georgeclerk

We recommend investors buy the stock of the largest online retail store, Amazon (NASDAQ:NASDAQ:AMZN). Amazon remains one of our favorite FANG stocks even during market downturns. The company has returned from its post-pandemic low and beat expectations in 2Q22. We expect Amazon to trade significantly higher in the coming quarters, specifically as the holidays approach. Our bullish thesis on Amazon is primarily based on our optimism about AWS as the company’s hottest growth driver.

We believe Amazon’s diversification of its services into health, robotics, and entertainment also provides further growth drivers to look forward to. Alongside its online store, physical store, mobile apps, Alexa, devices, and streaming, Amazon develops and produces media content and offers subscription and advertising services. Amazon is diverging to multiple markets, and we couldn’t be more excited about its growth prospects.

Another lawsuit and another yawn

Today the State of California sued Amazon on Antitrust grounds for stifling competition and causing price inflation. The complaint noted that Amazon’s contracts with 3P sellers and wholesalers inflate prices, stifle competition, and violate California’s Antitrust and unfair competition laws. This lawsuit and a host of others are just a distraction. We expect Amazon and the State of California to settle this with some minor remedies eventually. Amazon would likely have to pay some fines and change some business practices. But in our view, all these lawsuits will eventually be in the rear-view mirror. Amazon will continue to be the juggernaut it already is, making the stock a buy.

AWS remains the star of the show

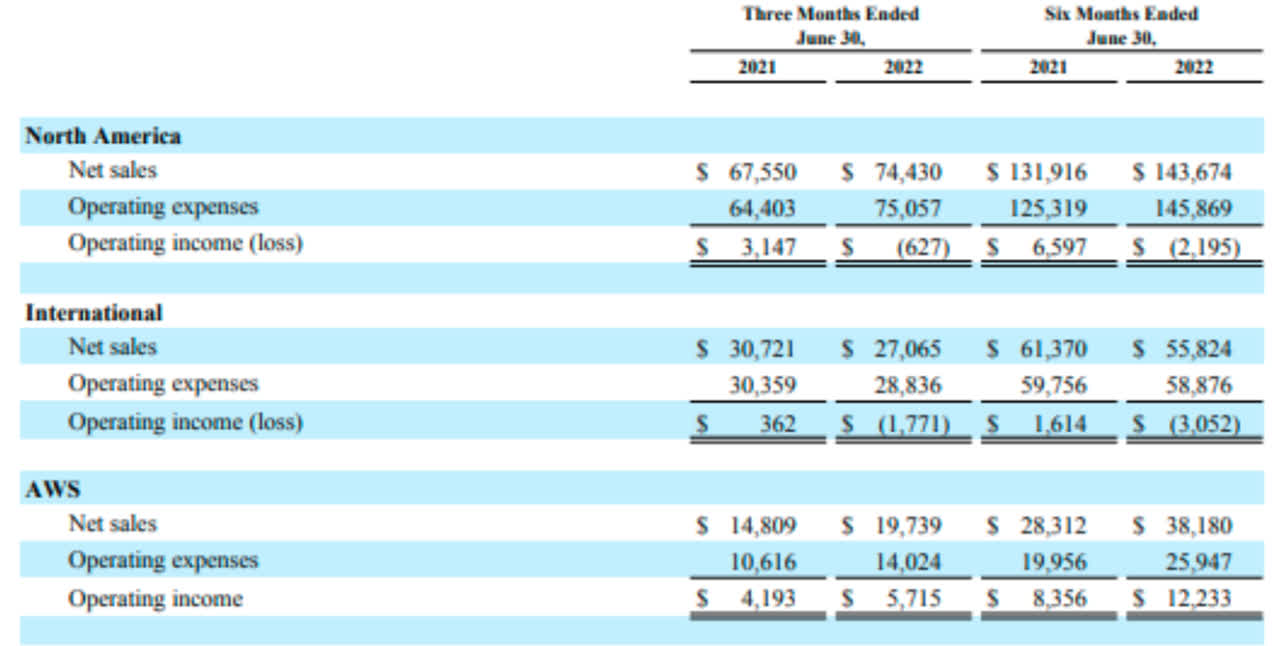

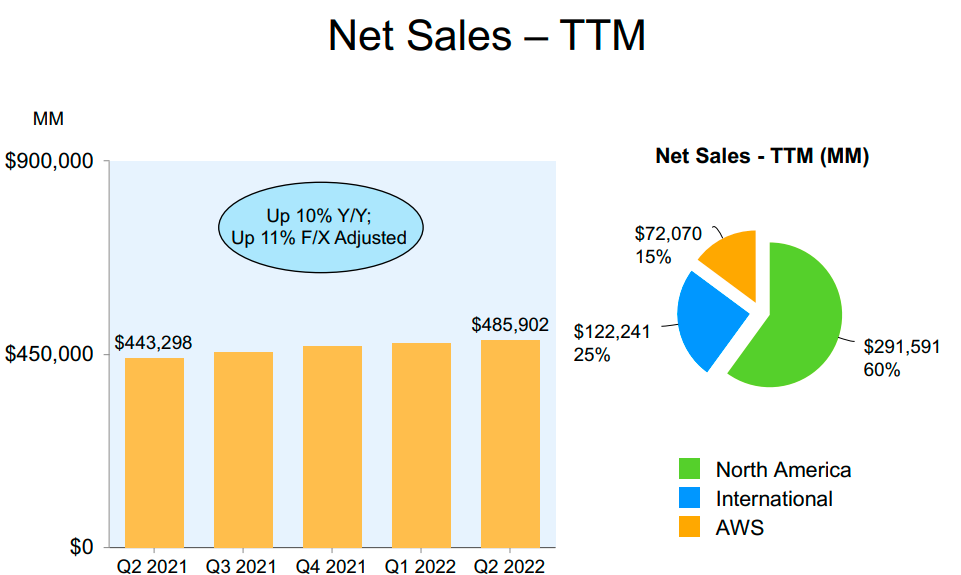

Amazon breaks its revenue into three segments: AWS, North America, and International. While AWS does not make up the most significant percentage of total revenue, it is the main profit driver for the company. Amazon Web Services (AWS) sales were up 33% year/year, and operating profits were up 36% year/year in 2Q22. AWS has soared post-pandemic, and we believe the segment will serve as Amazon’s growth driver going forward. AWS was the only segment to beat analysts’ expectations in the last quarter, clocking in $19.7B in revenue.

We are witnessing more robust demand in AWS as more companies embark on the journey towards the digital transformation and adoption of the AWS cloud. We believe AWS’ best days are still ahead of it. Amazon’s head of AWS, Adam Selipsky, noted that roughly 10% of the world’s IT has moved to the cloud. We expect the shift towards the cloud will continue to boost AWS growth and drive Amazon stock.

We expect increased demand for automation will aid in driving AWS’s growth. AWS received several new commitments from different companies and industries, including Delta Air Lines Inc. (DAL) and Eni S.p.A. (E), an Italian multinational oil and gas company. AWS remains one of the primary destinations for companies embarking on digital transformation. We expect AWS continues to grow in the high 20s to low 30s for the next few quarters. We believe many enterprises are accelerating digital transformation within their organizations, and we expect Amazon to be one of the principal beneficiaries, along with Microsoft (MSFT).

The following chart shows AWS’ performance during the past and this quarter.

Amazon

AWS can easily reach $80 billion in revenue by the end of C2022 and $100 billion by C2023, up 30% Y/Y in C2022 and 25% in C2023. We believe these estimates are conservative and could provide additional upside.

Our favorite growth drivers

Amazon is a growth stock. Amazon is building up several growth drivers for the post-pandemic environment. We expect Amazon to benefit from its expanding services and e-commerce offerings. The following is an outline of the growth drivers we are most excited about:

Ads

Amazon has developed a solid online advertising service by encouraging companies to spend significant amounts of money on advertising their goods via Amazon’s website and mobile app. In 2Q22, Amazon’s advertising revenue increased by 18%, while Facebook’s (META) business experienced its first-ever decline. According to Insider Intelligence estimates, Amazon’s digital ad market share is 12.6% this year, up 7.7% from 2019. We’re excited about Amazon’s position within the advertisement space because the company is not impacted by Apple’s (AAPL) iOS privacy update, unlike Snapchat (SNAP) and META. Amazon’s digital ad shares seem to be growing, while ad giant META is likely to see ad revenue shrink. We’re optimistic about Amazon’s ad revenue in the coming quarters.

During F2021, Advertising revenue grew by 56% to about $31.1 billion. During F2Q22, Ad revenue grew 21% Y/Y to about $8.8 billion. We continue to expect Ad revenue to grow near 25% in 2022 and 20% in 2023 to reach nearly $47 billion by the end of 2023. These estimates are likely conservative since both Facebook and Snapchat are ceding market share. While Amazon does not explicitly comment on the margins, we expect them to be similar to those experienced by Google and Facebook. Another profit engine in the making?

Amazon Prime

Like Costco (COST), Amazon Prime membership is turning out to be a lucrative revenue stream. We would argue that Amazon Prime membership is more beneficial to users than Costco’s, as members can be entertained and get free shipping benefits. Amazon increased both its annual and monthly membership rates earlier this year. Prime annual membership costs $139 and is up from $119, while monthly membership increased by $2.00 to $14.99. The increase in the prime membership alone is expected to generate about $3 billion in new revenue.

Amazon has over 200 million Prime subscribers, with over 147 million in the US. The recently concluded Prime Day saw more purchases and savings globally than any prior Prime Day occasion, with over 300 million products bought and over $1.7B saved. Prime members bought over 100,000 goods every minute from July 12th-13th. Per Amazon, Prime members spend 3x more than non-prime members, accounting for about 75% of all e-commerce transactions on the platform.

Prime Video

Amazon Prime and DirecTV have signed a multi-year agreement. Amazon will air “Thursday Night Football” games for the next 11 seasons. Amazon also secured a different audience with the premiere of The Lord of the Rings: The Rings of Power, attracting 25 million viewers worldwide in just 24 hours.

Health Care

Amazon’s expanding into the health care industry. The company shut down AmazonCare a month after announcing the acquisition of One Medical (ONEM)– its most significant competitor. We believe Amazon is buying its way into the healthcare market and furthering its plan to become a high-margin service company with advertising, AWS, and eventually a full medical services company. During the pandemic lockdown environment, telehealth demand soared. Since then, it has declined as in-person treatments were made available again. If the deal goes through, Amazon will control ONEM’s over 200 locations and around 770,000 patients nationally, giving it a much wider distribution than Teladoc (TDOC), its competitor.

Amazon also has the opportunity to use its technologies, such as its unrivaled delivery infrastructure and its well-established subscription business with more than 200 million customers globally. It may not be simple for Amazon to enter the healthcare sector, but we believe the company has all the necessary skills and tools to succeed.

iRobot

Amazon revealed plans to purchase iRobot (IRBT), a consumer robotics business. With its Alexa-enabled products, including smart speakers, alarm clocks, thermostats, and security cameras, Amazon has gradually entered the smart home market. We expect Amazon to integrate Alexa into iRobot devices to enable voice control eventually. We expect this business to grow to over a billion dollars in the next few years.

Alexa

Amazon has turned Alexa into a multibillion-dollar business through its smart devices and app store. Amazon is taking Alexa to the next level by introducing Alexa Game Control. Alexa game control lets customers play PC and console-based games using their voice. Players can perform in-game actions such as interacting with non-player characters (NPCs), swapping weapons, and performing other actions using their natural voice. We expect Alexa integrated games to eventually drive another leg of growth for the company.

Stock Performance

Amazon appreciated about 158% over the past five years. During this period, Amazon outperformed competitors Google (GOOG) (GOOGL), Walmart (WMT), Meta (META), and eBay (EBAY). Amazon is down 25% over the past year. YTD, Amazon is down about 24%. We attribute the decline to the slowing e-commerce environment post-pandemic. We’re not concerned about the slowdown as Amazon concentrates its growth in its AWS segment. We expect e-commerce demand to normalize next year.

The following charts show Amazon’s performance over the past five years among competitors and its performance YTD.

Valuation

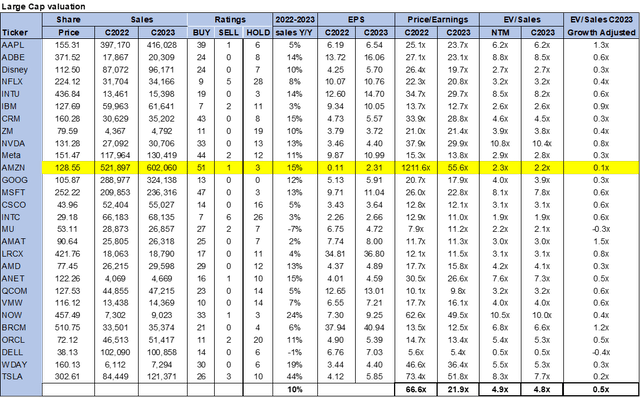

Amazon stock is not cheap. On a P/E basis, Amazon is currently trading at 55.6x C2023 EPS of $2.31 compared to the peer group that is trading at 21.9x C2023. On an EV/Sales, Amazon is trading 2.2x C2023 sales versus the peer group average of 4.8x. On a growth-adjusted basis, Amazon is trading at 0.1x versus the peer group trading at 0.5x. We recommend investors buy the stock now. The following chart illustrates AMZN’s valuation relative to its peer group.

Techstockpros & Refinitiv

Word on Wall Street

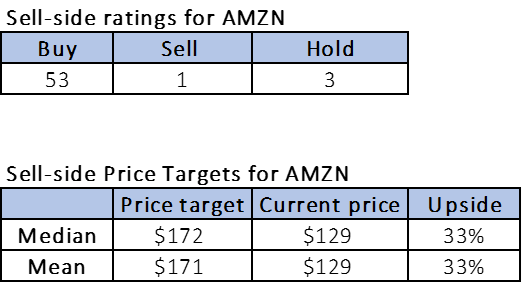

Of the 57 analysts covering the stock, 53 are buy-rated, three are hold-rated, and the remaining are sell-rated. Wall Street consensus is overwhelmingly bullish on the stock. Amazon is currently trading at around $129. The median price target is $172, and the mean price target is $171, with a potential upside of about 33%. The following chart indicates the sell-side ratings and price targets.

Wall Street analyst price targets

Risks to our bullish thesis

Amazon is not risk-free. Macroeconomic challenges, inflation, supply-chain problems, and oil shortages remain real concerns for Amazon’s business. The company is specifically exposed to inflationary pressures in North America, accounting for 60% of its net sales. Despite these near-term risks, we believe Amazon has the tools to expand its business and outperform the peer group in the long run.

Amazon

What to do with the stock

Amazon is a leader in e-commerce and now in cloud computing as well. We believe Amazon provides a favorable risk-reward profile, despite inflation. With the back-to-school and holiday seasons, we expect the stock to beat the peer group in the coming months. We believe AWS will likely continue to generate the bulk of Amazon’s profits. We recommend investors buy the stock at the current levels.

Be the first to comment