ilbusca/E+ via Getty Images

Introduction

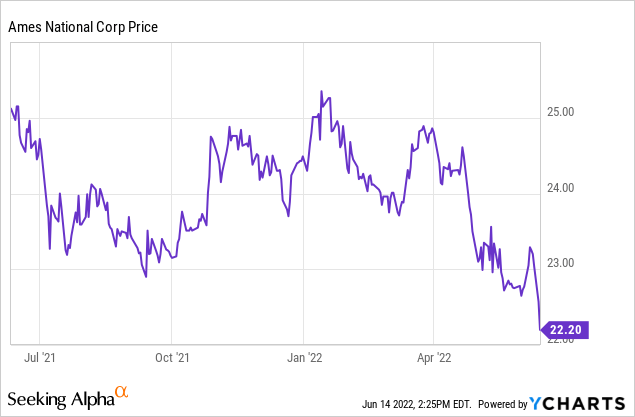

It’s been about six months since I last looked at Ames National (NASDAQ:ATLO), a small bank in Iowa. I was very charmed by the generous and safe 4.5% dividend yield and the bank’s conservative balance sheet with a strong focus on cash and securities. Unfortunately, the recent interest rate increases have reduced the fair value of those securities and the bank’s book value has slipped because of that. That is the only reason why I’m not initiating a long position right now as I’d first like to see how this situation evolves in the coming months or quarters.

Keeping an eye on the net interest income will be key

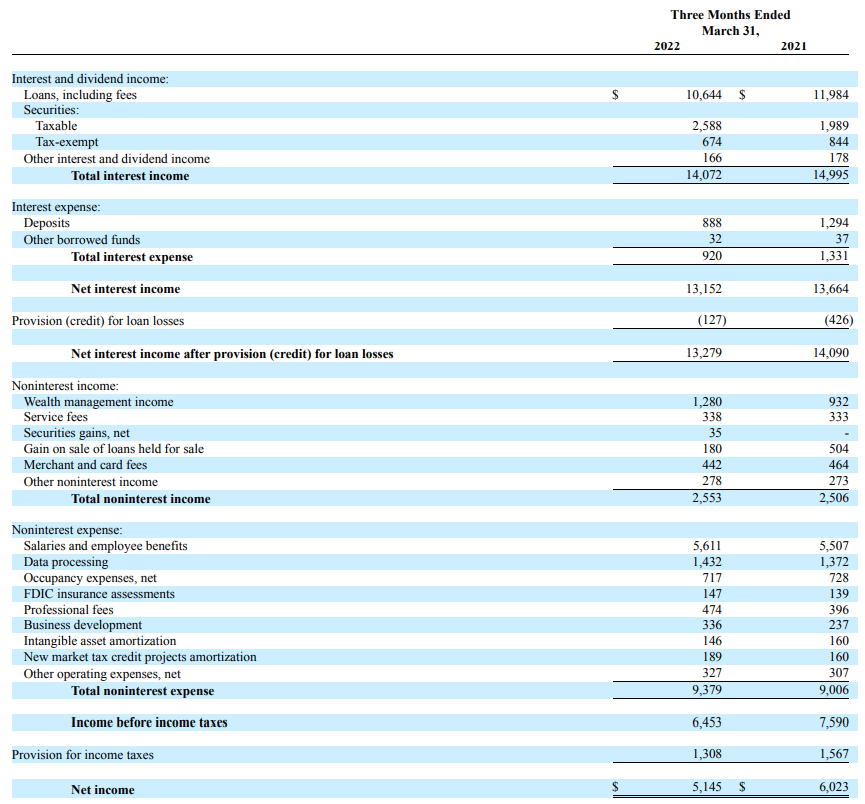

While most banks are still doing a good job in trying to keep the net interest income stable, Ames’ first quarter results show the bank had a slightly tougher time in making sure to keep the impact of the low interest rates on the markets on its net interest income limited. The total reported interest income decreased from $15M to $14.1M and although the interest expenses decreased as well, the decrease wasn’t sufficient to compensate for the lower interest income. The net interest income fell from almost $13.7M to $13.15M, a decrease of approximately 3.7%.

ATLO Investor Relations

Meanwhile, the bank also had to deal with an increase in the non-interest expenses and this also wasn’t offset by the (slightly) higher non-interest income. The pre-tax income before taking loan loss provisions into account was $6.3M, down from $7.15M. Ames was able to recoup about $127,000 in provisions it had recorded in previous quarters and this boosted the pre-tax income to $6.45M resulting in a net income of $5.15M or $0.57 per share. That’s a slightly disappointing result compared to the $0.66 EPS in Q1 of last year but keep in mind the higher contribution from loan loss provision reversals had a more pronounced positive impact on last year’s Q1 results.

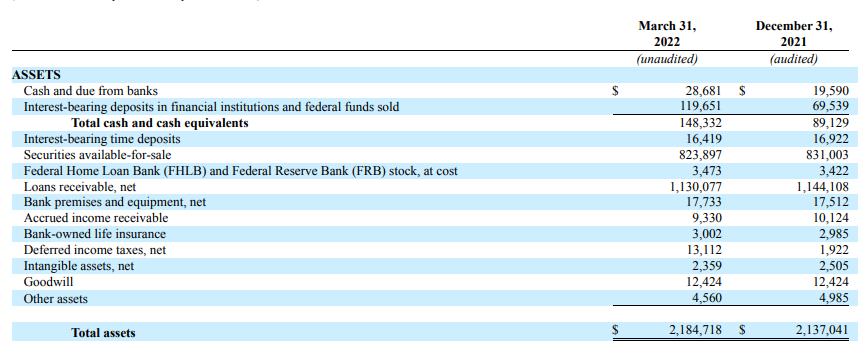

Meanwhile, it is interesting to see how Ames saw the size of its loan book decrease while its exposure to cash and securities increased. As of the end of Q1, the total amount of cash and securities on the balance sheet was 45% (up from 44% as of the end of December 2021) and that’s one of the highest ratios I have seen in the small-cap bank space.

ATLO Investor Relations

That also explains why the interest income is relatively low as these safer securities have lower yields than for instance mortgages or other loans. In a certain way, it is even remarkable ATLO was able to generate an EPS of $0.57 given its tendency to run a very conservative balance sheet.

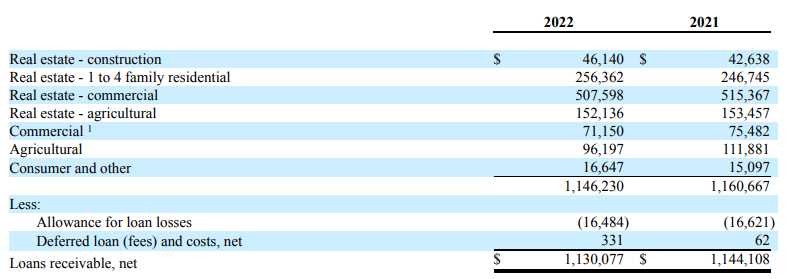

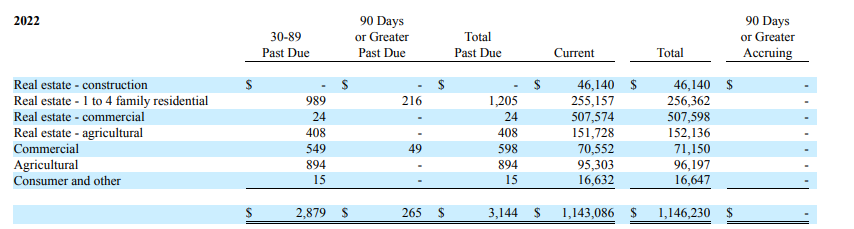

The majority of the $1.13B loan book is geared towards real estate with a specific focus on commercial real estate which makes up almost half of the loan book.

ATLO Investor Relations

And considering only $3.1M of the loans are classified as ‘past due’, the current loan loss provision of almost $16.5M definitely appears to be sufficient and that explains why Ames was once again able to recoup some of its loan loss provision. That being said, the total amount of loans past due increased by almost $1M compared to YE 2021 and the majority of this increase came from the agricultural loans which increased from just a few hundred thousand dollars to almost $0.9M.

ATLO Investor Relations

The dividend is still very safe thanks to the low payout ratio

Ames was paying a quarterly dividend of 26 cents per share and has recently hiked its quarterly payments to $0.27. This means the dividend is now coming in at $1.08 on an annualized basis and based on the current share price of around $22.50 the dividend yield has increased to approximately 4.8%.

That is quite appealing but it obviously also is important to make sure the dividend is sustainable. And considering the EPS in the first quarter was approximately 57 cents, the current dividend rate is very well covered as the payout ratio is just 47%. And keep in mind the bank should perform well in an increasing interest rate environment. We may see some hits to the book value (the bank lost about $30M in equity in the first quarter of the year due to recording higher unrealized losses and lower unrealized gains on its investment securities) so I definitely don’t mind the relatively low payout ratio.

By retaining over 50% of the earnings, Ames National will be able to retain just over $10M per year in earnings to prop up its equity value.

Investment thesis

The eroding book value is the only reason why I’m not immediately initiating a long position in Ames National Bank. I like the very conservative structure with plenty of attention to liquid assets but having a relatively outsized position in investment securities will result in (unrealized) capital losses and the book value may erode further in the second quarter of this year. As of the end of Q1, the tangible book value came in just below $19/share but I expect a further decrease of a few dollars per share.

This by itself does not worry me, but I’d like to monitor the situation for a bit longer before initiating a long position just to make sure the capital ratios and buffers remain strong. If everything checks out, Ames National could be a good addition to my portfolio.

Be the first to comment