Olemedia

Demand for batteries is soaring, fuelled by the growth in the E.V. market advances in the technology around lithium-ion battery (LIB), opening this 45-billion-dollar market to new suppliers and companies. By 2031 the market is forecast to exceed $135 billion, demand is likely to exceed supply for years to come, and companies that can produce reliable batteries at scale will have a vast pool of customers. There are prominent established players in the LIB market, which likely means that the standard graphite anode LIB will become a price-competitive commodity. Companies offering improved battery performance will command a price premium as their batteries will provide a competitive advantage to their customers.

My investments this year in battery stocks have been very successful, I wrote about Electrovaya (OTCQB:EFLVF) (EFL:CA) (EFL) in May and took a full-size position (for me, that is US$2000), and since then, the share price has risen 76%. I added to the position in September (another $1000, and added a comment to the article showing the technical reasoning), and that second position is up 15%. I have also invested in FREYR Battery (FREY) and exited for a 50% return to buy (DDD) (in this article).

Today I am analyzing Amprius Technologies (NYSE:AMPX) to see if it has the potential for a similar return. My criteria for investing in these battery companies (I am tracking 7) is all about the technology and its validation.

I need to answer two questions.

- Is the technology a proven advance?

- Can Amprius manufacture at scale?

If the answer is yes to both, I am buying; otherwise, I will continue watching.

Battery Technology

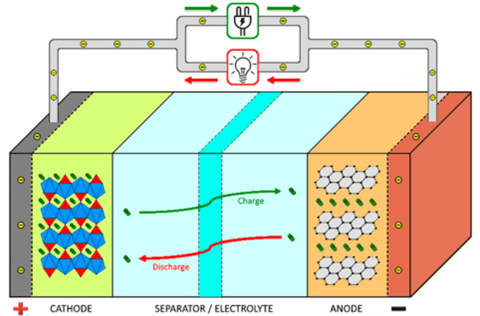

All batteries have the same few components; a cathode, an anode, an electrolyte, a separator, and a casing. A simple diagram explains the general setup.

Battery Diagram (components101.com)

It is all about chemistry. During charging, electrons move from the cathode through the electrolyte to the anode, where they are stored. During discharge, they move back from the anode to the cathode. The separator stops the anode and cathode from touching (which would cause a short circuit).

It is the separator that Electrovaya worked on, and their ceramic separator allows for a greater density of charge with improved safety and cycle life.

(MVST) and (QS) are also investigating the separator.

(SLDP) along with (QS) are developing solid electrolytes.

Amprius, along with (ENVX), are working on a silicon-based anode. Silicon anode research suggests that it has a maximum capacity ten times higher than standard graphite, which is good for the second most abundant chemical on earth. The companies researching in this area have to solve substantial problems. The electrochemical reaction between silicon and lithium leads to volume expansion (as much as 300%). The expansion leads to the electrode’s swelling, causing cracks and peeling. Inactive silicon particles are created, thin dendrites form that degrades the performance and causes safety issues, and continued use destroys the anode.

Most companies use some silicon in their anode; exactly how much and in what form is a closely guarded secret and the source of competitive advantage.

Amprius says it has found solutions to the problems of using silicon and that it has developed a 100% silicon anode. If so, its batteries will be far denser than those currently available in E.V.S offering, perhaps, a doubling of range.

Amprius Technology review

The key technological leap Amprius is working on is using silicon nanowires; silicon nanowires have been a promising candidate in many technical areas. Amprius says using them, it has developed a 100% silicon anode that directly replaces graphite in Lithium Ion batteries. Silicon Nanowires are 1 dimensional (quasi 1 dimensional, actually) and have been extensively researched. They have led to a 17-fold improvement in solar cell conversion efficiency, are known to be charge-trapping, and have high electrical conductivity.

Silicon Nanowires are not simple to manufacture, and so far, limitations in large-scale fabrication have impeded this material’s uptake. Amprius believes that they have also solved this problem.

Silicon Nanowires were shown to solve the problems associated with Silicon anodes by scientists at Stamford University in 2007. Amprius has spent a decade perfecting this technology and believes they are ready for full-scale production. Amprius has protected its tech with patents that will ensure that its production methods and structural anode assemblies will be a competitive advantage for some time. They worked with Meyer Burger (OTCPK:MYRBY) to develop the manufacturing process.

Validating the Tech

This is the crucial issue for me, earlier this month Morgan Stanley gave QuantumScape a sell rating saying.

While solid-state batteries may still represent the future of energy storage, the path to getting there is proving to be more difficult and longer-dated than we and the market had expected.

QuantumScape’s tech is promising but not validated. For me, validation of the tech is by commercial orders. The tech is validated if a customer buys the batteries for use in a commercially available product. Customers buying for testing purposes, in my view, does not count.

This was the critical point with Electrovaya; Raymond Toyota published a white paper validating the performance metrics and bought significant quantities of batteries they sold to end users as part of their forklift trucks. Electrovaya tech was validated, so I invested.

From the most recent 10q.

Currently, our batteries are primarily used for existing and emerging aviation applications, including unmanned aerial systems, such as drones and high-altitude pseudo satellites. We believe our proprietary technology has the potential for broad application in electric transportation. Our batteries and their performance specifications have been tested and validated for application by over 30 customers, including Airbus, AeroVironment, BAE Systems, the U.S. Army and Teledyne FLIR, and we have shipped over 10,000 batteries as of September 30, 2022, which have enabled mission critical applications.

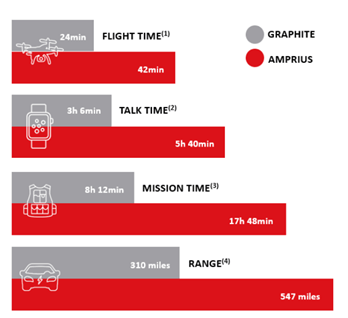

Amprius shares this graphic on its website and in shareholder letters.

Amprius Battery Performance (Amprius website)

The graphic and the “tested and validated by 30 companies” is potentially compelling evidence of the advantages of the Amprius battery tech. But does it meet my standard of commercial validation?

The Smartwatch data, Amprius says on its website, is.

“from customer reported data for an energy cell design”.

I have been unable to verify the customer or the performance data; the wording makes it sound theoretical, so it does not meet the standard.

Mission Time data. I could not find any evidence to back up the wearables claim and do not believe it to be based on commercial transactions but on testing and validation contracts.

The range of the E.V. car is an “estimate based on the Tesla Model 3” (from the website). I can find no evidence that Tesla has been a customer. Tesla is well known for developing and manufacturing its batteries. Despite the two companies being based in the same neighborhood, I could not find a commercial relationship to validate this figure.

The use of Amprius batteries in drones is encouraging.

Airbus, an early investor in Amprius, uses Amprius batteries in its High Altitude Pseudo Satellite Zephyr airplane. The plane runs on solar power, storing the energy it needs during the night in Amprius batteries. Airbus joined the October 2019 funding round of Amprius, stating that it wanted Amprius to expand its production capacity to meet the near-term demands of the Zephyr program. The Zephyr flew for 64 days in 2022, covering 140K nautical miles, all powered by solar and Amprius batteries.

In July this year, Airbus announced the formation of a new division, a connectivity service division that will use the Zephyr to deliver its platform. The division is an Airbus Defense and Space subsidiary and will offer an alternative to satellite and terrestrial connectivity. This comes very close to my threshold; if Airbus places an order for batteries for commercial service and not the test service, it will be met.

Amprius has also had success in this area, with Velodyne entering a three year purchase agreement to develop the use of Amprius batteries in drone applications. Once again, this is a development agreement.

In 2021 Amprius was awarded a contract to develop batteries for the U.S. army; this is a fast proto-typing contract but not a supply contract.

Manufacturing

The second of my two questions was, can Amprius manufacture at scale?

At the moment, the answer is no; they cannot.

Amprius currently has a small manufacturing line at its headquarters. They manufacture on a kilowatt hour scale. That is sufficient for the testing and validation orders they currently have.

Amprius received a new larger machine in October that will be capable of 2 megawatt hours of Anode production by the end of 2023. That is a tenfold increase in production, but to put it into context Electrovaya has a current capacity of 150 MWh and will be at 300 by the end of 2023. Tesla has a capacity of 37,000 MWh.

Conclusion

I think Amprius is too far from production for me to invest.

On the positive side:-

It has some great tech backed up by some breakthrough science.

Amprius is working with excellent partners to validate that tech and Airbus seems close to moving towards commercial production of its Zephyr airplane using Amprius batteries.

On the Negative Side:-

As yet Amprius does not have any real customers to validate its tech (under my definition of real customers not buying to test the product but to use it).

They are still working on the production process, and the recently received Anode production machine remains untested. It will undoubtedly need further modification before it meets the 2 MWh production plan at the end of 2023.

I said early in this piece that validation of the tech was the crucial issue for me; Amprius has not yet passed my hurdle on this.

If Amprius gets a real order and can prove that it can manufacture its Silicon anode at scale, then I will be a buyer. Until then, I will sit on the sidelines and continue to evaluate the other Battery companies on my watch list.

Be the first to comment