marchmeena29/iStock via Getty Images

Invitation Homes (NYSE:INVH) is a leading owner and operator of single-family homes for lease. The company’s portfolio contains over 80k homes in 16 markets across the U.S, with greater exposure to the Western and Southeastern regions of the country.

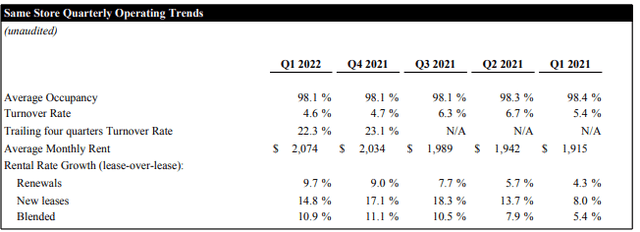

Heading into Q2 earnings, INVH is anchored by near-full occupancy levels that have been at or above 98% for the last eighteen months. Occupancy strength has also been paired with historically low turnover rates. Together, this has contributed to double-digit growth in net operating income (‘NOI’) for the last three quarters.

With average monthly portfolio rent of nearly $2,100, rates are still estimated to be 20% below current market rates. This is likely to provide a runway for continued growth in future periods, supported further by favorable macroeconomic trends in the broader housing market that are forcing many into rental units.

YTD, shares are down about 22% compared to a decline of 18% in the broader S&P 500. The stock is also underperforming close peer American Homes 4 Rent (AMH), who has generally tracked the market index. At nearly 26x projected FY22 adjusted funds from operations (‘AFFO’), shares aren’t discounted. However, a strong dividend growth rate and a narrow 52-week trading range presents an opportunity for investors seeking portfolio diversification and modest upside potential, given current market conditions.

Continued NOI Growth of Over 10%

In the most recent filing period ended March 31, 2022, INVH reported total revenues of +$532.3M. This was up 12% from the same period last year and in-line with expectations. Growth in the current period was driven by an 8.5% increase in average monthly rent per occupied home. In addition, there were 2,300 more units within the current comparable population.

Total expenses were also up but at a lower rate than revenue growth, at just 5.4%, driven primarily by an 8.3% net increase in property operating and maintenance expense. Expenses were also favorably impacted by a +$9M decrease in interest expense, resulting from lower gross debt outstanding and refinancing activities, which led to a 34bps decrease in the weighted average interest rate on their outstanding debt.

Strong revenue growth combined with effective cost control produced net income per common share of $0.15, up 50% from last year. Additionally, AFFO/share was up 12.9%, while NOI was up 11.7%, its third straight quarter over 10%.

Favorable Exposure to Key Market Regions

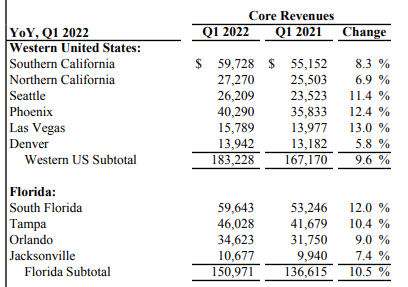

Within the same-store portfolio, total revenues were up 9.4% YOY in Q1’22 and 1.4% sequentially on higher average monthly rental growth. YOY, revenues grew double digits in the western regions of Seattle, Phoenix, and Las Vegas as well as in the State of Florida. This was supported in part by average rental growth of 8.3%, due in part by double digit increases in Phoenix and Last Vegas.

Q1FY22 Investor Supplement – Same-Store Revenue Summary

Similarly, these regions also drove same-store sequential growth, with 4% revenue growth reported in Phoenix and 2.3% in Florida. These gains, however, were partially offset by revenue declines in California and the Midwest.

Same-store core operating expenses were also held in check, up just 4.5% YOY. Contributing to the increase were higher property taxes and R&M, offset by lower turnover-related expenses, which exhibited a 12.4% decline from the prior year.

Confidence Through Market Participation

INVH remained highly active in the market during the current quarter, acquiring 518 properties in their wholly owned portfolio and 304 properties through their joint ventures. These acquisitions were completed at an average cap rate of 5.3%, which is comparable to the rates reported in the prior year. In addition, they also sold 141 properties at an average sales price of $372K.

Following their investment activities, the company ended the period with nearly 83k homes in their total portfolio. 91.2% of this total was comprised of their same-store population. While average occupancy was down slightly YOY, it remained the same as the prior two quarters at 98.1%. Paired with a 170bps decrease in turnover and declining bad debt, operating trends in the current period appear solidly stronger than the prior year.

In addition to favorable occupancy figures, INVH is benefitting from strong renewal rate growth of 9.7% and double-digit blended rate growth. While rate growth in new leases has moderated, it was still up nearly 15% for the period. A sizeable loss to lease of approximately 20% also provides a long runway for rental growth in future periods.

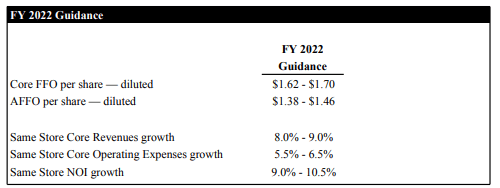

Looking ahead, management provided no revisions to current year guidance, which calls for same-store NOI growth of between 9-10.5% and an AFFO/share range of $1.38 to $1.46/share.

Q1FY22 Investor Supplement – 2022 Full-Year Guidance

A Capable Balance Sheet With Ample Liquidity

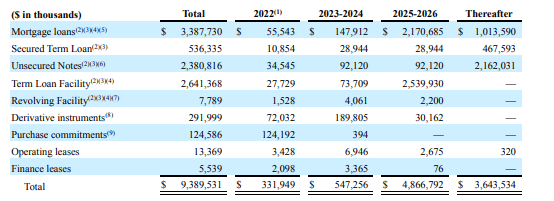

At period end, INVH had total assets of +$18.5B and total liabilities of +$8.3B, comprised principally of fixed-rate debt bearing interest at a weighted average rate of 3.3% with a weighted average years to maturity of 5.5 years.

As a multiple of adjusted EBITDAre, leverage stood at 6x. This is at the top end of the company’s targeted range but down from the first quarter last year. Of the total contractual obligations, over 60% is due prior to 2027, with +$4.9B due in 2025/2026. In a period marked with rising rates, this is not desirable at present due to the rollover risk. 2025 is still a number of years away, however. So, its possible rates could head lower by the time the debt matures in later years.

Q1FY22 Form 10-Q – Summary of Contractual Obligations

Also aiding INVH’s debt structure is their investment grade credit ratings with a stable outlook from all three credit agencies. This ensures the company will have access to capital at the best possible terms. In addition, INVH also had +$1.5B in available liquidity, comprised of cash and undrawn capacity on their revolving credit facility.

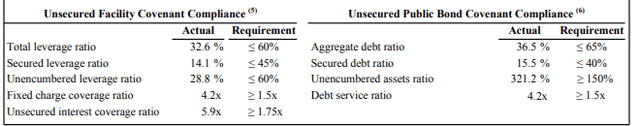

The company is also well within compliance with their required covenants. Continued compliance moving forward will support the ability to take on and service new obligations.

Q1FY22 Investor Supplement – Debt Covenant Compliance Summary

Strong Operating Trends on Double-Digit Rental Growth

INVH’s operational performance is supported by near-full occupancy and a sizeable loss to lease nearing 20%. With blended lease growth up double-digits, the company is currently experiencing favorable returns on their investments.

The short-term nature of their leases, however, does present a risk in an uncertain market environment. If rental rate growth slows, as what is appearing to be the case with their new leases, or if tenants choose not to renew, then cash flows could be adversely affected. But there are no apparent signs of it at present. Turnover remains at historic lows and record home prices on low supply are forcing many into the rental market. Though a setback may indeed occur, INVH would approach from a position of strength.

Q1FY22 Investor Supplement – Same-Store Operating Trends

Strong rental rate growth is contributing to strong cash flow generation, which is yielding impressive distribution gains for income-focused investors. Most recently, the dividend was increased nearly 30%, bringing their three-year compound annual growth rate (‘CAGR’) to about 18%.

In Q1, the total payouts were covered by 1.75x from operating cash flows and had a forward AFFO payout ratio of 60%, which is lower than the sector median of 73%. The strong degree of coverage should ensure payment continuity, though growth is likely to slow as rental rates moderate.

Over 10% Upside Despite Its Premium Multiple

As a leading owner and operator of single-family homes for lease in key market regions, INVH has benefitted from a macro environment marked with soaring home prices and rental rates. As more and more prospective buyers are priced out of homeownership, many are opting for rentals, which on average are 12% more affordable than owning a home in INVH’s markets, according to John Burns Real Estate Consulting.

Still, renters are paying record rates, which currently average nearly $2,100 in INVH’s portfolio. And this is still about 20% lower than current market rates. Though blended spreads are already up double-digits, the significant loss to lease presents a long runway for continued growth in NOI, which has been over 10% for the last three quarters.

The company’s significant expansion activities does present an element of risk, especially at current pricing multiples. If the economic environment deteriorates to the point where renters fall back on rent, INVH could be exposed to heightened downside risk. However, signs of an impending slowdown aren’t yet apparent. Unemployment remains low, job openings exceeds available workers, and households are better equipped financially than prior business cycles.

With near-full occupancy, record low turnover rates, and cash collections near pre-pandemic averages, INVH has sufficient cushion to weather any setbacks should one occur. In addition, the company has +$1.5B in liquidity and an investment grade balance sheet. These are further buffers against any reversal of fortunes.

Utilization of an 8.50% discount rate on an expected long-term dividend growth rate of approximately 3% and upper single-digit NOI growth over a 10-year horizon would yield an approximate value of $40/share. This would represent a forward multiple of 24.7x FFO at the low end of current year guidance.

While a better entry point is certainly possible, shares do offer at least 10% upside at current trading levels in addition to a dividend that has been growing at double-digit rates. For investors seeking portfolio diversification and modest upside potential, INVH is a solid add to any long-term focused portfolio.

Be the first to comment