ablokhin

Investment Thesis

Amazon (NASDAQ:AMZN) is not a growth company any longer. And as such, it should not trade at a growth multiple in my opinion.

Amazon’s Q4 guidance is likely to negatively surprise the investor community as it struggles to deliver guidance that matches expectations.

I make the argument that just because Amazon has been dead money for 2 years straight, it doesn’t mean it can’t go lower as investors reconsider their Amazon investment.

In the analysis that follows I posit a question. Do Amazon’s earnings matter to investors? I don’t think they do. Or better said, they don’t today, until all of a sudden, it becomes topic du jour.

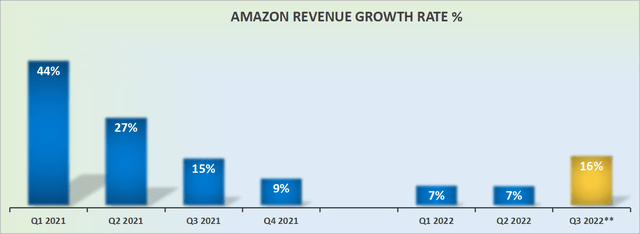

Amazon’s Revenue Growth Rates Are Going to Slow Down

We know that Amazon has easier comparables for its H2 2022 than it did for H1. That’s clearly positive and has allowed analysts to feel confident about Q3. However, my point of contention is that Amazon’s Q4 guidance is going to surprise analysts.

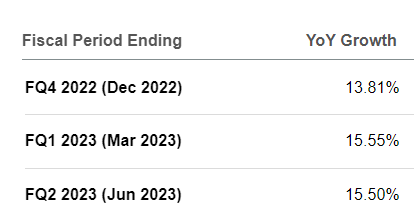

Amazon revenue estimates

As you can see above, analysts following Amazon are still expecting Amazon’s Q4 revenue growth rates to reach 14%. However, I passionately believe that these estimates are too high.

Because of two headwinds, that we’ll discuss next.

Currency FX Should be the Topic of Discussion

The dollar is surging against most other currencies at an unprecedented speed. For example, right now, USD trades at a 37-year high against the British Pound. Similar spreads can be found in other currencies too, such as the Canadian Dollar and the Euro.

Up until the present, globalization has been a demand driver for tech companies. Companies went for scale and exposure overseas and were rewarded by investors for having a winning strategy.

Today, that’s no longer the case, as the strong USD will be a massive detraction to growth rates. And the sectors that will be hit hardest will be found in tech. Recall, tech makes up slightly over 25% of the S&P500.

Moving on, Amazon’s business in Europe will be more than just a hindrance to its Q4 guidance. It will be a substantial step back for Amazon, at least in the near term. And the problem here is with investors’ expectations versus reality. Expectations, that I argue, are too high for Amazon.

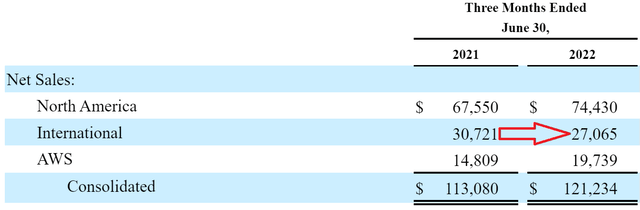

As you can see above, more than 20% of Amazon’s business comes from International sources.

What’s more, asides from its e-commerce arm, within the AWS segment, I believe that the AWS segment too has approximately 20% exposure to Europe, either directly or indirectly.

Accordingly, this means that Amazon’s Q4 guidance could take investors by surprise, as currency headwinds that investors haven’t had to think about over a multi-year period all of a sudden become a real headwind.

Next, we’ll discuss the second aspect that will likely impact Amazon’s Q4 guidance.

Global Cost of Living Crisis

There are 3 factors that are withering away at global household income.

- High food prices.

- High energy prices.

- Mortgage payments going up.

This last point affects fewer households in the US. But in Europe, where variable mortgage rates are the norm, this will impact households at a time when budgets are already stretched.

Now, I recognize that this is something that we, as investors read about, but don’t really pay much attention to.

The problem for Amazon is that they will see it in their revenues.

Moreover, given this trifecta of pulls on people’s discretionary income, that will make consumers more likely to shop around, rather than just going to Amazon as a default.

What’s more, today Amazon is not the only company that’s offering free rapid deliveries. Numerous companies now have similarly compelling propositions.

In summation, I don’t believe that Amazon’s Q4 guidance will point to mid-teens CAGR growth. I believe that investors are more likely to see Amazon’s Q4 guidance point to a single-digit CAGR than they are mid-teens CAGR.

AMZN Stock Valuation – Priced on P/E?

Up until now, Amazon has not been priced on an earnings multiple, because it has been perceived as a growth stock. But when a company’s growth rate goes from consistently growing at 30%, to a company that looks likely to struggle to report a 15% CAGR, investors will likely no longer view the company as a growth story.

And at that point, investors may start to slowly look down the income statement to see what’s on offer. And here, at the bottom of the income statement, a problem starts to glow red.

Slowly, one by one, investors might start to think, should Amazon be priced on an earnings multiple? Last year, even this thought was prosperous. What about today?

Next, two by two, investors start to think, should Amazon’s earnings matter?

And then, all at once, there’s a rude awakening. How do I value Amazon?

The Bottom Line

I recognize that it’s easy to be bearish when everyone is bearish. But at the same time, a lot of investors are looking to Amazon as an investment pick simply because it’s been dead money for the past two years. And by extension, at some point, it will be a good stock to own again.

And despite agreeing with that premise on the surface, I maintain that investors are due for a rude awaking once investors come to understand that Amazon in the near term isn’t a growth company.

And if it’s not a growth company, that means it’s a mature business. And if it’s a mature business, a lot of the allure of owning the stock will go out the window. And the only group of investors that will be interested in Amazon will be value investors. And for value investors, this stock is still too expensive.

One way or another, people can make whatever claim they want about how Amazon was a success story in the past decade and that it will find its footing again. But proclamations aside, I think the reality is that the stock today is overvalued. And I believe that it’s about to correct.

Be the first to comment