Thank you for your assistant/iStock via Getty Images

Investment Thesis

Ammunitions manufacturer AMMO, Inc. (NASDAQ:POWW) is a rare example of a growth company in a traditional industry. Founded in 2016, the company has increased sales by 120 times over the past five years and has shown a solid net income in the last reporting period. In our view, the potential has not been exhausted yet, as AMMO is ramping up production capacity in a favorable market environment. The launch of the new Manitowoc Wisconsin facility is expected next week, which will triple the current main production. In addition, POWW gained an essential strategic advantage with the acquisition of Gunbroker.com. According to our DCF valuation, the company is trading at a significant discount to our estimate of fair market value. We rate shares as a Buy.

Favorable Market Environment

Ammunition shortages are not a new phenomenon. Between 2008 and 2016, we have witnessed a rush of demand in the market several times, but the current shortage is unique in the complex of factors that influence it.

The psychological stress caused by the lockdown and the BLM protests were essential drivers for the growth in demand for weapons in 2020. In 2021, demand has reached a new level. According to the FBI, in 2021, the number of firearm background checks exceeded the 2020 figure by 10 million. Although the number of checks decreased in the first half of 2022, the figure is still the highest on record, excluding 2020 and 2021.

In addition to high demand, the ammunition market is experiencing a shortage of supply due to supply chain issues and high raw material prices. Political factors also have a stimulating effect on the market.

If before the pandemic, the lack of domestic supply was compensated by imports, now, due to the disruption of supply chains, U.S. ammunition imports have fallen by 34%. The problem is exacerbated by rising prices for commodities. Since the start of 2020, prices for lead, copper, brass, nickel, zinc, and steel have risen by around 5%, 48%, 66%, 72%, 36%, and 21%, respectively.

The Biden administration’s new regulatory initiatives are inspiring some of the ammo market’s bears. However, let’s look at history. After Barrack Obama was elected in 2008, Americans began to buy guns and ammunition en masse due to fears of new restrictions. The decline occurred after the election of Donald Trump in 2016. Joe Biden’s arrival in the White House has spurred demand again. Thus, we believe that new regulatory measures or talk about it are an important driver for the growth in demand for weapons and ammunition.

GunBroker Factor

The ammunition market is highly competitive. Today, there are 702 arms and ammunition manufacturing facilities in the United States, most of which sell their products through distributors and large chain retailers. Although current conditions are favorable, manufacturers will be forced to squeeze the already low margins of their products to maintain a share in a highly competitive market when the market returns to balance. Under these conditions, AMMO has an important strategic advantage in the face of the GunBroker.com marketplace, which the company acquired in May 2021 for $240 million.

Today Gunbroker.com is the largest ammunition marketplace in the U.S. with 7.3 million registered users. Firstly, its marketplace provides AMMO with an extensive database of market trends in different regions of the country, which allows the company to be one step ahead of competitors. Secondly, the company can sell its bullets to customers directly, avoiding intermediaries. Thus, AMMO becomes much more flexible in terms of pricing.

In 2021, Gunbroker.com added an average of 55,000 new users monthly and it allowed AMMO to reach net profit faster as the marketplace profitability is higher than that of the manufacturing segment.

Profitability Despite Aggressive Growth

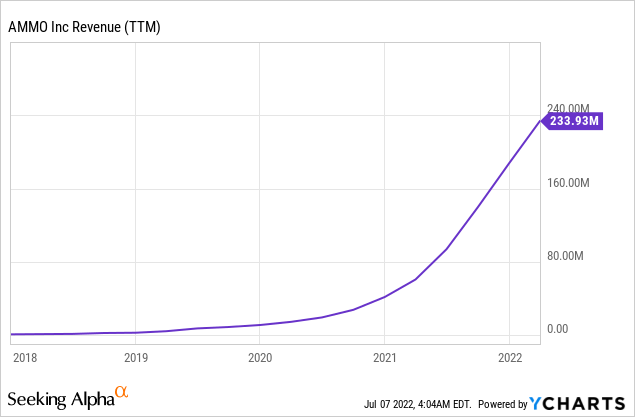

Over the past five years, AMMO has increased its sales from $2 million to $240 million. The company ended FY 2022 with 284.5% year-over-year growth.

It’s important that the growth potential is still huge. A new Manitowoc, Wisconsin, facility is expected to open next week, capable of tripling current main production. In addition, over time, AMMO plans to double production capacity at the new plants by deploying additional equipment already owned by the company. Management predicts a doubling of POWW’s market share in the next 2-3 years.

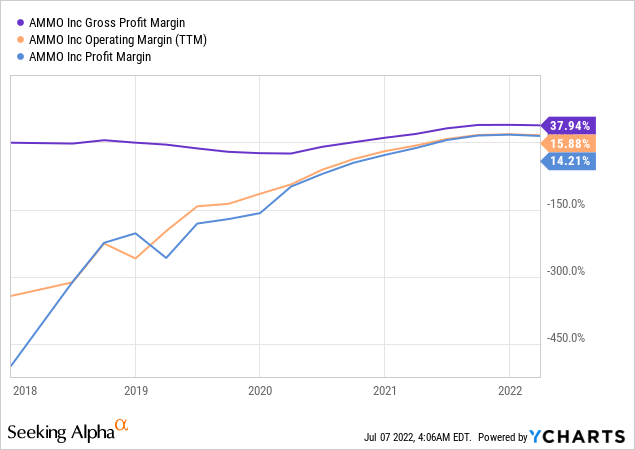

Despite aggressive growth, AMMO posted a net profit in 2022 for the first time. The gross margin increased from 18.2% to 36.9% over the period. The operating margin for the same period was 15.5% versus -8.6% a year earlier. Net profit margin increased from -12.5% to 13.8%. Management expects FY 2023 adjusted EBITDA to be $108-111 million versus $80 million this year, implying margin growth from 32% to 36%.

We expect the company to continue to improve profitability: firstly, by increasing production capacity and realizing economies of scale; and secondly, by reducing transportation costs, since the new Wisconsin facility is located next to the brass manufacturing plant.

POWW Stock Valuation

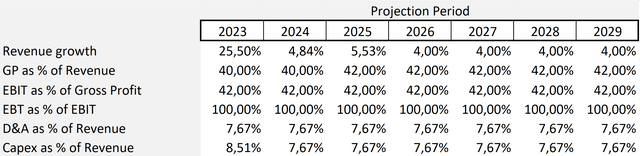

Our DCF model is built on some assumptions. We expect revenue to grow in line with the Wall Street consensus over the next two years, followed by a slowdown to 4%, in line with the terminal growth rate. Based on management’s expectations, we predict margins for the next year and assume that the figure would remain until the end of the forecast period. The assumptions are presented below:

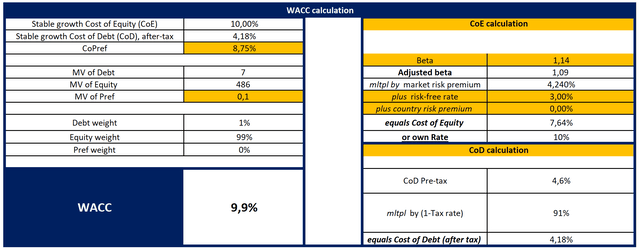

With the cost of equity equal to 10%, the Weighted Average Cost of Capital [WACC] is 9.9%, as AMMO has low financial leverage.

Although our model is highly simplified and does not take into account the significant increase in the margin that is expected after the Wisconsin facility reaches full capacity, it projects a fair market value of $741 million, or $6.4 per share. Thus, the upside potential is about 51%. Notably, our target price is below the Wall Street consensus of $8, implying more than 90% upside potential.

Conclusion

In our view, AMMO represents a rare growth opportunity at a value company’s price. Although the recent years’ results are impressive, the potential remains and the company is able to maintain a high rate of growth, as the new Manitowoc, Wisconsin, facility will triple the current main production. The company has already achieved profitability, and therefore it can hardly be called a high-risk case. According to our estimate, AMMO is trading at a significant discount to the fair price.

Be the first to comment