spooh

Q2 Recap And Thesis

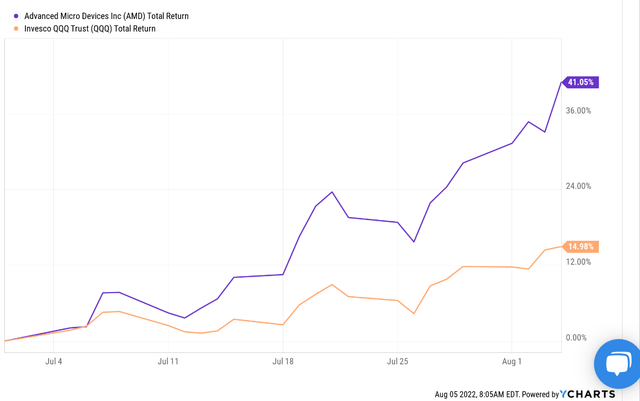

Advanced Micro Devices (NASDAQ:AMD) reported strong earnings earlier this week. It reported a quarterly EPS of $1.05 and total revenues of $6.55B, passing the $6B mark for the first time in its history. Movements in share prices were muted, partially by the geopolitical tension between the U.S. and China due to Nancy Pelosi’s Taiwan visit. But it still surged by more than 6% after the ER.

Many of the specifics of its ER have been analyzed by a couple of excellent SA review articles already. Therefore, in this article, I will just focus on one aspect which hasn’t been talked about so much yet: the addition of Xilinx. You will see that the synergies with Xilinx are immediately and substantially accretive to both lines since the deal was sealed in Feb 2022. And 2022 Q2 was really the first time the company reported the synergies for a full quarter.

The thesis is to argue what we’ve seen in Q2 is only the beginning of the potential. The Xilinx synergy adds both scale and scalability, paving AMD’s expansion for many years to come.

AMD’s Critical Scale And Xilinx

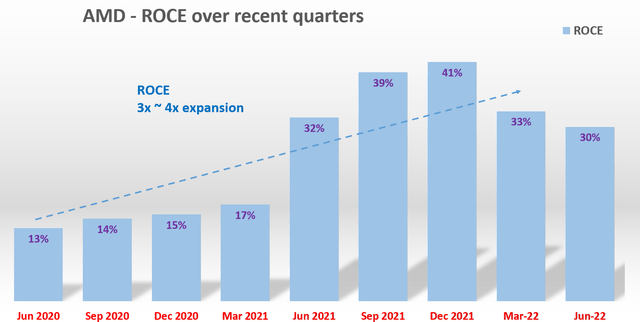

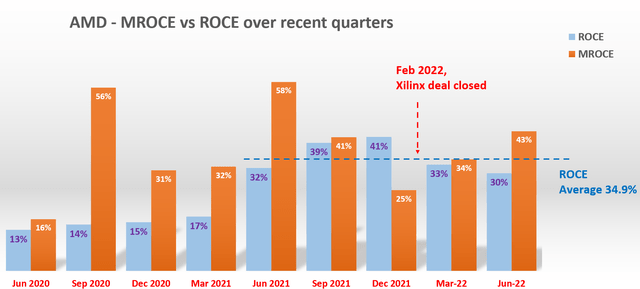

First, I will argue that AMD has passed the critical scale, especially after the addition of Xilinx. I will make the argument from the perspective of ROCE (return on capital employed) and MROCE (marginal ROCE). The graph below shows the ROCE for AMD during the past few quarters on a TTM basis.

The details for ROCE are in my earlier articles. In short, the calculation considered the following items as capital invested: working capital (including payables, receivables, inventory) and net PPE (property, plant, and equipment).

As you can see, AMD’s ROCE was in the 13% range even in Jun 2020, not the most exciting profitability level. To put things in perspective, the overall economy’s ROCE is about 20%. Then you see the accelerated expansion of ROCE starting in March 2021, a strong indicator of passing the critical scale to me. More specifically, its ROCE has hovered at a relatively low level around 13% to 17% until the March quarter of 2021. Then it took off from there and expanded dramatically to the 30% to 40% level, by almost a factor of 4x times from its relatively low level about 3 years ago.

Next, we will see that the Xilinx acquisition further expands its scale and also, more importantly, its scalability.

Xilinx Adds Scalability Too

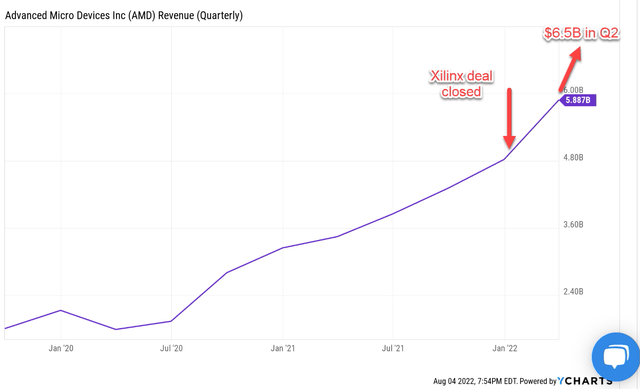

The Xilinx deal was closed in early 2022 (around mid-February). And you can clearly see from the chart below, the synergies with Xilinx are immediately and substantially accretive. Topline took an accelerated path of expansion after that, jumping to $5.88 from the $4.80 level in the past quarter, a growth of more than 22% QoQ. Then this quarter, only after about 6 months into the synergies, total revenues reached $6.5B, more than a 35% increase compared to before the acquisition.

As aforementioned, the main thesis is to argue what we’ve seen so far is only the beginning, because Xilinx not only adds scale (the first order effect) but also scalability (the second and nonlinear effect). And we will examine this next.

Here I will use the concept of MROCE (marginal ROCE) to examine scalability, a concept detailed in my earlier article here. As a brief summary:

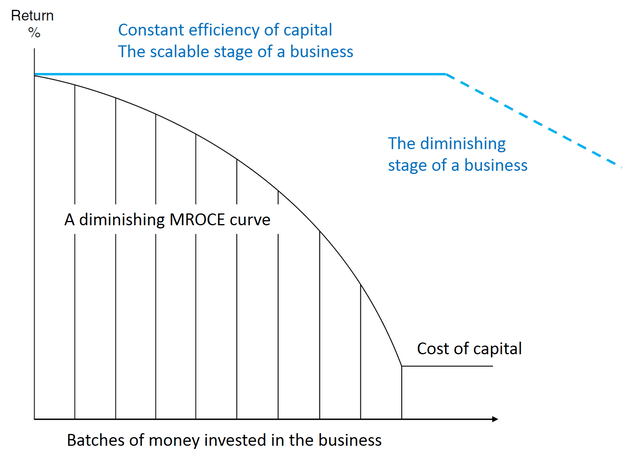

What the MROCE concept captures is a basic law in economic activities: the law of diminishing returns. A business will first invest its money in projects with the highest possible rate of return. Therefore, the first batch of available resources is invested at a high rate of return – the highest the business can possibly identify. The second batch of money will have to be invested at a somewhat lower rate of return since the best ideas have been taken by the first batch of resources already, and so on. And finally, the end result is a diminishing MROCE curve as shown.

For growth investors, diminishing return and declining MROCE is a sign of maturity and saturation. So let’s check the MROCE for AMD, as shown in the next chart. The method is detailed in my earlier article here. It essentially involved taking the derivative on the ROCE data shown above. During years when there were large fluctuations, a running average was taken to smooth the fluctuations. The smoothing also makes fundamental sense, as many capital projects have a lifetime longer than 1 year.

The results below show that diminishing return has not caught up yet. As mentioned above, its ROCE (the blue bars) has been expanding from about 13% to the current 30%~40%, and the average ROCER has been about 34.9% since June 2021, since it’s passed the critical scale. On the other hand, as you can see, its MROCE (the orange bars) has been expanding and trending higher too. Especially since the Xilinx addition, its MROCE has expanded from 25% in Dec 2021, to 34% the next quarter, and to the current 43%.

Business Outlook

Looking further out, the Xilinx acquisition can help AMD expand its addressable market tremendously. Take embedded systems as an example, its products can be deployed in virtually every market as CEO Lisa Su commented (abridged and emphasis added by me):

Looking at our Embedded segment, revenue grew significantly year-over-year to $1.3 billion, led by robust demand across all markets and nodes for our FPGA and Adaptive Computing products. Xilinx products are deployed in virtually every market, powering mission-critical applications for thousands of customers. We accelerated Xilinx’s product sales in the second quarter with the benefit of the additional manufacturing scale and resources of AMD… As we highlighted at our Financial Analyst Day in June, we have identified greater than $10 billion in long-term revenue synergy opportunities as we bring the AMD and Xilinx assets together.

Final Thoughts And Risks

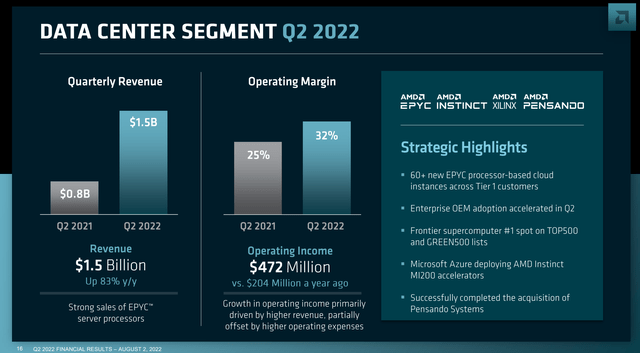

Xilinx can also help AMD with its data/server center processors too. But in the near term, its main competitor Intel (INTC) just provided a more immediate catalyst. Intel’s delayed shipments of its Sapphire Rapids gave AMD an open window for its Genoa. With the additions of Xilinx, AMD now provides the industry’s broadest set of data center processors.

Finally, risks. As aforementioned, I see some geopolitical issues and the PC market softening in the near term. In particular, the softness in the PC market has worsened in recent months. The market was expecting a single-digit decline earlier, but AMD is preparing for a mid-teens decline now, as CEO Lisa Su commented during the Q2 ER (abridged and emphases added by me):

…we have taken a more conservative outlook on the PC business. So a quarter ago, we would have thought that the PC business would be down, let’s call it, high single digits. And our current view of the PC business is that it will be down, let’s call it, mid-teens. And that’s contemplated into our third quarter guidance.

Be the first to comment