lindsay_imagery

Dear Readers/Followers,

As market volatility comes and goes, I take shelter under solid companies – and one of the sorts of companies I love investing in as a sort of safety proxy is actually water companies. They’re a form of utility-like power; they’re usually completely regulated. This gives them extremely good earnings visibility, and competition is usually nil. This also means that growth prospects for these sorts of businesses are relatively low – but that’s something I think we should be able to live with in exchange for the safety we have here.

Let’s get going and see what American States Water Company (NYSE:AWR) offers us – and what we should be paying for the company.

American States Water Company – What the company is and does

So, this is a low-volatility water utility with a stable and growing dividend, operating in relatively conservative, but somewhat environmentally impacted geographies (California) that also adds to its business segments and unregulated service business.

Many of these businesses add unregulated service businesses in order to provide a bit of a growth injection or possibilities for the non-dividend/non-CapEx cash flows. AWR is no different, but what it does that’s interesting is that its service business serves military bases under extremely long contracts.

This makes what the company does here, at the very least interesting.

The company has an A+ credit rating and a mostly institutional (77%) of the company’s shares with a market cap of around $3.6B and a dividend yield of 1.65%. For those of you that follow my articles on water companies in general, you’ll know that 1.65% isn’t really a bad yield in any way here – it’s normal for a water company to be around that level, and anything above 2% is actually a very good yield for a water company.

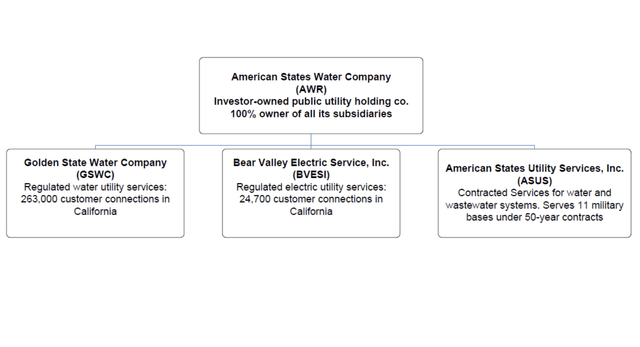

AWR has a very transparent and clear organizational structure, which looks as follows.

As with many water companies and utilities, we’re essentially investing in a holding company owning a number of subsidiaries – in this case 3. The GSWC is 73.3% of the business here, with BVESI only at 8.2% and the rest to ASUS.

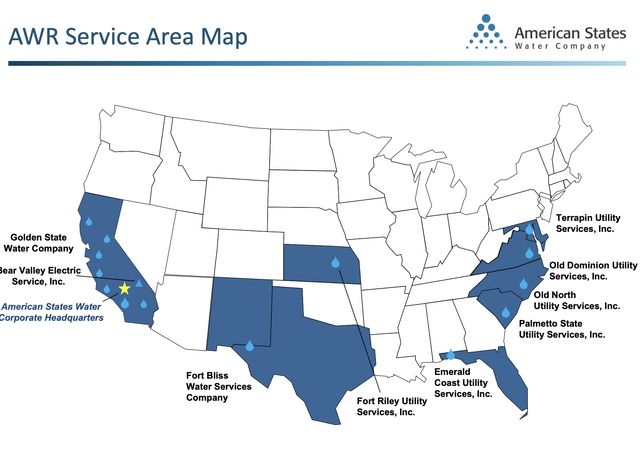

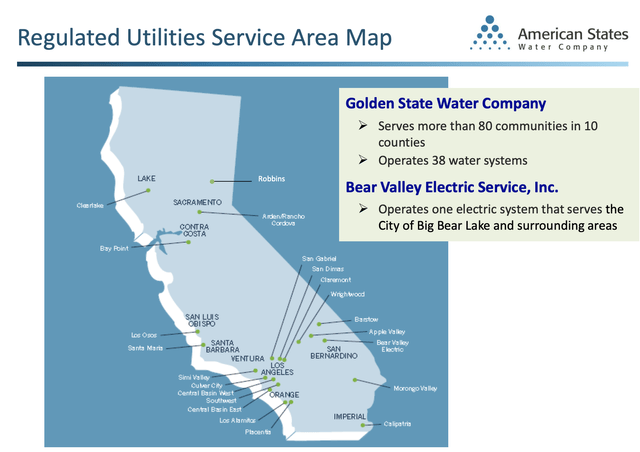

The company’s overall geographic service areas are more diversified than you would usually expect from this sort of business.

However, if we look at the areas for the actually regulated business, you’ll see that from that perspective, it’s actually a California-based business, with some of the more attractive areas on the east coast in its service areas.

The company’s regulated utilities in this case are GSWC and BVESI, which represent 75-82% of the company’s revenue and net income for the year. The utilities have a very solid customer base, with 90% of their business revenues derived from residential and commercial customers.

The relevant regulator, in this case, is the California Public Utilities Commission, or CPUC. The regulatory environment in Cali is viewed as favorable despite ongoing challenges, due to forward-looking periods that limit regulatory lag, and various decoupling mechanisms for the revenue from actual sales to enable consistent returns.

There is still a decent amount of public water utilities in the areas. AWR is well-positioned to take advantage of potential privatization opportunities which are actually fairly likely to occur, given the area’s economic strain/pressure for the next few years. This is a highly fragmented industry with very few public players, AWR being one of them, and entering it is almost impossible for new players that do not yet own assets or a portfolio of themselves.

The company also owns an attractive, Cali-based water rights portfolio. This is especially important in a geography like Cali, with a strained water supply going forward. AWR owns almost 71,000 acre-feet of groundwater rights, as well as 11,300 acre-feet of surface water rights.

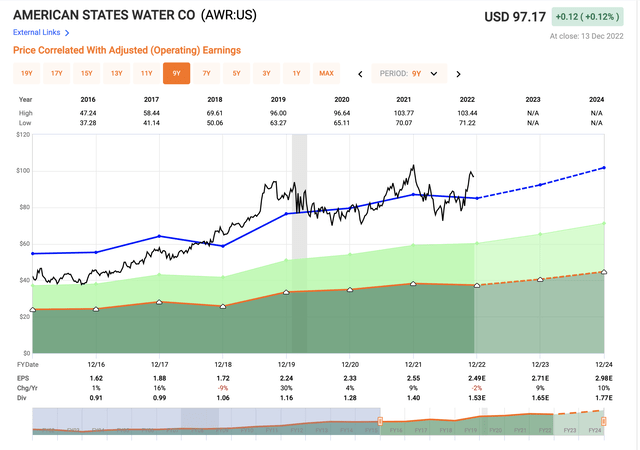

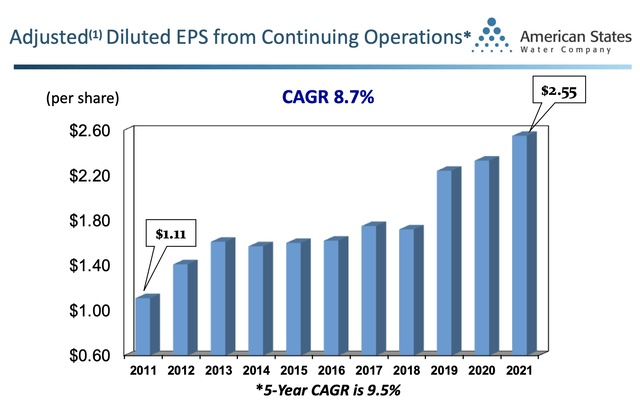

EPS for the company has been very solid – and AWR has been able to grow its earnings impressively over time.

A similar trajectory is very true for dividends as well, with the company has increased it by around 9.2% CAGR over time, following 68 consecutive years of dividend increases, which makes the company a dividend king.

The drought and the climate are significant risks for California specifically. 43% of the state is in “Extreme drought” and 92% in “Severe Drought”. 2022 is a record year here, as one of the three driest years on record. This has led legislators to sign very stringent laws for the use of water, with high water reduction targets – despite this, several areas have already declared water supply emergencies, and this includes service areas where AWR is here.

This has been accompanied by executive orders from the governor, calling on usage reductions of 20-30%.

The company can do very little to affect these macro climate questions. I don’t view these issues as materially impacting the company’s chance of surviving as a business, and for that reason, it’s a risk to have in mind, but not a risk that makes AWR uninvestable.

Latest results sort of confirm the longer-term upside for the company here. 3Q22 results were as water company results usually are. A stable result – although in this case, we did see a small decrease in adjusted diluted earnings on a per share basis. The company is on pace with its CapEx plan and is currently awaiting a rate case decision from the CPUC for GSWC. This decision is expected to come in the fourth quarter of this year, and this decision will be retroactive until 2022 January 1st.

AWS has also submitted a rate case application for BVESI to determine rates for 2023-2026. So, as of right now, there’s rate uncertainty in the mix, which we need to take into consideration when deciding on our share prices here. Operating top-line results were stable – total service revenue was down less than $2M, but remember that these revenues are still subject to retroactive rate case changes, so they may shift. Expenses aren’t the culprit here – at least not on a YoY basis, because company expenses were actually down by $100k for the quarter.

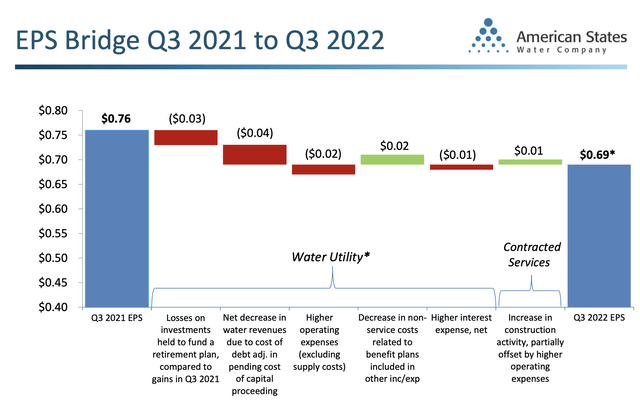

Instead, the EPS bridge looks something like this.

As you can see, the company’s main impacts same from some cost of debt, loss of investments, and some minor higher expenses as well as some minor interest rate increases here.

Company fundamentals remain extremely solid, all things considered. The A-rating isn’t going anywhere, and aside from some minor impacts on retirement plan investments, AWR’s 3Q22 was really solid. If water rates had been approved consistent with the settlement agreement, the company’s operating results would have been positive – and if the rate case goes through, this is what will happen. Because of this, we’re talking about a timing difference. This is also likely why the company’s valuation isn’t as impacted as you might believe here.

I expect AWR to continue to perform well. What this means is that the case for the company to be made for investing is simple.

Invest cheaply enough, and you will see positive RoR.

The company’s valuation

AWR’s valuation is a bit tricky. The company is a dividend king, and this usually comes with a hefty premium – and unfortunately, this is most certainly the case here.

I don’t see any issues with earnings for AWR – I see a problem in paying nearly 39x P/E for this company. Because from where I sit, the company isn’t worth that much.

AWR valuation (F.A.S.T graphs)

The average premium for the company lies between 31-35x P/E, which isn’t unreasonable for a water company like this – not one that’s also a dividend king.

But historically, at any time you bought the company at 39-40x P/E, you would have resulted in an eventual negative or sub-par RoR. For that reason, and for reasons of simple multiples, that’s why I see the company as too expensive here. The conservatively adjusted upside for this investment even on a 35.6x forward P/E, which is significantly higher than the average, is only 6.11% per year here. You’re making less return than the market on average, and that’s never a good sign.

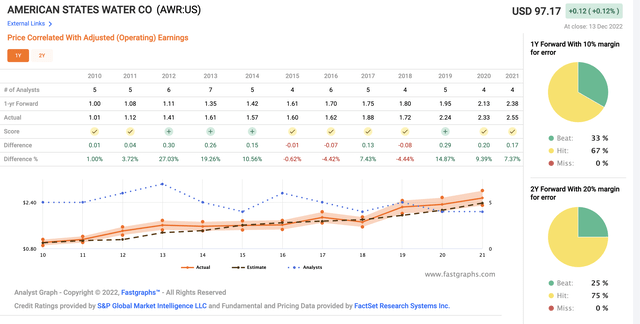

Analysts following AWR view the company as follows. Forecastability for AWR is very high. FactSet analyst never misses their targets on a 10-20% MoE-adjusted basis – not for over 10 years, and S&P Global analysts call for an EPS increase and revenue increase for the coming few years. The company even has a tendency to beat estimates, and not a small amount of the time either.

FactSet analyst accuracy (F.A.S.T graphs)

Even the normally exuberant analysts following the company – 5 of them in this case – call this company at least 5% overvalued at today’s share price. They consider AWR a company with a low stock price range of $86, but goes all the way up to $104, with an average target of $92.25. 2 out of those 5 analysts are currently at a “BUY”.

Concluding, I would say that the problem for AWR is simply the valuation. At the right price, this investment becomes a no-brainer for me, but I refuse to put cash to work at what is, without a doubt to me, an unattractive valuation prospect.

So going into AWR here, I consider it a “HOLD” with the following foundational thesis.

Thesis

My thesis for AWR is as follows.

- AWR is a dividend king and a water company with an A-rating and extreme levels of overall safety. It has an attractive operating structure and mixes around 80% regulated business with around 20% unregulated. The company has degrees of future-proofing and is a conservative allocator of capital, backed by the state of California.

- At the right and attractive price, this company becomes as I see it, a “MUST BUY” – but that time is not today. At nearly 39x normalized P/E, this company is a no go for me here.

- I view AWR as a “HOLD” – and I wouldn’t touch it below a PT of $85/share.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside that is high enough, based on earnings growth or multiple expansion/reversion.

The company, unfortunately, does not fulfill any of my valuation-specific metrics and criteria, and therefore is a “HOLD” here.

Be the first to comment