xavierarnau/E+ via Getty Images

Ameresco (NYSE:AMRC) is a leading independent cleantech integrator and renewable energy asset developer, owner, and operator with footprint throughout North America and the UK. It helps to drive energy system transformation by ensuring performance improvement through projects that help design, develop, finance, operate and maintain smart energy solutions and infrastructure upgrades. In my view, it currently runs on an appealing business model with multiple revenue streams and strong competitive positioning, while it displays high revenue visibility and ambition to capture segments with greater addressable market size. However, its stock price has been very volatile lately and traded way above its peers. Hence, I recommend holding the stock for the moment, until further price adjustment.

Green Edges

I believe that AMRC possesses an appealing and sustainable business model with the three reasons below.

Improving Revenue Diversification With Strong Market Positioning

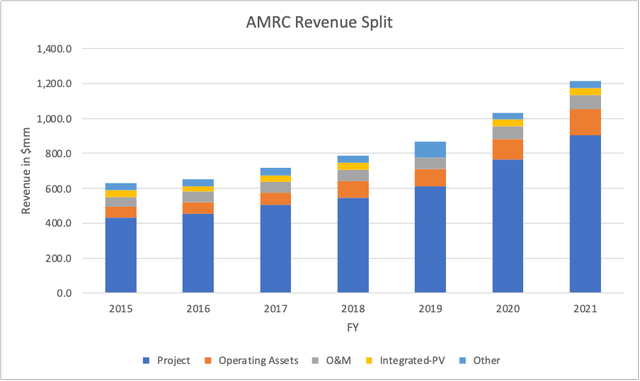

AMRC mainly distinguishes its revenue split based on project, operation and maintenance, energy assets and integrated PV segments. Although AMRC continues to experience high growth in project revenue, it is starting to realize higher revenue split from its energy assets as they contribute 57% of adjusted EBITDA in FY 2021 and they are recurring revenue for the company.

AMRC revenue split (Author and AMRC)

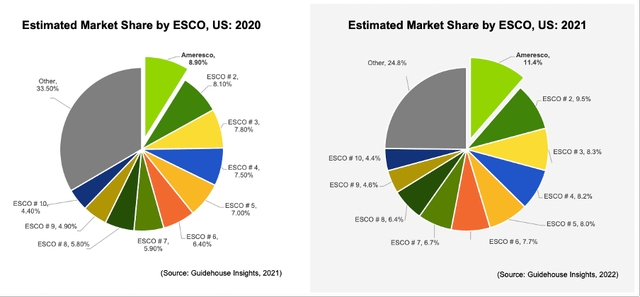

According to Guidehouse Insights, AMRC is ranked first as the best energy-as-a-service (EAAS) provider with superior technology expertise, reliable project track records and capable financing solutions. For now, it has already established itself as the US ESCO (energy services company) market leader in terms of market share. Its vision to provide end-to-end smart energy service with capabilities in energy efficiency, assets and analytics will widen its competitive lead as customers demand for an all-in-one energy solution. Its market-leading position will allow for more acquisitions as the ESCO market has potential for further consolidation – this opportunity has been reflected by AMRC recent acquisition of Plug Smart, an Ohio-based ESCO that specializes in the development and implementation of budget neutral capital improvement projects.

Estimated market share by ESCO (Guidehouse Insights)

Such integration and scale also allow AMRC to expand its EBITDA margin over time, as its consolidated adjusted EBITDA margin rose from 11.4% in FY 2020 to 12.6% in FY 2021 with similar increments across its business segments.

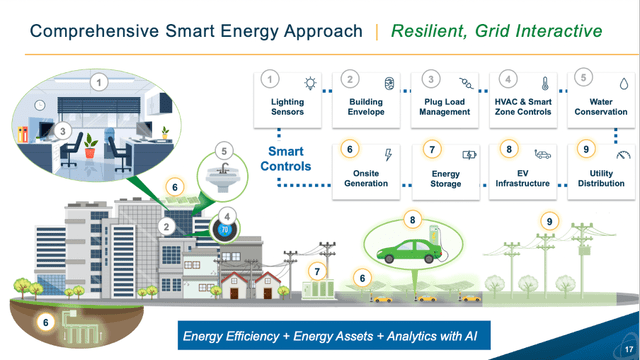

Comprehensive smart energy approach (AMRC)

Ambition To Capitalize On Expanding TAM

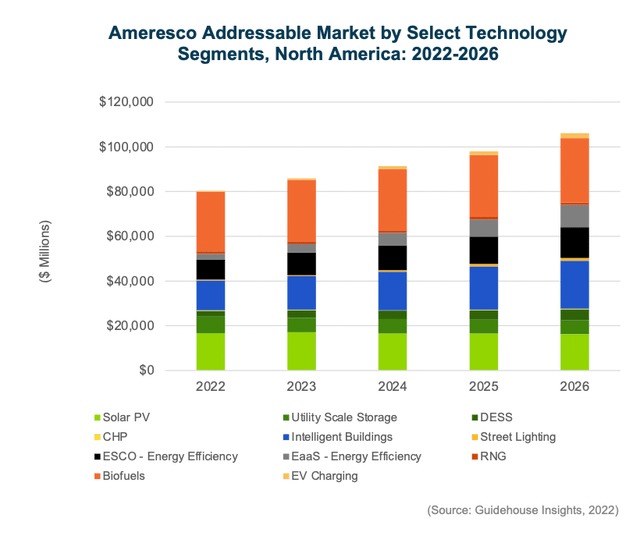

During its first investor day, AMRC has made its plan to ride the wave of growing total addressable market (TAM) and its ambition to capture such opportunity clear. Apart from biofuels, AMRC has significant technology expertise and competitive positioning in other segments. With its recent contract with Southern California Edison (SCE) to provide utility scale battery storage systems (BESS) in the largest contract ever, its execution ability is proven to be convincing – hence should be able to ride on this tailwind without much issue.

AMRC addressable market in North America (Guidehouse Insights)

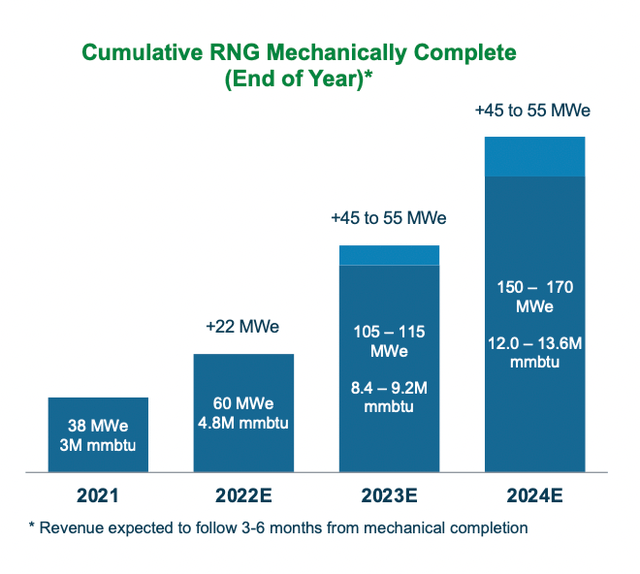

Besides, AMRC is now betting on the exponential growth of renewable natural gas (RNG) with 17 additional RNG plants in construction or permitting, from the existing 4 RNG plants in operation. It believes that it has the capability to serve the non-transportation sector with its offering supported by robust distribution network. Such development will increase its market share in the US RNG market from 6% in 2021 to 12% in 2023.

Cumulative RNG Mechanically Complete (AMRC)

However, we have not seen the takeoff of RNG use case and there may still be technological and feasibility issues with the technology. Hence, it is too early to comment on the significance of RNG for AMRC in the long term.

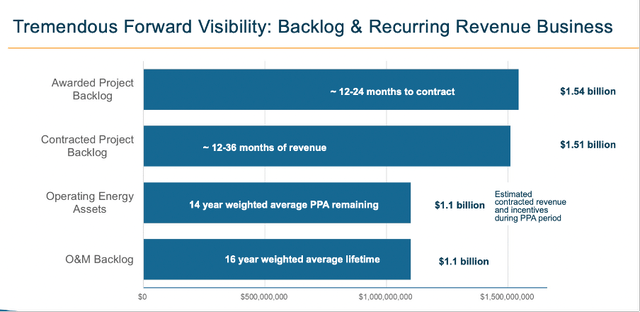

Significant revenue visibility

AMRC has a strong backlog that portrays revenue visibility worth more than $5bn, which provides sufficient runway to guarantee its topline over the short to medium-term. Its recent BESS project with SCE, development of RNG capabilities and potential strategic acquisitions can also be supported by its recent increase of $262 million in its company credit facility line.

Backlog and Recurring Revenue (AMRC)

Financials

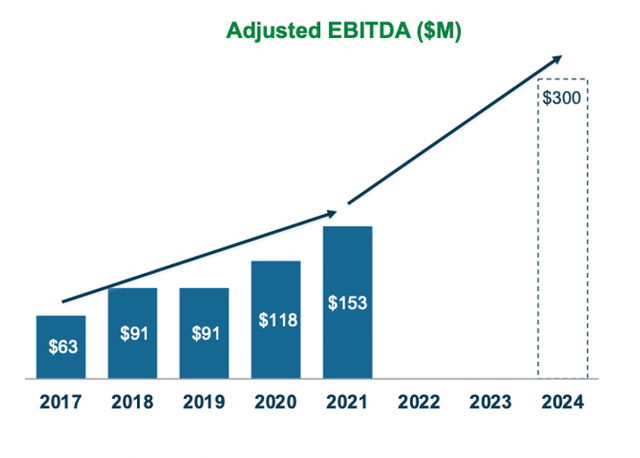

With the industry tailwind, its competitive lead and significant revenue visibility, AMRC is expected to double its 2021 adjusted EBITDA by 2024 to approximately $300mn, and it is pushing for growth in recurring business to boost its EBITDA margin.

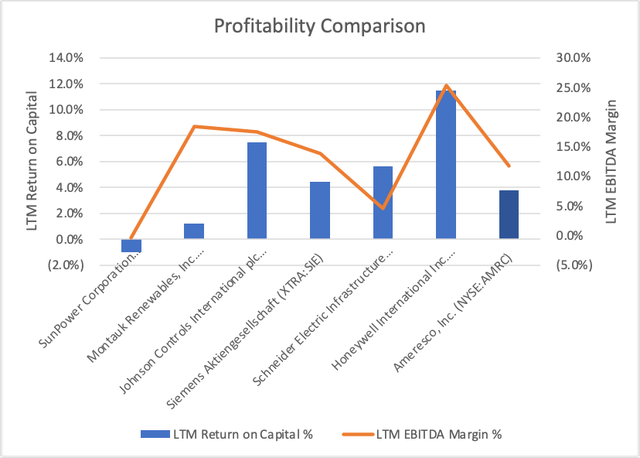

Comparing its profitability with its peer groups across various business lines, AMRC generally performed moderately, but losing out on both return on capital and EBTIDA margin to its larger peers such as Johnson Controls (JCI) and Honeywell (HON). It is worth noting that HON may not be a fair comparison to AMRC as it also operates in many other sectors, but the JCI and Schneider Electric (BSE:534139) could be interesting catch.

Profitability comparison (Author, CapIQ)

Return on Capital and EBITDA Margin – higher the better

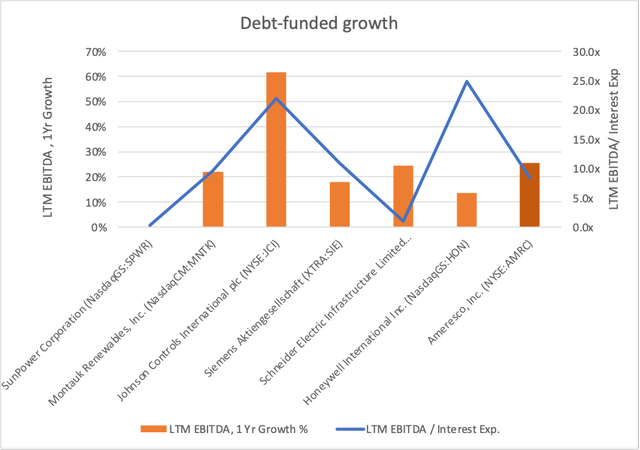

Meanwhile, AMRC also has moderate debt burden (which seems to be related to the market cap) with considerably high EBITDA growth rate. However, JCI has again outperformed in these metrics as it has experienced high growth with very little debt burden, making it a potential candidate to buy instead with similar sector and geographical exposure. However, JCI has fundamentally different focus which develops and operates building management system (BMS) with offerings such as heating, ventilation, and air conditioning (HVAC) despite its ambition to participate in the decarbonization future too.

Debt-funded growth (Author, CapIQ)

EBITDA growth and EBITDA/Interest Exp – higher the better

Valuation

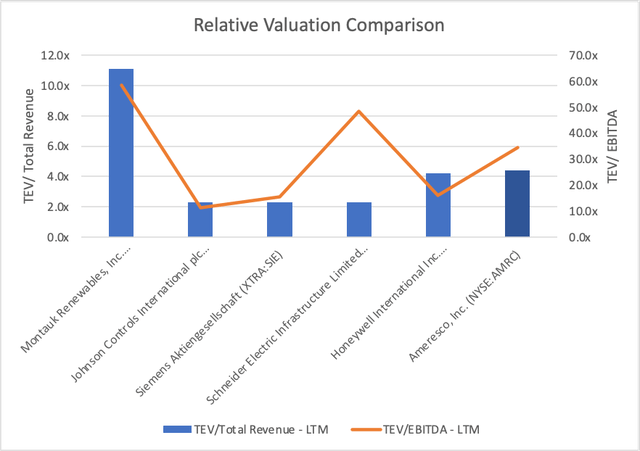

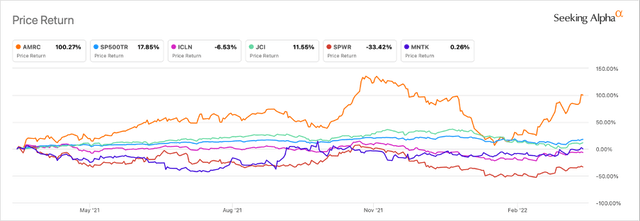

AMRC has significantly more volatile price trends in the past six months as there are mixed sentiments driven by wider market correction, and news about the SCE contract and other acquisitions. As it has mostly rebounded from its recent low in February, investors may be overly positive about AMRC.

Quite similarly, AMRC is currently situated in the ‘awkward’ mid cap tier with moderate valuations. Its current TEV/EBITDA of 34.6x seems high as it begins to grow into scale with stabilizing business model. AMRC’s capability to increase EBITDA through the shift towards end-to-end integration and energy asset business will be crucial, while its potential to capture growth in the high-growing segments such as RNG could be a turning point. However, the results of those initiatives will not be immediate and its current valuation for a reliable and growing mid-size ESCO seems more than fair. As it aims to double its EBITDA in 3 years, it is worth considering for a buy, potentially at a TEV/EBITDA multiple of around 20-25x if its fundamental and growth prospects remain strong.

Relative Valuation (Author, CapIQ)

TEV/Total Revenue and TEV/EBITDA – lower the better

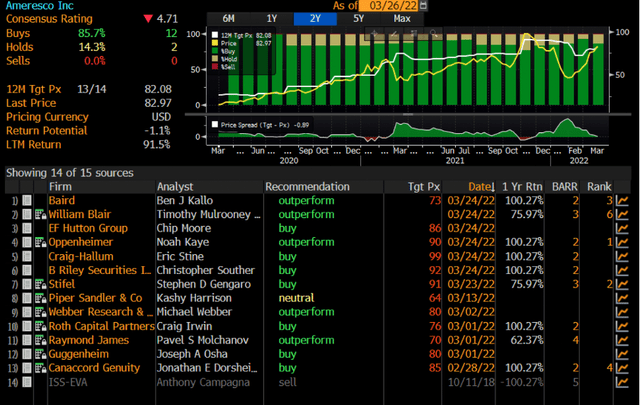

From the consensus overview, wall street is also considering AMRC to be at a fair value with a 12-month price target of $82.

Catalysts

Here is a summary of catalysts for AMRC. Some of them may have potentially been priced in, and the fading effects of catalysts due to impact overestimation may in fact hurt the stock price.

Surge In Energy Price

With recent surge in energy prices mostly triggered by the ongoing Ukraine war, more businesses are witnessing increasing energy cost which may accelerate their desire to increase energy efficiency and to shift towards renewable energy sources. Such trend will be a boost to the growth of AMRC topline for the short to medium term.

US Policy Boosts For RNG

To reduce Europe’s reliance on Russian gas, the US has announced joint plans to build ‘clean and renewable hydrogen-ready infrastructure’ at both sides. While there is still lack of clarity to the plans, the success of RG rollout in both continents will undoubtedly make AMRC’s current RNG expansion effort worthy of investment.

Energy Act 2020

The Energy Act has authorized a $2.3 trillion spending bill with $35 billion in energy research and development programs, as well as 2-year extension of the 26% credits for solar projects through the end of 2022. Such initiative has benefitted AMRC as it brought lower cost to its solar project developments, while potentially attracting more clean energy and energy efficiency businesses.

Risks

Supply Chain Disruptions

AMRC mentioned about its expectation on supply chain disruption extending into 2022 which has resulted in delays and disruptions for project completions. Such impact could be significant as AMRC’s project revenue is affected by completion timeframe and its effectiveness.

Fierce Competitive Landscape With Huge Players

AMRC operates within a competitive landscape with some of the biggest companies such as Siemens and Honeywell, which could expose itself to more head-to-head fights and even potential acquisition attempts. This may hurt AMRC’s topline and bring greater volatility to its stock prices if M&A-related news become significant.

Conclusion

In summary, AMRC has demonstrated competitive strengths within its business model with continuous effort to develop technologically advanced and innovative energy solutions focusing on both of its projects and assets business lines. Despite the stability and strong growth prospect, it does not seem to be undervalued at the moment as many catalytic factors seem to have been priced in. It is definitely worth observing the company and it could become a good ‘buy’ if its valuation multiple drops without deterioration in its underlying fundamentals.

Be the first to comment