Bill Oxford

In the modern era, information is power. But information only holds power when it can be shared. Without that ability, it is useless. Technological innovations over the past several decades have led to new ways in which we can collect and ultimately disseminate data. A great example can be seen when looking at the telecommunications space. Information can be transported using towers, wires, satellites, and so much more. One of the larger players in the market that’s dedicated to helping send data from point A to point B is American Tower Corporation (NYSE:AMT). This massive REIT, with a market capitalization of $120.3 billion, is a global player in the information transmission space. Over the past few years, management has done a great job growing the company’s top and bottom lines. Having said that, owning a high-quality operator that has demonstrated attractive growth and that achieves strong cash flows does not come cheap. For many value investors, an investment in an entity like this will not make sense. But for those who don’t mind paying a bit of a premium, the long-term performance could well be worth it.

A behemoth in telecommunications

According to the management team at American Tower, the company is one of the largest global REITs, and it operates as a leading independent owner, operator, and developer of multi-tenant communications real estate. The company’s primary operations involve the leasing of space on its communications sites so that wireless service providers, radio and television broadcast companies, wireless data providers, government agencies, municipalities, and other firms in other industries, can all benefit from the company’s ability to send data from its towers and other related assets. To be more specific, the company leases out space on its towers allowing customers to install and maintain their own equipment that is used however that customer sees fit. The information that is collected by the equipment is ultimately transported down to a base station, processed, and then transfer to another tower by means of an underground cable before being sent off to its destination. The vast network of towers the company has set up in the countries in which it operates empowers customers to send that data quickly and cost-effectively most anywhere they need.

In the long run, the future for a company like American Tower is bright. Between 2010 and 2019, for instance, the demand for mobile data increased by a multiple of 96. And that trend looks set to continue. With the rise of 5G and fiber, as well as innovations aimed at handling increased data such as small cells, it’s difficult to imagine a world where American Tower will ever come to suffer from a decline in demand. Recognizing the opportunity and data, the company has also made some interesting acquisitions in recent years. In late 2021, for instance, the business acquired CoreSite, an operator of data centers, in a deal valuing it at $10.1 billion. This followed the purchase, earlier in that year, of a tower company called Telxius, in a deal valued at $9.4 billion. While its acquisition of CoreSite involved the North American market, Telxius had operations in Germany, Spain, Brazil, Chile, Peru, and Argentina. Not surprisingly, American Tower is a truly global enterprise. Even though only 13.7% of the towers the company owns are located in the US and Canada, the company generated 52% of its revenue from those markets in 2021. But with 45,794 owned towers in Latin America and 75,080 spread across the Asia Pacific region, the company’s potential abroad is significant. It also has a presence in both Africa and parts of Europe.

Lately, management has been making some interesting moves outside of acquisitions. Most notably, on June 2nd of this year, the company announced the issuance of 8.35 million shares of stock at $256 per share, plus an underwriter’s option to issue another 835,000 shares. assuming that all possible shares are sold, this will bring in $2.29 billion in net proceeds for the company. It plans to use that capital to repay some of its debt under its $3 billion unsecured term loan. This followed the issuance of $1.30 billion of senior notes with staggered maturities and interest rates ranging from 3.65% to 4.05%. Those proceeds are being dedicated to paying down debt under the company’s revolving credit facilities. Although this latter deal may seem odd and may ultimately increase interest expense in the near term, this seems to be a way for the company to lock in lower interest rates in what will likely be a rising interest rate environment moving forward. In all, I see this as good planning by management.

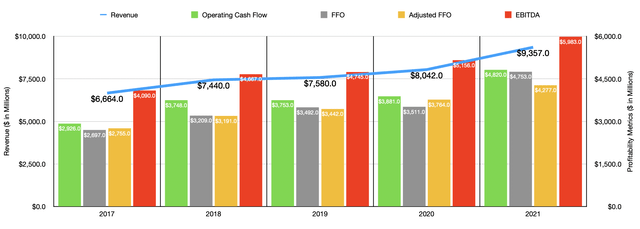

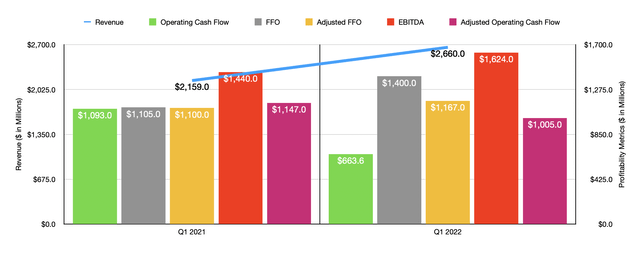

In recent years, the management team at American Tower has done a good job growing the company’s top and bottom lines. Revenue expanded from $6.66 billion in 2017 to $9.36 billion in 2021. In addition to growing organically, the company has dedicated a lot of capital to growing. And that growth looks set to continue this current fiscal year. For the first quarter of the company’s 2022 fiscal year, revenue came in at $2.66 billion. That’s 23.2% higher than the $2.16 billion generated just one year earlier. For the 2022 fiscal year as a whole, management expects revenue to come in at between $10.295 billion and $10.475 billion. At the midpoint, this would translate to a year-over-year increase of 14%.

Profitability for the company has also done quite well in recent years. Operating cash flow expanded from $2.93 billion in 2017 to $4.82 billion last year. FFO, or funds from operations, increased from $2.70 billion to $4.75 billion, while the adjusted FFO figure for the company grew from $2.76 billion to $4.38 billion. Meanwhile, EBITDA expanded from $4.09 billion to $5.99 billion. Once again, growth continues into the current fiscal year. FFO has gone from $1.11 billion in the first quarter of 2021 to $1.40 billion the same time this year. On an adjusted basis, it has increased from $1.10 billion to $1.17 billion. And EBITDA has increased from $1.44 billion to $1.62 billion. Operating cash flow is the only profitability metric that worsened, ultimately dropping from $1.09 billion to $663.6 million. But if we adjust for changes in working capital, it would have fallen from $1.15 billion to $1.01 billion.

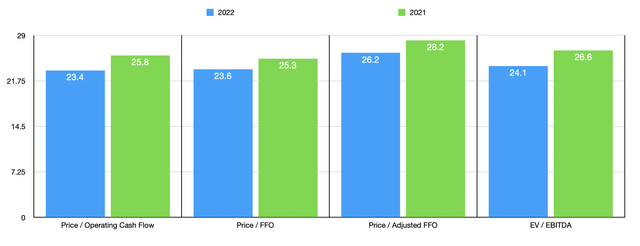

Management’s guidance for the 2022 fiscal year calls for adjusted FFO to be between $4.55 billion and $4.66 billion. This would translate to FFO of roughly $5.11 billion if we use midpoint figures. Meanwhile, EBITDA should come in at between $6.56 billion and $6.67 billion. No guidance was given for operating cash flow. But if we assume that it will increase at the same rate that EBITDA should, we should anticipate a reading of $5.15 billion for the year. Using this data, we can easily value the company. On a price to adjusted operating cash flow basis, the firm is trading at a multiple of 23.4. That’s down from the 25.8 reading that we get if we use 2021 results. The price to FFO multiple should drop from 25.3 to 23.6, while the adjusted figure for this should decline from 28.2 to 26.2. Meanwhile, the EV to EBITDA multiple should come in at 24.1. That compares favorably to the 26.6 reading that we get using 2021 results. As part of my analysis, I compared the company to five other specialty REITs. On a price-to-operating cash flow basis, these companies are trading at multiples of between 20.7 and 30.4. Three of the five companies were cheaper than American Tower. Using the EV to EBITDA approach instead, the range was from 15.8 to 29.9. In this case, only two of the five were cheaper than our prospect.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| American Tower | 25.8 | 26.6 |

| Crown Castle International (CCI) | 27.7 | 25.3 |

| Equinix (EQIX) | 22.0 | 26.8 |

| Public Storage (PSA) | 20.7 | 22.7 |

| Digital Realty Trust (DLR) | 22.1 | 15.8 |

| SBA Communications (SBAC) | 30.4 | 29.9 |

Takeaway

Data today suggests to me that American Tower is a fantastic company that would likely continue to perform well over the long haul. I do not have any doubt that shares are trading at a lofty price. But at the same time, this is a quality operator that will likely continue to grow in almost any environment imaginable. The stability the company offers and the cash flows that it generates will likely be worth the premium paid to many investors. What’s more, shares are actually more or less fairly valued compared to other specialty REITs. All of these factors, combined, have led me to rate the business a ‘buy’ for now.

Be the first to comment