karamysh/iStock via Getty Images

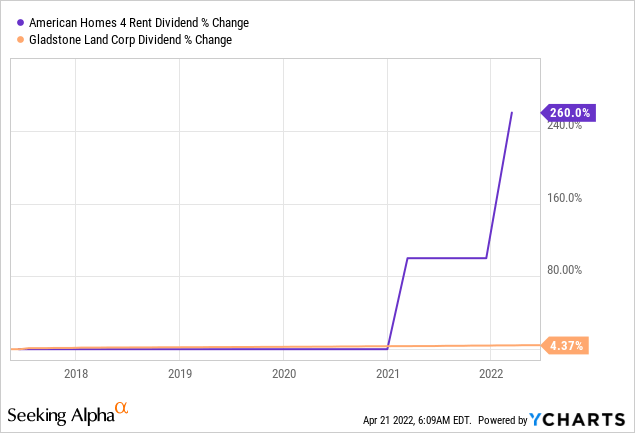

As a dividend growth investor, I am always looking for investment opportunities with attractive valuations. Sometimes, an investment which is overvalued on an absolute basis may present an opportunity if it is undervalued relative to other investments in my portfolio. I believe such a situation exists with respect to American Homes 4 Rent (NYSE:AMH). I happily sold my holdings in Gladstone Land in order to take advantage of the current investor mania for farmland-related assets and put that money to work in an investment which has, in my opinion, a much greater potential to grow its payout over time — AMH.

American Homes 4 Rent is an equity REIT which invests principally in single-family homes. It commenced operations in 2012, and since then it has gained a reputation as one of the premier operators in this space. The company had over 57,000 single-family homes in 22 states at the end of 2021, with close to 95% of those properties occupied. AMH’s role in the rental market is to serve as a centralized source of financial capital and management expertise. AMH is able to be successful due to the economies of scale that it is able to exercise over its large portfolio, its experience in the single-family rental space, and its technology platform.

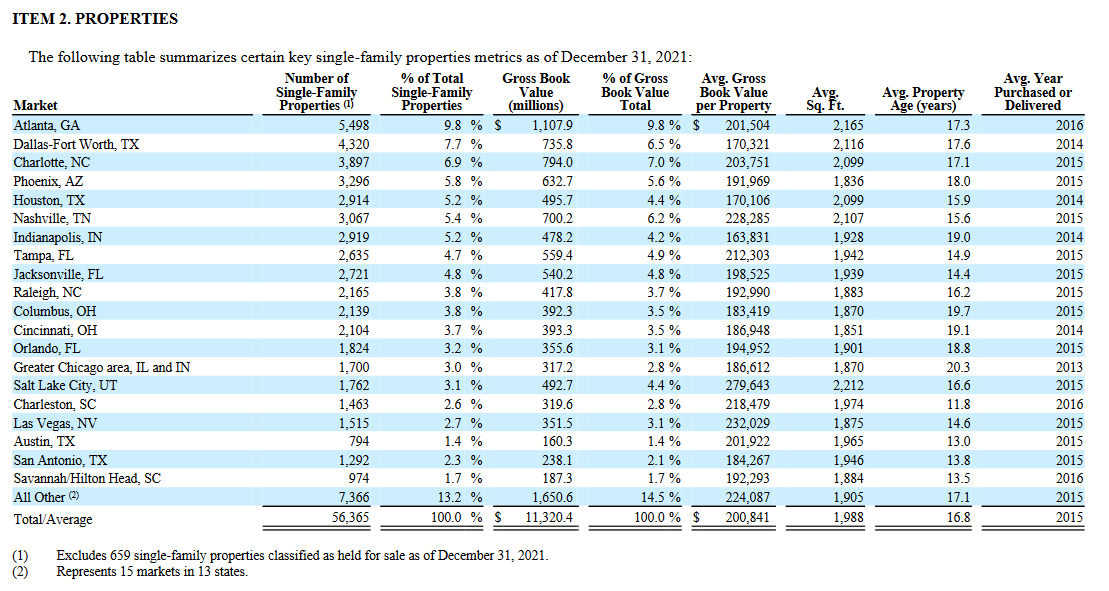

AMH has a well diversified portfolio, with only one market (Atlanta, GA) comprising close to 10 percent of the total rental portfolio. It is also worth noting the lack of representation of the West Coast of the country in AMH’s top rental markets. This gives the REIT a distinct southern exposure, with Georgia, Texas, Florida, and North Carolina making up significant chunks of the portfolio. AMH generally targets homes which are relatively new (i.e., built after the year 2000), are sized just right for growing families (at least three beds & 2 baths), and which occupy a $250,000 – $550,000 price point. The company also takes qualitative factors such as the condition of the property and proximity of good school districts into consideration which making its investment decision.

AMH 10-K Report

AMH has three main strategies to grow its portfolio – it can buy an existing home or portfolio of homes, it can buy a new home from a national builder, or it can build a new home using its in-house development team. This last option helps to distinguish AMH from many of its peers, including the publicly-traded Invitation Homes. In fact, AMH has 18,000 lots upon which it can choose to build additional rental units at some point in the future. This gives the company a unique avenue of possible growth beyond getting into bidding wars with other buyers during a white-hot bull market in housing. In fact, I believe that AMH management is demonstrating at least a modicum of discipline in not paying too much for new properties. For instance, during Zillow’s recent attempt to liquidate its inventory of company-owned real estate, AMH wound up not being a voracious buyer of the company’s inventory. According the CEO David Singelyn, while they bid an aggressively low rental yield for the properties, other buyers were willing to bid the rental yields even lower — and AMH chose not to chase the stratospheric prices of those properties. While the net result of this decision was fewer acquisitions for AMH, this tells me that management is not willing to pursue growth at any price, something which gives me more confidence in the trust’s long-term future.

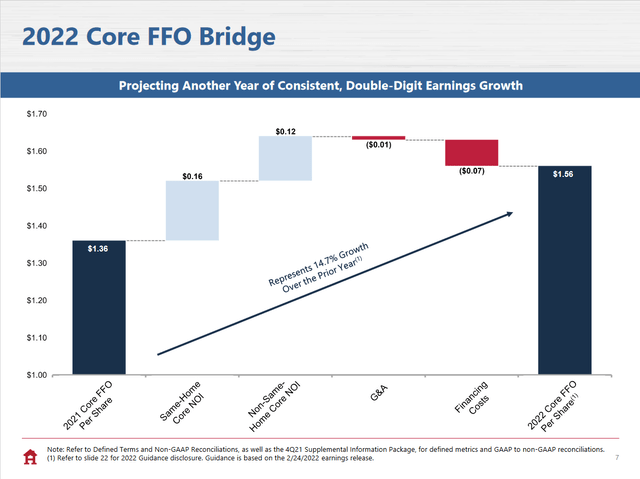

AMH’s growth — as well as the current inflationary environment — has powered a significant increase in revenue. These increases have given management confidence enough to guide for a double-digit percentage rise in core funds from operations (FFO). The $1.56 guided for in the below chart compares very favorably with the company’s current annualized dividend payout of $0.72, providing further support for the idea that AMH has ample room to continue to raise its dividend at a competitive rate. As interest rates go up, however, it is possible that the drag on FFO growth caused by financing costs may rise.

AMH Investor Presentation

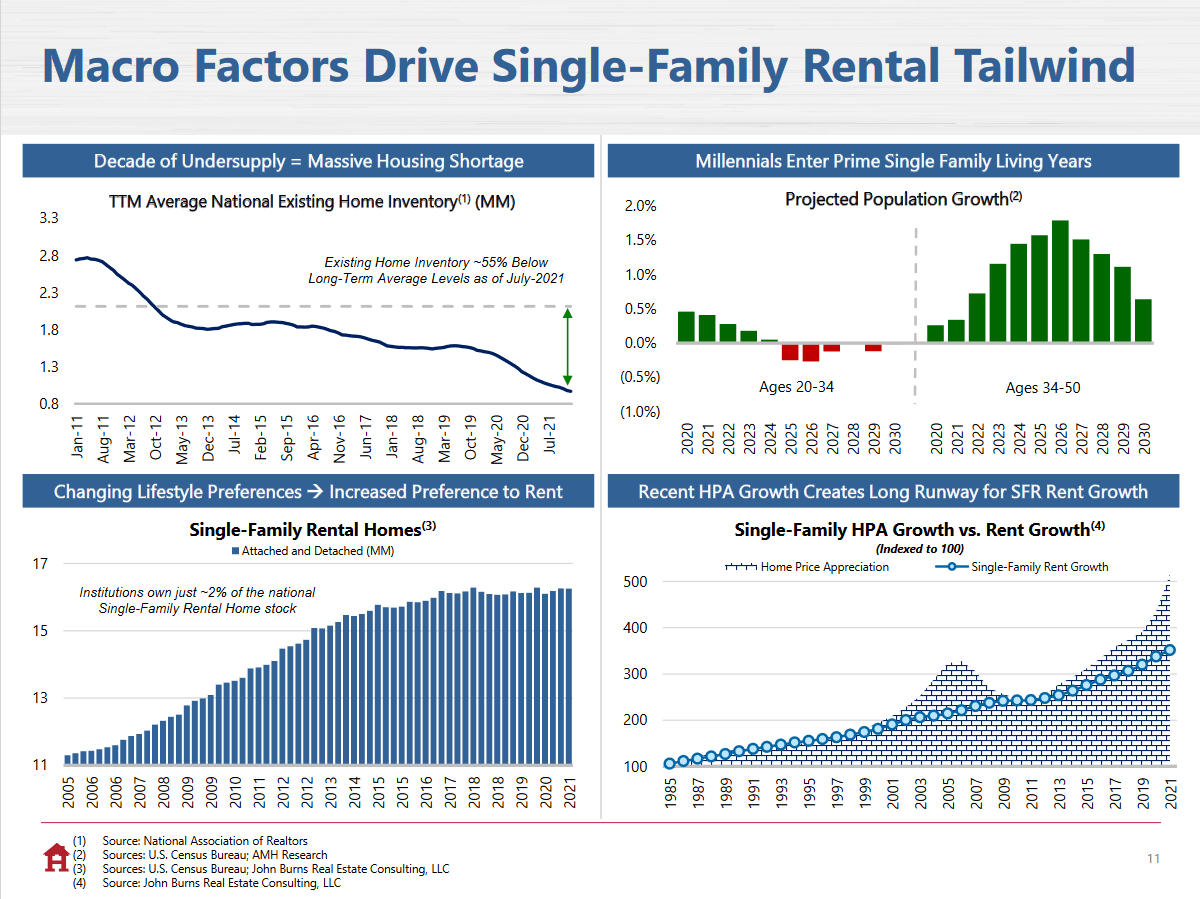

There are a number of favorable macroeconomic indicators which suggest that growth in the single-family rental segment is likely to continue for the foreseeable future. As millennials age into their prime earning years, persistently high housing prices may force them to stay renters for longer than they would otherwise be. This situation is likely to persist until the housing under-supply caused by the slowdown in construction activity after the Great Recession is resolved. Finally, while single-family rental growth has been robust since the pandemic, the price to purchase single-family homes has been explosive by comparison, suggesting that the relative economics of renting single-family vs. buying single-family may remain tilted in favor of renting for years to come.

AMH Investor Presentation

Dividends

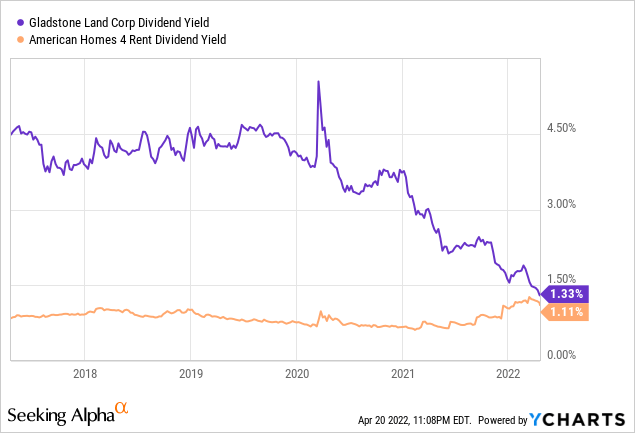

AMH has always offered a minuscule dividend yield. However, AMH compensates for this by offering favorable prospects for dividend growth moving forward. Just last year, AMH started its dividend growth streak by doubling its payout from five cents per quarter to 10 cents. This year, AMH has reduced its pace of dividend growth, but still committed to boost the quarterly payout by 80 percent. These massive increases likely signal a business which is looking to share more of its earnings with investors in the form of shareholder distributions. I expect AMH to continue to make this transition in the coming years, with double-digit percentage increases in the dividend payout for years to come. Contrast this blockbuster growth with that of Gladstone Land – a slower-growing REIT which, despite its higher starting yield, has averaged much lower growth in its dividend payout over the past few years.

The Case For (Relative) Value

American Homes 4 Rent is certainly not cheap by any absolute measure. By the same token, however, neither are many stocks which offer similar exposure to inflation-resistant assets. In fact, the argument can be made that AMH has lagged behind as certain other ‘inflation bets’ (like Gladstone Land) have seen their valuations gallop ahead of their historical ranges.

I recently evaluated my portfolio and came to the conclusion that Gladstone Land, with its now-anemic dividend yield and equally paltry record of dividend growth, was likely to be a poor income investment going forwards. Enter AMH. Given AMH’s recent record of massive dividend growth and my confidence in its ability to continue to deliver the same growth going forward, I concluded that AMH represents a very attractive destination to re-deploy capital from my already-profitable bet on farmland. As such, I recently closed my position in LAND and re-invested the proceeds in AMH. Income investors who are looking to exit overvalued positions might want to consider a similar course of action if they find themselves in a similar situation.

Risks

As with any investment, conduct your own due diligence before committing capital to AMH. First and foremost, the company’s nosebleed valuation should give all investors food for thought, especially with the Federal Reserve in an increasingly hawkish mood. If interest rates take a material move upwards, there is always the possibility that retail demand for AMH stock will slacken, taking the share price down with it. While I expect AMH’s robust new pattern of dividend hikes to keep it from being evaluated purely as a bond substitute by the market, I would not be surprised to see some jitters on that score as interest rates go up. Additionally, increased financing costs could make it difficult for the trust to acquire new properties, or do service its already sizeable debt load.

Another aspect to bear in mind is the risk that the company is acquiring or even building real estate at the very top of an overheated real estate market. Look with happened to Zillow when they overpaid for a bunch of houses recently. The net result was capital losses and, in concert with other micro- and macro- economic factors, a collapse in the company’s share price. While AMH is not in the same realm as a tech company like Zillow, it could still face similar risks if, in defiance of all expectations, real estate prices drop significantly. Such a scenario could reduce the value of AMH’s property inventory. Additionally, softness in hosing prices could also translate into less ability for AMH to raise rents, something which could limit its ability to grow its dividend going forward.

Final Thoughts

American Homes 4 Rent is one of the few publicly-traded investment options that retail investors have to get into the single-family rental game, short of buying their own rental property. While the valuation on this name is extremely stretched, the same can be said for certain other stocks as well. After evaluating some of my existing holdings relative to AMH, I made the decision that AMH possesses greater potential for dividend growth in the future. It is true that the future path of interest rates, home prices, and rental yields all pose risks to that potential. However, I believe that favorable long-term economic trends, AMH’s decision to pursue a three-pronged approach to growing its portfolio, and the disciplined approach to acquisitions shown thus far by management bode well for its future as a dividend income investment. Investors looking to put fresh capital to work should be cautious of current valuations, but those who are looking to put funds from an already-successful investment to work should kick the tires on AMH.

Use my work as a starting point for your own due diligence, not as a substitute. All investments involve the risk of loss of income as well as the principal. Consider consulting with an investment adviser before making any investment. I am not a tax professional or investment advisor. Please consider consulting with a tax professional before making any investment. Author-generated charts are subject to error due to discrepancies in source data or securities being listed on multiple international markets.

Be the first to comment