Justin Sullivan

Advanced Micro Devices (NASDAQ:AMD) is a great long-term play in the secular semiconductor growth theme, and recent earnings were strong and fundamentals continue to improve. Soft guidance is not a reason for concern for long-term investors and therefore its current cheap valuation is a buy signal.

Background

As I’ve covered in a previous article, AMD is one of my favorite companies within the semiconductor industry due to its great position in the industry, benefiting from the sector’s strong growth prospects over the long term. I invest mainly in secular growth companies in a few investing themes, namely semiconductors, electric vehicles, digital payments, 5G and big data, and AMD has been one of my largest holdings over the past year.

Beyond long-term growth tailwinds and a cyclical positive backdrop for the semiconductor industry due to the chip shortage, I see AMD as a good long-term play as the company has a great product portfolio and competitive position against its closest peers, of which its data center segment is, in my opinion, one of its expected strongest growth engines during the next few years.

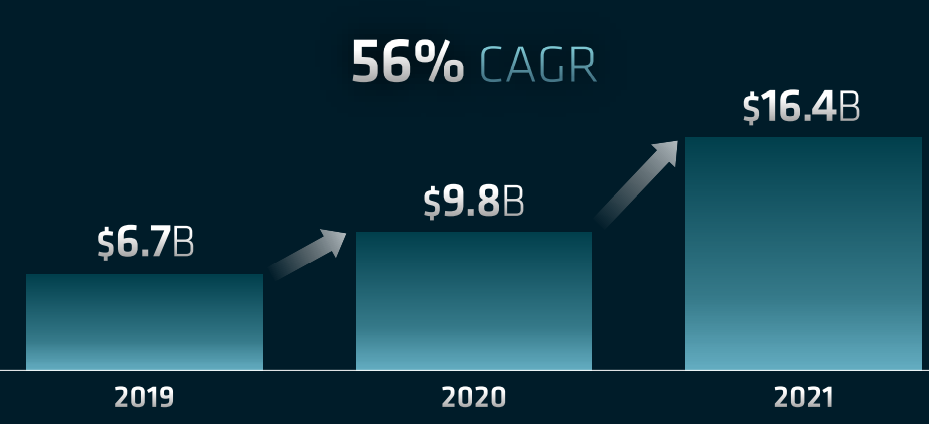

This background justifies its impressive growth track record over the past three years, reporting revenue CAGR of 56% to $16.4 billion in 2021, an impressive achievement for the company in a very competitive industry.

Annual revenue [AMD]

As I’ve discussed in previous articles, within the semiconductor industry, I have been more bullish on AMD and Nvidia (NVDA) over the past year, while despite a supportive industry backdrop I have suggested Intel (INTC) as being a value trap. Since my article on AMD was published (on September 16, 2021), AMD has dropped by about 8%, Nvidia is down by some 18% while Intel collapsed by more than 30%, as shown in the next graph (note that AMD is the white line, Nvidia the orange and Intel the yellow).

Share performance (Bloomberg)

As I’ve not covered AMD for almost one year now, I think it is now a good time to revisit its investment case and look at its most recent earnings, to see if it still is a good long-term investment in the semiconductor investment theme if the global economic slowdown is affecting the company’s fundamentals.

Recent Earnings

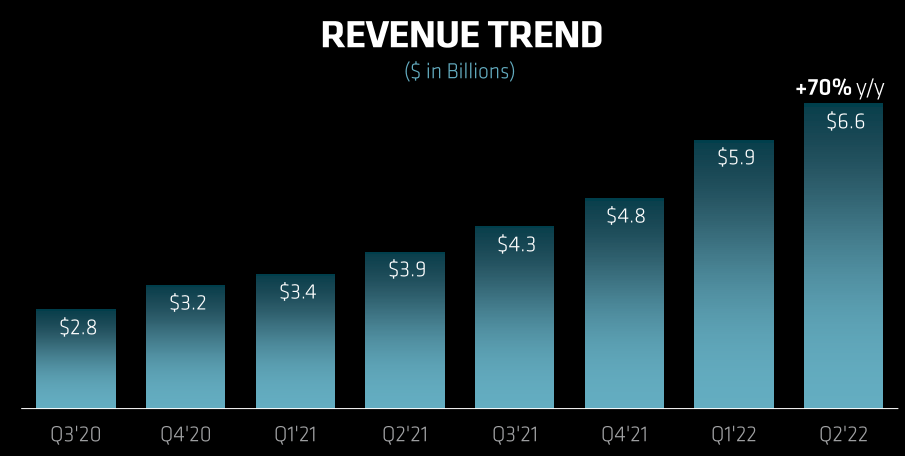

Regarding its financial performance, AMD has a very good growth history over the past few years, supported by its improved product portfolio. In the second quarter of 2022, AMD maintained a very strong operating momentum, reporting revenues of $6.55 billion and its EPS was $1.05, both slightly beating market expectations.

In the last quarter, its revenue increased by 70% YoY (including the integration of Xilinx), with growth coming from all segments (note that AMD is now reporting segments in a new way). Despite that, its Data Center business was a top performer, reporting revenue growth of 83% YoY, which is an impressive achievement. Moreover, this was much better than its competitor Intel, showing that AMD is continuing to gain market share in this segment and this trend is not expected to change in the short term as AMD continues to enjoy technological leadership against Intel.

Revenues [AMD]

As I’ve discussed in a previous article, in my opinion, this technological edge can’t be separated from the fact that AMD is a fabless company and relies heavily on Taiwan Semiconductor Manufacturing Company (TSM) for its chip production, which has been in the recent past the company with the most manufacturing capabilities in the world. This helped AMD’s EPYC chips to have better performance and energy efficiency than Intel’s chips for data center customers, which are in strong demand, and has been a strong boost to AMD’s revenues and earnings growth in recent quarters.

Considering that Intel has had many setbacks with its product development and is not expected to beat TSMC regarding technology capabilities over the next two to three years. Moreover, TSMC is already working on the 3nm process, which AMD can potentially use to improve even further its server’s chips and maintain an edge over Intel in the coming years, even though in the coming months its new products are expected to be produced using the 5nm process. This means that AMD should continue to gain market share over Intel in this segment over the next few years, which bodes well for revenue growth in the medium term.

Beyond strong growth in data center, other segments also reported strong revenue growth with the gaming segment increasing revenues by 32% YoY and the client segment reporting revenue growth of 25% YoY. Its embedded segment is now reported including Xilinx, thus growth figures are not meaningful. Additionally, its non-GAAP gross margin improved to 54% in Q2 (vs. 48% in Q2 2021), driven by higher revenue.

Its operating income more than doubled, excluding the amortization of intangible assets that are related to acquisitions and aren’t recurring, to $2 billion, representing an operating margin of 30%. Its non-GAAP net income was $1.7 billion, a very strong increase from the $630 million profit reported in the same quarter of last year.

Regarding its balance sheet and cash flow generation, AMD continues to report a very healthy profile considering that free cash flow amounted to $906 million in the quarter and had a net cash position of more than $2.7 billion at the end of last quarter, which allows it to invest on business growth and return excess capital to shareholders through share buybacks. In Q2, the company repurchased $920 million of its own stock, and should continue to do share buybacks in the coming quarters supported by its strong financial profile.

Even though AMD’s results were very strong and growth momentum remained on a positive path, which was a key factor to consider in this earnings card after Intel’s very weak earnings reported recently, AMD’s guidance for the next quarter was soft and was the main thing responsible for share price weakness following its report.

For the third quarter, AMD expects revenue to be between $6.5-6.9 billion, while the market was expecting $6.8 billion, and for the full year AMD expects revenue to be between $26-26.6 billion. This soft guidance is mainly justified by a decline in PC demand post-pandemic, which is likely to lead to lower revenue growth for the client segment in the next few quarters. This seems to be a cyclical issue more related to weakening economic activity and to some extent some conservative guidance considering that AMD is expecting a higher drop in the PC market than Intel and industry forecasts. Therefore, AMD’s long-term fundamentals remain good and growth in all other segments is expected to remain strong in the short term, while if market conditions in the PC market do not deteriorate that much, the company can easily beat its conservative guidance in the next quarter.

Growth Prospects & Valuation

While quarterly reports are important for investor sentiment and short-term share price movements, as a long-term investor, I focus more on fundamentals and market expectations over the next few years.

Since my previous article on AMD, the company has completed the acquisition of Xilinx and Pensando Systems, clearly improving its position in the industry, especially in the high performance computing segment, which is a positive step to improve its fundamentals. These deals should start now to produce cost synergies, stronger innovation and product differentiation, boding well for AMD’s growth and profitability in the future.

Moreover, these acquisitions also enhance AMD’s long-term growth prospects, as the company increases its total addressable market and reaches new customers in more diverse end-markets, boding well for strong growth momentum in the coming years.

AMD is now in a very good position to be a major player in the rise of high performance computing, artificial intelligence and gaming, which are secular growing markets and where AMD’s market share is still relatively low. According to the company, its total addressable market including Xilinx can reach some $300 billion in the next five years, while in its previous 2020 presentation it set its TAM at about only $79 billion. This shows that AMD’s growth prospects over the long term are quite strong and its recent growth momentum is not expected to slow down anytime soon.

TAM [AMD]

Taking into consideration this positive background, it is no surprise that according to sell-side estimates, AMD should continue to report strong growth metrics over the next few years. Indeed, even though AMD’s growth rates should start to decrease somewhat as annual comparisons become tougher, its momentum is expected to remain good over the next four years.

AMD’s revenues are expected to be about $26.2 billion in 2022 (+59% YoY), and in-line with the company’s guidance, while the annual growth rate should decrease to around 12-15% in the following three years to about $38 billion by 2025. This represents a CAGR of around 24% over the next four years, which is still very strong revenue growth figure.

Beyond strong revenue growth, AMD’s margins are also expected to improve given that its gross margin was 48% in 2020 and is projected to be about 58% by 2025. This means that earnings growth should be somewhat higher than revenue growth during this period, which makes sense as the company becomes more efficient as costs should increase at a lower rate than revenues, plus there is also some synergies coming from recent acquisitions that should have a positive impact on AMD’s business margins.

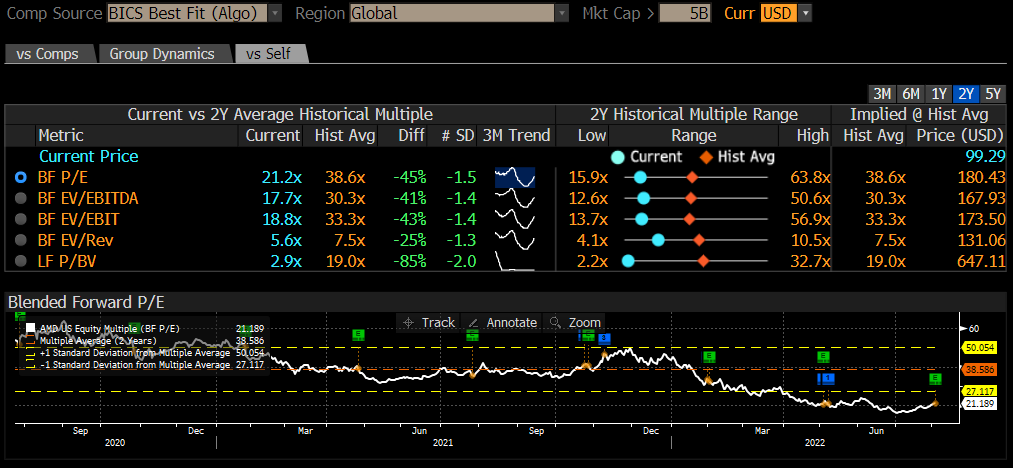

Despite these strong fundamentals and good growth prospects, AMD is currently trading at only 21x its earnings expected over the coming 12 months, at a strong discount to its historical average. Over the past couple of years, AMD has traded on average at about 38.6x forward earnings, which means that AMD has de-rated considerably in recent months and is now trading at the cheapest valuation since 2018, even though its business transformation has been impressive and fundamentals have improved considerably.

Valuation (Bloomberg)

Considering its historical valuation and taking into account 2025 EPS estimate of $6.26, my price target for end-2024 is $237 per share, which is more than double AMD’s current share price. Even being more conservative and assuming that AMD will trade at the same multiple by end-2024 as it is trading now, my price target is $132 per share. This clearly shows that AMD has attractive upside potential over the next two years and is currently a great play for long-term investors that want to be exposed to the fastest growing companies in the semiconductor industry.

Conclusion

AMD’s recent growth has been impressive and its financial profile is quite robust, a huge transformation from a few years ago. Its recent results were strong and much better than its closest peer Intel, showing that it has technology leadership and operating momentum is not expected to change much in the coming years. Despite this backdrop, its shares are quite cheap considering its historical valuation, making it a great bargain in the current market environment.

Be the first to comment