MF3d/E+ via Getty Images

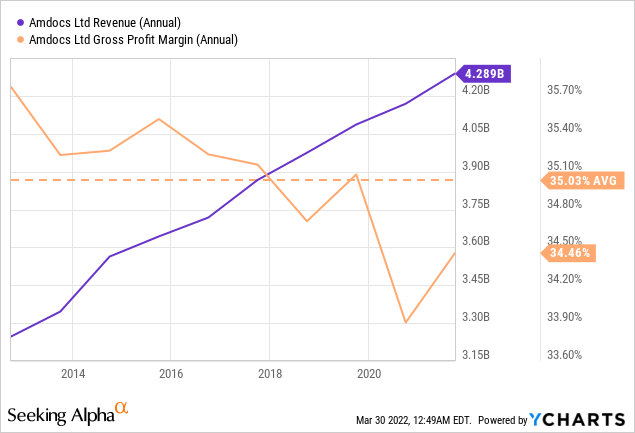

Amdocs (NASDAQ:DOX) is a software and services company predominantly serving telecom firms. The catch-up that most telcos have been playing to achieve vertical integration has somewhat dwindled their charm as the leading adopters of technology. As evidenced in Amdocs’ gross margins, telcos need to play catch-up has led to the company focusing a lot more on managed services vs pureplay software, which is why its margins are around the 35% levels vs 80%+ for subscription/SaaS players.

We thus remain cautious on the name and look for execution-driven strength in margins.

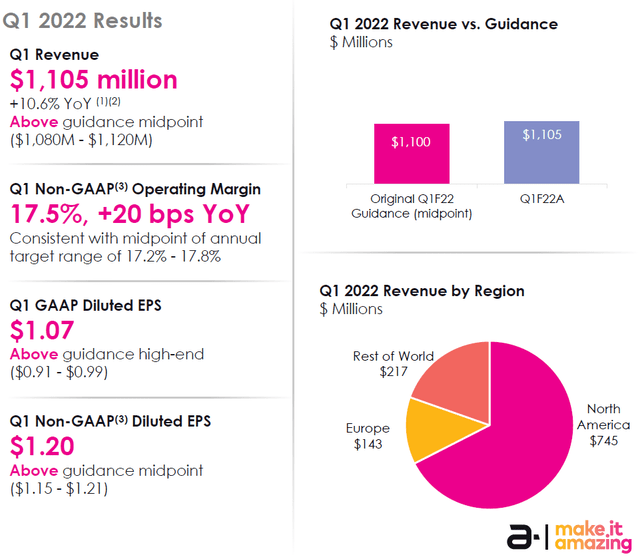

Q1 2022 Results

Per the latest reported financials, DOX’s 2022 Q1 revenue growth (y/y) came in at 1.7%. On a pro forma basis, the company claims to have grown at 10.6% (excluding the impact from the divestment of OpenMarket in fiscal 2021. The management claims that OpenMarket was clocking around $80 million per quarter).

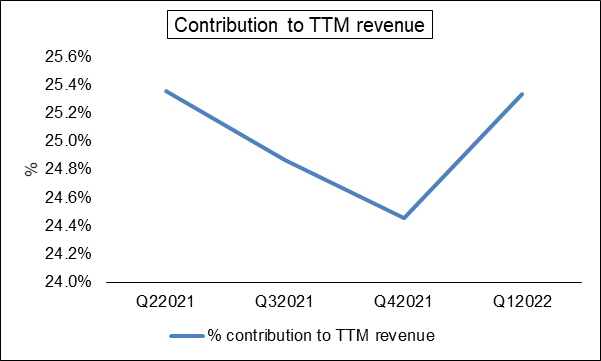

Over the last four quarters, the maximum contribution (25.4%) to revenue came from Q22021.

Company filings

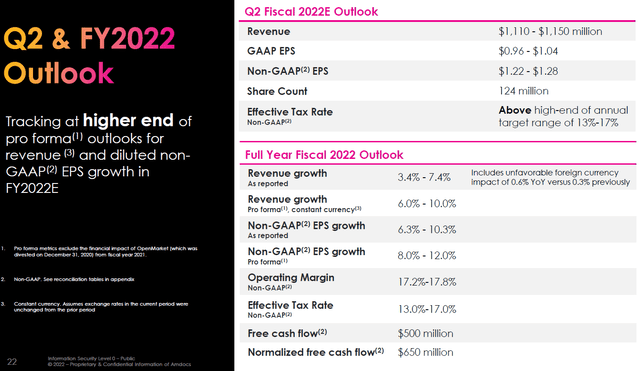

The 2022 Q1 revenue growth (y/y) was lower than both TTM revenue increase (y/y) of 2.2% and the compounded annual growth rate (2018-2021) of 2.6%. For the year, the management has guided to the following:

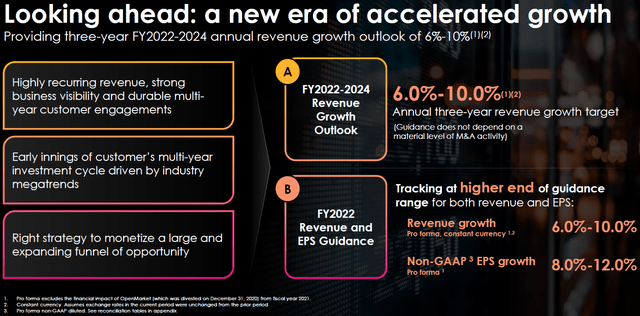

The management has further extended its vim to the company’s outlook for the next three years.

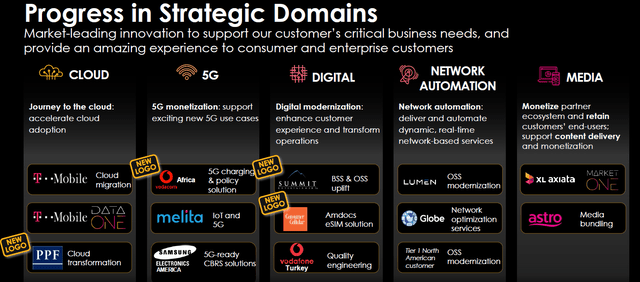

I would say, the best-ever positioning of Amdocs that all the mega trends that they were there, we predicted them, invested a lot to make sure that we are ready, and we talked about these megatrends like 5G, journey to the cloud, network automation, the digitalization in general, I think we are very ready to this megatrend.

Source: Q1 2022 Earnings Call from Seeking Alpha

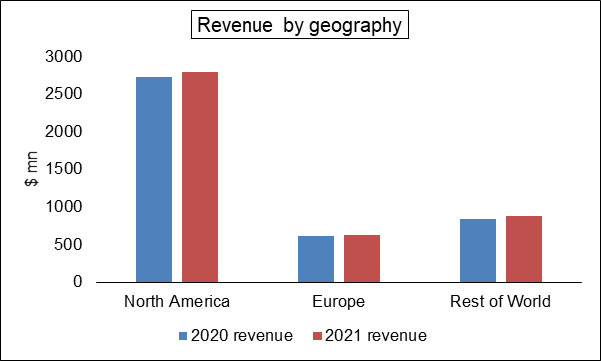

Despite the new logo additions, the weakness in AT&T (T) and divestiture of OpenMarket have led to emerging markets growing faster (Amdocs continues to wind down its exposure in Europe post the OpenMarket exit).

Company filings

Financials

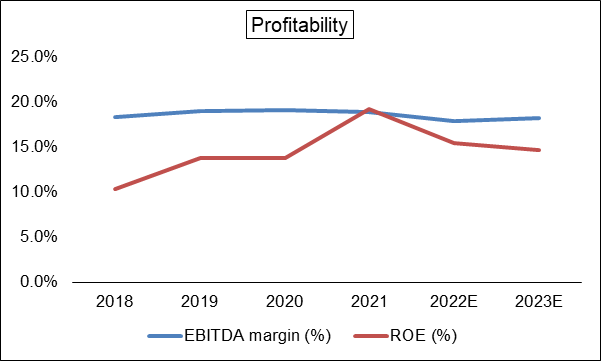

Over 2018-2021, both the EBITDA margin and ROE have expanded by 60 bps and 889 bps, respectively. We expect the EBITDA margin and ROE to move together, with the EBITDA margin expected to go down by 67 bps and ROE to decrease by 457 bps, respectively.

Company filings, Author’s analysis

Our expectations are etched in the company’s fortunes continued to be tied with those of telecoms, where 5G deployment and integration continue to overwhelm their focus on the application layer.

In the past, the revenue and profit growth have both trended up, resulting in the PAT margin expansion of 714 bps. We expect revenue to be positive and accelerating in the future with 2023 revenue is expected to reach $4.9 billion, implying a compounded rate of growth of 6.6% during 2021-2023. Over 2018-2021, the revenue increased at a compounded rate of 2.6%, to reach $4.3 billion, from $4 billion in 2018.

For the net profit growth, we expect it to be slower in the future with 2023 PAT expected to reach $725 million or a compounded rate of growth of 2.7% over 2021-2023. During 2018-2021, the net profit increased at a compounded rate of 24.8%, to reach $688 million in 2021 from $354 million in 2018. Our expectations of revenue and profit movement imply a potential margin contraction of 117 bps in the future.

Product portfolio

While the market seems to be getting excited by the SaaS in Amdocs’ product portfolio, we see the company still having an uphill task of percolating these products sufficiently through the customer base.

the idea of MarketONE (a SaaS platform) is rather than every one of our customers will start to integrate specifically in a bespoke way to Netflix, to Shopify, to many, many other content, Peacock, HBO Max, whatever, to do it in one on one integration, we have a platform today that actually integrated for many, many OTTs

Source: Q1 2022 Earnings Call from Seeking Alpha

Another risk that might elevate the pressure on margins is wage inflation. While the management expects personal development and career opportunities to help mitigate people’s challenges, the pricing dynamics in the telecom space may not allow for significant expansion, with Amdocs management expecting operating margin to remain around 17%.

Risks

- While European exposure for Amdocs has been somewhat limited (see the above section on revenue split by geography) by the divestment of OpenMarket, the Ukraine – Russia conflict could cause revenue weakness, denting the management’s expectations.

About one-fourth of the open market business was in Europe. But I think the more kind of fundamental and interesting thing in Europe is the fact that we have naturally ramped down some large-scale transformations and recent awards are starting to ramp up now in terms of revenue. So we expect a much stronger second half in 2022 for Europe

Source: Q1 2022 Earnings Call from Seeking Alpha

- Although the three-year plan looks promising, by the management’s own admission, execution risk remains central to Amdocs’ strategy.

- Amdocs’ SaaS products are yet to see any significant uptake and thus the margin improvement from them remains circumspect.

- On the cost side also, in addition to wage inflation, geopolitically-inspired currency risk could act as headwinds to the margins.

In addition, a slight impact sequentially and also year-over-year is coming from the currencies. A lot of the currency movements we are talking about is impacting our European business.

Source: Q1 2022 Earnings Call from Seeking Alpha

Conclusion

We apply a 13.2x multiple to the 2022 estimated EPS of $5.2 to arrive at a price of $69. Our estimate of EPS is arrived at by keeping the EBITDA sub 18% and for the P/E, we have adjusted the historical P/E to reflect our perception of the risk involved.

Additionally, to account for the potential upside from any strength in sales, we also value the company on a P/S basis, applying a 2x multiple (historical, risk adjusted) to estimated 2022 revenue of $4.6 billion to arrive at a price of $74.

Our range of price represents an 8-15% decline vs the current price. However, based on the 10-day and 50-day moving average trend, there appears to be near-term strength in DOX’s stock price.

Overall, it might be prudent to let the management’s plans fructify over the next few quarters before trying to play the telco space through Amdocs.

Be the first to comment