lamyai/iStock via Getty Images

Exxon Mobil’s (XOM) CEO just announced his forecast, where by 2040 every new passenger car sold in the world will be electric. Despite consistent population and energy growth, his forecast is for 2040 crude oil demand to be lined up with 2013-2014 demand. As we’ll see in this article, we expect energy companies to take the profitable journey of tobacco companies.

In this article, we highlight several valuable investments we recommend to take advantage of that.

History

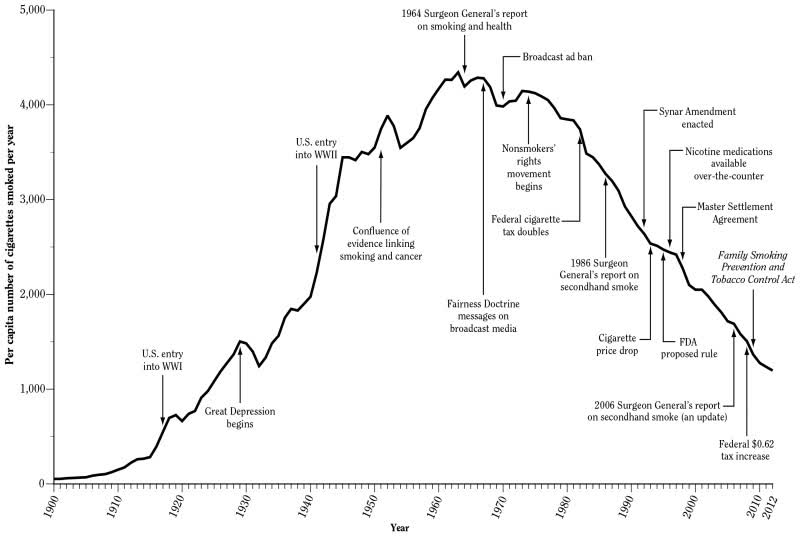

For those unfamiliar, we provide a brief history of the tobacco markets. In 1964, with one of the most dramatic health reports in history, the surgeon general announced the negative health effects of tobacco.

From that level, smoking rates in the U.S. began to decline dramatically. The Master Settlement Agreement near year 2000 came with $365 billion in agreed costs to be paid out, but capped market share and the liability of the companies in future lawsuits. It also let the payments be spread out over a number of decades.

Yet since that decision, Altria (MO) has been one of the best-performing companies in history, generating double-digit annualized returns as a tobacco company with one of the most reliable dividends around. That history is why we don’t see the impacts of climate change and resulting decline in fuel consumption as all doom and gloom for the sector.

A Changing World

We think oil and gas companies have an ability to outperform in the coming decades for four reasons:

1. Global Energy Demand

2. Consolidation and Margin Growth

3. Decline Rates and Capital Spending

4. New Business Opportunities

The global energy demand is going up rapidly. That energy will need to come from somewhere. Whether it comes from natural gas or renewable, energy companies will be incredibly well-positioned to take advantage of the need to construct those new sources of demand. That highlight the strength of energy company’s portfolio.

Traditionally, when an industry becomes unpopular, it tends to see additional consolidation and resulting margin growth. The current run-up is a result of chronic underinvestment during weak prices in the 2020 downturn. We expect to see the largest companies like Exxon Mobil undertake more consolidation like in the late 1990s, early 2000s.

Third, oil companies don’t require billions of investments that never pay themselves of. Oil fields have a decline rate that’s expected to be much more significant than the decrease in demand. That means that oil companies can handle the downturn, not by losing money on existing investments, but investing less.

Lastly is new business opportunities. We’ll discuss carbon capture and management in the next segment; however, we expect the energy transition to cause several new business opportunities. Oil companies are skilled at deploying capital in projects worth tens of billions and we expect them to take advantage of these new opportunities.

Carbon Capture and Management

There’s a strong push to decrease emissions and search for efficiencies in the market. While we don’t disagree with that, we feel that the story of carbon capture and management is under-told, and that oil and gas companies have some of the most unique assets to participate here in a large-scale format and earn the resulting profits.

Current tax credits to capture carbon are $50 / ton and Exxon Mobil has said it wants at least $100 / ton. However, with that number more of a “wish”, let’s assume that as the market grows to be worth hundreds of billions if not more, the $50 / ton price point can be achieved by firms actively working on large-scale carbon storage.

That means, to capture humanity’s total emissions of 37 billion tons / year, the cost would be roughly $1.8 trillion. But there’s actually much more to that number. China, for example, the largest emitter globally, is expected to see an almost 70% decline in energy-related CO2 emissions, as the country moves away from coal.

Across the vehicle lifespan, those electric cars, Exxon Mobil’s CEO expects everyone to be driving will be sending out much less CO2. With increased industrialization, we expect CO2 emissions to remain roughly flat until 2040 globally but start decreasing after that. So that $1.8 trillion in our view represents a true peak.

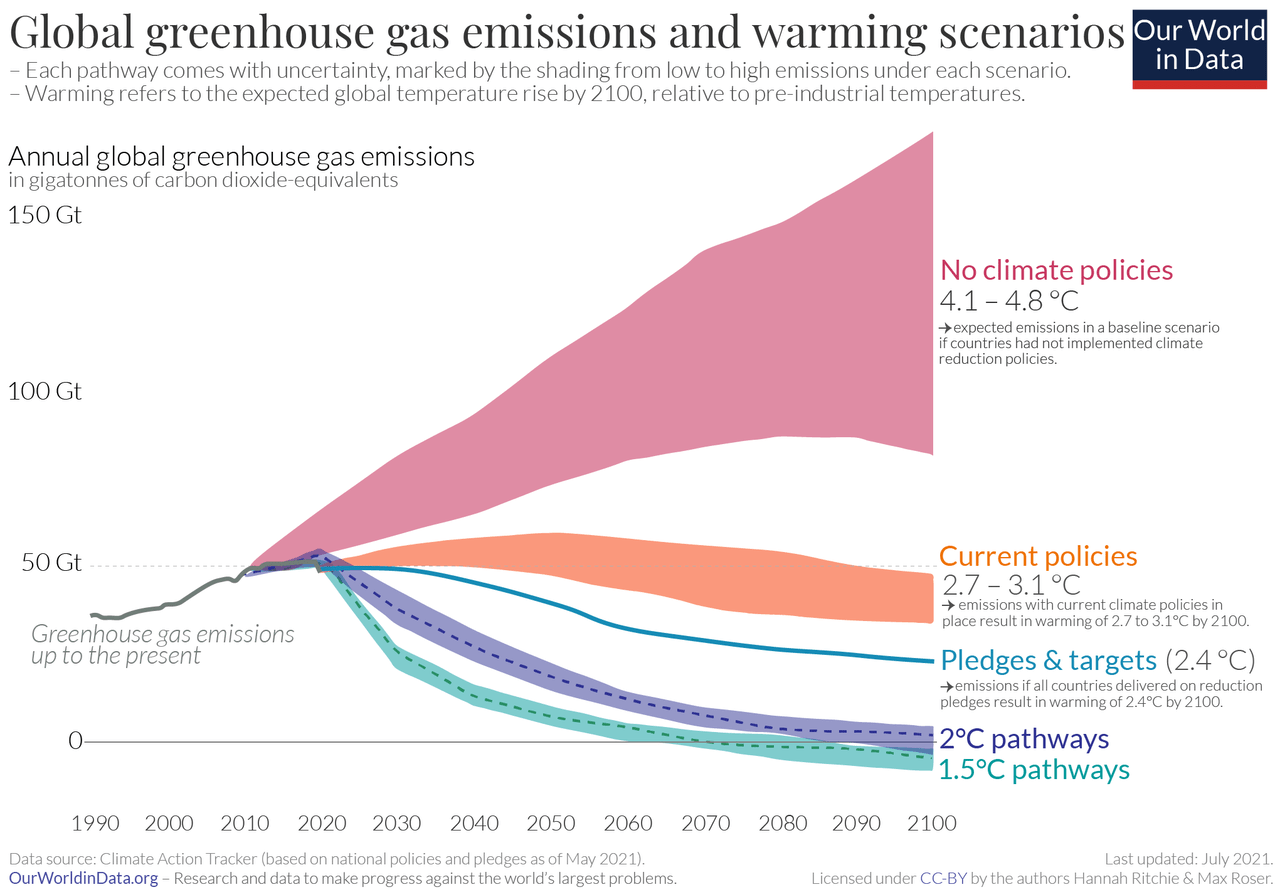

Global CO2 Emissions – Our World In Data

The above graph shows emissions under a variety of forecasts throughout the century from where we expect to be. We don’t expect humanity to hit the 2 degrees Celsius target, but with pledges and targets for 2.4 degrees that still enables net emissions to be roughly 30 billion tonnes for most of the century, meaning only the easiest 10-20 billion tonnes need to be captured.

More so, it’s worth highlighting that $1.8 trillion isn’t a ridiculous amount of money in the global economy. At $115 / barrel, the global oil industry is $4.2 trillion / year. So even if oil alone had to shoulder the entire cost as a tax (which makes no sense), it would be a $50 / barrel tax. Coal accounts for a much larger source of emissions.

If you instead did it as an “efficiency tax” on global energy consumption, the $1.8 trillion of the 170,000 TWh in global energy consumption, would come out to $0.01 / KWh, a level that most people would barely notice on their electric bills and fairly close to the federal gasoline tax at $0.33 / gallon of gas.

If you instead decide to only capture the easiest 10 billion tonnes and get that cost down to $25 / tonne, your annual cost of $250 billion is now $0.046 / gallon of gasoline. The three takeaways here are:

1. This is a business that oil companies, due to their existing expertise in the field and nature of emissions can comfortably come to dominate.

2. This will likely become a large-scale business in the coming decades due to the nature of how hard it is to reduce emissions (Exxon Mobil is predicting it as a $4 trillion market in 2050).

3. It will be profitable and likely passed onto consumers as a “tragedy of the commons” tax.

Exxon Mobil

For those looking to invest, we see several great opportunities in the sector. The most standout of them? Exxon Mobil. In our view (read more here), Exxon Mobil has three things that make it a unique investment at this time.

1. Carbon Capture. The company is a world leader in carbon capture and has numerous assets where carbon capture is easy. It’s expanding existing facilities, has accepted the realities of climate change, and is working towards large-scale capture such as in the Houston Shipping Channel. The proposed $100 billion hub here has the ability to capture 100 million tonnes / year or ~0.2% of the world’s emissions by 2040.

2. Strong Existing Assets. Exxon Mobil has an incredibly strong portfolio of assets as things currently stand. The company is expanding into LNG significantly and its Guyana, Brazil, and Permian assets have some of the lowest production costs of large-scale producing assets. This will support the core of profits.

3. Size. Exxon Mobil is one of the largest oil producers with the widest scopes. That means the company has the financial strength and ability to acquire competitors and chase consolidation should the industry start moving into that direction improving margins.

Midstream

Another area where we see substantial opportunity is in the midstream world. Here Enbridge (ENB) is one of our favorite investments (read more here).

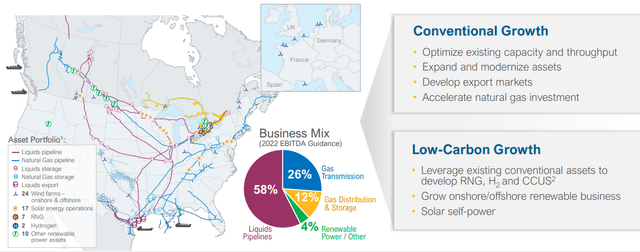

Enbridge Assets – Enbridge Investor Presentation

Midstream companies form a sort of “toll road” for energy, moving it from where it’s produced or refined to where it’s needed. For obvious reasons, the largest-producing shale oil fields and the largest population centers tend to have wide gaps. Enbridge is at the forefront of this “toll road” business with unique and integrated assets throughout North America.

The company has a more than 6% dividend yield in a growing business today. In exchange for investing, you not only get access to conventional growth assets that are essential to our modern standard of living, including crown jewel gas transmission and liquids pipelines from Canada to the Northeast and Gulf Coast.

You also get access to a respectable renewable and power business that is growing rapidly, taking advantage of opportunities in the renewable space. The company will continue to act as a toll operator with its valuable portfolio of assets, and in our view, will continue to drive substantial shareholder returns.

Conclusion

In many ways with long-term demand is expected to decrease, even from the perspective of CEOs in the industry. Exxon Mobil has said they expect gas vehicles to be gone by 2040, a major source of demand, as the industry continues to change. However, we don’t see this as anywhere near the end of the industry.

The industry remains innovative and skilled at profitably deploying billions of capital. The end of oil doesn’t mean the end of energy as energy demand is expected to increase. We see several opportunities here and highlight two of our favorites that we recommend investing in, Exxon Mobil and Enbridge. Let us know your thoughts in the comments below.

Be the first to comment