Justin Sullivan/Getty Images News

The AMD (NASDAQ:AMD) stock has been on a tear since releasing robust March-quarter results in early May that quashed investors’ fears of a slowing semiconductor cycle following a multi-year boom. The stock gained more than 20% in May, before succumbing to a broad-based semiconductor drag over the past week following reports of a mixed industry outlook from peers like Intel (INTC) and Micron (MU).

But AMD’s most recent Financial Analyst Day presentation on Thursday continues to underscore its preparedness for the next stage of accelerated growth, driven by an extended foray in AI opportunities that stand to repeat its data center success achieved in recent years. The recent consolidation of Xilinx and Pensando remain significant contributors to AMD’s innovation roadmap ahead, underscoring a large and fast-expanding total addressable market (“TAM”) that is poised to bolster the stock’s longer-term valuations. AMD’s penetration into next-generation technology opportunities is also supported by a robust demand environment that will help ramp its new products to scale, enabling a positive balance between growth investments and healthy margin expansion.

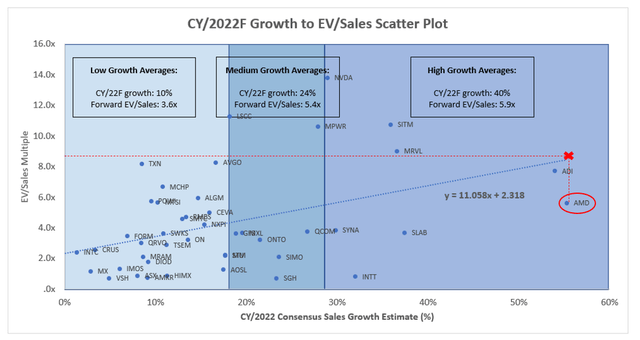

AMD is currently trading at under 5x EV/CY’23E sales, which is a significant discount to the 5.5x mean observed across the fabless semiconductor peer group, especially given its industry-leading growth profile. Considering AMD’s data center momentum buoyed by its existing technology stack, as well as the ongoing realization of synergies ensuing from recent acquisitions, the stock remains a compelling investment pick at current levels.

AMD’s Renewed Technology Roadmap

AMD has unveiled a series of upgrades to its existing product-line that combines next-generation performance with continued innovation:

Improved CPU Cores: As discussed in our previous coverage, the “Zen 4” and “Zen 4c” CPU cores are the backbone to AMD’s next-generation EPYC server processors for data center application. The newest Zen 4 cores in AMD’s enterprise CPU technology will “power the world’s first high-performance 5nm x86 CPUs later this year” – referencing TSMC’s (TSM) industry-leading 5-nanometer process that enables greater performance (for those who are less familiar with the intricacies of chip technology like me, smaller nanometer processors are more powerful because it means the space between the high volume of transistors within a single chip is greatly reduced, thus lowering the “distance travelled by electrons to perform work” and reducing energy consumption while enabling faster computing). The Zen 4 delivers 25% more performance-per-watt and 35% more performance overall compared to its predecessor.

AMD also announced the development of a next-generation “Zen 5” CPU core, which will be a brand new “grounds-up” development with a focus on optimizing performance and efficiency for all workload applications, especially AI and machine learning. Scheduled for launch in 2024, the Zen 5 CPU cores will leverage TSMC’s most advanced 3nm process.

The continued improvements made to AMD’s CPU technology continue to bolster its competitive advantage in terms of both performance and quality. By addressing some of the fastest-growing market needs, such as increasingly large models like AI and machine learning workloads, AMD reinforces its ability in capitalizing on burgeoning data center opportunities in the new era of digitization ahead.

AMD RDNA 3 Architecture: The newest gaming architecture takes a step up from the previous RDNA 2 launched earlier this year. In addition to improved graphics in PC and console gaming promised by its predecessor, the RDNA 3 architecture delivers 50% more performance-per-watt thanks to the migration to 5nm manufacturing technology as mentioned above. The added combination of a “chiplet design and next generation AMD Infinity Cache technology” will also enable better performance at “low power and low latency”.

The new and improved RDNA 3 architecture is expected to extend RDNA 2’s prowess in capturing share of the rapidly expanding gaming market, which is expected to become a $400+ billion market by 2028. With 50% more performance and a lower power requirement, the RDNA 3 architecture is expected to strengthen AMD’s ability in catering to demand arising from the growing popularity of leisure gaming, eSports, digital gaming content creation and streaming. Similar to the RDNA 2 architecture, the newest RDNA 3 architecture will likely drive greater adjacent revenues from its semi-custom business as well, given its improved performance capabilities will unlock greater use cases for OEMs looking to co-developed tailored technology solutions in gaming.

4th Gen Infinity Architecture: The newest system-on-chip (“SoC”) design approach is expected to further streamline the “integration of both AMD IP and 3rd party chiplets”. Recall that AMD’s Infinity Architecture is a SoC design that connects “chiplets, memory and I/O dies, and other components” for high-performance computing (“HPC”) data center applications. The 4th Gen Infinity Architecture essentially extends the architecture’s support of AMD IPs to those of third-party vendors as well to unlock new computing possibilities.

The latest development is not surprising given the number of high-profile investments made this year to extend the company’s foray into other fast-growing nascent technologies. The added support for third-party IPs effectively enables the integration of those recently acquired from Xilinx. Recall that Xilinx is a leader in the development of adaptive SoCs for application across a variety of technologies ranging from aerospace and automotive to cloud and communications infrastructure. By extending support to third-party vendor IPs, AMD’s 4th Gen Infinity Architecture unlocks the synergies from the Xilinx merger by enabling a seamless transition for the company into new markets that it previously did not have a prominent role in.

AMD CDNA 3 Architecture: AMD’s CDNA architecture is designed for application in some of the most demanding use cases, including “scientific computing and machine learning applications”. As a competitive offering in addressing HPC, hyperscale data center and AI workloads, the newest CDNA 3 Architecture promises “5x greater performance-per-watt compared to [its predecessor] on AI training workloads”. The newest development combines “5nm chiplets, 3D die stacking, 4th generation Infinity Architecture, next-generation AMD Infinity Cache technology, and high bandwidth memory (“HBM”) memory in a single package”, thus promising more power with less energy.

The improved CDNA Architecture also bolsters AMD’s increasing prominence in data center and HPC opportunities. The company’s technologies, such as the “AMD Instinct MI200” series data center GPU processors powered by its existing CDNA 2 architecture, already plays a critical role in addressing the “growing demand for compute-accelerated data center workloads” for mainstream users. AMD’s chips can now be found across the “world’s 10 largest hyperscalers” and plays a critical role in powering some of the most powerful supercomputers in the world.

And the improved performance enabled by AMD’s CDNA 3 Architecture is expected to further extend that prowess, underscoring greater market share gains ahead. AMD’s newest “Instinct MI300” series accelerators will mark the first to be powered by the CDNA 3 Architecture. Extending the capabilities of the Instinct MI200 Series, the Instinct MI300 Series will deliver an “8x increase in AI training performance”.

AMD XDNA Architecture: The XDNA Architecture is the newest addition to AMD’s family of offerings. Built on the “foundational architecture IP from Xilinx”, the XDNA Architecture “consists of key technologies including the field-programmable gate arrays (“FPGA”) fabric and AI engine (“AIE”) – core areas of Xilinx’s expertise – to enable optimized performance and energy efficiency for application in complex workloads such as AI and signal processing. The AMD XDNA IP is scheduled for debut in 2023, beginning with the integration into the AMD Ryzen series processors used primarily in powering desktop/notebooks.

The newest development underscores another synergy opportunity stemming from AMD’s recent acquisition of Xilinx. As the leader in the development of FPGA and adaptive SoCs for application in emerging technologies spanning cloud data center and communications infrastructure, Xilinx puts AMD in a unique position for TAM expansion by enabling new technologies such as the XDNA Architecture – the global FPGA market is forecasted to grow at a compounded annual growth rate (“CAGR”) of 8.5% through 2025, as rising adoption of emerging technologies continues to bolster demand.

Reducing Carbon Impact: Increasing performance-per-watt is a common theme throughout the latest technologies unveiled by AMD. By developing more energy efficient chips without compromising on performance, AMD effectively addresses issues like climate change from its source, in addition to enabling next-generation technologies like AI and HPC deployed to solve similar complex problems.

The increasing urgency to reduce global carbon emission levels and rein in climate change has accelerated the incorporation of ESG considerations across the enterprise sector worldwide. This is further corroborated by the rapid expansion of the green bonds market in recent years, which grew by $500 billion in 2021 alone (+50% y/y). Over the next three decades, capital spending aimed at driving net emissions down to zero is expected to reach $275 trillion, or approximately $9.2 trillion per year. The statistics, along with the increasing demand for data center hardware, underscore the additional growth opportunities unlocked by the high-performance, yet low-energy-consuming, processors that AMD has to offer.

Expanded Data Center Strength with Pensando

Global demand for data center processors will remain elevated in coming years, as cloud computing remains a critical need in the corporate sector with no signs of slowing in adoption. Despite the current array of macroeconomic risks that span from tightening monetary policy and financial conditions to the resurgence of COVID in China and the Russia-Ukraine war, businesses have continued to migrate their workloads to the cloud, in which data center processors remain the backbone of.

With only 11% of the corporate landscape feeling confident that their legacy business models will be “economically viable through 2023” and another 64% raising the need to step up on digitization plans, corporate spending on digital transformation is fast approaching an inflection point. More than half of corporates are expecting cloud adoption to account for a significant portion of investments in the next two years, driving the global cloud-computing market towards a market value of more than $800 billion by 2025.

These statistics continue to corroborate a robust demand environment for both cloud service providers and supporting chipmakers like AMD, even under a potentially tightening economic environment in the near term. More than half of the corporate scene have expressed that they would rather “tighten the belt” in other parts of the business than to miss out on digital transformation, which is considered a strategic investment in differentiating themselves from competitors, while also enabling cost efficiencies.

In addition to bolstering data center market share gains through the acquisition of new technologies from Xilinx and Pensando, AMD’s existing EPYC server processors have continued to play a critical role in enabling its market leadership in related opportunities today. In addition to “Genoa” and “Bergamo”, which we have already discussed in detail in our recent AMD coverages, the company has unveiled two additional processors to its 4th Gen EPYC processors line-up during the Financial Analyst Day presentation – the “Genoa-X” and the “Siena” – which will begin deliveries in 2023/2024:

- Genoa-X: The Genoa-X is a step-up from the Genoa. Both processors feature the Zen 4 cores, but the Genoa-X is optimized with AMD 3D V-Cash technology to “enable leadership performance in relational database and technical computing workloads”. Meanwhile, the Genoa is designed to be the “industry’s highest performance general purpose server CPU”.

- Siena: The Siena EPYC processor is also powered by Zen 4 cores, and is specifically designed for optimized “intelligent edge and communications deployments”. In our opinion, the Siena EPYC processors may have been a strategic development to complement AMD’s foray into new use cases such as communications infrastructure and telco application enabled by newly adopted Xilinx technology, marking another synergy unlocked.

Looking further ahead will be AMD’s planned debut for its 5th Gen EPYC processor in 2024. While details are lacking on the family of next-generation server processors, codenamed “Turin”, AMD revealed they will be supported by “three variants of the Zen 5 core in its CPU roadmap, including Zen 5, Zen 5 with 3D V-Cache, and Zen 5c”, similar to the Zen 4 core series that cover general to cloud-optimized applications. The 5th Gen EPYC processors will also feature the 4nm and 3nm manufacturing processes to unlock new performance capabilities.

In addition to EPYC developments, AMD’s recent acquisition of Xilinx, as discussed in earlier sections, and Pensando also bolsters its technology stack used in penetrating data center opportunities. The chipmaker completed its acquisition of Pensando in late May, which stands to further the company’s “data center product portfolio with high-performance data processing unit (“DPU”) and software stack” going forward. With customers including high-profile names like Goldman Sachs (GS), Microsoft’s Azure (MSFT), HPE (HPE), and Oracle’s cloud unit (ORCL), Pensando boasts its strength in “high-performance, fully programmable [data] packet processors and [a] comprehensive software stack that accelerates networking, security, storage and other services for cloud, enterprise and edge applications”.

During AMD’s Financial Analyst Day, the chipmaker dedicated time to introduce Pensando’s DPU line-up. Taking a page from rival Nvidia’s (NVDA) corporate strategy, which typically combines hardware and software offerings to enable end-to-end solutions, Pensando’s DPUs are complemented by a “robust software stack with zero trust security throughout”. The acquisition of Pensando is expected to complement Xilinx’s “strong software stack” and AMD’s hardware engines, and accelerate efforts in creating full-stack, hardware-software solutions that aim at “[unifying AMD’s] overall product roadmap going forward”.

In addition to bolstering AMD’s hardware-software stack, Pensando’s capability in providing intelligent, performant and secure DPUs also catapults the consolidated company into high-growth opportunities stemming from the global cybersecurity market – a $300+ billion opportunity by mid-decade. Cybersecurity has never been more important, as global enterprises embark on a transformative age of digitization. Increasing generation of and reliance on data, paired with rising frequency and sophistication of cyberattacks (e.g., data breach, identity theft, ransomware, etc.) has heightened demand for reliable and adaptive IT security solutions.

In addition to the rapid transition of workloads to the cloud, bolstering cybersecurity efforts is another top priority identified by the public sector, which makes strong tailwinds for both AMD’s hardware and software businesses – more than 38% of global corporations have identified cybersecurity improvement a top investment priority. We believe the acquisition of Pensando has come at an opportune time, as the acquired technology complements AMD’s existing data center offerings to enable “solutions that can accelerate data transfer speeds while providing additional levels of security and analytics that will define the performance of next-generation data centers”.

Driving AI Leadership with Xilinx

AMD’s newest technology offerings also underscore its increasing foray in AI opportunities. Global demand for AI hardware (e.g., data center processors) is expected to accelerate at a CAGR of 43% towards $1.7 trillion by the end of the decade, which spells strong tailwinds for AMD’s next growth focus.

Drawing on Xilinx’s proprietary “AI Engine” (“AIE”) technology, which is built on its Versal ACAP (Adaptive Compute Acceleration Platform) architecture – a legacy Xilinx product that can be “easily programmed by software developers and hardware programmers” to accommodate a wide range of use cases and workloads – AMD has created the XDNA Architecture. As discussed in earlier sections, the XDNA Architecture enables integration of Xilinx’s AI expertise across AMD’s existing processor line-up, starting with the Ryzen in 2023. The hardware capabilities will accordingly be complemented by Xilinx’s software expertise in AI as well, and later be integrated across the EPYC server processors, as well as “Xilinx Versal products for small and mid-size AI models to complement next-generation AMD Instinct accelerators and adaptive SoCs”.

Xilinx’s AIE technology is categorized by two types: AIE and AIE for Machine Learning (“AIE-ML”). Both are designed to handle “machine learning inference (“ML inference”) applications and advanced signal processing workloads like beamforming, radar, and other workloads requiring a massive amount of filtering and transforms”. But AIE offers better performance in handling advanced signal processing workloads (e.g., telco solutions), while AIE-ML offers better performance in handling ML inference applications (e.g., data analytics).

The integration of Xilinx’s AIE technology into AMD’s broader product portfolio underscores its eagerness in paving the foundation for further market share gains in other verticals, such as telcos and related infrastructure. On one hand, AIE-ML will continue to complement AMD’s existing prominence in HPC and data centers, and further its trajectory in capturing share gains stemming from complex data workload demands. Meanwhile, AIE will unlock growth opportunities in new verticals such as 5G-specific solutions – a $10 billion market opportunity – for AMD.

Financial and Valuation Sensitivity Analysis

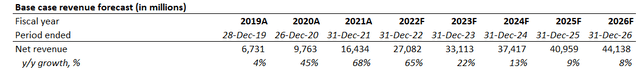

Considering the Pensando acquisition had just closed, and management has yet to disclose the pro-forma annual revenues generated from the unit, we have performed a fundamental and valuation sensitivity analysis by taking AMD’s guided long-term revenue growth CAGR of 20%. The base case forecast remains consistent with the one discussed in our most recent coverage on AMD, which includes an estimate on Xilinx contributions based on the acquired entity’s historical performance disclosed in public regulatory filings, as well as its partial period performance consolidated into AMD during the first quarter.

Base Case Recap: Our base case financial forecast based on AMD’s actual first quarter results, with the addition of expectations pertaining to Xilinx-related sales, projects top-line growth of 65% to $27.1 billion by the end of the current year. The year-on-year growth assumption slightly exceeds management’s guidance of +60% for the year, which we consider reasonable given seasonality demand that is expected to be bolstered by new product launches in the latter half, as well as AMD’s consistent track record of outperformance.

Looking ahead, annual total revenues are expected to further expand at a four-year CAGR of about 13.0% towards $44.1 billion by 2026. Much of the growth will continue to be driven by rising demand for data center processors ahead of continued ramp in “cloud, enterprise and HPC customer adoption”. AMD is also well-positioned to benefit from an enlarged TAM with accelerated expansion of its product portfolio and offerings through consolidation of various best-in-class technology providers that include Xilinx and Pensando this year as discussed in the foregoing analysis.

AMD Base Case Revenue Forecast (Author)

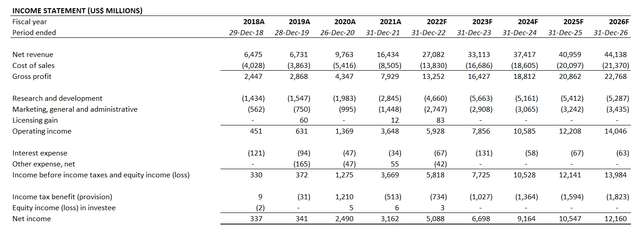

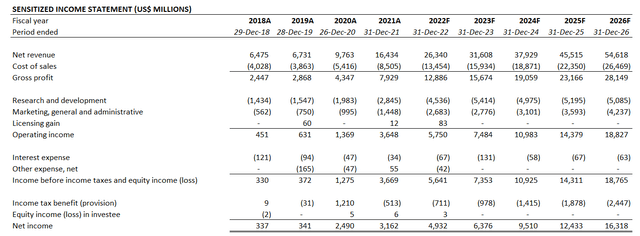

Combined with AMD’s projected cost structure, which takes into consideration the company’s continued strength in scaling new product launches as well as an increasing mix of higher-margin data center and Xilinx-related sales, the company is expected to generate net income of $5.1 billion (+61% y/y) in the current year with further growth towards $12.2 billion by 2026.

AMD Base Case Financial Forecast (Author)

AMD_-_Forecasted_Financial_Information.pdf

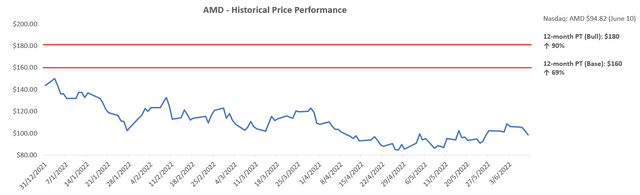

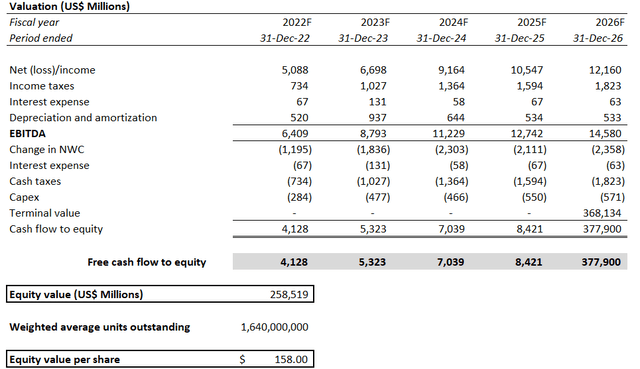

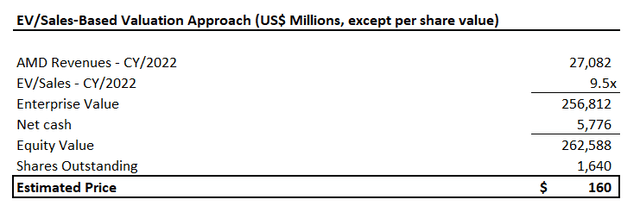

Drawing on our base case fundamental forecast, our 12-month price target for AMD is set at $160, which represents upside potential of close to 70% based on the stock’s last traded share price of $94.82 (June 10th). The valuation reflects AMD’s anticipated strength in maintaining market-leading growth that includes support from acquisition-related synergies. But near-term macro headwinds, as well as the consolidation of a higher debt balance from Xilinx operations will increase AMD’s exposure to rising borrowing costs ahead and slightly weigh on its valuation outlook.

AMD Valuation Analysis (Author)

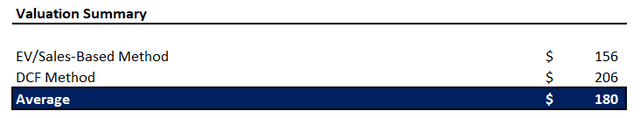

The base case price target is derived by equally weighing results from the discounted cash flow (“DCF”) and multiple-based valuation analysis.

AMD Base Case Valuation Analysis (Author)

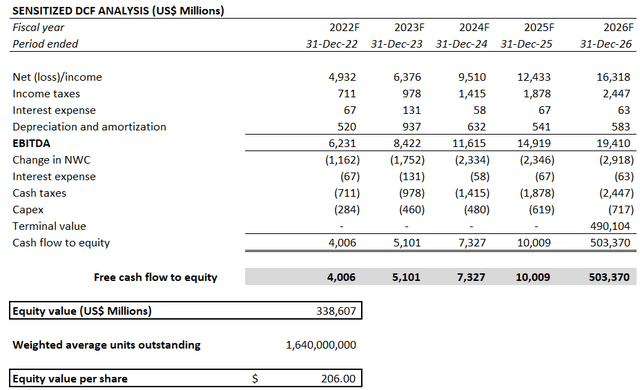

For the DCF analysis, we have applied an exit multiple of 25.3x, which bumps AMD’s valuation back in line with peers that exhibit a similar growth profile. The company is currently trading at a discount to peers despite boasting leading growth prospects and a technological advantage. As such, we believe a slight premium multiple is reasonable given AMD’s rising exposure to high-demand segments like cloud, AI and HPC, buoyed by continued expansion of its technology roadmap.

AMD Base Case DCF Analysis (Author)

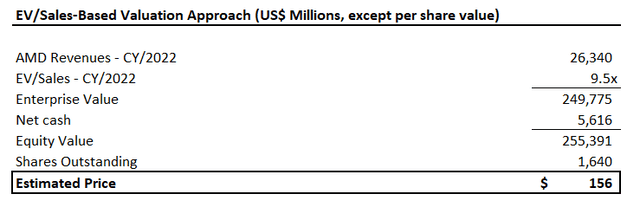

For the multiple-based analysis, we have applied a forward EV/sales multiple of 9.5x, which is derived with the same intention as our DCF analysis to gauge the company’s valuation prospects if traded more in line with peers:

AMD Peer Comp (Author) AMD Base Case Multiple-Based Valuation (Author)

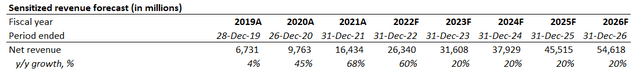

Sensitivity Analysis: Applying the 20% CAGR for top-line expansion guided by management over the next four years to gauge the additional contributions from Pensando, AMD is expected to finish the year with revenues of $26.3 billion (+60% y/y), with further expansion towards $54.6 billion by 2026.

AMD Sensitized Revenue Forecast (Author)

Keeping the forecast cost structure unchanged from our base case projections, which is in line with management’s long-term non-GAAP gross margin target of more than 57% and operating margin target in the mid-30s% range, net income per the sensitized forecast is expected to expand from $4.9 billion (+56% y/y) in the current year towards $16.3 billion by 2026.

AMD Sensitized Financial Forecast (Author)

Drawing on the sensitized fundamental forecast based on management’s long-term financial guidance disclosed in the latest Financial Analyst Day presentation, while holding all other valuation assumptions (i.e., valuation multiple, WACC, etc.) constant from our base case analysis, AMD’s price target surges to $180. This would represent upside potential of close to 90% based on the stock’s last traded price of $94.82 (June 10th).

AMD Sensitized Valuation Analysis (Author) AMD Sensitized Multiple-Based Valuation Analysis (Author) AMD Sensitized DCF Analysis (Author)

Conclusion

Global macroeconomic uncertainties remain the largest overhang on technology growth stocks, especially those exposed to softening consumer risks like chipmakers, which explains the ongoing volatility experienced across the semiconductor sector this year. Yet, from a fundamental standpoint, AMD continues to benefit from a robust demand environment and fast-expanding TAM by being the backbone of core existing and emerging technologies, underscoring continued valuation strength in the long-run. In our view, the stock remains a core investment amidst the ongoing market turmoil this year, with valuation upsides to re-merge strong once macroeconomic headwinds subside and focus redirects to AMD’s fundamental strength.

Be the first to comment