Apriori1

Background

America’s Car-Mart (NASDAQ:CRMT) is a buy here, pay here (BHPH) auto dealership network in the South-Central US, centered in Arkansas. BHPH is a strange beast. It blends elements of a traditional automotive dealership with a specialty finance business. In truth, neither part could work without the other. The finance business needs vehicles to originate loans, and the dealership business needs captive financing to enable sales.

My natural position is to be skeptical toward lenders, and particularly auto lenders. It is, as they always say, easy to lend money and hard to get it back. This is why I place so much stock in Car-Mart’s multi-decade, consistently profitable track record. They made money through the global financial crisis. In fact, they’ve made money every year since founding in 1981. They have consistently bought back stock. And they have compounded book value by 14% for two decades, and faster still before that.

The business has a model that works. It targets small towns, with less competition. It entirely incentivizes its associates based on collections, and empowers them to make decisions about which vehicles to stock and to whom to lend. That’s vital in this business: when you’re dealing with sub-prime customers, you’re using meaningless credit scores. You need to exercise discretion and good judgment based on qualitative factors. Most customers pay in cash after their paycheck comes in, and more than half of these customers go on to do another deal with Car-Mart.

It is also conservatively financed. Against $919m of net receivables, it has $512m of debt – far less leverage than most finance businesses, which lever up their equity manifold. Given quarterly collections are around $100m, and also noting the non-recourse nature of the securitization debt, I struggle to see any scenario where the balance sheet even becomes a topic of conversation.

In short, the business has durability. It has been robust in different scenarios, it fulfils a basic and unending need for transportation, and it has a decentralized culture geared toward the key variables which drive this business.

That is why, for most of America’s Car-Mart’s history, it has traded at a healthy valuation; typically around 2x tangible book value, or circa 14-15x forward earnings. No longer, as the stock is down ~64% from its peak and below its 2019 levels, despite profits still be substantially above those pre-pandemic benchmarks.

So let’s demolish the story, and try to understand the market’s incredibly bearish perception. Why is CRMT trading at just 0.8x book today, and 6x forward earnings, and why does the stock represent such a compelling contrarian opportunity?

How the market sees it

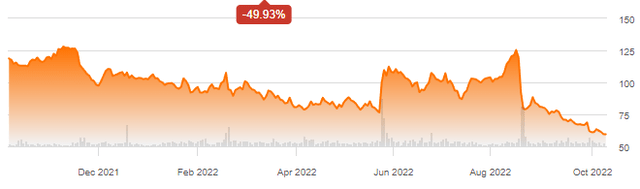

The market has two areas of panic when it comes to CRMT. One worry is enough to spook investors. Two sees them running for the hills, with the stock down by about half over the last twelve months:

… and that’s coming from a pretty dire performance in H2 2021, too.

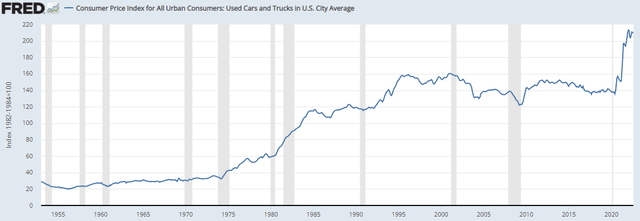

Let’s discuss the first fear factor. It’s one that’s obvious for anyone who keeps up with the news: auto prices.

Auto prices have shot to the moon since the start of the pandemic. Booming demand, catalyzed by fiscal stimulus, met ever-tightening supply. Auto plants were shut down and, when they re-opened, supply chain conditions in everything from semiconductors to machined parts threw previously tight production schedules out of the window. FRED’s dataset shows you the lay of the land perfectly:

It’s not unreasonable to worried about earnings at auto dealerships in a market like this. Will they be left with overpriced inventory? What happens as prices normalize? When demand drops, who will be left holding the bag?

Funnily enough, I am less worried about this than others might be. I focus on the structural economics at CRMT, and I’m not convinced the recent auto bonanza has changed those structural economics. Is it possible that the inventory on their balance sheet, marked at $145mm, needs to take a 20% haircut if prices retrace?

Sure. That’s two quarters’ profit decimated. But it’s hardly existential, and a much more likely scenario is simply that they trade in and out of these vehicles with a little less margin as prices level over the coming months. I do not try to extrapolate from the supernormal profits of 2021 and 2022, and I don’t place any weight on the fact that CRMT is on circa 4x historic earnings. The last two years were exceptional. We may have to ‘pay’ for them later.

Yet, if you’re being really long-sighted, you might note that one of the problems of rising vehicle prices is that CRMT is having to push out loan terms to keep payments affordable, and lend more to each customer. This is far from ideal. CRMT would rather have shorter terms and more repeat business, than have more at risk on any individual deal. Consumers would rather have cheaper and higher quality cars. I’m not actually convinced that consistently high auto prices would be a good thing, and so I welcome a retracement.

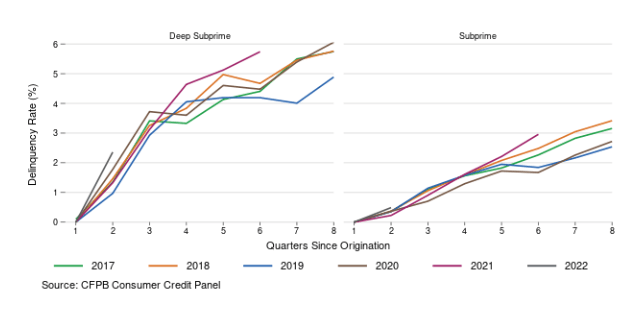

No, the much more pressing – and real – concern is around rising delinquency rates for auto loans generally, as the credit markets start to tighten. If delinquencies are rising across the board, surely sub-prime must be the worst possible place to be? Investors are already, regrettably, getting a taste of this: in CRMT’s most recent quarter, credit loss provisions pushed up to $82m, significantly reducing profitability. The chart below, from the CFPB, shows the growing cause for concern:

CFPB

I will not try to persuade you that rising delinquencies are good. They are obviously not. I will try to persuade you that you might be surprised at how well CRMT can deal with tougher times.

Ask yourself, for instance, what you might think happened to CRMT’s profitability in 2008-2009, encapsulating one of the biggest and deepest recessions in living memory. If you answered “made money both years, and still averaged an 11% return on equity”, you’d be right. Subprime auto loans, if underwritten well, behave much better than most investors seem to expect. Non-payment of these loans is largely linked to vehicular failure (why pay for a loan on a busted car?) and unemployment. If folks have their jobs, they keep paying. When some do lose their jobs, at 16.5% simple interest rate gives you a lot more meat on your bone versus the prime lenders, who can’t handle any deviation from their tight models.

The current incredibly tightness in the labor market for blue collar workers, while being a challenge for many listed businesses, is a boon for CRMT. If we do get a recession, I think there’s an outside chance that – for the first time in a while – it’s the white collars getting squashed first.

Not to get too deep in the weeds, but one should also bear in mind that accounting standards require that subprime lender make large provisions for non-payment at the inception of loan contracts. As at the latest quarter, these provisions amounted to 22.4% of the total receivable balance. This is a sizable buffer already in place in case things start turning south.

My base case for CRMT is a normalization over the coming few years. Loan losses have been unusually low, and gross margins have been unusually high. Unemployment may well start to rise and challenge these economics. But I would be amazed if the situation was genuinely as bad as the market is implying.

Medium-term prospects

Instead, my belief is that America’s Car-Mart will essentially revert to its pre-COVID economic structure. I see no reason to see why it would have changed and, if anything, it is likely to have improve somewhat as credit conditions tighten. Paradoxical, I know, but 2010 to 2012 were some of the best years in CRMT’s history, as better quality customers found themselves with fewer traditional financing options.

Bad times favor good operators.

But I’m not going to start getting too excited. Let’s err on the conservative side.

I think volumes will remain firm in CRMT’s business. Their customers, half of which are repeat, need a vehicle to travel to work. These are not discretionary vehicles for driving at the weekends. These are folks who buy older, budget vehicles, with shorter replacement cycles and predictable needs. Recent acquisitions suggest to me that the group will not struggle to find ways to deploy capital.

In the ten years prior to 2021, which saw an explosion in profitability, America’s Car-Mart earned an average return on equity of 13.6%. As we touched on above, we have a few factors pulling in different directions which might affect this figure:

POSITIVE

- Scale has enabled operating leverage, as the group has expanded both its dealership base and its receivables balance much faster than its central functions

- The group has been slightly more ambitious with its debt load, which was extremely conservative historically (receivables were half debt funded, half equity funded. Compare that with most banks, which use 10% equity or less!)

NEGATIVE

- Car prices will probably be gliding downward for the foreseeable future, which will pressure vehicle gross margins

- Macroeconomic conditions are likely to be tighter and unemployment is likely start moving upward, which will push up charge-offs and require more substantial provisioning

We could have a long debate about where this all pans out. I am comfortable with an assumption anywhere from 10% – 14%. I think about 12% will prove conservative, as the leveraging of the group and the more aggressive sales focus are, I believe, more pertinent factors than the negative issues (noting how they have handled previous tough times).

With that sort of figure, the group is trading on a 2024 earnings multiple of approximately 5.4x.

It is not often you get consistently profitable, conservatively modelled, growing businesses at about 5x earnings. And, as I have noted above, in CRMT’s past, you never would have gotten it at this price. It took two macro panics to push it down to these levels.

There’s another easy way to think about returns for investors buying today. If the group does an average RoE of 12% going forward, it will reinvest it all into the business. It always has done. Hence, earnings will grow at 12% per annum. If the price-to-book multiple stays at 0.8x – its lowest in decades, remember – that 12% RoE will simply be your expected return.

If the multiple goes back to 1.5x or 2x, as it has tended to trade, you’ll double your money. I don’t know when that will happen. But I do think a solid business like this will move back there at some point, so I view it a little like an option. 12% is a solid return with a little kicker that at some point I think you’ll double your money. Build a portfolio of these, and you’ve a great foundation to build real wealth.

Trading Strategy & Conclusion

In terms of price targets, I like to model on a multi-year basis, so I have my eyes on 2025 book value at CRMT somewhere north of $100. Depending on market conditions, I will be a seller toward the 1.4x tangible book multiple figure, which is a number which starts to properly discount the excellent economics at CRMT, yet allows for a higher rate environment. $140 looks like an ambitious target today, but is below its 2021 peak, and represents only 50% above its pre-pandemic level, which would be five years prior.

It sounds almost foolhardy, but I do not expect there is much macro news which would cause me to change my mind on CRMT. Bad news is being over-incorporated into the price, so I expect to increase conviction if economic forecasts get worse and CRMT declines. Again, I should reiterate that this view is dependent on one being comfortable with the fundamental economics, and one should also dig into and appreciate the dynamics by which CRMT’s expected returns get stronger as wider market conditions get tougher, finance businesses lose money, and competitors withdraw.

I am, however, keeping a close eye on the quality of the loan book and the pace of growth. Jeff Williams, CEO, talks about becoming a ‘sales-first’ organization to turbo-charge growth. This may be very lucrative in the short term, but lending businesses which become too growth oriented can find themselves prioritizing top line targets over lending quality. I think a cultural shift will be incremental in nature, but if we are investing for a multi-year timeframe, we need to be aware of these movements. I think it’s important to state up front the factors which will cause one to change one’s mind.

The short-term prognosis is cloudy: but that’s the best way to make money. America’s Car-Mart has been a great business for decades, but it’s only when others are panicking that you’ll get it for a knock down price, too.

Editor’s Note: This article was submitted as part of Seeking Alpha’s best contrarian investment competition which runs through October 10. With cash prizes and a chance to chat with the CEO, this competition – open to all contributors – is not one you want to miss. Click here to find out more and submit your article today!

Be the first to comment