Pgiam/iStock via Getty Images

Investors are facing a perfect storm this year due to the ongoing bear market, which has resulted from the surge of inflation to a 40-year high and the increasing risk of an upcoming recession. Most stocks are highly vulnerable to recessions. They are also vulnerable to excessive inflation, which exerts pressure on their operating costs.

American Water Works Company, Inc. (NYSE:AWK) is a bright exception, as it has repeatedly proved essentially immune to recessions. In addition, the company has limited exposure to inflation and can easily pass its increased costs to its customers. As a result, it is resilient in the highly inflationary environment prevailing right now. However, the market seems to have already priced the virtues of this high-quality utility in its stock.

Business overview

American Water Works provides water and wastewater services to approximately 3.4 million customers in 14 states in the U.S. The company serves both residential customers and commercial customers, such as food and beverage providers.

Thanks to the essential nature of its business, American Water Works has proved essentially immune to recessions in several occasions. Even under the most adverse economic conditions, consumers and companies do not reduce their consumption of water. This proved to be the case in the fierce recession caused by the pandemic in 2020. The company grew its earnings per share by 7% in 2020, to a new all-time high, and by another 10% in 2021. The resilience of the company to recessions is paramount in the current investing environment, as an imminent recession has become almost inevitable due to the efforts of the Fed to restore inflation to its normal range.

The other major challenge for most companies is the 40-year high inflation, which has resulted from the immense fiscal stimulus packages offered in response to the pandemic, as well as the ongoing war in Ukraine, which has greatly reduced the global supply of several commodities. Due to high inflation, many companies are facing steep increases in the costs of raw materials, freight and labor and thus they have incurred a sharp contraction in their operating margins and profits. American Water Works is a bright exception, as the effect of inflation on its cost base is limited while the utility can easily pass its increased costs to its customers.

Moreover, while utilities are well known for their reliable growth of earnings, most of them are characterized by slow growth and hence they are unappealing to most investors. This is not the case for American Water Works. To be sure, the company has grown its adjusted earnings per share at an 8.6% average annual rate over the last decade. This is undoubtedly one of the highest growth rates in the utility sector.

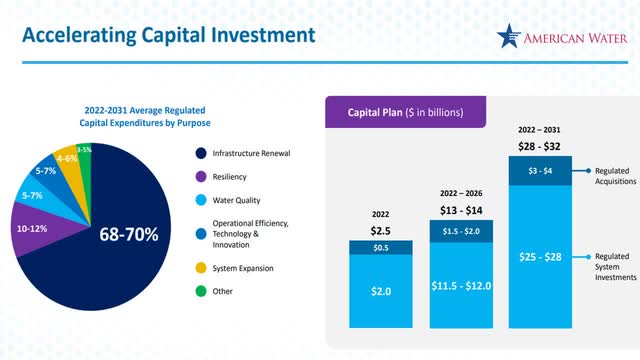

Even better, American Water Works still has ample room for future growth. The company has a capital plan of $28-$32 billion until 2031.

American Water Works Growth Plan (Investor Presentation)

As this amount is approximately 120% of its current market capitalization, it is evident that management is investing heavily in future growth.

American Water Works is also trying to grow its earnings by acquiring many small companies. Management expects to achieve 5%-7% growth of earnings per share thanks to its investments in its regulated business and 1.5%-2.5% growth thanks to the acquisition of smaller peers.

American Water Works Growth Outlook (Investor Presentation)

Thanks to these growth drivers, the utility expects to grow its earnings per share by 7%-9% per year on average until 2026. Analysts seem to agree on this outlook, as they expect the company to grow its bottom line by 8.2% per year on average until 2026.

It is also worth noting that American Water Works has not missed the analysts’ estimates in 8 of the last 10 quarters. It is thus likely to meet or exceed the analysts’ estimates in the upcoming years. Overall, American Water Works has an exceptional performance record and is likely to remain on its reliable growth trajectory for many more years.

Debt

As inflation has skyrocketed to a 40-year high, the Fed is in the process of raising interest rates aggressively, in an effort to cool the economy. Higher interest rates provide a strong headwind to highly indebted companies, which are forced to refinance their debt at higher rates.

American Water Works is well protected from rising interest rates. Its interest expense consumes 32% of its operating income while its net debt (as per Buffett, net debt = total liabilities – cash – receivables) stands at $18.3 billion, which is only 73% of the market capitalization of the stock. Given also the reliable cash flows of American Water Works, investors should rest assured that the company has great financial flexibility. The credit ratings of S&P ((A)) and Moody’s ((Baa1)) are testaments to the solid balance sheet of the utility.

Valuation

The stock of American Water Works has incurred a 24% correction this year, but it remains richly valued. To be sure, the stock is currently trading at a price-to-earnings ratio of 31.4. This is undoubtedly a rich valuation level, especially for a utility stock.

Given the exceptionally high price-to-earnings ratio of the utility, it is evident that the market has already priced several years of future growth in the stock. If American Water Works meets the analysts’ consensus over the next four years, then it is now trading at 22.9 times its expected earnings in 2026. In other words, the market has already priced at least four years of future growth in the stock.

It is also important to note that the ongoing bear market has been caused primarily by the impact of inflation on the valuation of stocks. Excessive inflation greatly reduces the present value of future cash flows and thus it exerts pressure on the price-to-earnings ratio of most stocks, particularly the ones with significant expected earnings growth. The price-to-earnings ratio of the S&P 500 currently stands at 19.9. This means that the valuation of American Water Works is currently 58% richer than the average valuation of the broad market. To cut a long story short, American Water Works appears fully valued, especially when compared to the S&P 500.

Dividend

Most shareholders of utilities hold these stocks for their generous dividends. American Water Works has raised its dividend for 14 consecutive years and currently has a payout ratio of 57%. Thanks to its healthy balance sheet, its reliable growth trajectory and its resilience to downturns, the company is likely to continue raising its dividend for many more years. During the last decade, the utility has grown its dividend at an 8.0% average annual rate, which is much higher than the 4.6% median dividend growth rate of the utility sector.

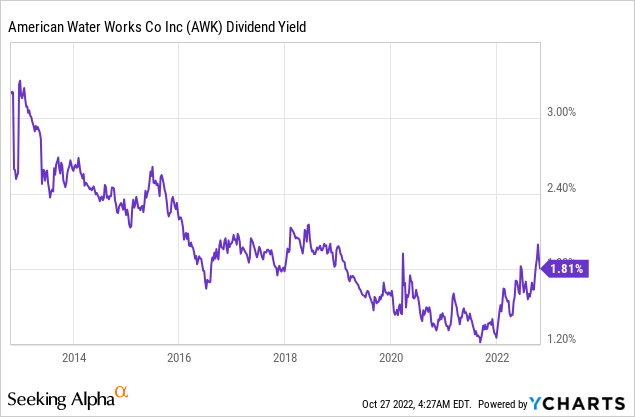

On the other hand, American Water Works is currently offering a nearly 10-year low dividend yield of 1.9%.

Such a low yield is unattractive, especially given the 40-year high inflation prevailing right now. The low yield of American Water Works is also a signal that the stock is richly valued. Overall, income-oriented investors should probably wait for a more attractive entry point.

Final thoughts

American Water Works has been growing faster than most utilities and is essentially immune to the current challenges posed by excessive inflation and an upcoming recession. However, the market seems to have already appreciated the merits of investing in this high-quality utility. Therefore, American Water Works investors should wait for a more opportune entry point, probably around the technical support of $115. This level corresponds to 18.9 times the expected earnings in 2026, and hence it is much more reasonable than the current American Water Works stock price.

Be the first to comment