Andrei Berezovskii

Advanced Micro Devices (NASDAQ:AMD) rallied to end last week after Intel (INTC) reported better than feared results. The chip giant was feared to have caused the inventory problem leading to the big preliminary cut to Q3’22 estimates for AMD. My investment thesis is very Bullish on the company ultimately taking market share from Intel as the inventory correction in the PC market is resolved by next year.

Ugly Quarter

Intel reported Q3 revenues matched analyst estimates, but the chip giant reported a horrible quarter in reality. The company saw revenues fall 15.5% to $15.3 billion and gross margins were only 45.9%.

Revenues were $15.3 billion in the prior quarter for sequentially stable results. Intel did guide to further weakness in Q4’22 with similar weak gross margins at only 45.0%, well below the 60%+ margins of the good old days.

The numbers suggest Intel cut prices earlier this year as inventory built up over the last few quarters. The good news is that the chip giant is now shipping PC CPU chips below actual demand running in the 295 million annual range while claiming the company gained market share. Just in April, the CEO famously claimed the chip shortage wouldn’t end until 2024 likely leading to the inventory correction of the last 2 quarters.

On the Q3’22 earnings call, CEO Pat Gelsinger made the following statement regarding PC demand:

We are still shipping below PC consumption and the inventory correction continued in Q3, but not as quickly as we forecasted.

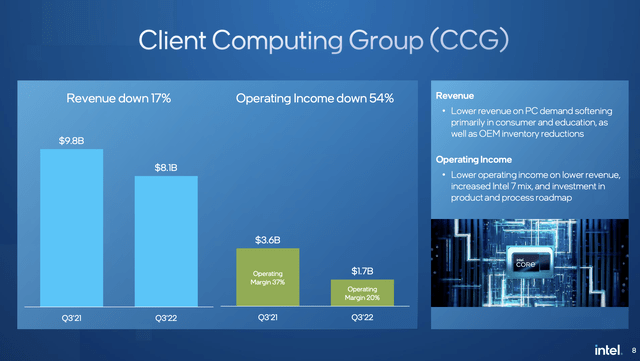

Intel reported Client Computing revenue at $8.1 billion in Q3, down 17% from last year. AMD reported Q3 Client revenue collapsed ~50% to only $1.0 billion in the quarter.

Intel saw Client Computing revenues actually tipped up in Q3, though the chip giant was averaging $10 billion in quarterly revenues in 2021 with Q4’21 at $10.1 billion. A big key to the weak quarterly results for Q3’22 were operating profits getting cut in half to only $1.7 billion.

Source: Intel Q3’22 presentation

The clear point here is that Intel was dumping chips on the market to have the operating income fall even more than the revenues. The company saw revenue collapse in Q2’22 and should’ve been able to take costs out during the September quarter.

Unlike the server market where AMD continues to take as much market share as TSMC (TSM) can produce chips, the CPU market remains complicated. AMD hasn’t had the chip supplies to attack the low-end processors, allowing Intel to maintain higher sales levels and possibly flooding the market with extra inventory.

The good news for AMD is that Intel doesn’t plan to keep dumping chips crashing ASPs and hitting margins. The company is already shipping chips below PC consumption.

The chip giant plans to cut $3 billion in costs in 2023 on a plan for up to $10 billion in cost reductions through 2025. As Intel is slashing costs the next few years, AMD should continue building the organization up to fully match Intel.

Intel has a goal of returning to 60%+ gross margins leading to 40% operating margins. The company can’t achieve these goals by dumping chips on the market with 45% gross margins while AMD hits 50% gross margins while having to slash numbers.

The fact Intel still has triple the quarterly revenues of AMD, yet the small player now has the higher gross margins is very telling. Intel needing to cut nearly $10 billion in costs from the operating structure speaks to how the business has gotten bloated and CEO Pat Gelsinger sees the competitive threat from AMD remaining in place long term.

Ignore 2022 Numbers

A lot of analysts guessed the inventory correction would take a couple of quarters to correct, suggesting the PC market should enter 2023 in a cleaner inventory picture. The market already knows the Q3 results will be weak and investors shouldn’t expect much for Q4 either with Intel guiding revenues down with a possible additional revenue dip to only $14 billion.

The global economy and chip demand should stabilize by 2023 allowing AMD to return to growth by taking market share, especially in the Datacenter space. Analysts oddly have AMD revenues hitting the original $26+ billion revenue target for 2022 with an EPS of only $3.96.

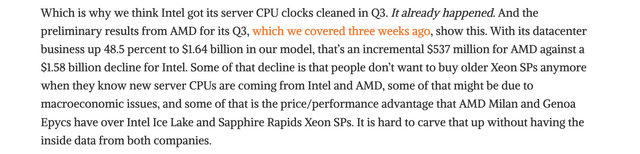

Investors shouldn’t expect such a weak EPS. AMD has complete domination in the Datacenter market highlighted by this summary from The Next Platform.

Source: The Next Platform

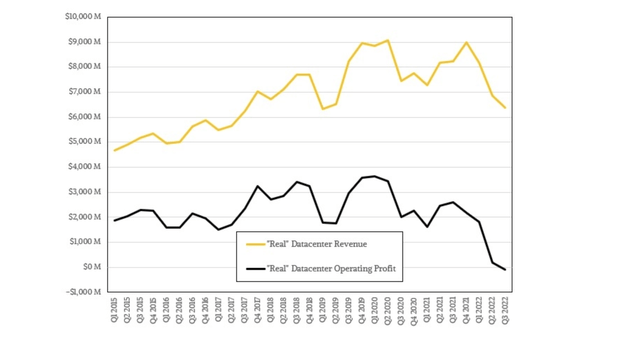

When looking at the profit picture of Intel’s Datacenter business, one can clearly see how the chip giant can no longer compete on price. Intel only generated $0.9 billion in operating cash flows during Q3 and the Datacenter business was obliterated during the last couple of quarters with operating profits completely eliminated.

Source: The Next Platform

AMD is in a far better position for 2023 considering Intel can’t go down the path of competing on price anymore. The chip giant is now free cash flow negative due to low gross margins on a high cost structure.

The company will report Q3’22 results after the market close on November 1. AMD management will provide key commentary on the large surprise cut to Client sales and guide towards Q4’22 expectations to confirm whether this was an Intel inventory issue impacting AMD or something else.

Takeaway

The key investor takeaway is that no indication exists that AMD won’t return to taking market share after the inventory correction resolves. On the Q3 earnings call, the company is likely to provide strong indications for the business in the years ahead.

The chip company was on pace to a $6+ EPS primarily due to taking more Datacenter market share with Genoa chips that easily outpace Intel chips on price performance. Where AMD trades in the short term is hard to predict, but the stock is a long-term buy on weakness.

Be the first to comment