dent the stock’s growth profile and investment thesis.

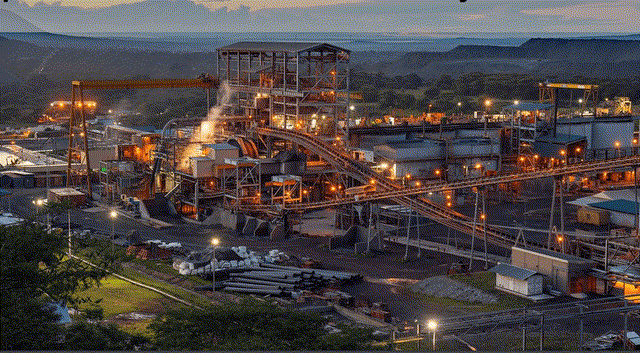

AngloGold Operations (Company Presentation)

Just over five months ago, I wrote on AngloGold Ashanti (“AngloGold”), noting that while its valuation was improving, the stock was in a precarious position technically, with no strong support until $14.60 per share. Since then, the stock has slid over 20% and has violated key support in the $14.60 region. Meanwhile, its development pipeline could become much less robust if we see a stricter stance on new mine construction in Colombia. The good news is that this negative development looks mostly priced into the stock, with AngloGold trading at less than 4x cash flow with little value ascribed for its development pipeline.

Colombian Election

For those unfamiliar, Gustavo Petro won the Colombia election last month and is the first leftist leader to be elected in Colombia, edging out his opponent Rodolfo Hernandez. He has called for a halt to all new oil exploration and also discussed banning large-scale open-pit mining, though it’s not clear whether this will apply to current projects or just stop new projects from being constructed. Fortunately, Colombian mines currently in operation are underground (Buritica, Marmato, and Segovia) and should not be affected. Still, we could see stricter rules for these assets going forward.

Gramalote

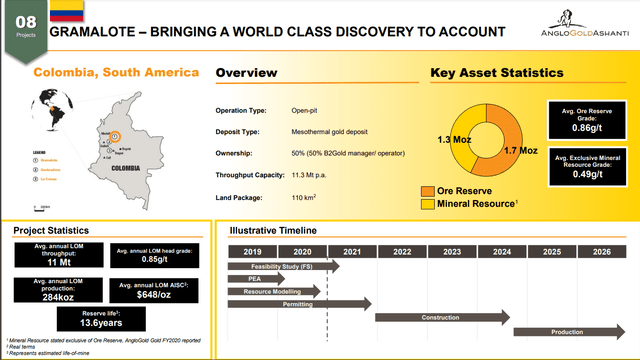

Regarding AngloGold, the company owns a 50% interest in the Gramalote Project in Colombia (120 kilometers northeast of Medellin), a proposed open-pit project that I would consider large scale. This is because its annual throughput rate is expected to come in at 11 million tonnes per annum, making it one of the larger gold mines globally if it were in production today (30,000 tonnes per day). While slightly behind schedule with a Feasibility Study due at year end, Gramalote was expected to move into production by 2026, assuming the timely receipt of permits.

Gramalote Project (Company Presentation)

Based on AngloGold’s 50% weighting, this was expected to be a major contributor for the company, with first-five year average production of ~350,000 ounces at sub $700/oz all-in sustaining costs (~175,000 ounces attributable to AngloGold). Not only are these costs well below the industry average (FY2022 estimates: $1,290/oz), but they’re ~45% below AngloGold’s FY2022 cost guidance mid-point of $1,360/oz. Hence, while the project would have been a moderate needle-mover from an output standpoint (~6.5% growth), it would have had a meaningful effect on AngloGold’s industry-lagging margins.

Given that Gramalote is not only an open-pit project but also a development project, the medium-term future of this asset doesn’t look very bright under Gustavo Petro’s four-year term. This means a degradation in the project’s NPV (5%) attributable to AngloGold, as the first production appears to be pushed out to 2030 at the earliest vs. a previous plan of 2026.

Quebradona

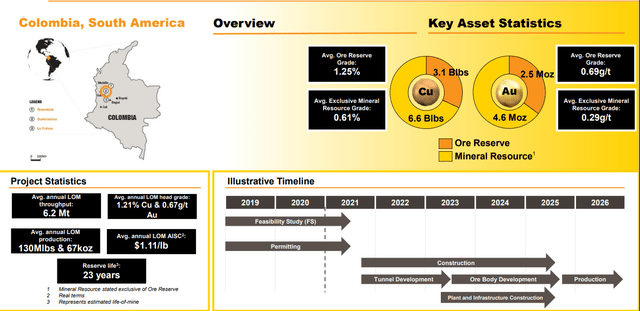

Moving over to AngloGold’s Quebradona Project, it’s in the Cauca Region, 60 kilometers southwest of Medellin, and is 100% owned. This project was expected to be a significant contributor to the company’s production profile, with the potential to produce ~140 million pounds of copper and 70,000 ounces of gold for the first ten years, or the equivalent of over 360,000 ounces of gold per annum. The costs at this project also were forecast to be industry-leading, with average all-in sustaining costs below $1.20/lb copper.

Quebradona Project (Company Presentation)

Quebradona was unique in that it had some of the highest copper reserve grades of any development project, and it sported a 20+ year mine life. Over the mine life, production was forecasted at ~3.0 billion pounds of copper, 1.4 million ounces of gold, and ~22 million ounces of silver. The construction period was estimated at four years, meaning that once permitting is in place, it will still be nearly five years before production begins. As we can see, the previous outlook was a 2026 start, but this is not looking to be the case anymore.

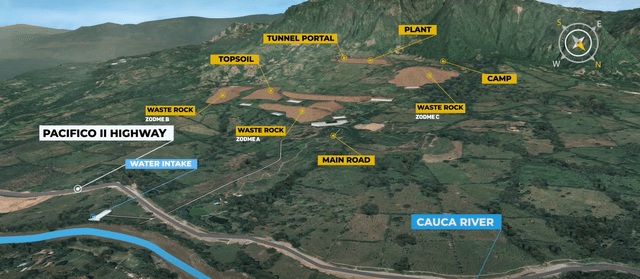

Fortunately for Quebradona, it’s expected to be an underground operation, not falling under Petro’s proposed open-pit mining ban. However, it’s already struggling to advance through permitting, with the recent refusal to reopen the application to the environmental license for the asset by Colombia’s National Environmental Agency [ANLA]. Hence, adding a new President with a stricter stance on mining will not likely make permitting much easier for this project. As it stands, AngloGold must file a new environmental impact assessment if it wishes to go ahead with permitting the project.

Quebradona Project Layout (Company Website)

After adding together the two production profiles and the estimated production start from AngloGold’s 2021 Capital Markets Day, these assets were expected to combine for ~170,000 ounces of gold and over 150 million pounds of copper per annum for its first five years, or ~500,000 gold-equivalent ounces (GEOs). Just as importantly, these ounces were expected to be produced at industry-leading costs (sub $700/oz Gramalote, sub $1.20/lb Quebradona), providing a nice boost to AngloGold’s margin profile. However, with production from these projects looking less likely this decade, the company’s growth/margin profile is much less impressive.

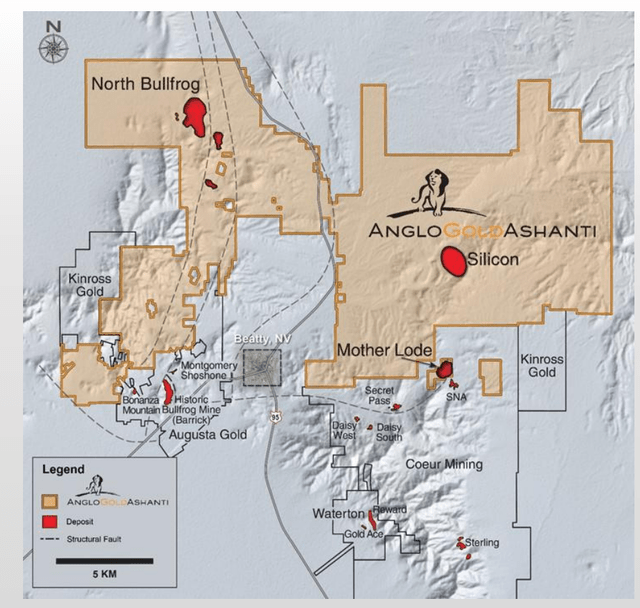

Some investors will argue that the Nevada opportunity is significant, with Merlin, Silicon, and North Bullfrog potentially combining for 300,000 ounces of annual gold production later this decade. However, I would be shocked to see a 300,000-ounce production rate from Nevada reached before 2028, with the first production from North Bullfrog likely in 2026, followed by Silicon and Merlin if the current plans remain in place. While this would partially offset the contribution from the Colombian development assets, I wouldn’t expect as robust a margin profile. Besides, it might be a ~300,000-ounce contribution by 2029 vs. ~500,000 GEOs for Quebradona/Gramalote combined in the first five years by 2027.

Nevada Project Potential (Company Presentation)

In my view, the negative news out of Colombia is a downgrade to the investment thesis. Having said that, if we were to see less of a hardline stance on mining, such as we’ve seen in Peru under Pedro Castillo, this wouldn’t be as big a deal to AngloGold. However, while current open-pit mining might remain in production, I’m less optimistic about new projects that require permits, which applies to Gramalote (AngloGold 50% ownership). So, if AngloGold is looking for growth, it will need to rely on Obuasi Phase 3 (5,000 tonnes per day), which is only an incremental 1,000 tonnes per day on top of its planned Phase 2 ramp-up (Q3 2022), and Nevada (post-2025 opportunity).

AngloGold vs. Peers

Following the amalgamation of Agnico Eagle (AEM) and Kirkland Lake and the Northern Star (OTCPK:NESRF) / Saracen merger, the 1.50+ million-ounce producer space finally has an upgraded growth profile. This is because both companies appear capable of growing production up to 30% by the end of the decade from 2022 levels, assuming they can execute successfully on their projects. Being a higher-cost producer with operations in Africa, AngloGold has been a less desirable pick relative to Northern Star and Agnico, with the other two benefiting from better margins and more attractive jurisdictions.

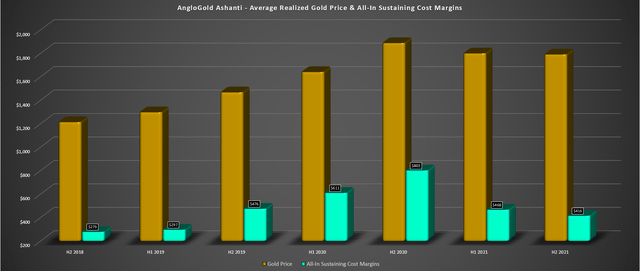

AngloGold – AISC Margins (Company Filings, Author’s Chart)

However, with AngloGold sporting a decent growth profile as well, coupled with future margin expansion, it wasn’t a bad option for patient investors, with the possibility for the rare combination of margin expansion plus higher production. This would be helped by the much lower expected costs at Gramalote and diversification into a green metal, copper, with ~70% plus margins at Quebradona ($4.00/lb copper price).

Unfortunately, without this growth profile (depending on developments in Colombia), I see AngloGold being more similar to Kinross (KGC), having limited growth this decade, slightly higher costs than peers, and weaker margins. So, while both are cheap, they are lower-quality than Agnico and Northern Star. The reason is that while they may have more leverage to a higher gold price due to their cost profile, they lack production growth, meaning they must rely on a higher gold price to grow earnings materially.

In the case of Agnico and Northern Star, the higher production profile will allow them to grow earnings and dividends without help from the gold price, making them more attractive names for investment (steadily growing annual earnings and cash flow per share). Investors could argue that AngloGold Ashanti is cheap enough that the potential for limited growth is baked into its valuation, and I would agree. Still, I prefer to own the best names in a sector with the strongest track records and margins, and with Quebradona/Gramalote, AngloGold had a bright future. However, with uncertainty around these assets, I’m less optimistic about the long-term outlook. Let’s take a look at AU’s valuation:

Valuation and Technical Picture

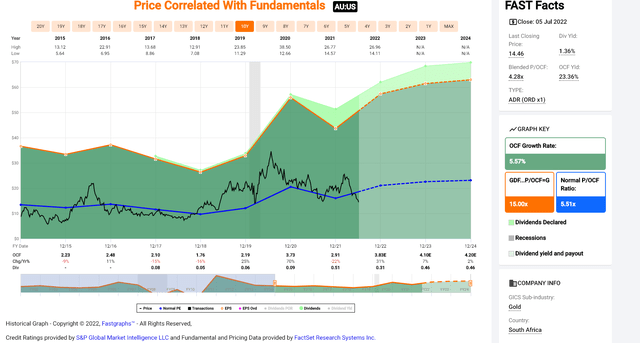

Looking at the chart below, AngloGold has historically traded at ~5.50x operating cash flow and currently trades at just 3.5x FY2023 cash flow estimates at a share price of $14.45. Even if using a more conservative FY2023 cash flow figure of $3.95 and a more conservative cash flow multiple of 5.0, the stock appears to have a meaningful upside to a fair value of $19.75. However, regarding industry laggards, I prefer a minimum 30% discount to fair value to justify starting new positions. After applying this 30% discount to AngloGold, this translates to a low-risk buy zone of $13.85 or lower, 4% below current levels.

AngloGold Ashanti – Historical Cash Flow Multiple (FASTGraphs.com)

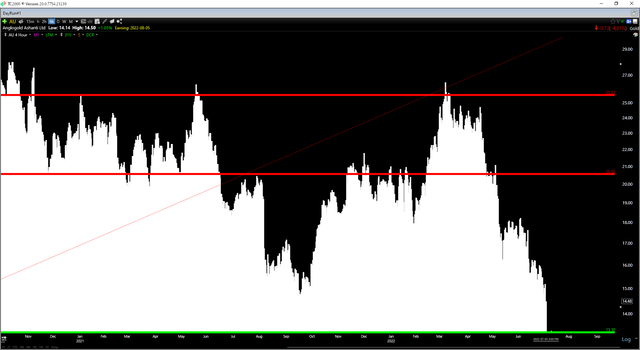

The good news is that while AngloGold may not be in a low-risk buy zone from a valuation standpoint, the technical picture shows that AngloGold is sitting just above a key support area at $13.30. When buying miners due to their volatility, I prefer to buy within 5% of major support levels, suggesting a low-risk buy zone of $13.95 or lower. So, if AngloGold were to continue to correct, the stock should offer a low-risk swing-trading entry for nimble traders, which also lines up pretty closely with its low-risk buy zone from a valuation standpoint.

AU Daily Chart (TC2000.com)

Summary

AngloGold Ashanti is arguably the most impacted gold producer from the Colombia Election, assuming the proposed open-pit mining ban comes to pass. Having said that, with the stock down 48% in less than 80 trading days, much of this negativity looks priced into the stock, and it’s nearing a key support level at $13.30. So, if I were looking to start a long position in the stock, any pullback below $13.95 would represent a relatively low-risk entry point. However, with AU being a higher-cost producer (~$1,500/oz all-in costs), I think there are far more attractive and safer bets elsewhere in the sector.

Be the first to comment