andresr/E+ via Getty Images

American Outdoor Brands, Inc. (NASDAQ:AOUT) controls a diverse portfolio of consumer products and accessories brands, covering everything from hunting, fishing, and camping equipment. The company had a record 2021 benefiting from strong pandemic dynamics with consumers seeking lifestyle goods and outdoor entertainment options. On the other hand, 2022 has proven to be challenging, considering the shifting economic environment.

Indeed, the company just reported its latest quarterly report which missed expectations while shares are down more than 60% year to date. Still, we highlight what remains some positive fundamentals including ongoing profitability, a solid balance sheet, and a compelling long-term growth outlook. Recognizing the near-term headwinds and reset expectations, we see value in AOUT at the current level with upside potential.

American Outdoor Brands Earnings Recap

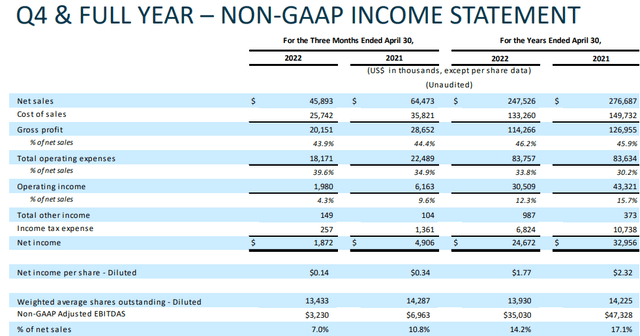

This was the company’s fiscal Q4 earnings with a non-GAAP EPS of $0.14, which missed the consensus estimate by $0.23. This adjusted figure excludes a large impairment charge, with American Outdoor Brands writing off $68 million in goodwill, reflecting a balance sheet accounting adjustment to the lower market capitalization of the company’s stock price over the past year. By this measure, the quarterly GAAP EPS loss was -$5.71.

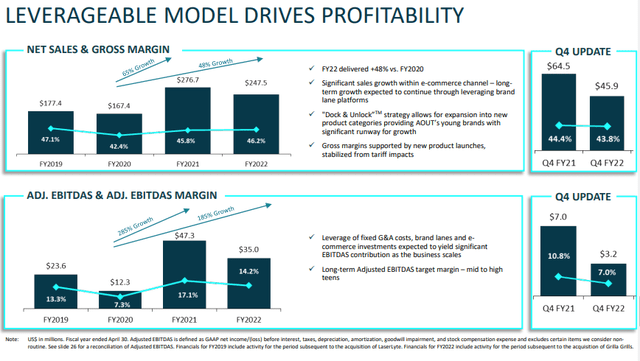

Q4 revenue of $45.9 million was down 28.8% year over year, although management made the point of highlighting how the comparison period in 2021 was exceptionally strong. For the full fiscal year 2022, net sales were up 48% over pre-pandemic levels, which helps place in context the more recent volatility.

Overall, the takeaway here is that despite the more difficult environment, this is a fundamentally profitable business with 2022 adjusted EBITDAS at $35 million. The company ended the quarter with $19.5 million in cash and over $70 million in available liquidity against $25 million in long-term debt.

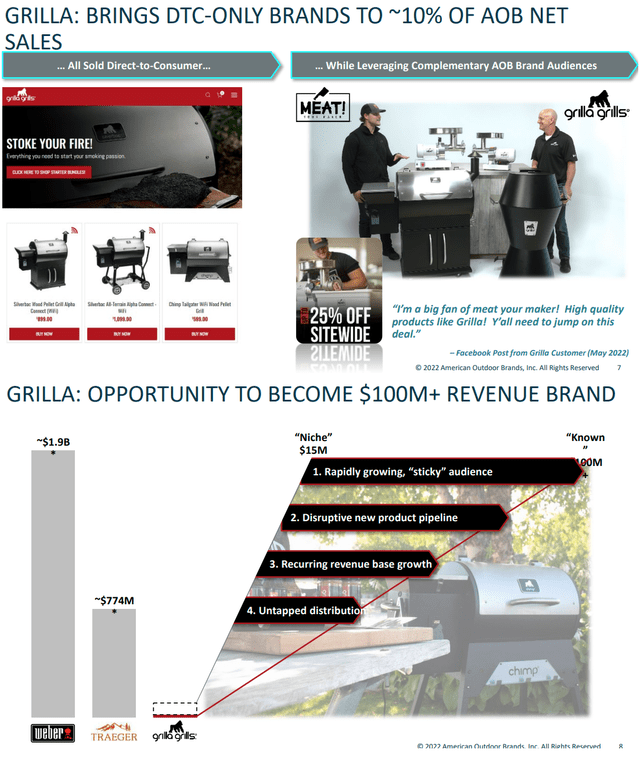

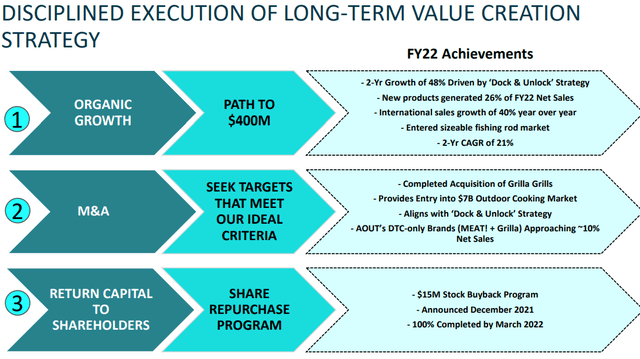

One strong point has been the momentum in direct-to-consumer offerings, up 73% y/y in 2022 which is part of the core strategy to focus on high-growth categories and build out some of the early-stage brands. American Outdoor Brands has also made traction by expanding internationally.

AOUT Long-Term Outlook

The bullish case for American Outdoor Brands is that operating conditions can stabilize with a return to growth going forward. We mentioned the pandemic consumer spending boom drove a record 2021. The upside here is that several brands have grown their following, with an expanding base of customers attracted to the high-quality and innovative features.

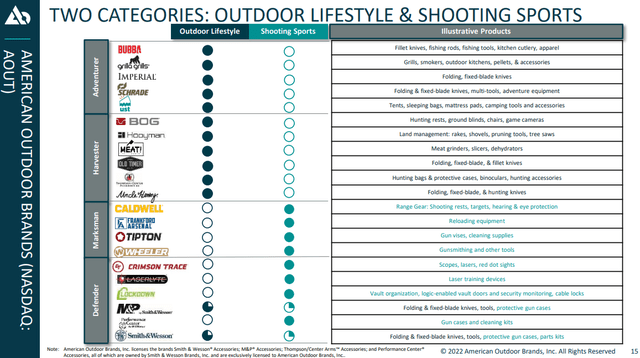

The way we are looking at AOUT is that any of its +15 company-owned brands have the potential to eventually break out and become category leaders. It’s worth noting that AOUT was created in 2020 as a spin-off of gun maker Smith & Wesson Brands Inc (SWBI) although it maintains a licensing agreement to market items such as protective gun cases, and cleaning kits in the shooting sports category and defense segment.

In our opinion, one of the more exciting brands from the portfolio is “GRILLA”, a direct-to-consumer line of specialty outdoor grills and niche meat smokers. Management explains that from $15 million in sales last year, representing just 6% of the total business, the company sees a runway for GRILLA to generate over $100 million in annual revenue. Compared to Weber Inc (WEBR), the leader in the category which generated nearly $2 billion in sales last year, GRILLA capturing just a small portion of the addressable market highlights the significant potential.

The other aspect of the business that makes it interesting is the cross-selling opportunities. An example would be a customer of “BUBBA” specialty filet knives receiving offers for the “MEAT!” brand of vacuum sealers. The point here is to say that the entire portfolio is complementary to capture a like-minded target audience. Management shares data showing that the portion of the U.S. population participating in “outdoor recreational” activities has climbed in recent years, including the number of first-time campers, and registrations for hunting or fishing licenses.

All these factors represent positive macro tailwinds for the company in its segment. A long-term target for the company is to reach $400 million in annual revenue through a combination of organic growth, new products, and potential strategic acquisitions.

Management is not providing guidance, but commented in the earnings conference call that it intends to control costs while maximizing profits this year. According to consensus estimates, AOUT is forecast to grow revenues by 4% in 2023 while EPS of $1.30 represents a decline of -27% compared to fiscal 2022. Looking ahead, the expectation is that growth rebounds in fiscal 2024 while EPS recovers back to $1.94.

As it relates to valuation, AOUT trading at a forward P/E of 6.2x reflects the deep pessimism towards the stock with a discount based on the forecast for declining earnings in 2023. The setup here is that the stock should respond positively to the potential that sales and earnings trends improve going forward. We see room for the company to outperform the current estimates as part of the bullish case for the stock.

AOUT Stock Price Forecast

Looking at the stock price trading action, AOUT has simply been a falling knife, with shares trending lower since hitting an all-time high above $36.00 in June of last year. Our message here is that the AOUT with a current market sitting right around $100 million or an enterprise value of $140 million is starting to look interesting. The business has a real value, and this is not a case where the shares are under any risk of collapsing to zero.

That being said, it’s hard to see where the bottom ultimately is considering the market’s risk aversion, particularly towards this segment of consumer products that are exposed to cyclical trends. From a macro perspective, we’ll want to see some confirmation that inflation has peaked with better than expected economic indicators as a sign that the economy remains resilient. Improving economic data may be needed to get the bulls back in control.

Final Thoughts

Recognizing the ongoing market headwinds, we like AOUT’s brand portfolio enough to give the company a benefit of the doubt. We rate shares as a buy with a price target for the year ahead at $10.50, representing an 8x multiple on the current consensus 2023 EPS. We see underlying sales supported by organic momentum, with the potential for stronger than expected trends over the next few quarters helping to mark a turnaround.

As a micro-cap stock, AOUT is naturally high-risk, and this one is particularly speculative, but there is room for shares to climb significantly higher over the next several years if management can successfully reclaim an earnings trajectory. In the near term, our forecast is to expect volatility to continue, but we also see the current level as a good spot to begin accumulating shares slowly.

Be the first to comment