lisegagne/E+ via Getty Images

The big story at AMC Entertainment Holdings (NYSE:AMC) in recent months has been the issuance of preferred equity units (APE) to shareholders.

Let’s revise the structure of these APE securities. Each of them represents a one-hundredth interest in a share of AMC’s Series A Convertible Participating Preferred Stock.

What’s that, I hear you say: you don’t know what the preferred stock is?

The preferred stock of AMC is an unlisted security, each of which can technically be converted into 100 AMC shares.

Therefore, if you own an APE share, you have a one-hundredth interest in a stock that might, someday, be converted into 100 AMC shares.

Since one-hundredth of 100 is simply one, this is how the economic value and voting rights of APE shares are the same as AMC shares.

However, conversion is unlikely to happen any time soon, as the AMC Board are not currently authorized by shareholders to issue any more AMC shares (more on that in a moment).

So for now, the conversion is only a technical possibility – but an important one, because it’s the basis on which APE shares have value.

A crucial distinction

We’ve established that APE shares a one-to-one derivative of AMC shares. The question arises: what is the difference between APE and AMC, if their economic value and voting rights are the same?

The answer is basically that there is none.

The company created a new security, with a new ticker, that was identical to the old security.

The key difference is this: the company lacked the authorization from shareholders to issue any more ordinary AMC stock.

From the 2021 10-K:

Our authorized capital stock consists of 524,173,073 shares of Class A common stock, par value $0.01 per share (“Class A common stock”) and 50,000,000 shares of preferred stock, par value $0.01 per share. As of December 31, 2021, there were 513,979,100 shares of Class A common stock outstanding and no shares of preferred stock outstanding.

So the company had run up against its limit as far as Class A issuance was concerned – 514 million shares outstanding, and only 524 million shares authorised.

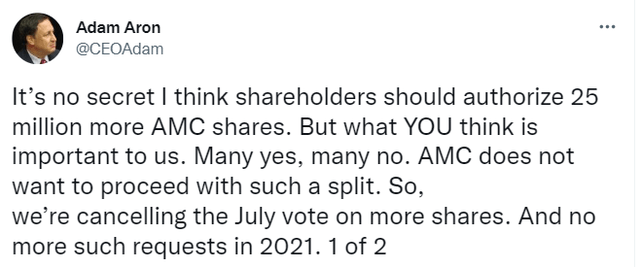

During 2021, the company flirted with the idea of issuing more common stock, but many shareholders were reportedly unhappy with the prospect of yet more dilution. CEO Adam Aron was forced to give up on the plan.

Adam Aron (Twitter)

He promised there would be “no more such requests in 2021”. If only the institutions could have guessed what he (or his advisors) would come up with next!

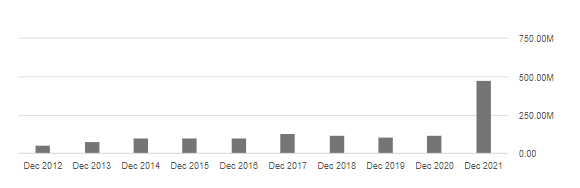

Here is the evolution of AMC’s share count over recent years:

AMC Share Count (Seeking Alpha)

The enormous dilution of 2021 did save the company from suffering the same fate as Cineworld/Regal (currently undergoing Chapter 11 bankruptcy), but it appears that the largest shareholders – respectable mainstream funds, for the most part – reached the limit of what they could tolerate.

However, if you go back to the 10-K excerpt I pasted above, you’ll note that that the company had an unused, authorized limit of 50 million shares of preferred stock.

This is the “loophole”, as it has been called, that the company used to issue APEs.

As Adam Aron said in his announcement letter to shareholders:

The issuance of APE’s now is made possible given the previously and repeatedly announced approval by AMC’s shareholders back in 2013 that the creation and issuance of AMC preferred stock could occur solely at the AMC Entertainment Board of Directors’ future discretion.

Given the unusual design of APE stock, it’s likely that the institutions who own AMC were surprised by how this preferred stock authorization would eventually be used!

A pointless security

In the traditions of finance, the purpose of preferred stock is to do something different to common stock. Typically, it provides investors with a compromise: a safer income stream than common stock, but with less potential upside.

Preferred stock that has all of the same features as common stock is in fact pointless, except where the company and its shareholders disagree as to how much common stock should be issued.

But in his letter to shareholders, CEO Adam Aron argued that far from being pointless, the APE share issuance was a “decisive and valorous action”.

He wrote that “for a variety of reasons, a dividend distribution in just about any form has been a longstanding request from our investor base. Today, we answered your call.”

Again, in the traditions of finance, the purpose of dividends is to return cash to shareholders. Stock dividends are common enough, but how many of AMC’s shareholders, if any, called for a stock dividend rather than a cash dividend? And why? What is the useful economic purpose achieved by an AMC stock dividend?

He also wrote:

So, too, this issuance of 516,820,595 new APEs will essentially serve the same purpose as the much voiced request for a “share count,” as the new AMC Preferred Equity unit will ONLY go to holders of company issued and outstanding AMC common shares. Again, today, we answered your call.

Here, he is referring to a conspiracy among some retail AMC shareholders, that the official AMC share count is somehow wrong. He is suggesting that the issuance of APEs will help to shut down this theory.

It should go without saying, but debunking conspiracy theories held by retail traders is not a good justification for a stock dividend.

He then veers into yet more questionable territory:

Because the dividend is only being distributed to our current shareholder base as of the dividend record date, there also is NO DILUTION from this initial issuance of the APEs associated with this dividend, because these new APEs all go, and only go to holders of company issued AMC common shares. The number of issued and outstanding AMC common shares will remain at 516,820,595 after the dividend is paid, and each shareholder also will own one APE for every share of AMC common stock held.

My objection to this statement is that while the initial APE issuance by itself did not dilute shareholders, their creation allowed for much greater shareholder dilution in the future.

Indeed, Mr. Aron explains in the shareholder letter that APEs will allow AMC “to raise money if we need or so choose, which immensely lessens any survival risk… [APE is] a currency that can be used in the future to further strengthen our balance sheet, including paying down some of our debt and other liabilities”.

Latest filing

All of which brings us to the latest filing, issued September 26th, 2022. A fundraising arrangement has been agreed with Citigroup:

As a natural next step [to the APE issuance], today AMC entered into an equity distribution agreement (the “Equity Distribution Agreement”) to allow for the sale from time to time of up to a maximum of 425,000,000 AMC Preferred Equity Units.

Remember that AMC can issue up to 50 million units of Series A preferred stock.

The Series A preferred stock has been created with a 100x multiplier against the common stock. This means in total there could eventually be up to five billion APEs (the Board has currently allowed for up to a maximum of one billion APEs).

In the August FAQ sent to shareholders, the company said:

The AMC Board currently has no plan or intention in calendar years 2022 or 2023 to authorize more than this initial 1 billion amount of APEs. However, AMC’s Board of directors may authorize additional AMC Preferred Equity units at any time in the future at its sole discretion, including in 2022 or 2023 if it deems such an issuance to be in AMC’s best interests…

It’s noteworthy that they couldn’t wait even two months before they arrangements for the additional issuance of APEs.

APE currently trades at $3.64, an attractive discount to AMC common stock. Arbitrage between APE and AMC shares may be possible.

But unfortunately for the company, the low price of APE stock limits its usefulness when it comes to raising funds: even if the company sold the entire 425 million tranche announced today at $3 (a 20% discount to the latest APE share price), it would raise less than $1.3 billion.

According to the most recent 10-Q, the company has corporate borrowings (net of cash) of $4.4 billion. Therefore, unless the APE share price can rise considerably to absorb additional supply, APE issuance will provide only partial deleveraging relief to the company.

And while only providing partial relief, an additional 425 million APE shares would increase the company’s total share count by over 41%.

Far from “no dilution”, I fear that AMC and APE shareholders will soon be facing very considerable dilution.

Be the first to comment