sutlafk/iStock via Getty Images

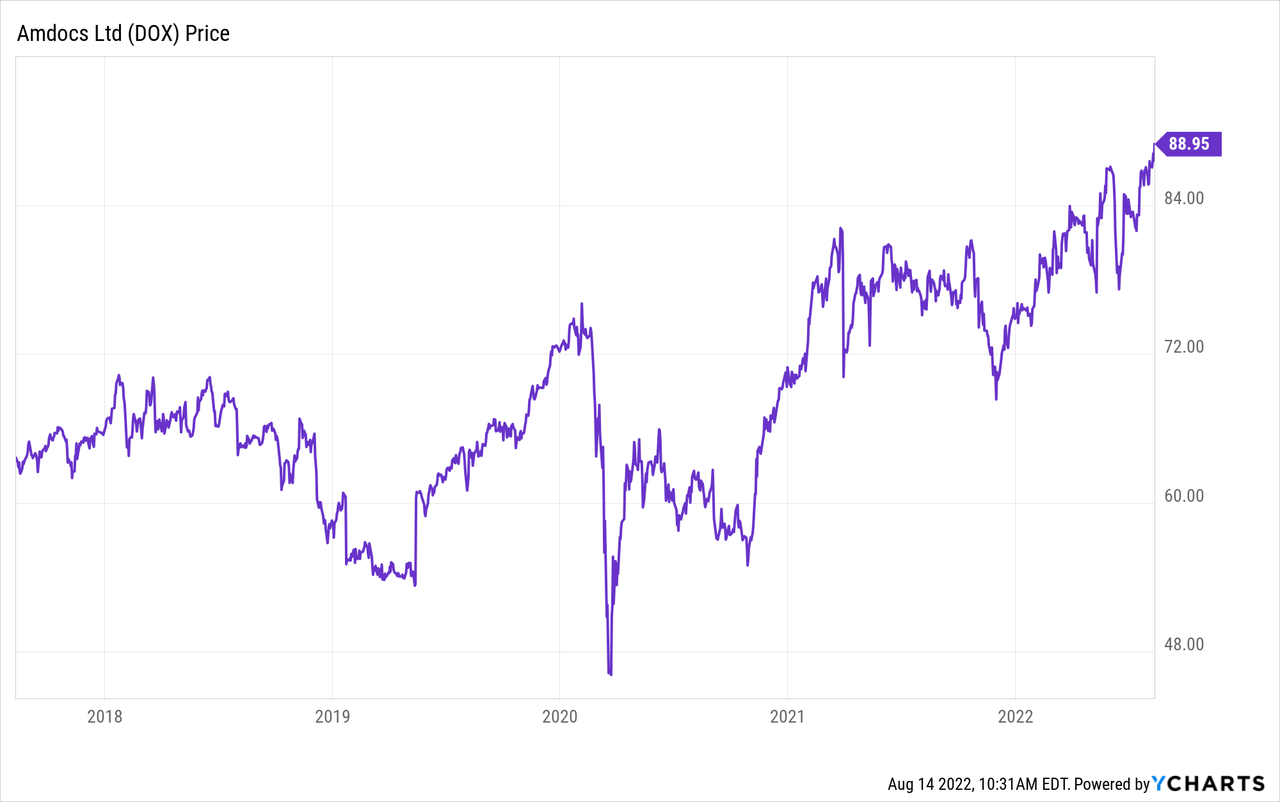

St. Louis, Missouri-based Amdocs (NASDAQ:DOX), an IT provider of 5G and cloud-based networking, customer care, engagement, assurance and billing services, is outperforming the broad market this year (+18.5% YTD) and has a total return of 59% since my initial BUY rating coverage started on Seeking Alpha back in September of 2020 (see Amdocs: Time To Play Catchup). The company is generating strong free-cash-flow and has a meaningful share buyback program that is significantly reducing the outstanding share-count. The Q3 earnings report released a couple of weeks ago was bullish: record revenue, a strong backlog, and slightly better forward guidance. DOX has a strong balance sheet, and its stable and sticky business model enables it to bolster organic growth with opportunistic and strategic M&A. The company should be able to keep growing revenue at ~10% annually, with earnings growing a bit faster than that due to share-count reduction. I reiterate my BUY rating on DOX based on its rather defensive nature, strong profitability & free-cash-flow profile, steady-as-she-goes growth, and rational valuation.

Investment Thesis

5G networking and cloud-based IT services company Amdocs provides customer care, engagement, and billing support that are the kind of sticky services that its customers (companies like AT&T, T-Mobile, Comcast, etc.) are very hesitant to switch due to the potential for a messy migration, customer disappointment, and increased cost. As a result, DOX has stable revenue which generates significant free-cash-flow. A strong balance sheet and its free-cash-flow profile enables the company to reward shareholders while using M&A to supplement organic growth.

Q3 Earnings

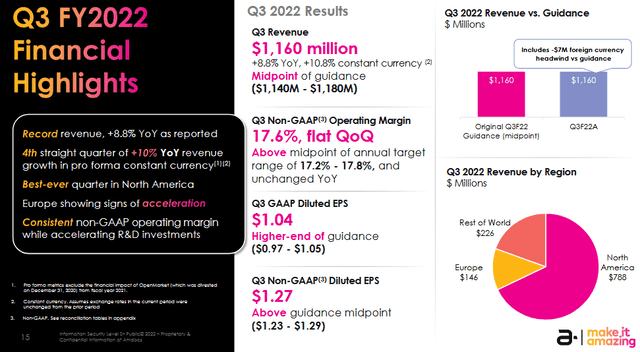

DOX released its Q3 EPS report on August 3rd, and it was a beat. I say a “beat” because, despite a $7 million foreign exchange headwind, revenue was a record (+8.8% yoy and an acceleration of the 3.9% in the prior year) and EPS came in toward the high-end of guidance:

Amdocs

Note that, in constant currency terms, it was DOX’s fourth straight quarter of 10% yoy revenue growth due to record North America results ($788 million or 68% of total revenue). Normalized free-cash-flow during the quarter was $144 million – which equates to $1.17/share based on the 123.153 million fully-diluted shares outstanding at quarter’s end. Margin was flat sequentially but met the mid-point of guidance despite the FX headwind.

On the Q3 conference call, Amdocs CEO Shuky Sheffer reported on recent business developments:

Q3 was also another quarter of robust sales momentum. We strengthen relationship with large and long-standing customers like T-Mobile and AT&T’s Cricket Wireless, we are happy to say that we expanded our managed services engagement for an additional five years, as Tamar will touch on later. Additionally, we further grew our footprint with other major operators including Vodafone Germany, which has selected Amdocs for follow-on digital transformation projects.

Sheffer also said DOX integrated more than 27 million customers for Excel in Indonesia as part of a multi-year managed digital transformation project. The project will enable Excel to launch innovative digital services and enhance their customer experiences. Amdocs is also reaching millions of Brazilian subscribers in all cities serviced by Telefonica Vivo.

Share Buybacks

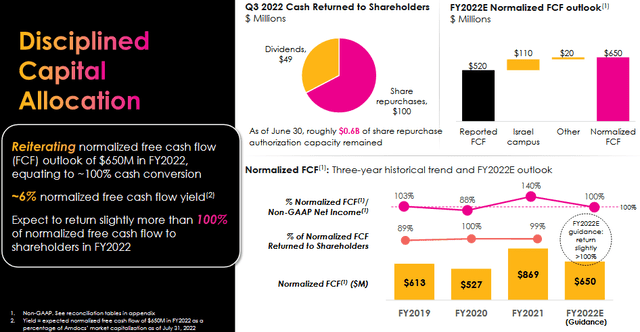

During the quarter, DOX repurchased $100 million worth of shares while paying out dividends of $49 million:

Amdocs

Now, typically I don’t like to see such an over-emphasis on share buybacks. However, to illustrate my point that Amdocs actually has a “meaningful” share buyback program that outpaces employee stock compensation (somewhat rare these days …), note that the outstanding share-count in my first article on DOX in September of 2020 (Q3 FY2020) was 133,593,000. At the end of the recent Q3 report (two years later), the outstanding fully-diluted share-count was 123,153,000, or down 10,440,00 shares, or -7.8%. That is a meaningful reduction in shares that has – along with strategic M&A and organic growth – worked to increase EPS from $0.90/share in Q3 FY2020 to (non-GAAP) $1.27/share in Q3 FY2022.

Going Forward

DOX reported a 12-month backlog that was a record $3.95 billion – that’s +10% yoy, +$60 million qoq, and gives investors relatively high visibility into the future.

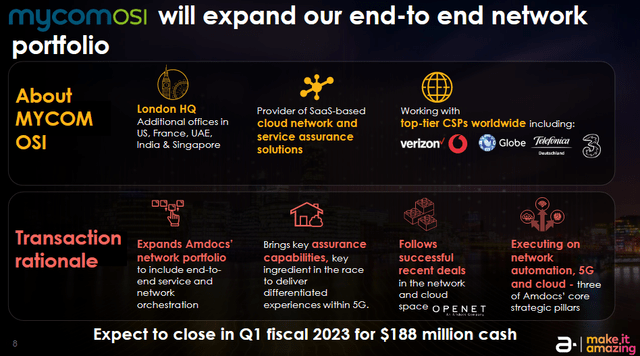

The acquisition of MYCOM OSI was announced in May for $188 million in cash and is expected to close during Q1 FY2023. MYCOM OSI is a privately-owned business headquartered in London but also has offices in the US, France, the UAE, India, and Singapore. MYCOM OSI was the first service assurance vendor to offer its applications via a SaaS-based subscription model over the public cloud. Although the acquisition is not expected to have a material effect on earnings over the next couple of year, DOX appears to be playing the long-game here by expanding its end-to-end network and assurance solutions while opening the door to new customers for which it can then offer its other services:

Amdocs

Risks

Amdocs is not immune to the macro-risks currently facing the global economy: high inflation, a rising interest rate environment, COVID-19 related shut-downs and supply-chain challenges, as well as the negative impacts of Putin’s horrific war-of-choice in Ukraine that has, effectively, broken the global energy & food chains.

As of the end of Q3 (June 30th), Amdocs had $650 million in debt, $850 million in cash, and a $500 million credit facility. That being the case, and considering DOX generated $144 million in FCF during the most recent quarter, the company can easily afford the $188 million MYCOM OSI acquisition. However, I am surprised the company made an acquisition for which the near-term benefits aren’t more meaningful.

FX headwinds may persist in the coming quarters due to the potential for continued strength in the U.S. dollar given the Federal Reserve’s intention to keep raising interest rates to fight inflation. That said, and as noted previously, 68% of Q3 revenue came from North America.

Summary & Conclusion

Amdocs is what I consider to be a slow-n-steady growth company that has an excellent profitability and free-cash-flow profile, which it uses to buy back shares and grow via M&A. The backlog is strong and gives investors high visibility into the future. In my opinion, this kind of solid – perhaps even “defensive” – business model is what the market currently favors and is likely the reason why DOX is outperforming. And while I admit I don’t completely understand the rationale of the planned MYCOM OSI acquisition given the lack of near-term payback, it is a relatively small deal which DOX can easily afford and there certainly could be some strategic value in expanding DOX’s first service assurance offerings as well as additional customer acquisition which will open the door to DOX’s other offerings. Meantime, significant share reduction should enable DOX to grow EPS and FCF/share faster than top-line growth. DOX is a BUY and could easily earn $5.25 in FY22 and $5.70 in FY23. The stock could easily hit $100 (or more) over the next 12-months, simply given a market-multiple of 20x.

I’ll end with a 5-year price chart of DOX stock:

Be the first to comment