JHVEPhoto

After Advanced Micro Devices, Inc. (NASDAQ:AMD) provided weak preliminary guidance for Q3, and Intel Corporation (INTC) guided down for Q4, the market wasn’t expecting much out of the quarterly results for AMD. The semiconductor company didn’t provide much to excite the market about the current quarter, but AMD remains on path to a big 2023 with more Data Center growth and normalized PC sales. My investment thesis remains ultra-Bullish with the stock trading around $60.

Focus On The Keys

AMD reported Q3’22 revenues of $5.57 billion, basically in line with preliminary guidance of $5.6 billion. Also, the company hit guidance for a gross margin of 50%.

CEO Dr. Lisa Su provided this important statement on the earnings release providing the key to the quarterly results (emphasis added):

Despite the challenging macro environment, we grew revenue 29% year-over-year driven by increased sales of our data center, embedded and game console products. We are confident that our leadership product portfolio, strong balance sheet, and ongoing growth opportunities in our data center and embedded businesses position us well to navigate the current market dynamics.

AMD doesn’t suggest the financials were impacted by any change in the competitive environment. The issue remains a big inventory correction in the consumer segment of the PC market while other business segments had strong quarters.

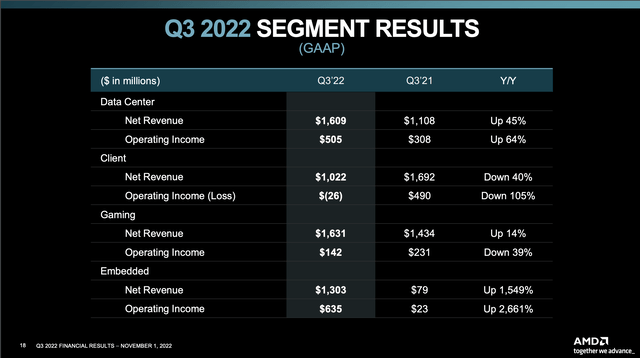

Source: AMD Q3’22 presentation

Despite this massive correction in PC inventories hitting margins, AMD still generated $1.1 billion in quarterly net income. The company lost over $500 million in gross profits from the dip in Client revenues sequentially in the quarter, yet AMD still produced a ton of income for a company previously thought incapable of making money.

On a positive note, Client processor ASPs were actually up YoY due to a richer box of Ryzen desktop processor sales. These numbers would support the theory of Intel flooding the market with low-end chips, though AMD never provided this excuse for missing quarterly results.

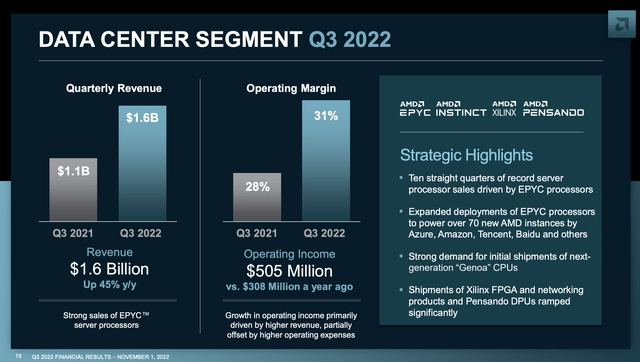

The Data Center remains a huge growth opportunity with revenue of $1.6 billion, up 45% YoY while profits soared. Intel reported a huge decline in category revenues while profits evaporated.

Source: AMD Q3’22 presentation

AMD still has a long runway to catch Intel with a $4 billion quarterly revenue base in Data Center. The good news is that the chip giant no longer generates profits in this category and must now cut costs with a limited ability to continue down a path of cutting ASPs.

A lot of research continues to confirm the expectation for AMD to capture substantial market share gains in 2023. TrendForce reports Sapphire Rapids chips mass production won’t occur until 1H’23 now. These delayed shipments will allow AMD to capture 22% of the x86 server CPU market in 2023, up from only an estimated 15% this year.

AMD guided to Q4’22 revenue of only $5.5 billion, basically sequentially flat with Q3 results. Gross margins are expected to rise back to 51%, up from 50% in Q3. The benefits from further Data Center gains from Genoa wouldn’t completely show up in financials until Q1’23.

Focus On 2023 Outlook

AMD hasn’t provided any updated financial guidance for 2023 to offer the market a better indication of the lasting effects of the PC inventory correction. As discussed above, the company still expects solid growth in other categories like Data Center and Embedded.

The company had to cut 2022 revenue targets back to $23.5 billion for the year. If AMD only returns to the original 2022 financial targets, the semiconductor company would generate the following numbers next year:

- ’23 Revenue = $26.3B

- Gross Profits @ 54% = $14.2B

- OpEx @ 24% = $6.3B

- Operating Income = $7.9B

- Taxes @ 13% = $1.0B

- EPS = $6.9B/1.6B shares = $4.31.

Investors should look at a baseline EPS number for 2023 of $4.31. AMD might have slightly higher OpEx as a percentage of revenues due to the revenue shortfall.

The company has the potential for plenty of revenue upside from a return to normalized PC shipments in 2023 along with the growth in Data Center and Embedded. Long term, AMD will return to previous goals for revenues topping $30 billion and an EPS of $6+. The only question is whether the rebound occurs in 2023 or 2024, with the latter being the more likely outcome at this point due to macro issues.

Takeaway

The key investor takeaway is that AMD hit a major road bump during the 2H of 2022. The chip company still appears set up to thrive on a return to a normal PC environment due to expected massive market share gains in Data Center.

AMD stock remains exceptionally cheap at 15x normalized EPS targets and closer to only 10x bull case EPS targets of $6+.

Be the first to comment