artas

Overview

For those who haven’t been following AMMO, Inc. (NASDAQ:POWW) since last quarter, it can be summarized with a few key points:

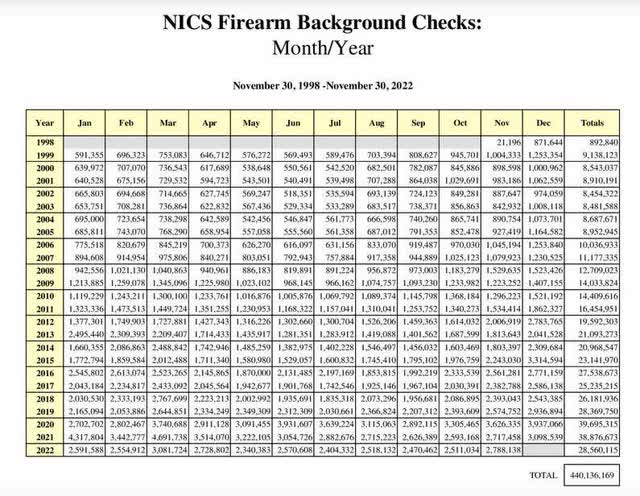

- Revenues are down around 20% YoY: This is consistent with industry trends as firearm demand has slowed since the 2020/2021 peaks.

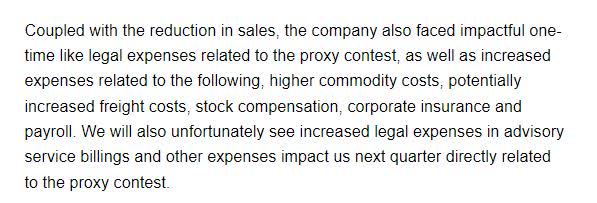

- Costs are up substantially: Increased expenses related to the following; higher commodity costs, potentially increased freight costs, stock compensation, corporate insurance, and payroll.

- There was also a costly proxy contest: The company wanted to split its two main businesses, which failed to garner any momentum.

- Profit margins went slightly negative: net income went negative for the first time since March 2021. This broke a streak of 5 consecutive quarters with positive net profit margins.

- The fiscal 2023 revenue outlook was reduced: Management expects revenue between $220M to $240M, down 27% from prior guidance.

- The fiscal 2023 EBITDA outlook was also reduced: Management expects EBITDA between $30M to $40M, down 60% from prior guidance.

As many of you already know, POWW is in a very cyclical business and this quarter revealed demand across the industry slowed. Ammunition sales were down 27% and marketplace revenue was down 13% from last year. There’s going to be a time when demand will surge again, but industry experts are not predicting that to be in 2023. As a result, I believe POWW will face challenges in the fiscal year 2023/2024 from an EPS perspective, which could negatively impact its share price. My current target price for POWW is $1.57 per share. This is based on a few factors:

- 2023 revenue guidance: ~$230M

- Estimated profit margin: 5%, based on the trailing 12 months of earnings

- Total shares outstanding: 117M

- P/E multiple: 16x, based on S&P 500 historical averages

This implies around a 10% downside from its current price of $1.75 per share at the time of writing. In my opinion, using a 5% profit margin is very optimistic for 2023 given the current market environment of higher costs related to inflation. We do not know how long this trend will last, and I believe it’s unreasonable to pay a premium for it as an equity shareholder.

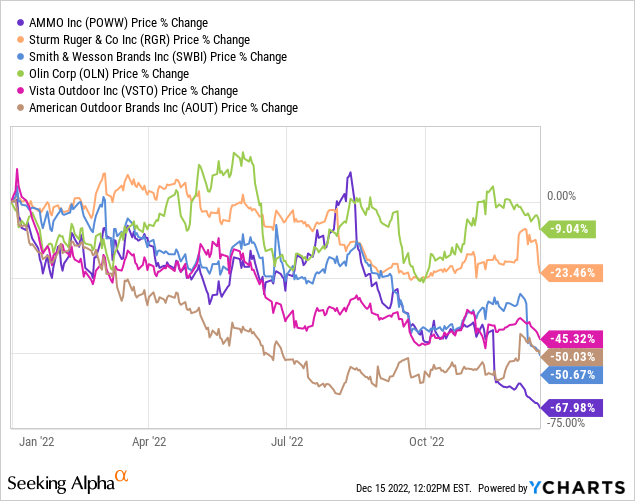

Despite these headwinds in the short term, I still believe POWW is well-positioned to be successful, especially from a balance sheet perspective. The company has plenty of cash to sustain itself during these challenging times, and liabilities appear to be manageable. Additionally, current assets far exceed current liabilities. When industry demand begins to turn and/or inflationary pressures ease, look out. POWW could generate superior returns on a percentage basis relative to other companies in the industry due to its smaller size and how beaten down the stock is. When will that happen? No one knows for sure. I believe the best strategy is to wait patiently and review future management commentary related to costs. It’s too risky right now to try and guess if things will turn around in the next quarter. And it appears markets are continuing to price that risk in, as shares have declined considerably over the last few months.

Costs Are Up Now, But For How Long?

One of the biggest unknowns for POWW is how long we can expect costs to be elevated. While there are some early indications of inflationary pressures easing, we don’t know how it will fully impact the ammunition industry. AMMO, Inc.’s CFO Rob Riley did provide some great commentary during the latest earnings call last month:

AMMO, Inc. CFO Rob Riley On Q2 Margin Impact

Seeking Alpha

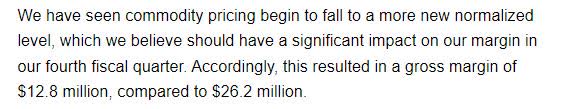

In regards to what is expected for future quarters, he did indicate that cost pressures are beginning to ease:

Seeking Alpha

The challenge as an investor is trying to gauge how long expenses will actually be elevated. While CFO Rob Riley did indicate costs are beginning to ease to “normalized” levels, it’s hard to say what exactly that means for 2023 and beyond. Since POWW was founded, there has been a wide range of operating margins, which can be attributed to the company’s rapid top-line growth and the cyclical nature of the business. So it’s hard to say what “normalized” really means in my opinion. At the same time, there are signs that industry demand has started to slow. No companies were spared from this, as you can see below:

Industry Stock Performance 2022 YTD

On a percentage basis, POWW has been one of the worst-performing stocks in this industry YTD. As a smaller, growing company it’s not surprising to see a larger share price impact during downturns like we’re seeing now. A key metric investors follow for this industry is the NICS Firearm Background Checks, which indicates new entrants into the market. As you can see below, most of the monthly data points for 2022 are below 2021 numbers, with the exception being November.

FBI

Right now there are a lot of signs pointing to a slower start in 2023 for POWW’s top-line revenue: a more balanced Congress, lower background checks, and growing ammunition supplies. However, we all know that can change very quickly. Any signs of new government legislature gaining traction or increased geopolitical tensions can change the outlook of this industry in a matter of days. In that case, POWW’s share price will likely appreciate in value if investors believe revenue growth will outweigh its current cost issues.

Conclusion

To be clear, I think POWW’s share price will eventually rebound when cost pressures ease and industry demand begins to turn again. This is primarily due to its strong balance sheet which I think can withstand any downturns for the next few years. However, it appears POWW’s current valuation is priced as if it’s still profitable. This has now become a “show me” story in my opinion. Revenue and EBITDA guidance is down significantly, no matter how you want to view it. These two metrics are the best gauges for trying to estimate profitability right now, and it doesn’t look great.

I believe the best plan is to revisit POWW in a few quarters and listen to what management is saying in regard to industry trends and how they are managing expenses. What will commodity and transportation costs look like? POWW’s CFO said they are seeing cost pressures ease in Q4, so we’ll see if that is the case. If there are improvements, I will revisit my analysis and see what a fair valuation would entail for shareholders.

Be the first to comment