JHVEPhoto

Q3 recap and thesis

Amgen (NASDAQ:AMGN) delivered another strong quarter in Q3 2022, beating consensus estimates on both lines. The business is firing on all cylinders. It delivered robust operating margins in a challenging environment, while at the same time maintained strongly invested in first-in-class pipeline opportunities. Free cash flow totaled at $2.8b in Q3. More importantly, management raised guidance for FY 2022. Total revenue guidance is now raised to be in a range of $26B-$26.3B, compared to the prior outlook of $25.5-$26.4B. And EPS outlook (non-GAAP basis) is raised to $17.25-$17.85, compared to the prior range of $17.00-$18.00.

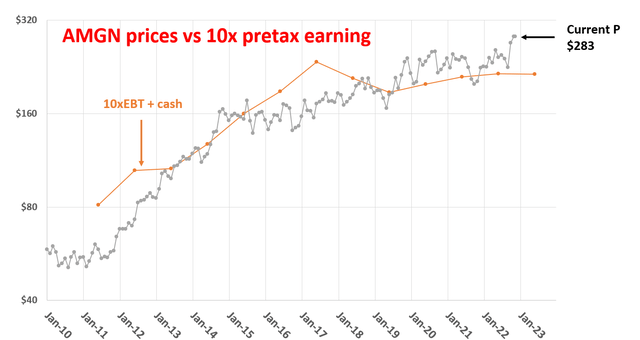

Its stock prices have been advancing in tandem, reaching an all-time high near $296 recently. The prices have retreated a little and currently hovers around $283, only about 4% below its all-time high. And this brings me to the thesis of this article. Even at the current near-record price, AMGN still offers an opportunity that is equivalent to owning a 7.5% yielding equity bond according to Buffett’s 10x EBT rule. Furthermore, looking ahead, I expect its volume growth to easily offset lower selling prices and also foreign exchange headwinds. So, in this sense, it is a 7.5% yielding equity bond with coupon growth build in.

AMGN and Buffett’s 10x Pretax Rule

The chart below shows the prices of AMGN and its 10x pretax earnings (also referred to as EBT, Earning Before Taxes). As you can see, whenever its prices became near or below 10x EBT (with cash position adjusted), it has been great opportunities to buy. And vice versa. At its current price level of $283, it is price at a valuation of 13.3x FWD EBT (assuming 14% tax rates), equivalent to 7.5% pretax earnings yield or a 7.5% equity bond.

Source: author based on Seeking Alpha data

In case you are new to Buffett’s 10xEBT rule or why 13.3x EBT is equivalent to a 7.5% equity bond, I have a blog article providing the details and the Q&A I’ve received on this topic. A quick recap here:

- Buffett paid ~10x pretax earnings for many of his largest and best deals. The list is long, ranging from Coca-Cola, American Express, Walmart, Burlington Northern, and also the more recent AAPL purchase. It is hardly a coincidence because buying a business that stagnates forever at 10xEBT would already provide a 10% pretax earnings yield, directly comparable to a 10% yield bond. Any growth is a bonus.

- The 10xEBT rule does NOT mean you should go out and buy every/any stock that is priced below 10xEBT. Investors face two primary risks: A) quality risk or value trap, and B) valuation risk, i.e., paying too much. The 10x pretax rule is mainly to avoid the type B risk AFTER the type A risk has been eliminated already.

- Then how do we eliminate type A risks? I look for three things primarily. First and second, the business should have no existential issue in short term and the long term. And third, the business should have a decent chance to grow (at the so-call perpetual growth rate). This will be a plus.

AMGN: does it have existential issues?

Thus, let’s first address the type A risks and see if AMGN faces any existential issues. I simply do not see any such issues for AMGN either in the near or long term with its scale, profitability, and strong product lineup.

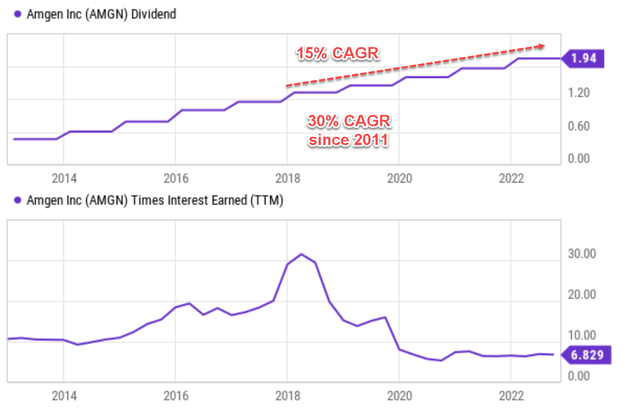

A shortcut to hack into survivability is the dividend payout. As shown in the chart below, AMGN has been paying and growing dividends at a spectacular pace in the long term and near term. Its dividend growth rate since 2011 has been a remarkable 30% CAGR. Although using 2011 as a starting year might be biased since that was when AMGN started paying dividends. Using the payouts in the past 5 years, its dividend growth CAGR is still a robust double-digit 15%. In the meaning time, the business maintains a strong financial position too. As seen from bottom panel of the chart, its interest coverage has been very stable in the recent years around 6.8x (and probably overly conservative in the past with coverage above 10x before 2020).

Looking further out, AMGN enjoys strong secular tailwinds due to a combination of longer life expectancy, its strong product mix, and robust pipeline. The following projection from the US Medicare and Medicaid center shows that:

Our national health spending is projected to grow at an average annual rate of 5.4%, far exceeding inflation and GDP growth, for 2019-28 and to reach $6.2 trillion by 2028.

And AMGN is well-positioned to capitalize on such secular support. It has been growing its key products through both volume expansion, new product offerings, and also strategic acquisitions. It just launched two new brands, LUMAKRAS and TEZSPIRE, and both are reaching more patients. It has recently completed the acquisition of ChemoCentryx (at $52 per share). And its pipeline is truly intriguing in my mind. Numerous trials are under way, focusing on a range of ailments, including asthma and lupus.

Source: Getty Images and US Medicare and Medicaid.

AMGN’s perpetual growth prospects

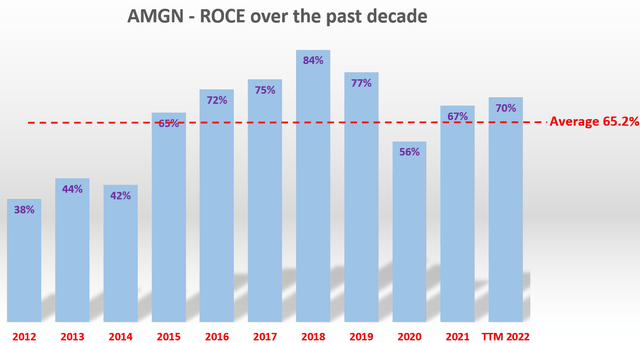

In the long run, the growth rate of a business is governed by two things in the following way: Longer Term Growth Rate = ROCE * Reinvestment Rate, where ROCE stands for the return on capital employed. The ROCE of AMGN is shown in the plot below. As you can see, it maintains a high level of ROCE around 65.2%, with great consistency, since 2015.

Source: author based on Seeking Alpha data

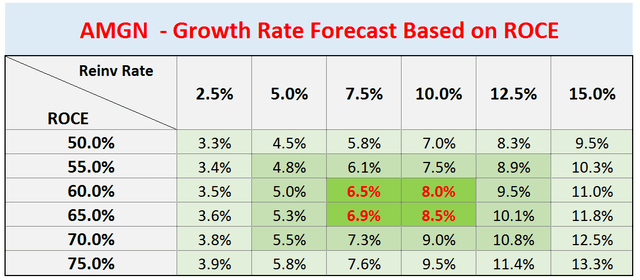

With a 65.2% ROCE, AMGN could maintain a 5% to 6.5% long-term growth rate with reinvestment rates (“RR”) in the range of 7.5% to 10% (its average level in recent years). Even assuming a lower end of RR near 7.5%, the long-term growth would be around 5% (ROCE * RR = 7.5% * 65.2% = 4.9%). Note that this is real and organic growth rate. As aforementioned, medical care expenses are project to outpace inflation, so I think it is total justifiable to add an inflation escalator (say a conservative 2%) to its growth rates as shown in the table below. In the end, its long-term growth rate would be upper-single-digit range (around 6.5% to 8.5%).

Now let sum things up using the 10xEBT framework:

- Paying 10x EBT for a stagnating business is equivalent to owning an equity bond with a 10% yield. Under AMGN’s current conditions, its valuation is 13.3x EBT, equivalent to a 7.5% equity bond.

- In the meantime, there is a good chance for 6.5%~8.5% long-term growth.

- Thus, an investment under current conditions is similar to a 7.5% equity bond with about 6.5%~8.5% of annual coupon growth built in.

Source: author based on Seeking Alpha data

Risks and final thoughts

As aforementioned, AMGN is facing some near-term headwinds in terms of lower selling prices, receding demand for mature products, and also foreign currency exchange impacts. Its top-line progress has also been partially offset by lower COVID-19 manufacturing collaborations. Although in my view, as COVID-19 continues to fade into the background, I am optimistic that patient prescriptions for its products will remain on the rise as individuals visit hospitals and doctors’ offices more regularly.

To conclude, AMGN is currently for sale around 13.3x EBT, not the best fit for Buffett’s 10xEBT Rule, but quite close. Furthermore, as a healthcare leader, its operations are far less vulnerable to broad-based economic concerns in my mind. While Amgen has not been immune to these concerns such as high rate of inflation and supply-chain disruptions, it’s much more resilience with its leading positions and strong financial positions. In other words, its type A risk is far lower than other stocks and hence easily justifying some valuation premium above the 10xEBT rule. All told, a 7.5% pretax earnings yield combined with 6.5~8.5% annual growth rate still offers favorable odds of double-digit return in the long term.

Be the first to comment