Richard Drury/DigitalVision via Getty Images

AMD’s (NASDAQ:AMD) earnings saw a miss on revenue and earnings consensus estimates, though the price reacted positively post-market at about +4.7%. There’s some key information to unpack from the results and transcript considering this macro backdrop. But to summarize, the company has displayed strength in fundamentals, especially when compared to its semiconductor peers.

Recent Price Action

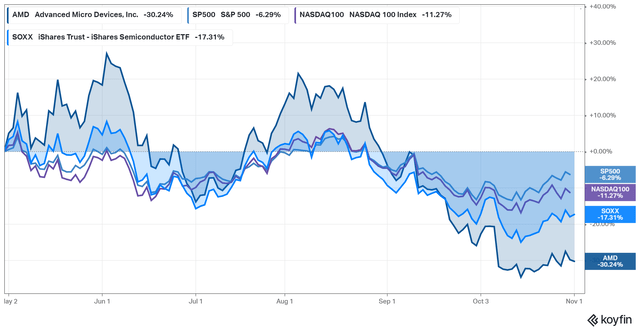

In my last article, I made the bull case for AMD at $75 a share stating that there’s a dislocation in value between the stock and the broader industry. Fundamentally speaking, AMD’s revenue drivers were based on market share gains in data centers and servers, against Intel. So despite the anticipated PC market weakness, there were enough drivers for growth to continue that ought to have resulted in stronger relative performance against the SOXX ETF for example.

AMD 6M Price Performance (Koyfin)

Unfortunately, it didn’t, perhaps frustrating many investors. Early this October, AMD had a pre-earnings release marking a $1B sales miss on account of the PC demand effectively halving from the previous quarter to this one. That shocked the stock and contributed to the relative price underperformance.

All that said, I continue to hold a rather contrarian bullish position, and AMD is now a substantial holding for The Abstract Portfolio. While price performance has thus far not played out, my working hypothesis on market share gains has been confirmed by the latest earnings call.

Earnings Analysis

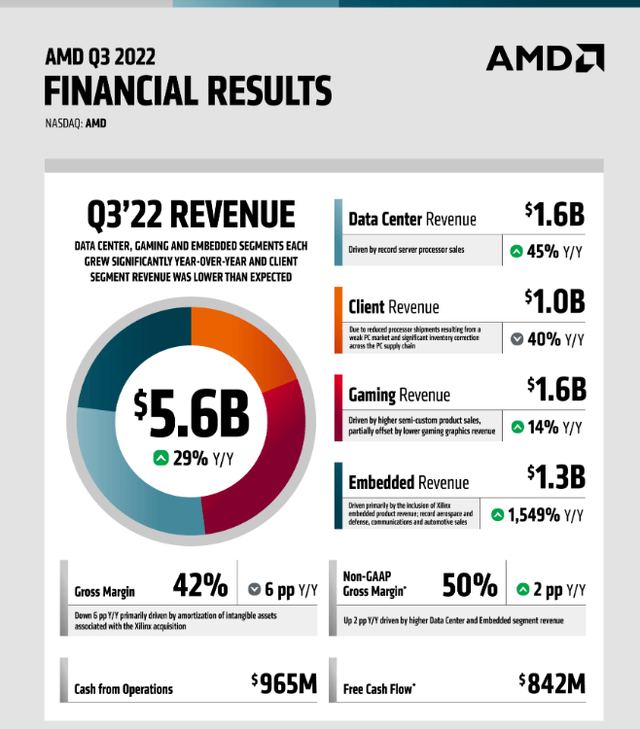

AMD Q3 22 Earnings Infographic (AMD IR)

Let’s talk revenue and earnings first. YoY metrics don’t provide too much colour as they ignore the variations of internal trends based on product releases and seasonality between segments against a calendar year. Sequentially, sales have contracted ~15% from last quarter.

The sales results were mostly expected since the last “release”, -40% YoY in the Client (PC) Segment, and an even sharper -53% QoQ from Q2 2022. This shock, as I’d like to put it, factors in significant damage resulting in a $1B top-line miss. How much worse can it get?, Let’s assume, the entire world stops buying chips for PCs and we’ll experience another $1B evaporation a quarter for the segment. I do not see the entire segment being destroyed even in a recession so it’s safe to say that no sales shock in a recessionary scenario for PC would equal the one we’ve already had in the coming year.

Meanwhile, other segments remain strong. Embedded Revenue includes an inorganic boost from Xilinx, which is of course impacting the overall top-line growth too. Without Xilinx, AMD’s growth is closer to single-digit percentage points YoY for Q3. Data centers remain the strongest, adding the silver lining to the mix of information we’ve seen. As usual, cloud transformation, AI, and server computing remain critical even in macro down-cycles. AMD remains in the unique position to grab data centre share against Intel. Even Pat Gelsinger of Intel remarked that they’re expected to lose share for up to two years to competitors in the segment. It is by far, the biggest pile on opportunity, in the 10s of $billions on an annual basis. If AMD keeps executing on segment growth like this, the stock will be more than fine.

The earnings miss was driven by two factors. First, the amortization costs related to the Xilinx acquisition for intangible assets, and second, the PC demand shock that added pressure on inventory. The former was appropriately removed from Non-GAAP numbers as it’s not going to recur over the long term. Non-GAAP Gross Margin remains at 50%, and Non-GAAP EPS is at $0.67. The GAAP EPS of $0.04 is not concerning given the amortization expenses. Importantly, Free Cash Flow remains only slightly down from the previous quarter from $900m to the $840m range marking robust cash generation despite sales and inventory shocks.

What do we make of all the pros and cons? AMD remains a strongly free cash flow generative company with a robust balance sheet. The data centre segment will continue to offset PC demand, providing extra relative growth performance compared to the industry. Future shocks to PC demand of a $1B miss are mathematically impossible from here, so a lot of the damage has been done. Embedded and Gaming should also turn south given the macro backdrop, though the Data Center ought to provide a comfortable cushion considering the vertical’s business momentum against an opportunity that’s multiples higher. Intel’s “data centre and AI” segment for instance still did $4.1B+ last quarter and contracted 27% YoY.

Transcript Highlights

We have three clear priorities guiding us. First and foremost, we are focused on executing our road maps and delivering our next generation of leadership products. Second, we are building even deeper relationships with our customers as we make AMD a fundamental enabler of their success. And lastly, we remain very disciplined in how we manage the business.

We will continue to invest in our strategic priorities around the Data Center, Embedded and Commercial markets, while tightening expenses across the rest of the business and aligning our supply chain with the current demand outlook.

The secular trends driving increased demand for high performance and adaptive computing in the cloud, at the edge and across intelligent end devices remain unchanged and provide a strong backdrop for long-term growth.

– CEO Lisa Su, Q3 Transcript

As for my takeaways from the call, I think the following points are worth noting:

- PCs will be down again next quarter, and AMD will continue to be disciplined in monitoring macro conditions.

- PC-related inventory issues will need to be sorted out for the next quarter or two, and some expenses have been incurred for higher expected demand that won’t be recoverable.

- Supply has increased in Q4 for the data centre, and the team expects unconstrained supply for Genoa chips as of 2023; this is a big deal as we’ve known AMD has been somewhat supply-constrained before.

- Macro headwinds do exist, even for data-centre, but AMD is relatively confident in its value proposition; North America and Cloud Hyperscalers remain strong, Enterprise-buyers are taking time to make decisions, and China remains weak on demand this year.

- Regulations against China have had minimal impact on revenue so far. While the country remains a large revenue contributor, it is often comprised of PC-related non-Data-center chips.

The big picture remains the same – market share gains in a contracting semiconductor landscape. AMD does expect some recovery in PC in 2023 as consumers often don’t put off purchases for too long. This falls in line with ’08-’09 when demand was destroyed and then subsequently grew rapidly after a year. Upgrades for semiconductor buyers are usually worth it after a long enough time, though their buying habits oscillate in periods of macro distress. The consumer-related factors parallel that of Nike, Walmart, and Apple earnings as well, where discretionary product demand has been crushed and inventories have spiked up. Apple, for instance, reduced their orders for iPhone 14s.

Overall, it is an earnings print that implies stability in the core business. This stability is perhaps key in calming the market’s nerves going into 2023. Dynamics may change, but the separate business segments are balancing each other out. It always helps to look to the long-term and focus on quality products and leadership. There’s no reason for Lisa Su to suddenly start underperforming now after the most spectacular multi-year turnaround of any large-cap company I know of.

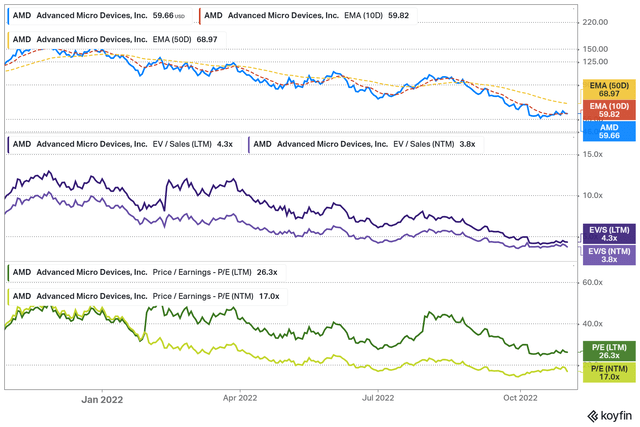

Looking Forward, Valuations

On the Q4 guide, AMD expects flat sequential sales growth, which is an improvement from the -15% QoQ we saw in Q3. Both Embedded and Data Centers are expected to grow YoY and sequentially. Q4 is a 14-week quarter so take the guide with a little more salt than usual. Non-GAAP Gross Margin is forecasted at 51%, a slight uptick from this quarter.

It is too early to remark on 2023 and there’s no guide to go by, but the business appears to be far more resilient than its peers, particularly Intel for example. Both, Intel’s “Client” and “Datacenter” businesses are on contracting trends. Analysts, according to the Koyfin database, expect a modest 10% YoY growth in sales for 2023. I reckon anything above flat would prove to be a positive outcome on current valuations.

AMD Valuation Multiples (Koyfin)

AMD trades at 17x earnings on a next twelve-month (NTM) basis. In my opinion, this remains a bargain for the long-term investor. Earnings may contract and be revised lower, so take 20x as a working number. It’s always difficult to remark on potential recessions – in fact, it’s the first one I’ll be going through in my career. That said, there’s a strong rational basis for investing in AMD. Their data centre segment will continue to gain market share in the coming two years at least – Intel’s CEO implied that (not me). The growth opportunity for semiconductors remains ever-present and expanding. Meanwhile, we have Lisa Su leading the firm as a now legendary business operator with an exceptional track record. So here’s your shot if you’re truly looking long-term for there’s enough growth in the funnel to capture. It’s not supposed to be easy being a long-term investor, especially in situations where the stock you’re evaluating had a 50%+ drawdown, but that’s exactly where contrarianism could serve as an edge.

Risks

Geopolitics: America’s Chinese semiconductor restrictions have been minimally invasive for AMD, but an all-encompassing CPU ban is going to hurt. Artificial Intelligence computing tends to be carried out more by GPUs anyway. Taiwan and TSMC remain a critically contended zone, and a potential invasion is an unignorable probability in the coming few years. Geopolitical events are important tail risks to consider.

Macro: It can be worse than AMD’s own forecasts and the analysts’ too. A Fed-induced recession to combat inflation is an uncomfortably probable outcome for 2023.

Competition: Pat Gelsinger is a proven technical CEO and operator that may put up a stronger data centre fight with Intel a lot sooner than expected. Other technologies such as ARM may eat into the x86-dominated computing markets.

Systemic: Volatility, drawdowns, and liquidity crunches are all system-wide effects that may influence all stocks. AMD is perhaps more exposed as a higher-beta stock vs. the S&P 500.

Conclusion

Q3 Earnings results displayed stability in AMD’s core business. A large part of that derives from strength and business momentum in the data-centre segment, arguably AMD’s largest opportunity that is multiples higher than its current share. PC Demand has evaporated rapidly, and that will remain a negative drag on growth, but another sales shock of this magnitude is theoretically impossible as the Q2-Q3 growth was -53% and over $1B. A lot of damage is already done, and if you’re a long-term investor, a P/E of 17x (or even 20x) on a next-twelve-month basis offers excellent risk-reward. I am long AMD.

Be the first to comment