DarioGaona/E+ via Getty Images

Nearly three months ago, I wrote on Americas Gold and Silver (NYSE:USAS), noting that its discount was more than justified relative to peers and that it was a name that was best to avoid. This is because the company had a poor track record of delivering on its goals, and it was unlikely to shake its trend of consistent net losses this year with a falling silver price. Since this update, USAS is down another 40%, massively underperforming its peers and the price of silver. While the 90% share price decline might have investors anxious to buy the dip, I continue to see USAS as an inferior way to buy the dip in the precious metals space. Let’s take a look at the Q2 results:

Galena Operations (Company Presentation)

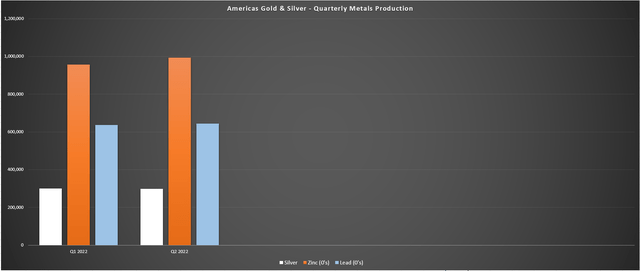

Q2 Production

Americas Gold & Silver (“AG&S”) released its Q2 results earlier this month, reporting quarterly production of ~299,300 ounces of silver, a marginal decline from Q1 2022 levels (~300,300 ounces). This was related to a slight decrease in silver at the company’s 60% owned Galena Mine, with the asset producing ~285,700 ounces of silver in Q2 2022, a nearly 2% decline from the previous quarter. The lower production was related to a slight decline in throughput to ~28,600 tonnes milled, partially offset by a 3% improvement in silver grades (319 grams per tonne) on a sequential basis.

Americas Gold & Silver – Quarterly Metals Production (Company Filings, Author’s Chart)

Last year, AG&S noted that it would be commissioning its replacement hoist at the operation in Q3 2022, which should benefit Galena (increased hoisting capacity), leading to increased production and higher profitability. However, the company has since revised this outlook to “by Q4 2022“, with this now changed to “late Q4 2022″. This delay shouldn’t be surprising and is par for the course for the company, given its historical track record of meeting guidance. For those unfamiliar with USAS, the company guided for 100,000 GEOs in FY2021. Actual production came in at less than 25% of this figure, near 20,000 GEOs, depending on what gold/silver ratio one uses.

“The Company’s gold equivalent production is expected to increase from approximately 14,000 ounces in 2019 to a range of 60,000 to 70,000 ounces in 2020 and 90,000 to 110,000 ounces in 2021, greater than a 300% and 500% increase, respectively, in gold equivalent production compared with 2019. The two-year outlook does not include production from the Galena Complex following the announcement of the recapitalization plan for 2020”.

– Americas Gold & Silver, February 18th, 2020

The good news is that while the project is behind schedule, the hoist will benefit the Idaho Mine and is one key piece to increasing production to 3.6 million ounces in 2024, a 100% increase from FY2022 guidance (1.40 – 1.80 million ounces). The other good news is that Cosala continues to perform well, producing ~127,800 ounces of silver in Q2 after restarting following a two-year hiatus post-COVID-19. The Mexican mine (Cosala) is expected to transition into the Upper Zone at Cosala later this year, an area where silver grades are much higher. Combined with higher-grade stopes at Galena, this should lead to a meaningful increase in silver production in H2 2022 (800,000+ ounces vs. ~600,000 ounces in H1 2022).

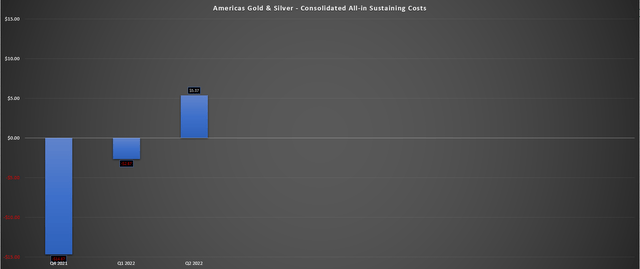

Costs & Margins

While AG&S production results were solid, costs have continued to creep higher, with the company subject to similar inflationary pressures as its peers. AG&S noted that costs were up due to increased employee retention costs and higher materials/consumables costs. The result was an increase in all-in sustaining costs to $5.37/oz, up from negative $2.67/oz in Q1 2022. While these are still very respectable costs for a company selling a commodity for $22.45/oz in Q2 2022, we could see further pressure on margins in H2 2022. This is because zinc and lead prices have softened, impacting by-product credits, and the silver price is much lower, likely to average $19.50/oz or less in Q3 2022.

Americas Gold & Silver – Consolidated AISC (Company Filings, Author’s Chart)

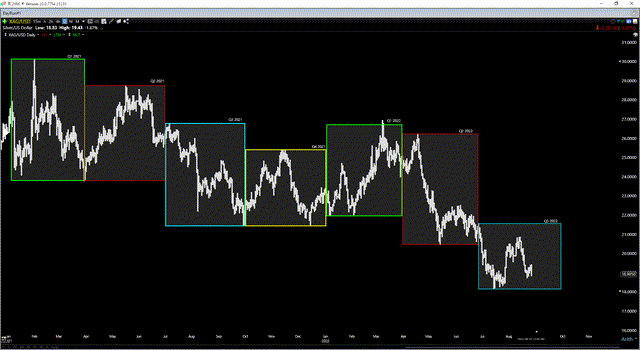

While margin compression is not ideal, AG&S is at least in a much better position than Endeavour Silver (EXK) and will continue to report positive margins. In contrast, Endeavour Silver is set up for negative AISC margins in Q3 2022 if the silver price doesn’t improve immediately. Still, this weakness in the two commodities (lead/zinc) that significantly benefited AG&S’ cost profile in the most recent two quarters, combined with a ~15% decline in silver, partially explains the weakness in the stock recently. The chart below shows that the silver price has averaged $19.80/oz quarter-to-date, translating to a 12% decline sequentially.

Silver Futures Price (TC2000.com)

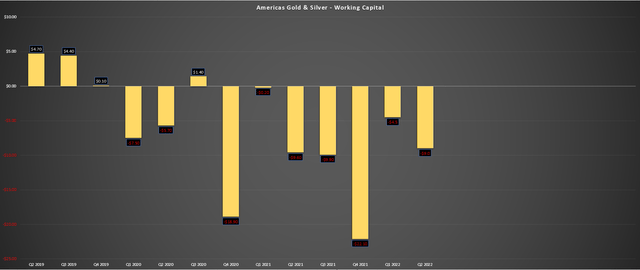

Some investors might point out that AG&S’ margins are exceptional, among the highest sector-wide at more than $10.00/oz even with a sub $20.00/oz silver price. While this is true, the company has still been unable to consistently generate net income since it has two very small operations with high fixed costs. In fact, working capital remains in negative territory as of Q2, with USAS ending the quarter with $8.8 million in cash, negative $9.0 million in working capital, and another net loss of $9.3 million in the period.

Americas Gold & Silver – Working Capital (Company Filings, Author’s Chart)

With the company unable to generate free cash flow even with higher metals prices in H1 2022 (~$24.00/oz silver, $1.71/lb zinc, $1.00/lb lead), I don’t see any reason to be overly optimistic about H2 with the higher production to be offset by lower commodity prices and inflationary pressures. So, while it is positive that silver production is increasing, I see this as mostly overshadowed by the increased treatment/refining costs and weaker lead/zinc prices. That said, the real test will be how Galena finally operates with a replacement hoist, given that it should see a meaningful benefit from higher production to leverage the fixed costs at the asset.

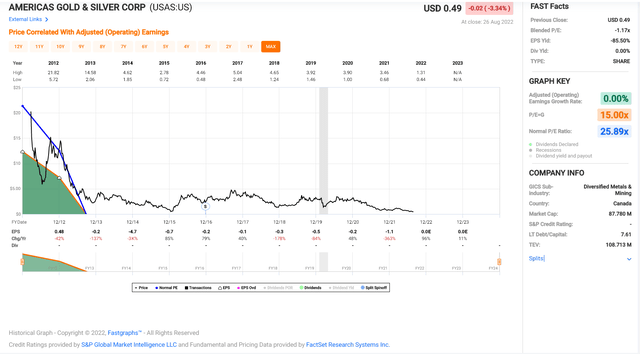

USAS Earnings Trend (FAST Graphs)

Finally, looking at the earnings trend, AG&S is set up for another year of net losses per share, with current estimates sitting at (-) $0.05, which would mark nearly a decade of consecutive net losses per share. This is not inspiring at all for investors, and even if the company meets FY2023 estimates of $0.01, it’s hardly trading at a palatable valuation, sitting at 50x forward earnings estimates. This is nearly triple what investors are paying for more established producers that are much more liquid, like Agnico Eagle (AEM), at less than 20x FY2023 earnings estimates. So, even if AG&S does meet its best-case estimates next year, there’s much more relative value elsewhere. Let’s look at the other issue with AG&S’ valuation below:

Valuation

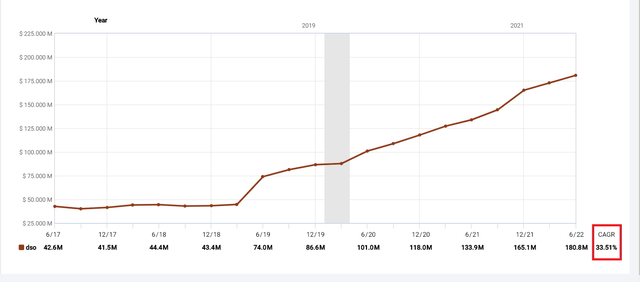

Based on ~198 million fully diluted shares and a share price of US$0.50, AG&S trades at a market cap of ~$99 million, which would appear to be a very cheap valuation for a precious metals producer. However, the company has significant liabilities and has continued reporting net losses, even during periods of elevated metals prices (H1 2022). Combined with its weak balance sheet ($8.8 million cash, $9.0 million working capital deficit), I do not believe it’s wise to rely on the current share count, especially for a company that has diluted shareholders at a torrid pace over the past several years.

Americas Gold & Silver – Rising Share Count (FAST Graphs)

In fact, I would not be surprised to see the share count increase to more than 230 million fully-diluted shares by the end of next year, pushing the market cap to $115 million even at the same share price. This would be an improvement from its previous track record of share dilution, which has been at a 30% + CAGR since 2017. Some investors might argue that share dilution is less likely, with production ramping up at both operations and a goal to more than triple silver production by 2024. However, given the weak balance sheet and inability to meet targets historically combined with a sub $22.00/oz silver price, I am less confident that the team can generate cash flow to pay off its liabilities to avoid further share dilution.

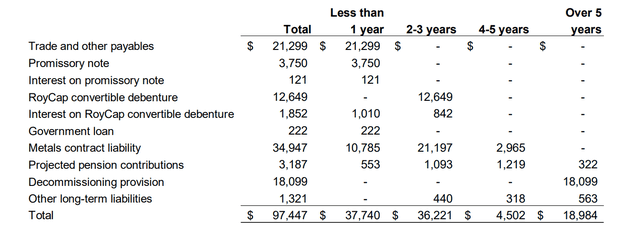

Americas Gold & Silver – Contractual Obligations (Company Filings)

Finally, the whole point of owning precious metals stocks is to outperform precious metals prices with as little risk as possible (otherwise, just own the metal itself). This is best accomplished by owning stock in companies consistently growing production, meaning earnings are often growing even in periods of flat to lower metal prices. However, production growth is not enough; investors should be rigid and look for companies also growing production/sales volumes on a per share bases. While some exceptions can be made given that this is hard to accomplish, the exceptions are that companies should at least have one of the better track records within the sector.

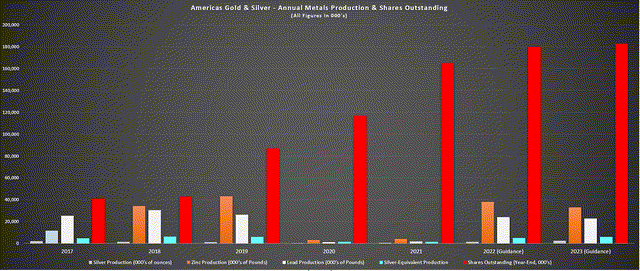

When it comes to AG&S, it continues to have one of the worst track records of production per share growth sector-wide. This is evidenced by investors getting approximately 0.15 SEOs per share held in 2018 (6.2 million SEOs produced / ~43 million shares), and even if it meets the high-end of 2023 guidance, this figure will have dropped by more than 70% to just ~0.04 SEOs per share held. The magnitude of this decline is important, showing that there isn’t some minor slippage in production per share but steady share dilution with little progress from a production standpoint, suggesting poor capital allocation.

AG&S – Annual Metals Production & Shares Outstanding + Forward Estimates/Guidance (Company Filings, Author’s Chart & Estimates, Production Guidance)

So, with nearly 300% growth in the share count since 2017 and rising costs, investors would be looking for a minimum 150% increase in the silver price to offset this dilution in this period. I do not believe it’s wise to rely on a 150% increase in a commodity to offset share dilution, especially when companies with much better track records, like Agnico Eagle, are also paying investors to hold their stock. To summarize, I continue to see AG&S as un-investable, and I would be cautious about relying on future guidance from the company given the poor track record, which I’ve discussed in previous updates.

So, what would change my mind?

If the silver price were to increase above $25.00/oz for more than two quarters and the company were to meet its stated FY2023 goal (2.6 million ounces of silver), this would reduce the risk of future share dilution, allowing USAS to generate steady free cash flow. It would also help to see the company bring Relief Canyon back into production, reducing its exposure to Mexico, which has proven to be a more challenging jurisdiction for some companies. Given the difficulty mining Relief Canyon to date, I believe this operation might be a lost cause, making it difficult to satisfy this requirement.

So, while I would be willing to change my mind if these boxes were checked, I don’t see a high probability of any of these three things occurring simultaneously any time soon. For this reason, I continue to favor names like Karora Resources (OTCQX:KRRGF) for gold exposure and SilverCrest Metals (SILV) for silver exposure, with both companies consistently over-delivering on promises, unlike AG&S.

Summary

AG&S has outlined ambitious plans to double silver production by 2024, and while this might be achievable, I’m much less confident in the company accomplishing this without share dilution. This is especially true with silver and base metals prices softening. Hence, investors might get their wish of production growth and a return to the 6.0+ million SEO mark, but this could be offset by additional share dilution. Given that other companies are growing without any need for future share dilution and strong balance sheets, I see far better ways to get gold/silver exposure than AG&S. Therefore, I continue to see the stock as un-investable, and I would view rallies above US$0.68 as selling opportunities.

Be the first to comment