PonyWang

Amtech Systems (NASDAQ:NASDAQ:ASYS) is a designer and manufacturer of capital equipment and supplies for the semiconductor industry with manufacturing capabilities in the US and China.

The company is exposed to the cyclical nature of capital equipment in the semiconductor industry. In the current scenario, it seems Amtech has been riding the upper portion of an investment cycle triggered by US sanctions on China, and COVID supply-chain restrictions.

However, even in what seems to be the upper portion of the cycle, Amtech is unable to earn a return that justifies its current stock price. This without considering the unprofitable lower portion of the cycle.

In a positive account, Amtech is debt-free and has about $50 million in cash. If the company decided to use that cash to repurchase shares, it would still not be able to justify its current share price. If instead Amtech decided to acquire a company, it may do better, but on a much more risky proposition.

Note: Unless otherwise stated, all information has been obtained from ASYS’ filings with the SEC.

A cyclical, competition prone industry

Amtech manufactures several types of capital equipment for the semiconductor industry. Particularly, Amtech concentrates on thermal and substrate processing for power electronics.

The company manufactures machines that polish the semiconductors, or special ovens that can apply different temperatures in different portions of a circuit. It also manufactures materials and substrates used in the deposition portion of the manufacturing process.

I will not lie to the readers, I am not an expert in semiconductor manufacturing. However, I think you do not need to be an expert on the topic to understand the dynamics behind Amtech’s market and profitability.

In summary, I think Amtech’s industry is very cyclical, and can also push competitors into fierce rivalry that tends to destroy profitability. It is also not an industry where companies can build a valuable moat.

To begin, the company comments in different sections of its 10-K report for FY21 that the semiconductor capital equipment industry is cyclical. Semiconductor manufacturers invest heavily during some periods, generating extra capacity, which then drives prices and profitability down, decreasing investment.

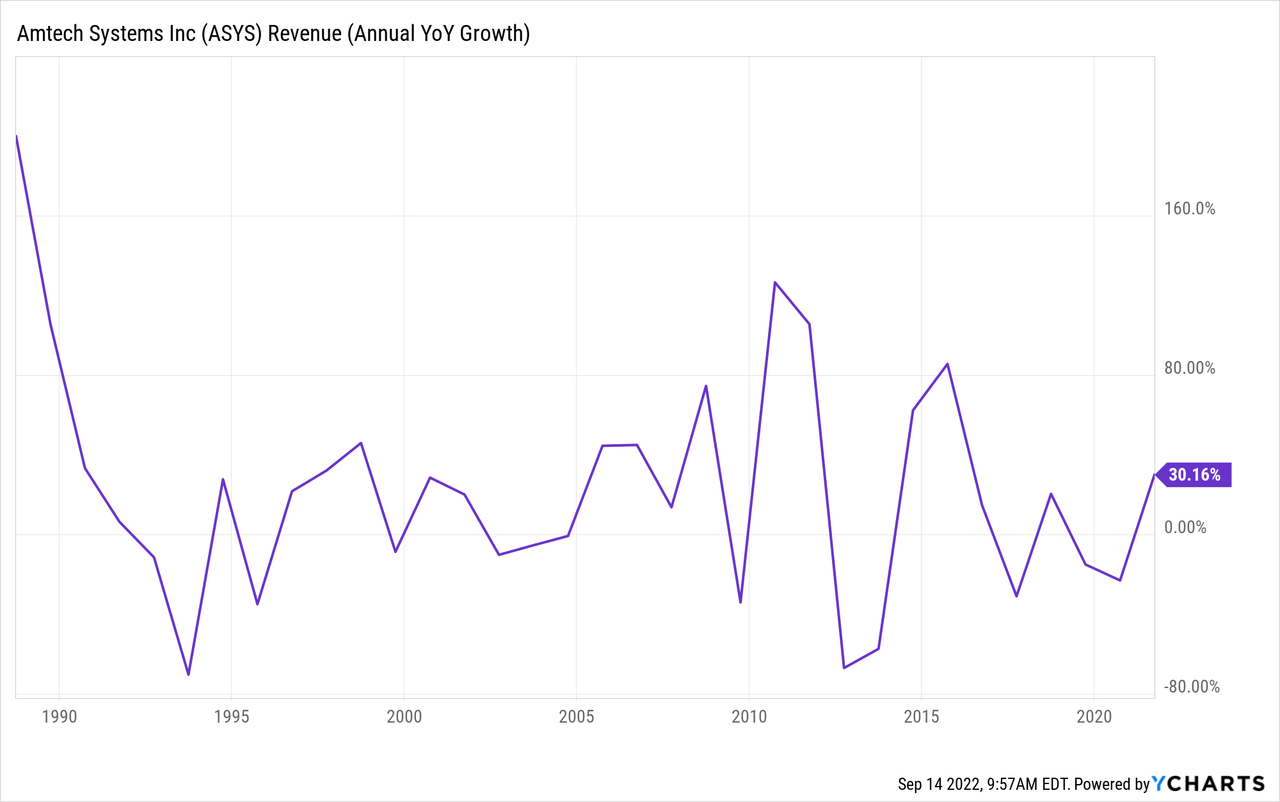

This situation can be grasped on Amtech’s revenue YoY growth since the 1990s, shown below. The company believes that the industry’s cycle lasts between 10 and 18 quarters, with 4 to 6 of contraction and 6 to 11 of growth.

Adding demand cyclicality to a complex design and manufacturing process yields super high rivalry.

In order to present a new piece of equipment to the market, each company has to spend millions on engineers for years. It also has to invest in advance in the equipment necessary to manufacture the new piece, and to train skilled employees. When the new piece of equipment is offered to the market, all of these costs are already sunk. This means that all competitors have an incentive to increase volumes, even at the expense of price or profitability. When all competitors engage in this type of rivalry, profitability falls for everyone.

The semiconductor equipment industry is then a high risk, low reward industry. It is high risk because it may happen that a competitor develops a substantially superior product that yields all of the previous investments almost worthless. It provides a low reward because unless the company develops a killer product, it will be forced to compete on volume.

The industry’s customers also push for competition because they have the means to compare competing products on technical and objective grounds.

I have mentioned in other articles that in order to develop a moat or a brand, the customer should ideally be unable to compare two competing products on any rational basis. When you compare Coke to Pepsi, do you compare on the basis of sugar to cm3, or any objective form of sweetness, taste, etc.? No, you compare on totally subjective grounds.

The problem is that the purchasing department of a semiconductor manufacturer is probably formed by engineers that know exactly what to look for in a particular equipment. Even if a particular brand built a reputation for quality, or reliability, it is still based on somewhat objective grounds.

Finally, there are no indications in Amtech’s reports that their equipment has high switching costs for customers. There is no mention to particular standards being used or that the company provides turnkey or all-included solutions. It seems that their equipment is a plug-and-play portion of a complex process. Of course, a reader with more technical knowledge on this area may provide more information on this aspect.

Amtech in particular

In my opinion Amtech has both positive and negative aspects. The negative aspects are related to cost controls and operations, and the positive aspects are related to low debt and global diversification.

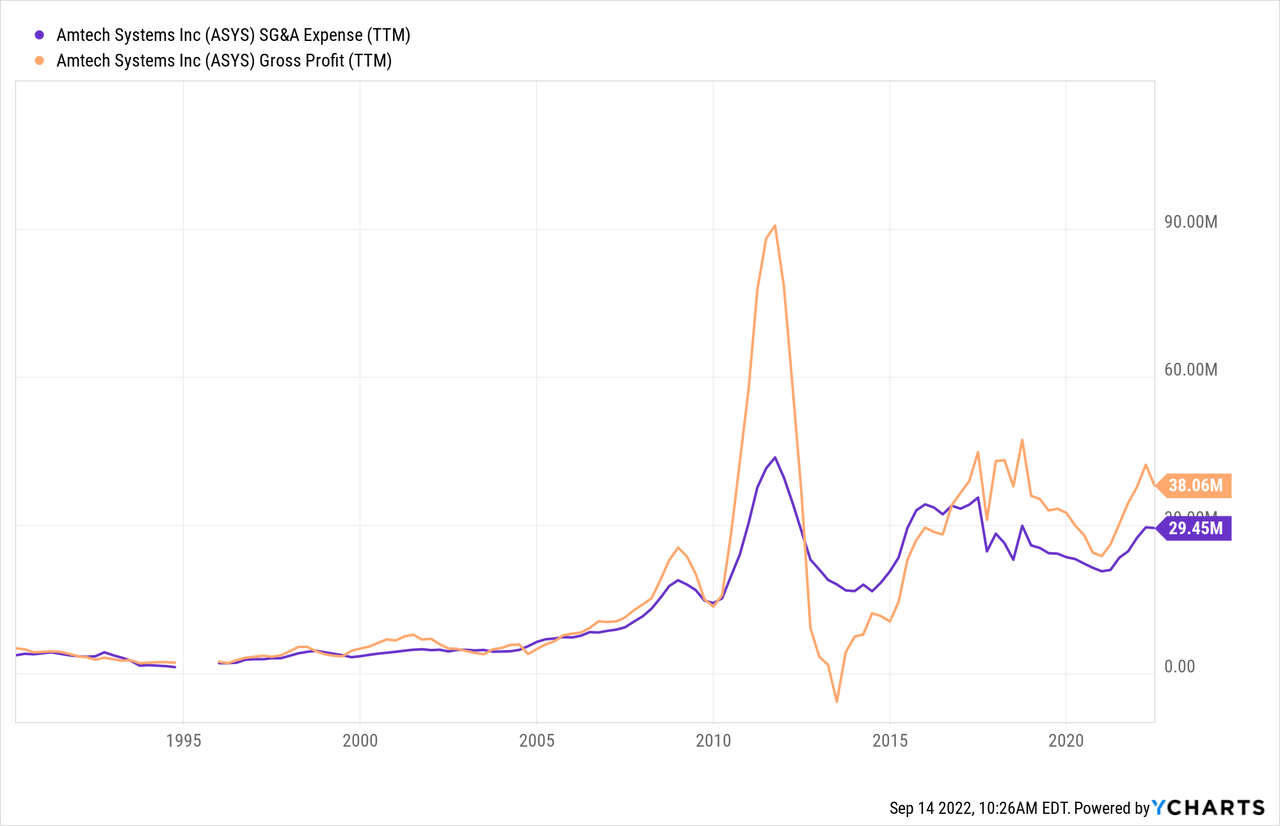

On the negative side, Amtech’s SG&A expenses are relatively fixed, and high. This is a negative aspect for a company that operates in a low profitability, cyclical industry. The chart below shows the tremendous movements in gross profits, against which SG&A expenses seem fixed.

There are other indications of low efficiency. On its 10-K, Amtech comments that 31% of its employees are neither in manufacturing, nor sales or services, nor research. If they are not in these value generating areas, then what do they do?

This lack of efficiency at the corporate level might be caused by lack of a powerful shareholder. The company’s proxy statement shows that the largest shareholder is an asset manager with decision power over 20% of the shares. Like many companies in low profitability industries, Amtech might be a target for activist investors looking to make its operations more efficient.

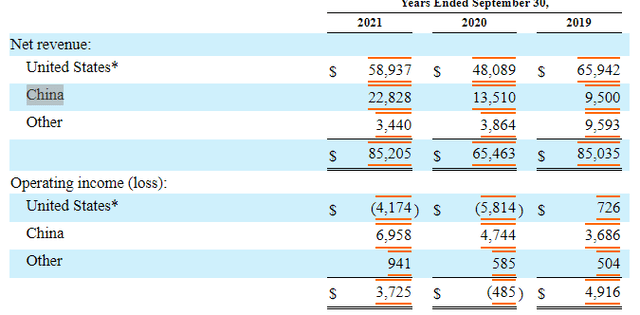

This cost problem is clear also at the geographic level. Amtech does not provide detailed segment disclosing by geography, but does separate revenue and operating income between the US and China. Like the table below shows, China generates much higher operating income with lower revenues. The problem with the table is that Amtech does not inform how it allocates costs like corporate, or R&D, that are not easy to separate by geography. If, for example, the US is allocated all SG&A and R&D costs, just because those employees are in the US, then the US operations’ profitability is underestimated. Even considering those caveats, it does not seem illogical that a manufacturing operation is more expensive in the US than in China.

ASYS’ revenue and operating income by geography (ASYS’ FY21 10-K report)

In positive territory, Amtech’s revenues are diversified across the world, which provides some protection from the cycle but also shows that the company can compete in different scenarios. According to the company’s FY21 10-K report, in that year 29% of revenue came from China, 22% from the US, 15% from Taiwan and 9% from Germany.

Another interesting aspect of global diversification comes from the recent US-China tensions around semiconductors. If these economies move further into decoupling it could prove beneficial for Amtech, because it has manufacturing capabilities in both countries. However, there are other big players in the industry that can trade with both economies, like Taiwan, Japan, South Korea, and Northern Europe.

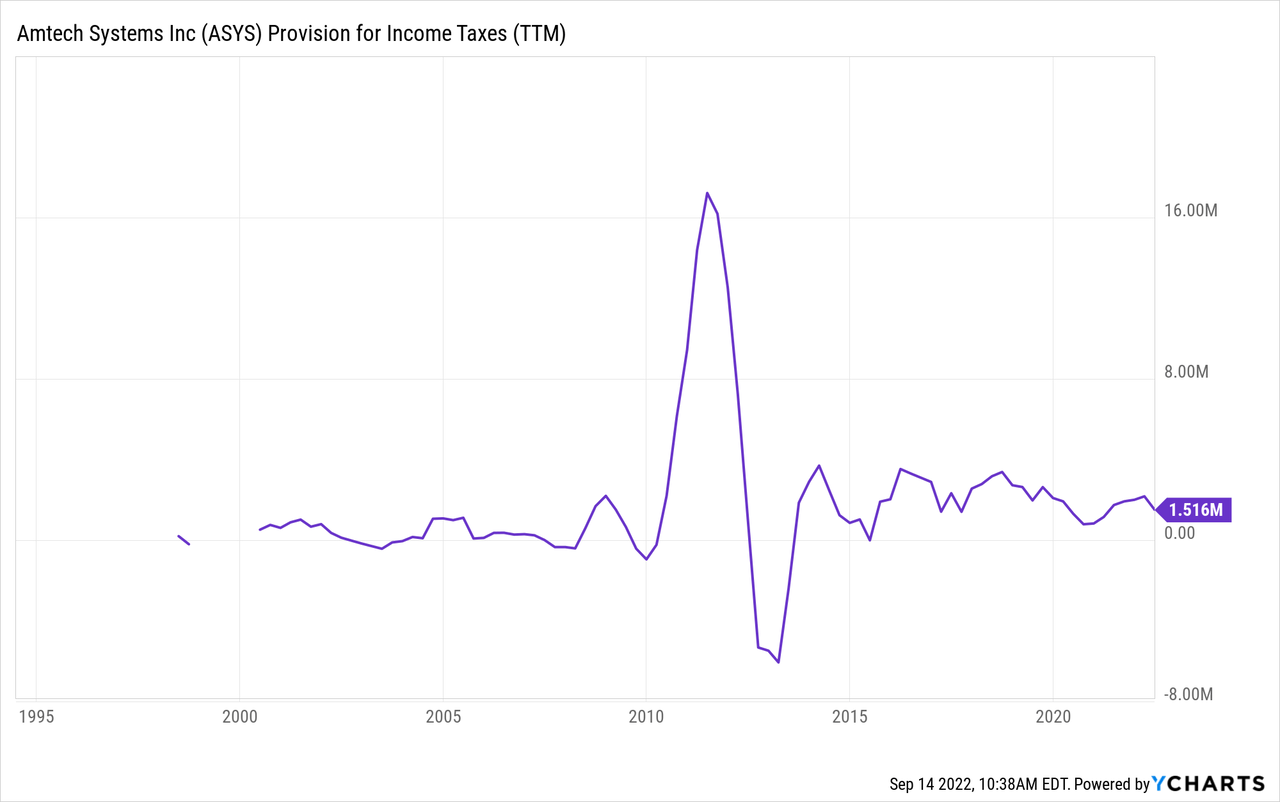

Being a multinational company does have its disadvantages too, for example in terms of taxes. The chart below shows that Amtech recorded positive provisions for income taxes in almost every operating year, even though it has generated pretax losses in many of them. This happens because the losses are generated in a country where no profits are expected, and they cannot be computed against profits in another country.

Another positive aspect of Amtech is its total lack of debt and enormous cash cushion. After selling and leasing back its main manufacturing facility in the US, and paying back a mortgage tied to that facility, Amtech shows zero debt and $50 million in cash reserves, according to the company’s 10-Q report for 3Q22.

At current prices, that cash could purchase one third of the company’s outstanding shares, significantly boosting earnings per share. We will consider this aspect in profitability calculations below.

The company could also acquire a competitor or enter into new segments. Amtech has made significant acquisitions before, some of which proved profitable and some of which did not.

The company cites BTU international, a manufacturer of special ovens for circuit boards, as a positive example, without providing much financial data. A negative example is the company’s investment in semiconductors for solar power. This segment was written-off in 2019, after significant impairments, while generating more than $10 million in operating losses in that year alone.

The problem of an acquisition for $50 million or a figure close to that is that it has the potential to completely change the company’s dynamics and profitability profile. Unless the reader is very familiar with the industry, it can become difficult to judge the soundness of such an acquisition before the new subsidiary has operated for a few years.

Share price considerations

Amtech currently trades at a market cap of $150 million. Depending on the company’s use of its cash reserves we can consider that market cap or a reduced enterprise value of $100 million.

The minimum profitability required for a $150 million market cap company is $15 million, or a 10% earnings yield. I say minimum because given the company’s cyclical markets, profitability in good years should be higher in order to accommodate for bad years, and because Amtech has not shown signs of growth across the cycles in terms of net income.

However, in FY21, which could be considered the upper portion of the cycle in the industry, Amtech generated only $1.5 million in net income. As of 3Q22, eliminating the one-time proceeds from the sale and leaseback of its Massachusetts facility, Amtech expects about $3 million in net income for FY22.

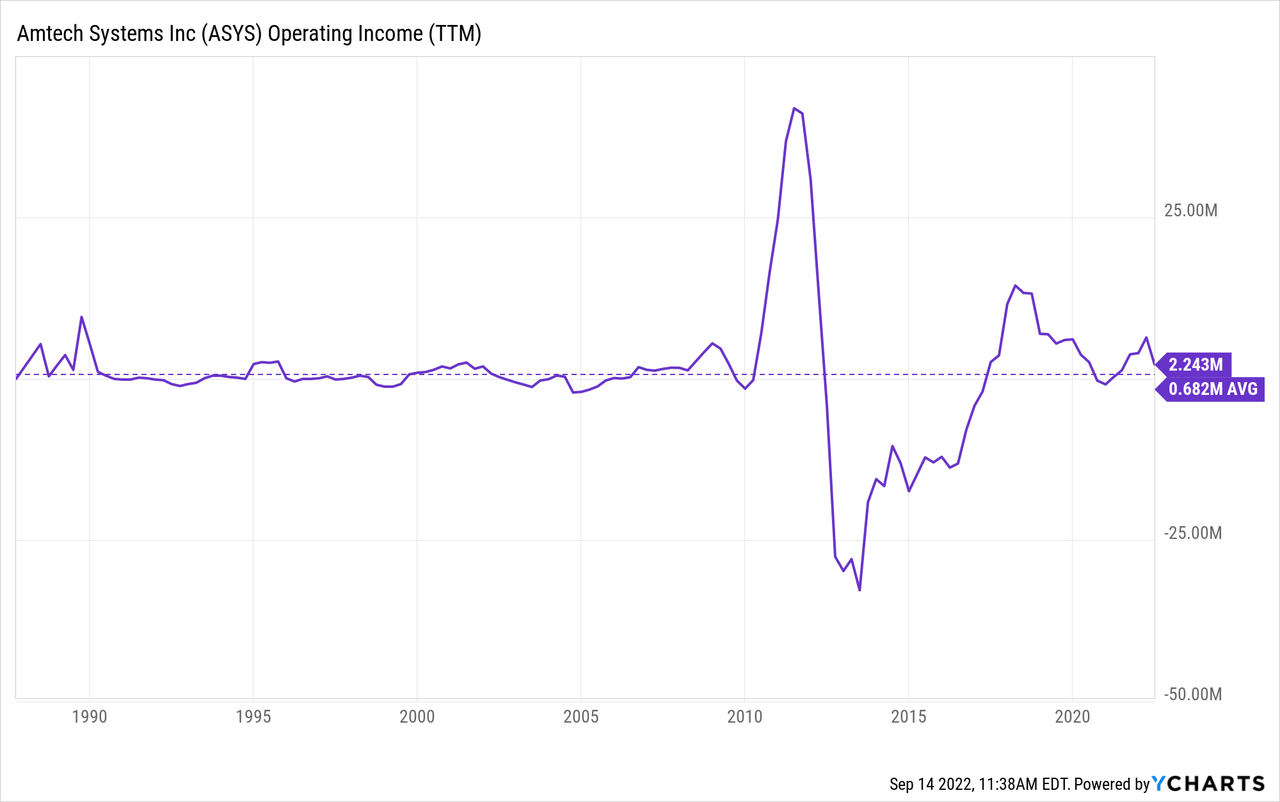

These figures are significantly behind the assumed minimum of $15 million in net income. In fact, the company has only once generated operating income close to that figure, and the average operating income has been $0.6 million since the company went public. The chart below shows that, and also that the company has not been able to grow operating income across the cycles.

Even if we consider that Amtech repurchases stock for $50 million, or one third of its current market cap, therefore increasing EPS by 50%, the stock price is still expensive. Considering $3 million in net income, against 9 million shares after repurchasing 5 million shares, then earnings per share fall around $0.33, against a stock price above $10.

Conclusions

Amtech is definitely expensive at current prices.

The company has not shown the ability to grow, it operates in a less than desirable industry, and shows problems handling its SG&A expenses.

Current stock prices seem expensive even ignoring that the company is operating in the upper portion of its industry’s cycle, and considering that it repurchases one-third of its share base.

In my opinion, Amtech is a no-go for any long-term investor. A speculator could wait until the semiconductor capital equipment industry turns into the downward portion of its cycle to purchase and wait for a rebound.

Be the first to comment