Justin Sullivan

After the bell on Thursday, we received preliminary third quarter results from chipmaker Advanced Micro Devices (NASDAQ:AMD). As worries have built about weakness in the technology space, shares have come down about $100 from their all-time high. Unfortunately for investors, the company’s Q3 results were very weak, significantly impacting the short-term growth picture, and sending shares to a new 52-week low.

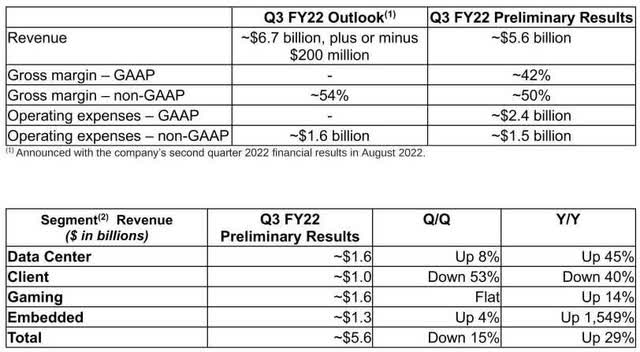

As a reminder, AMD had previously guided to a revenue midpoint of $6.7 billion, which would have represented 55% year-over-year growth. Part of this was due to the company’s continued market share increase, while a chunk of the increase was due to the Xilinx acquisition. Recently, I discussed the second major warning from DRAM and NAND company Micron (MU), and last week, AMD joined with its own warning in the semiconductor space. The graphic below details AMD’s Q3 preliminary results, with the highlight being year over year revenue growth expected to be just 29% for the period.

Q3 Preliminary Results (Company Release)

First of all, the Data Center, Gaming, and Embedded segments showed solid growth and were in-line with management’s expectations. Unfortunately, the PC market weakened quite a bit in the quarter, which not only resulted in reduced processor shipments, but also significant corrective actions regarding inventory across the supply chain. AMD is also expecting to take about $160 million in charges related to pricing, inventory, and reserves in the client and graphics businesses.

As bad as the revenue guide was, the numbers that are further down the income statement look even worse. Gross margins were impacted due to reduced shipments and average selling prices. It’s also hard for management to reduce operating expenses quickly in a tough environment. The original guidance called for a little over $2 billion in non-GAAP operating income, but the current forecast implies just $1.3 billion. Analysts were looking for 43% growth in non-GAAP EPS to $1.04, but it’s possible that we see the adjusted bottom line actually declines year over year from last year’s $0.73, depending on how other income items and taxes fare. Don’t forget that the share count is a lot higher this year due to the all-stock nature of the Xilinx deal.

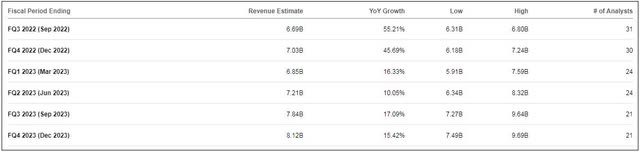

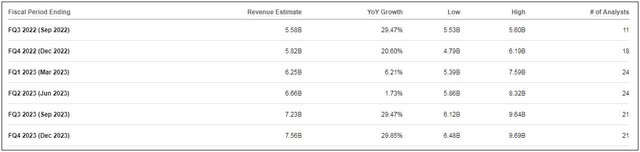

As we’ve seen with Micron and others in the past, these kind of warnings in the semiconductor space generally aren’t one-time events. When AMD hit a rough patch in 2018, revenue growth went from 67% at the peak to almost negative 23% at the bottom. As the graphic below shows, estimates prior to the warning were already calling for a significant revenue growth percentage slowdown next year, mainly due to the lapping of the Xilinx deal closing. The second image shows where estimates stand as of Sunday, to give you an idea of how much they have come down already.

AMD Estimates Before Warning (Seeking Alpha) AMD Estimates After Warning (Seeking Alpha)

If the inventory reduction process or PC demand softness last another couple of quarters, it wouldn’t surprise me if AMD prints a year over year revenue decline at some point, with Q2 of next year being the most probable according to analysts. I certainly will be interested to hear from management on how much stock they’ve bought back during Q3 and if they plan to do so during Q4. The company seems to still be producing solid free cash flow, but if results aren’t going to turn in the next few quarters, pausing the buyback may be warranted.

Of course, long-term investors will certainly say that lower stock prices are an opportunity. AMD shares lost almost 14% on Friday, closing at $58.44 and touching a new 52-week low during the session. As a point of reference, the average price target on the street was nearly $118 as of Thursday, but it has dropped about $15 so far since. In February of this year, that average street figure topped out at just over $151, with the stock itself peaking at nearly $165 last November.

For those interested in the name, one could certainly buy the stock, but some investors might be worried markets haven’t bottomed just yet. Another option might be to sell below market puts, which either would get you in at a lower price or give you a nice yield over a period of time. For instance, the April 2023 $50 puts could be sold for $5.40 currently, which if exercised would get you in essentially under $45, or get you a 9% plus yield over the next 6 plus months. Even with the rise of bond yields, you wouldn’t get that from fixed income currently, but you’d miss out on upside should AMD shares surge moving forward.

In the end, AMD announced preliminary Q3 results that were well below company expectations and street estimates. The PC market weakened during the period, causing the company to fall more than a billion dollars short on revenue. Operating margins also got whacked as a result, which will send earnings estimates and price targets lower moving forward. We’ll get the full report on November 1st, at which point we’ll find out if the street has lowered its estimates enough, or if this pain is going to continue into year’s end. With shares now at a 52-week low, investors could look at this as a long-term opportunity, or perhaps try an alternate strategy like selling below market puts if they are worried that the bottom isn’t in quite yet.

Be the first to comment