Sundry Photography

Introduction

I first covered Amgen Inc (NASDAQ:AMGN) in early December 2021 and published a follow-up analysis in March 2022. The main factors for my muted optimism at the time were a somewhat sobering pipeline and a focus on immunological drugs, in particular Enbrel (etanercept), which I suspected could suffer from collateral damage from Humira’s (AbbVie, ABBV) loss of exclusivity (LOE).

However, it should be recognized that the earnings of big pharma and biotech companies can fluctuate wildly over the years – recurring blockbusters are no guarantee, but as long as management is solid and balance sheets are robust, these companies ultimately do quite well. In my last article, I positively appreciated the shareholder-friendly stance of Amgen’s management, which is paramount at a time when my own expectations lead me to believe that we could be in for a “lost decade” in terms of capital gains. Dividends are a welcome and reliable companion in difficult times. In addition, a dividend that’s growing at or above the personal inflation rate is also an excellent hedge against inflation (see my recent article on a very common fallacy). Of course, all this assumes that the underlying business generates ample free cash flow.

In this update, I will discuss Amgen’s recently reported third quarter results and reevaluate whether I still think the stock is a buy given the apparent demand for safe have equities, which large pharmaceutical companies obviously are, especially late in the cycle.

AMGN Q3 Earnings Review

In 2021, I discussed the concentration risks of several large pharmaceutical companies, highlighting Amgen as a company with a bit too much exposure to the U.S. and therefore at risk of being impacted by the upcoming drug price negotiation initiative. A year later, the presumed headwind has not gone away, but Amgen’s focus on the U.S. has largely insulated it from exchange rate headwinds that other, more internationally-diversified companies are experiencing to a considerable extent. In the third quarter, the company saw only a 2% negative impact of foreign exchange on product sales, which were down 1% year-over-year. Volume growth of 8% was solid, but was mainly offset by lower selling prices. Quarterly operating income and earnings per share, both on a GAAP basis, increased 12% and 20%, respectively, highlighting the company’s focus on share repurchases at what I believe are good valuations (see discussion below). Free cash flow generation remained strong ($2.8 billion in Q3, $6.5 billion in the first nine months of 2022), but of course the company still needed to raise debt to fund a recently completed acquisition ($3.7 billion), the significant share repurchases ($6.4 billion), and the dividend ($3.2 billion).

In the aforementioned analysis from late 2021, I noted that Amgen’s current revenue distribution is somewhat overly dependent on Enbrel, the company’s cash cow that it has been milking for more than 20 years. This is still true today, and in Q3 2022 Enbrel still accounted for nearly 18% of Amgen’s product sales ($1.11 billion). Quarterly sales were down 14% year-over-year, and the decline in recent quarters can be attributed, among other reasons, to Humira’s LOE, as the two biologics are used to treat similar indications. However, this is just the beginning of the end of Enbrel, and Amgen is increasingly forced to find new sources of revenue. In addition to internal drug development, the company also is active in mergers and acquisitions. Recently, the company announced the completion of its acquisition of ChemoCentryx (CCXI), which I will briefly discuss in the following section.

Amgen’s osteoporosis drugs denosumab (Prolia/XGEVA) and romosozumab (EVENITY) posted quarterly sales increases/decreases of +7%/-4% and +35%, respectively, and together accounted for 25% of total quarterly product sales. Of course, another notable sales driver is Otezla (apremilast), a biologic for the treatment of psoriasis and psoriatic arthritis, which at $627 million was up 3% from the year-ago quarter.

In terms of long-term growth catalysts, the novel lung cancer drug sotorasib (LUMAKRAS/LUMYKRAS) deserves mention. It targets a relatively common (13%) cancer mutation in the KRAS protein that was previously thought to be resistant to therapy. Recently, the company announced that treatment with sotorasib resulted in longer progression-free survival and higher objective response rate in patients compared with docetaxel (Taxotere, Sanofi, SNY) (CodeBreaK 200, phase III trial). However, LUMAKRAS is still at a very early stage, underscored by quarterly sales of $75 million, up 108% year-over-year.

Also of note is tezepelumab (marketed as TEZSPIRE), a monoclonal antibody for the treatment of asthma that works by blocking thymic stromal lymphopoietin, a cytokine that plays a key role in airway inflammation. The compound was co-developed with AstraZeneca (AZN) and approved for the treatment of severe asthma in the U.S. in late 2021 and in the EU in September 2022. It’s understandable that sales are just starting to ramp up, and the drug generated quarterly sales of $55 million in the U.S., a 90% increase from the previous quarter.

Finally, Amgen also is leveraging its expertise in developing promising biologics in the biosimilars space. For example, the company has developed AMGEVITA to get a piece of the large Humira pie. However, AMGEVITA (also marketed as AMJEVITVA) is by no means a new development, having already been approved in the U.S. in 2016 and in the EU in 2017 for the treatment of various inflammatory diseases. It’s Humira’s rigorous patent protection in the U.S. that has held back competition, but in 2023 Amgen will finally be able to market the treatment in the United States.

As the year nears its end, Amgen has narrowed its full-year guidance and now expects total revenue of about $26.15 billion (midpoint expectation) and earnings per share of $17.55 on a non-GAAP basis, up slightly from its previous midpoint expectation of $17.5.

What To Make Of The Acquisition Of ChemoCentryx?

On Oct. 20, Amgen announced the completion of its acquisition of ChemoCentryx (CCXI) for approximately $3.7 billion. Through ChemoCentryx, Amgen acquired Tavneos (avacopan), a first-in-class treatment of anti-neutrophil cytoplasmic antibodies-associated vasculitis (ANCA-AV, AAV), a severe but rare autoimmune disease, affecting between 8,000 and 10,000 people in the U.S. each year, or with an incidence of 20 to 25 people per million and year according to a paper investigating a UK mixed ethnicity population (Pub Med ID 27274096). Tavneos has been approved by the FDA in October 2021.

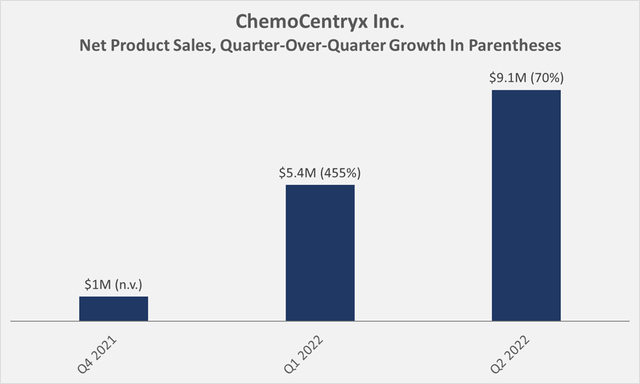

Paying nearly $4 billion for a therapy for a rare disease certainly sounds rich, in particular when reviewing CCXI’s product sales that exclusively stem from Tavneos (Figure 1). This is somewhat reminiscent of the early-stage performance of Gilead’s (GILD) acquisitions, which, as I discussed recently, seem to be starting to bear fruit. That’s not to say, however, that I’m equally optimistic about the potential of Tavneos – it’s really hard to imagine the drug reaching blockbuster status.

On a slightly more positive note, Tavneos can theoretically be considered a “pipeline within a drug” – as ChemoCentryx management boldly wrote in its 2021 10-K. For example, the company is developing Tavneos for the treatment of complement 3 glomerulopathy (C3G, an extremely rare kidney disease, ACCOLADE trial) and hidradenitis suppurativa (a chronic, inflammatory, debilitating skin disease with an estimated prevalence of 0.1% in the U.S., p. 10, CCXI’s 2021 10-K). In addition to Tavneos, the company also is investigating the potential of its orally administered drug candidate CCX559 as a programmed death protein 1/programmed death-ligand 1 inhibitor (cancer treatment).

Figure 1: ChemoCentryx’s net product sales on a quarterly basis (own work, based on the company’s 2021 10-K and the 2022 10-Q1 and 10-Q2 statements

Creating Shareholder Value Through Share Repurchases

In the first nine months of 2022, Amgen repurchased $6.36 billion worth of shares, for an average price per share of $242. During the same period in 2021, Amgen repurchased 14.8 million shares at an average price of $238 per share. The decline in the stock price in Q4 2021, when Amgen repurchased an additional 6.9 million shares, helped reduce the average cost to $230 per share.

At the end of Q3 2022, the company still had $4.6 billion in remaining authorization under its buyback program, and just recently Amgen announced an increase by another $2.4 billion (p. 19, third quarter 10-Q), bringing total unused authorization to $6 billion. For the full year, however, the company still expects “only” $6 billion to $7 billion in share repurchases, so no more buybacks are expected in the fourth quarter, which is positive in view of the recent increase in the share price. This suggests that management no longer views the shares as cheaply valued. However, I think it’s more reasonable to view the paused buyback program simply as a result of Amgen spending more than the free cash flow generated so far in 2022 (about $6.5 billion unadjusted) on dividends and buybacks ($9.5 billion total) while increasing its debt by approximately $7 billion. Of course, that’s not to say that the company is engaging in financial engineering here – I just see this as an opportunistic move from a company that operates on the back of a very strong balance sheet and generates reliable free cash flow. In addition, the increase in debt is due to the expected payment of about $3.7 billion to Chemocentryx’s shareholders.

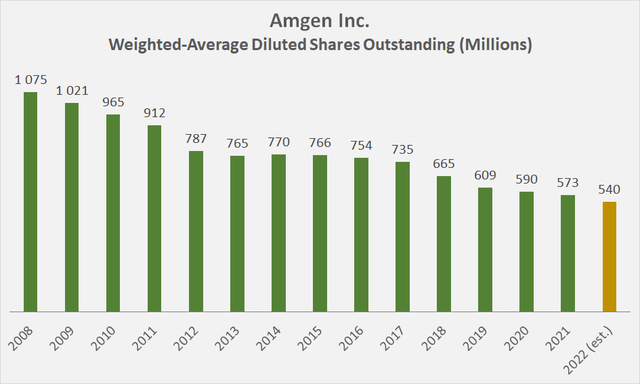

In any case, the continued emphasis on returning cash to shareholders through buybacks (in a sustainable manner, as I discussed in my previous article) has led to a huge increase in EPS and a proportional reduction in the cash required to pay dividends. Assuming that Amgen’s buybacks have indeed come to a preliminary conclusion, long-term Amgen shareholders (Figure 2) have seen earnings per share double in just 14 years thanks only to buybacks.

Figure 2: Amgen’s weighted-average diluted shares outstanding since 2008 (own work, based on the company’s 2008 to 2021 10-Ks and an own estimate for the 2022 figure))

Concluding Remarks

Amgen reported solid results on Nov. 3 that were largely in line with expectations, highlighted by a slight increase in sales and earnings guidance. The company’s over-reliance on Enbrel has likely spooked investors in the past, but promising developments, particularly related to its novel lung cancer treatment LUMAKRAS and asthma therapy TEZSPIRE, have roused the bulls. Amgen’s osteoporosis business continues to perform well and now contributes about 25% of the company’s quarterly revenue. Recent positive news about olpasiran (AMG 890, OCEAN(a) trial), a small interfering RNA molecule that reduces lipoprotein A synthesis in the liver, prompted the company to initiate a Phase 3 trial and fueled further optimism among shareholders for the company’s future. At the time of writing, the stock is approaching the psychologically important $300 mark, which would represent a market capitalization of $162 billion.

I own a sizable position of Amgen in my portfolio, appreciating the dependability of the company’s free cash flow and management’s emphasis on a solid balance sheet and cash returns to shareholders. Personally, I’m somewhat less optimistic about Amgen’s growth prospects than the broader market, and I’m a bit skeptical of the recently completed acquisition of ChemoCentryx. The consideration paid to CCXI shareholders appears excessive when assessing the current stage of the assets from a layman’s perspective, but at the same time I think it’s too early to dismiss avacopan as a flop. However, the sales to date and the expected use of the compound exclusively in rare or very rare diseases put a big question mark behind its commercial potential.

In my earlier articles, I described the stock as somewhat undervalued, but did not see any real catalysts for a price increase. I concluded that Amgen is best owned as a dividend growth stock.

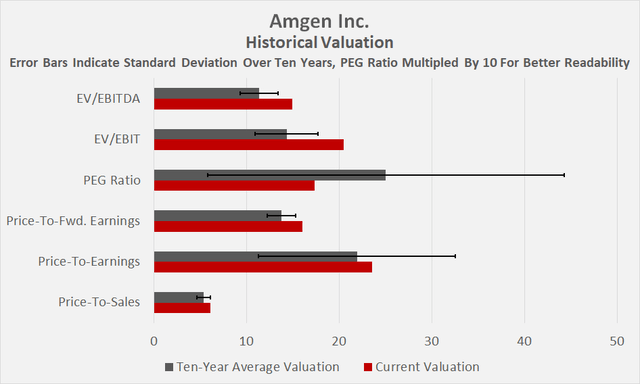

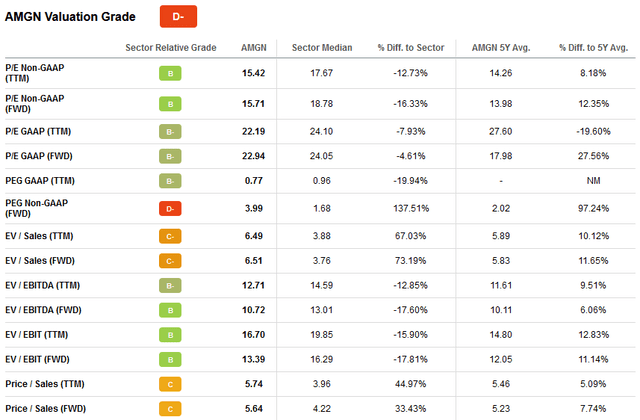

As it turns out, promising news on several of Amgen’s novel compounds, but more importantly, general market weakness and the resulting flight to safety, have led to a surprisingly good returns that make me think about selling my position, or at least part of it. However, at the current price of nearly $300, I consider Amgen to be only slightly overvalued (Figure 3, Figure 4) and am therefore hesitant to trigger a taxable event. Investor service Morningstar has currently assigned a fair value of $255 to the stock and thus also considers it slightly overvalued.

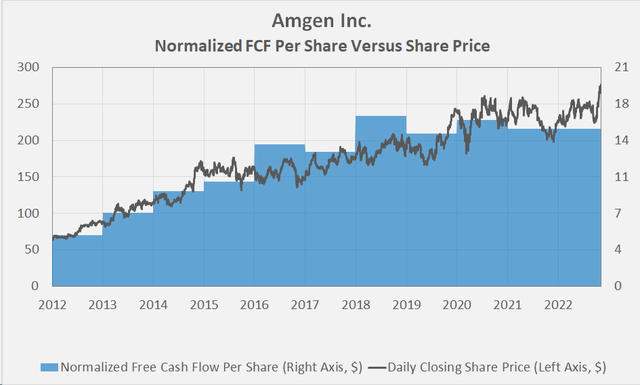

As a long-term oriented investor, I think it’s therefore the right thing to focus on a growing dividend instead of short-term capital gains. Amgen’s management has proven beyond a doubt that it remains committed to increasing the dividend, and the 11th consecutive increase is just around the corner, expected in early December. However, it’s also important to take into account the virtual absence of normalized free cash flow growth in recent years (Figure 5), highlighting Amgen’s less-than-successful efforts to revive growth to date. I’m therefore watching the stock closely and certainly will not add to my position at this level.

Figure 3: Historical valuation of Amgen (own work) Figure 4: Selected valuation metrics for AMGN (taken from AMGN’s valuation tab on Seeking Alpha) Figure 5: Overlay of AMGN’s normalized free cash flow per share and daily closing share price (own work, based on the company’s 2010 to 2021 10-Ks and own estimates)

Thank you very much for taking the time to read my article. In case of any questions or comments, I am very happy to hear from you in the comments section below.

Be the first to comment