Alex Potemkin

Want to know what’s leading this low-volume market right now?

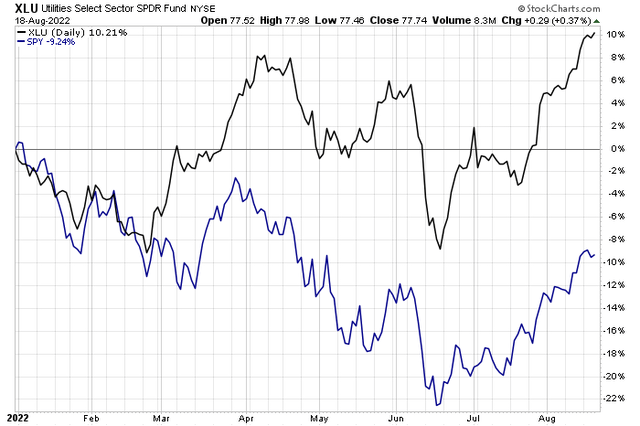

Look no further than the Utilities sector which notched an all-time high on Thursday. The Utilities Select Sector SPDR ETF (XLU) is up more than 10% thus far in 2022 while the S&P 500 SPDR Trust ETF (SPY) is lower by 10%. Investors have found safety within the group of low-beta names that includes companies in the power generation business and those engaged in the transmission and distribution of domestic energy.

Utilities Crushing The S&P 500 Year-To-Date

One Regulated Water company is a risky wager – due to valuation – for investors seeking growth at a reasonable price.

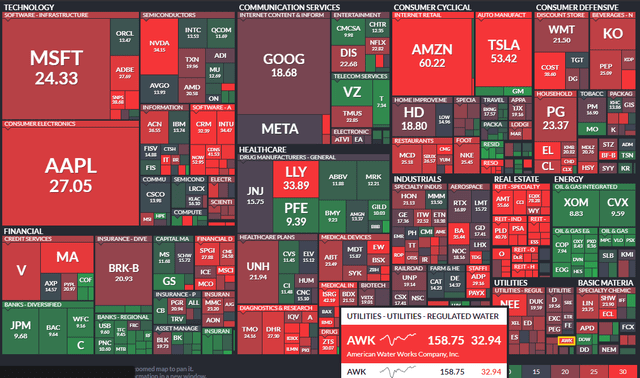

High-Priced Utilities Sector Companies: Forward P/E Ratio Heat Map

According to Bank of America Global Research, American Water Works Company, Inc (NYSE:AWK) is headquartered in New Jersey and provides regulated water service along with a smaller nonregulated business oriented towards the military. New Jersey and Pennsylvania make up the bulk of the company’s revenue. AWK is 9.7% of the Invesco S&P Global Water Index ETF (CGW).

The $29 billion market cap S&P 500-listed Water Utility industry company in the Utilities sector trades at a lofty price-to-earnings ratio of 22.2-times last year’s earnings and pays a relatively low yield of 1.65%, according to The Wall Street Journal. The sector’s yield is 2.8%, per SSGA Funds.

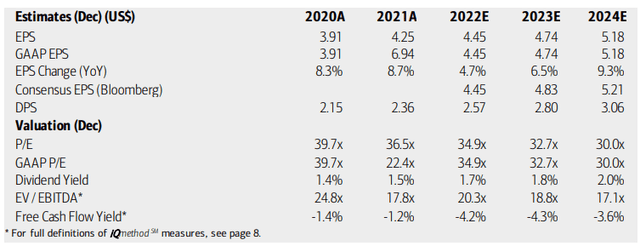

AWK’s high P/E is not warranted given a tepid earnings growth rate in the coming years. BofA notes that American Water has favorable ESG characteristics, but that alone does not justify a valuation that is probably about 20% too expensive. Moreover, there is a competitive threat from the biggest company in the sector – NextEra (NEE).

AWK’s EV/EBITDA multiple is high, too, while the firm’s free cash flow yield is in the red.

AWK Earnings, Valuation, Dividend Yield Forecasts

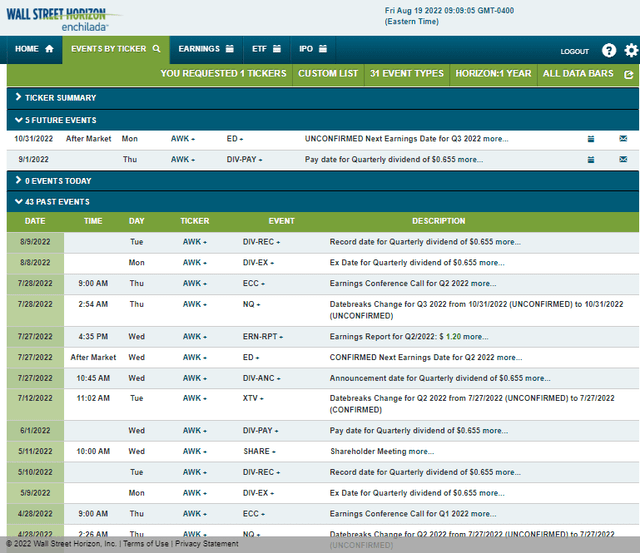

Looking ahead, American Water’s Q3 earnings date is unconfirmed for Monday, October 31, AMC, according to Wall Street Horizon. A dividend pay date hits on the first of September.

American Water Works Corporate Event Calendar

The Technical Take

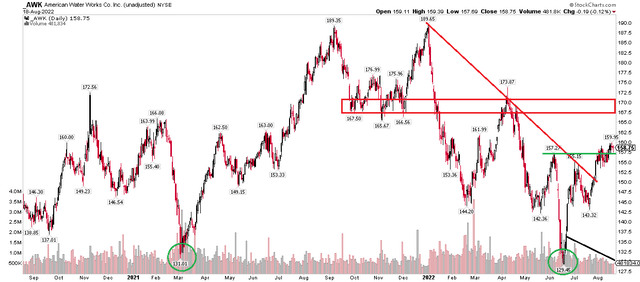

AWK shares are over-valued fundamentally to me. The chart is a bit more bullish, but it also features relative price weakness. AWK is down 15% this year, including dividends, compared to the sector’s 10.2% total return. That’s worse than the broad market in 2022, as well. On the bullish side, I see shares modestly breaking out above the mid-$150s, but that has come on declining volume. Moreover, there’s resistance starting at $165 that could prove problematic for those long AWK shares.

The stock did, however, breakout above a downtrend resistance line off its turn-of-the-year high near $190. It also put in a bullish double-bottom at around $130. Overall, shares might just chop around here for a while.

AWK 2-Year Chart: Mixed Technicals, Some Room For Upside

The Bottom Line

Price action in the Utilities sector looks great, but the valuation is exceedingly high for its low-growth features. AWK in particular is expensive, and it has been an underperformer this year. I would avoid it for now, but shares could inch a bit higher into the mid-to-high $160s.

Be the first to comment