Grand Warszawski/iStock Editorial via Getty Images

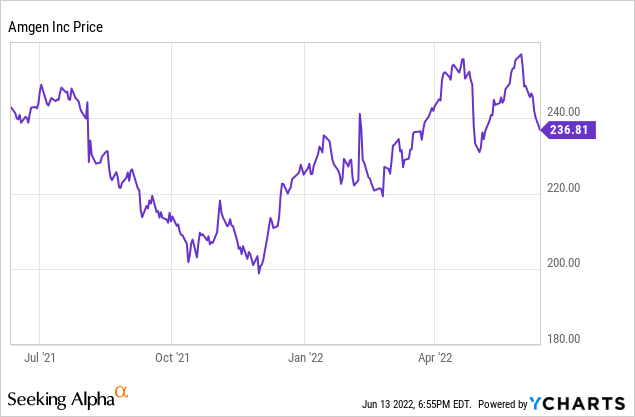

Amgen (NASDAQ:AMGN), one of the first successful biotechnology pharmaceutical companies, is on the comeback trail. Right now, due to the general decline in the stock market and in the biotech sector, it is very attractively priced. That does not mean its stock price cannot decline further, but it does mean that buying now is highly probably to look smart a year or two from now. In addition, it pays a cash dividend, which is rare in the biotech industry. Since I wrote about Amgen in April in Amgen’s Cancer Portfolio and Pipeline Make It A Buy, in this article I will focus on more recent developments and how they fit into my bull thesis.

Quick Q1 2022 results recap

Amgen Q1 2022 results were reported back on April 27. Revenue in the first quarter of 2022 was $6.24 billion, up 6% from Q2 2021. As has been the case for several years now, the growth rate was a result of declining revenue for older drugs, especially the ones that have lost patent protection, balanced by increasing revenue from newer drugs. For instance, Neulasta revenue declined 28% y/y to $348 million, while Lumakras, a new cancer drug, earned $62 million, compared to nothing in Q1 2021, before it received FDA approval.

Net income was $1.48 billion using GAAP, or $2.34 billion on a non-GAAP basis. Those were down 10% and up 9% y/y, respectively. EPS (earnings per share) were $2.68 GAAP and $4.25 non-GAAP, leading to a 5% y/y decline or a 15% y/y increase, respectively. EPS growth was better than net income growth because share repurchases reduced the number of shares used in the calculation.

Amgen ended the quarter with a cash and equivalents balance of $6.54 billion, so there should be no danger to operations or the dividend. However, long-term debt was $36 billion. Free cash flow in the quarter was $2 billion. Cash in the quarter was greatly reduced by the use of $6.4 billion to repurchase shares.

New Olpasiran Data

Olpasiran is a small interfering RNA or RNAi designed to lower apolipoprotein, which in turn lowers lipoprotein(a), a risk factor for atherosclerosis, strokes, and heart attacks. It is licensed from Arrowhead Pharmaceuticals (ARWR). On May 31, 2022, Amgen announced positive topline Phase 2 olpasiran data from a double-blind, placebo controlled study. Lp(a) readings were reduced for a majority of patients. Full data will be presented at a future medical conference. Depending on Phase 3 results and FDA thinking, it might eventually be prescribed to the 20% of adults with readings above 125 nmol/L. If so, it would be a very big revenue generator. Even if the threshold was set to include only the highest risk 1% of adults, it would create a huge revenue screen. But keep in mind that sometimes the larger Phase 3 trials required for approving a drug turn up issues not seen in the Phase 2 trials.

Riabni, biosimilar to Rituxan, Approved by FDA for rheumatoid arthritis

On June 6, 2022, the FDA approved Riabni for treating moderate to severe rheumatoid arthritis. This was on the basis of both Phase 3 data and on its being a biosimilar to Rituxan, which is marketed by Biogen (BIIB). There are already several Rituxan biosimilars on the market. Riabni had already been approved for treatment on non-Hodgkin’s Lymphoma, chronic lymphocytic leukemia, and other related diseases. While this will be an incremental revenue generator for Amgen, the market for RA therapies is huge. For Biogen, Rituxan generated $147 million in revenue in Q1 2022, down 18% y/y due to generic competition. Amgen did not report separate Riabni revenue in Q1 2022 but lumped it into its “Other” category.

Vectibix beat Avastin in a trial

On June 5, 2022, Amgen announced new Phase 3 results for Vectibix for colorectal cancer. Vectibix was initially approved in 2006 and generated $201 million in revenue in Q1 2022. The new study compared Vectibix combined with chemotherapy to Avastin combined with chemotherapy in first line wild-type RAS metastatic mCRC (colorectal cancer). The study was conducted in Japan by Takeda (TAK) and was randomized. The data showed Vectibix improved OS (overall survival) to 36.2 months from 31.3 months for Avastin, including patients with left-sided tumors. The trial included 823 patients. Since Vectibix is already approved in the first-line mCRC wild-type KRAS setting, I expect the results will be used to inform physician decisions as to which drug to try first. Avastin is marketed by Roche (OTCQX:RHHBY) for a variety of cancers including mCRC.

But more Neulasta biosimilars approved

On the downside, on May 27, 2022, another biosimilar to Neulasta was approved. Fylnetra was jointly developed by Amneal Pharmaceuticals (AMRX) and Kashiv Biosciences. Amneal previously had Releuko, a biosimilar to Amgen’s Neupogen, approved. Both products are expected to launch in the second half of 2023. Both Amgen drugs already had biosimilar competition. I mentioned the Neulasta drop in revenue in Q1 above. Neupogen is a much smaller market, generating only $39 million for Amgen in Q1, but up 12% from the year-earlier quarter. As multiple biosimilars enter, the market prices tend to get driven down and the original drug loses market share.

The Dividend

Amgen recently paid a dividend, on June 8, 2022. It went ex-dividend on May 16, 2022. The annual dividend is $7.76, yielding 3.23% at a stock price of $237. With a P/E Ratio of about 23.6, it appears earnings are adequate to support this level of dividend. In Q1, cash used for dividends was a bit over 50% of free cash flow.

Conclusion

When my last Amgen article was published, on April 20, 2022, Amgen stock closed at $255.38. As I write, it is hovering around $238, so it is even cheaper now. I believe that is not due to a change in Amgen’s prospects; if anything, they have improved. Rather it is due to the general decline in the markets. Given the complexity of the world, it is hard to predict what markets will do. But the medical landscape, and revenue from it, is more predictable.

If olpasiran is approved, it could have a more positive effect on Arrowhead’s stock price; since it is a much smaller company, the revenue impact would be greater. See my most recent take on Arrowhead at Accumulate Arrowhead For Its RNAi Pipeline. However, given the likely need for a Phase 3 trial, that approval is likely two to three years away.

Amgen has a strong pipeline that should continue to generate new drug approvals over time. While results will fluctuate quarter by quarter, I believe Amgen will generate overall revenue growth despite losses to biosimilar rivals for some of its older drugs. I believe the value proposition is very good at this point. Even if there is a national or global recession, drug sales tend to be resilient. That said, once investors become discouraged, and stop thinking about long-term value, it is impossible to predict how far stock prices, in general or for individual stocks, will drop before returning to rational levels. Unlike most other biotech stocks, with Amgen, an investor can enjoy the dividend while waiting for the market to correct itself. Most pharmaceutical stocks are on sale right now; many of the smaller companies appear much more undervalued than Amgen. If there you have an appetite for risk, you might do even better with some of the smaller biotechs that do not offer the relative safety of Amgen.

Be the first to comment