DNY59

Introduction

In August 2022, I wrote a bearish article on SA about silver mining company Americas Gold and Silver (NYSE:USAS) in which I said that unit costs were high.

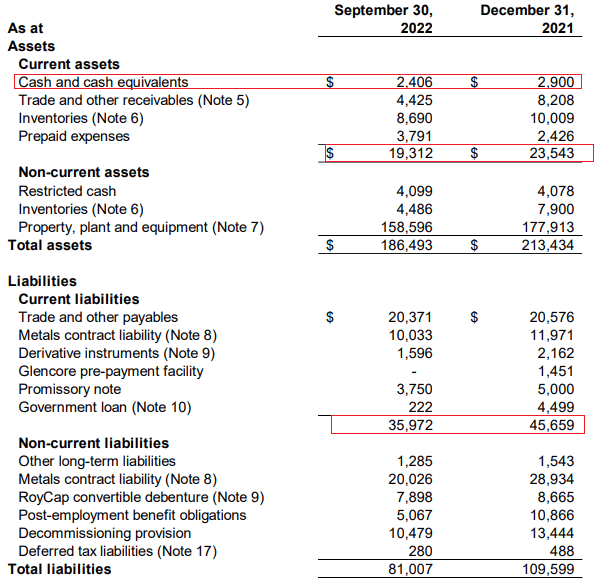

Well, silver equivalent production in Q3 was pretty much the same as the previous quarter but lower zinc prices led to a deterioration of the working capital deficit to $16.7 million as of the end of September. Considering the estimated capital cost for the Galena Hoist project was increased by $2.2 million to $8.9 million, the company appears to be in trouble. Let’s review.

Overview of the Q3 2022 results

In case you haven’t read my previous article about Americas Gold and Silver, here’s a brief description of the business. The company owns the Cosala Operations mining complex in northwestern Mexico and a 60% interest in the Galena Complex in the Silver Valley district in Idaho. It also holds the mothballed Relief Canyon gold mine in Nevada as well as the San Felipe silver-zinc-lead development-stage project near the U.S. border.

Americas Gold and Silver

Relief Canyon started operations in February 2020 but was shut down in August 2021 due to carbonaceous material found in the pit. Gold leaching continues there but the quantities produced are immaterial. The mine could be restarted in the future, but Americas Gold and Silver first needs to find a way to improve recovery rates and I’m not optimistic this will happen anytime soon.

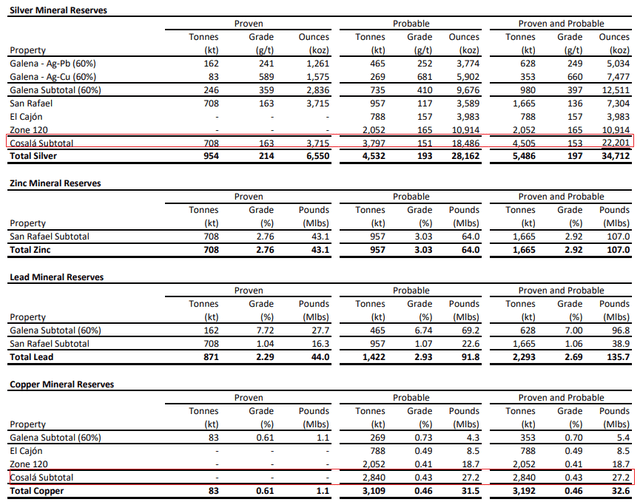

In September 2022, the company updated its mineral reserve and mineral resource estimate and silver reserves at the Galena Complex rose by 26% year on year to 20.9 million ounces. Considering that exploration drilling since June 2021 has been focused on this project, I find this result unsurprising. As of June 2022, proven and probable reserves included 34.7 million ounces of silver, 107 million pounds of zinc, 135.7 million pounds of lead, and 32.6 million pounds of copper. Most of the silver, zinc, and copper reserves were located at Cosala.

Americas Gold and Silver

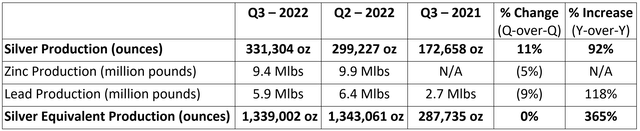

Turning our attention to the Q3 2022 results, silver production rose by 11% quarter on quarter, but zinc and lead production declined by 5% and 9%, respectively. As a result, silver equivalent production was almost unchanged.

Americas Gold and Silver

Silver production should improve in Q4 2022 thanks to higher average grades. At Cosala, production at the higher-silver grade Upper Zone at the San Rafael deposit is ramping up. At Galena, production will focus on higher-silver grade stopes.

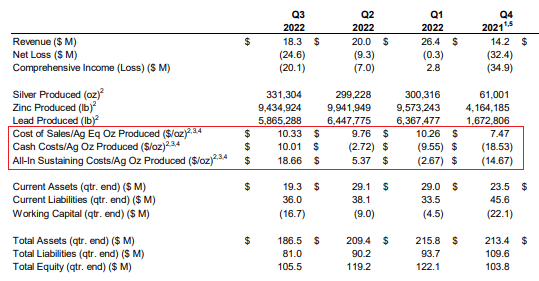

Unfortunately, consolidated Q3 2022 all-in sustaining costs (AISC) per silver ounce produced more than tripled to $18.66 due to lower zinc and lead prices. Yet, I don’t think you should pay too much attention to this metric as zinc accounts for about half of revenues. Cost of sales per ounce of silver equivalent produced was almost unchanged.

Americas Gold and Silver

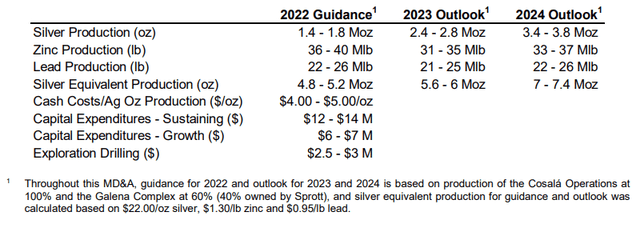

The guidance for the full year includes production of 4.8 million to 5.2 million ounces of silver equivalent and I think the results will be at the upper end. As you can see from the table below, Americas Gold and Silver aims to boost production significantly by 2024 and a key component to this plan is the Galena Hoist project, which will increase hoisting capacity at the operation at Galena.

Americas Gold and Silver

Galena Hoist is expected to boost annual silver production above 2 million ounces and should be commissioned by the end of this year. Americas Gold and Silver spent $2.4 million on this project in Q3 2022, thus bringing the funds invested to date to $6.5 million. Unfortunately, the company revealed in its Q3 production results that the estimated capital cost for Galena Hoist was increased by $2.2 million to $8.9 million as a result of inflationary pressures and higher installation costs. In my view, this puts the company in a tight spot as the balance sheet already looked weak. You see, lower metal prices led to an 8.5% quarter on quarter decrease in revenues and net cash used in operating activities came in at $6.7 million in Q3 2022. As of September, Americas Gold and Silver had a cash and cash equivalents balance of just $2.4 million while the working capital deficit was $16.7 million.

Americas Gold and Silver

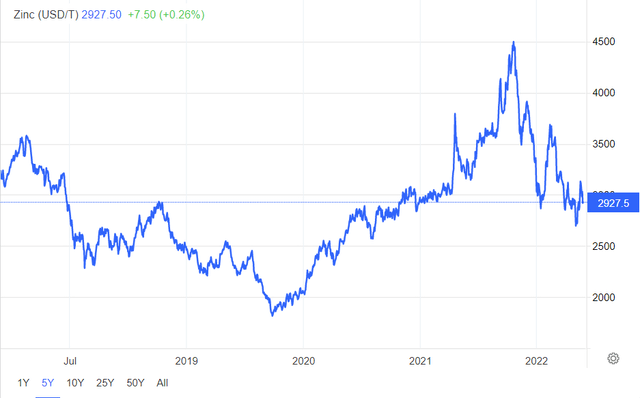

In my view, the main reason for the financial troubles of Americas Gold and Silver are falling zinc prices and I don’t expect them to recover anytime soon. The zinc market had a great start to 2022 thanks to rapidly rising demand due to the easing of restrictions related to COVID-19. However, prices have been falling over the past few months due to the deterioration of macroeconomic conditions across several major economies. In addition, several smelters in Europe had to slash output or shut down due to high energy costs.

Trading Economics

Looking ahead, I think that the picture looks grim. An increased number of COVID-19 cases in top zinc consumer China is likely to lead to more lockdowns which would affect demand significantly. Potential further disruptions in Europe due to energy shortages also remain a concern.

Overall, I think that Americas Gold and Silver is likely to have a couple of challenging months ahead due to low zinc prices and funding issues and I’m bearish in the short term. That being said, the prices of commodities are notoriously volatile, and I think that short-selling companies in the mining sector is dangerous. It could be best for risk-averse investors to avoid Americas Gold and Silver.

Looking at the risks for the bear case, it’s possible zinc prices won’t fall further. It’s possible that China abandons its strict zero-Covid policy or that we have a warm winter in Europe. Also, an end to the Russian invasion of Ukraine is likely to send energy prices in Europe lower which would lead to the restart of a significant number of smelters.

Investor takeaway

Americas Gold and Silver aims to significantly increase its output over the next two years, but this requires significant capex and investment in exploration drilling. With zinc prices declining over the past months, the company’s cash used in operations is rising while the working capital deficit is widening. I think that there could be significant stock dilution in the near future. Avoid Americas Gold and Silver stock.

Be the first to comment