biffspandex/E+ via Getty Images

Investing in the bond market can be a complex endeavor, particularly when dealing with non-traditional assets like fallen angel bonds. These bonds, originally issued with investment-grade ratings, have been downgraded to high-yield or “junk” status, often due to the issuer’s financial difficulties. As a result, they offer the potential for higher returns, but also come with increased risk.

One of the primary vehicles for investing in this sector is the VanEck Fallen Angel High Yield Bond ETF (NASDAQ:ANGL). This exchange-traded fund, or ETF, seeks to replicate the price and yield performance of the ICE US Fallen Angel High Yield 10% Constrained Index, which is comprised of U.S. dollar-denominated fallen angel bonds.

I think this is an interesting fund that covers a part of the market to consider AFTER a major credit dislocation takes place, which I still suspect is nearer than people think given the lagged effects of the fastest rate hike cycle in history.

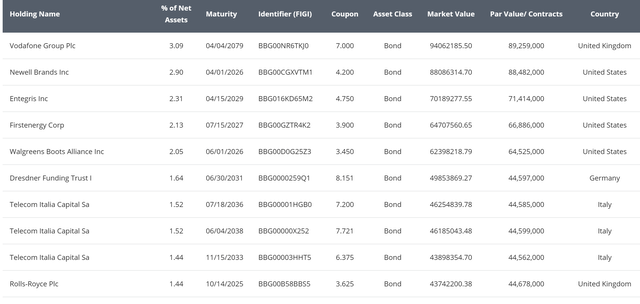

ETF Holdings

ANGL’s portfolio comprises fallen angel bonds issuers across various sectors. No single position makes up a large weighting of the fund, making this well diversified overall.

Sector Composition and Weightings

The sector composition of ANGL provides an interesting insight into the fund’s strategic allocation. The sectors with the most significant representation in the fund include:

-

Consumer Cyclicals: Representing a sizeable chunk of the portfolio, this sector includes companies whose revenues and profits are directly influenced by the fluctuating economic cycle.

-

Technology: Another major sector in the portfolio, it comprises companies developing and providing technological products and services.

-

Energy: This sector, consisting of companies involved in oil, gas, and renewable energy production, also contributes significantly to the portfolio.

-

Industrials: This sector encompasses a broad range of companies involved in manufacturing, construction, and distribution, among other activities.

-

Financials: This sector, including banks, insurance companies, and investment firms, also forms a considerable part of the portfolio.

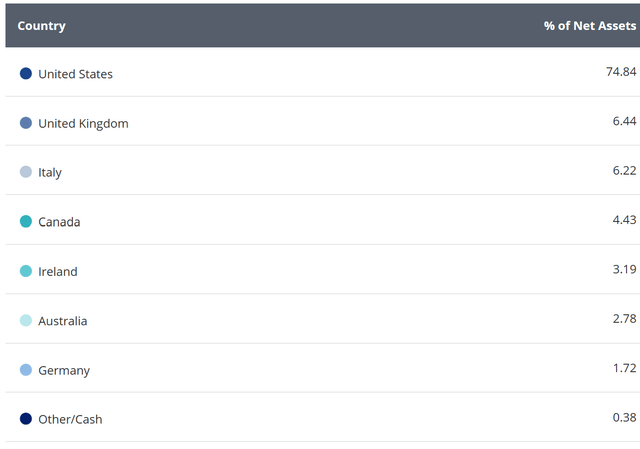

This is primarily U.S. centric, with 74% of the holdings here, and the remainder overseas.

Peer Comparison

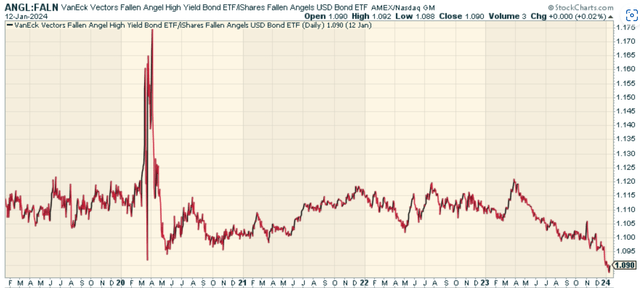

When comparing ANGL with other similar ETFs, such as the iShares Fallen Angels USD Bond ETF (FALN), certain distinctions emerge. FALN, for instance, has a lower expense ratio (0.25% compared to ANGL’s 0.35%) and a slightly higher yield. However, ANGL has a longer track record and a larger asset base, which may appeal to investors seeking stability and liquidity. The price ratio between the two suggests they typically trade in-line with each other, though ANGL more recently has slightly underperformed.

Pros and Cons of Investing in Fallen Angels

Investing in fallen angel bonds, and hence in the ANGL ETF, brings with it certain advantages and disadvantages. Some of the pros include:

-

Potential for High Returns: Due to their downgrade, fallen angel bonds are often undervalued, providing the opportunity for substantial capital gains if the issuer’s financial situation improves.

-

Higher Quality: Compared to traditional high-yield bonds, fallen angels are often of higher quality, as they were initially rated as investment-grade.

-

Diversification: Investing in fallen angel bonds can add diversification to an investment portfolio, as their performance may not correlate directly with other asset classes.

On the other hand, the cons include:

-

Higher Risk: The downgrade to junk status indicates financial difficulties for the issuer, increasing the risk of default.

-

Interest Rate Sensitivity: Like all bonds, fallen angels are sensitive to interest rate changes, which can affect their value.

-

Sector Concentration: Fallen angel bonds can sometimes be concentrated in certain sectors, increasing the risk if that sector underperforms.

Conclusion: To Invest or Not to Invest?

Investing in the VanEck Fallen Angel High Yield Bond ETF can offer attractive returns for those willing to accept higher risk. The fund’s focus on fallen angel bonds, which have a track record of outperforming the broader high-yield bond market, could make it a worthwhile addition to a diversified investment portfolio. However, investors need to be aware of the risks associated with these bonds and should consider their own risk tolerance and investment goals before investing. VanEck Fallen Angel High Yield Bond ETF is one to keep on the watch list to pounce on whenever default risk starts getting more attention within the bond market more broadly.

Markets aren’t as efficient as conventional wisdom would have you believe. Gaps often appear between market signals and investor reactions that help give an indication of whether we are in a “risk-on” or “risk-off” environment.

The Lead-Lag Report can give you an edge in reading the market so you can make asset allocation decisions based on award winning research. I’ll give you the signals–it’s up to you to decide whether to go on offense (i.e., add exposure to risky assets such as stocks when risk is “on”) or play defense (i.e., lean toward more conservative assets such as bonds/cash when risk is “off”).

Be the first to comment