akinbostanci

Investment Thesis

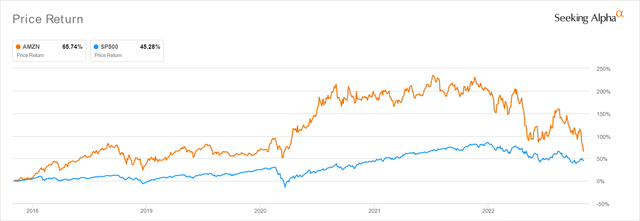

AMZN 5Y Stock Price

Buy Amazon (NASDAQ:AMZN) now. There we go. That’s it for the article. Really.

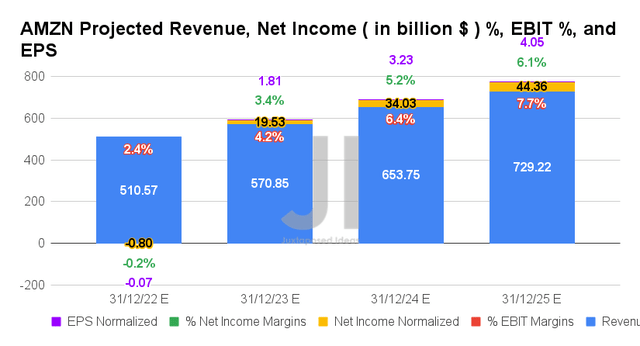

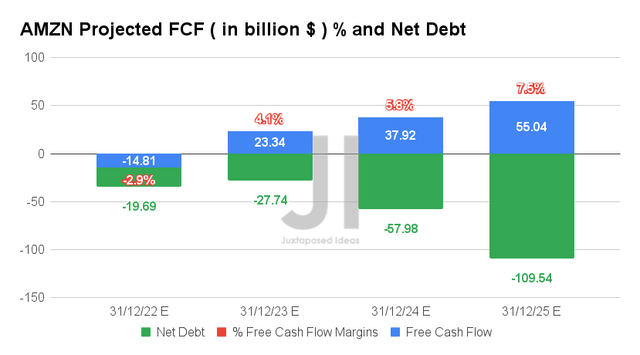

Those that buy AMZN stock at current levels are looking at extreme discounts never seen before, back at pre-pandemic levels when the company was reporting revenues of $280.52B and net incomes of $11.58B. Instead, investors are getting this next decade’s early Christmas present at a -51.02% discount, which is projected to achieve record-breaking top and bottom lines of $729.22B and $44.35B by FY2025, respectively. These numbers represent an impressive normalized CAGR of 17.2% and 25%. Though notably slower compared to hyper-pandemic levels of 29.4%/ 69.6% and pre-pandemic levels of 27.3%/ 69.7%, we are not concerned at all, since we are also looking at a stellar Free Cash Flow (FCF) generation of $55.04B by FY2025, compared to FY2019 levels of $21.65B.

Come on. These numbers look impressive, no matter what others say! Once Mr. Market is done venting those extreme recessionary fears about AMZN’s normalized sales and the AWS segment, he will naturally come to his senses once macroeconomics improve and demand returns. These are temporary headwinds at best.

Mr. Market Is Too Drunk On The Recession Fears & Ignoring AMZN’s Capabilities

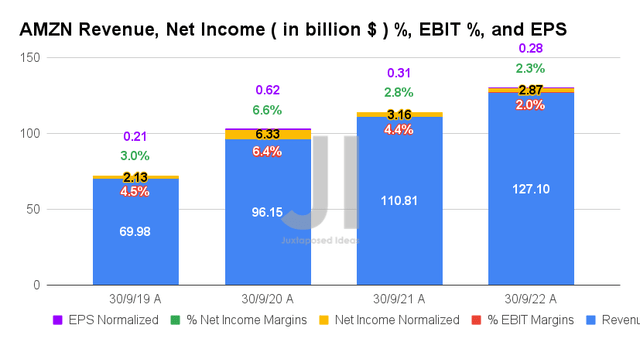

In its recent FQ3’22 earnings call, AMZN reported revenues of $127.1B, indicating an excellent increase of 4.84% QoQ and 14.7% YoY. Nonetheless, its EBIT margins of 2% and net income margins of 2.3% remain compressed against historical execution, triggering short-term headwinds as the company grapples with elevated operating costs. Notably, its Stock-Based Compensation of $5.55B for the quarter represents notable QoQ growth of 6.73% and YoY of 74.52%. Thereby, explaining its lower EPS of $0.28, though we have to highlight the beat against the consensus estimate of $0.20.

Furthermore, analysts were concerned about AMZN’s slower AWS growth at 4.05% QoQ and 27.43% YoY, while notably reporting a lower operating margin of 26.3% compared to 30.29% in FQ2’21. Its subscription revenue is also decelerating at 2.18% QoQ and 9.33% YoY. Combined with the worsening FX headwinds and the management’s commentary of moderating sales growth ahead, no wonder the market was spooked and, consequently, sent the stock plunging by -16.97% since its FQ3’22 earnings call.

Nonetheless, investors must not forget the upcoming second Prime Day, Thanksgiving, and Christmas sales, which have always provided generous boosts for AMZN’s financial performance thus far. For FQ4’21, the company reported an impressive 24% QoQ/9.4% YoY growth, against FQ4’19 levels of 24.93%/20.8%, respectively. Naturally, we do not expect to see similar numbers for FQ4’22, given the impending recession and higher oil/gas prices through the difficult winter ahead. However, there is a good chance that the QoQ growth will be more than decent, with an estimated increase of 14.9%. Thereby, indicating the massive potential for a moderate stock recovery ahead, despite the tougher YoY comparisons.

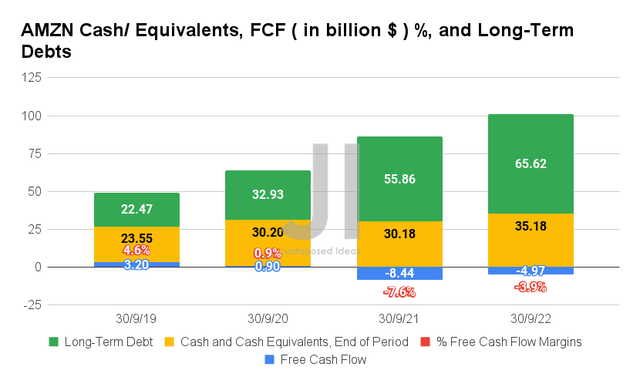

Though its FCF generation of -$4.97B in FQ3’22 may also disappoint some investors and analysts, it is important to note that capital expenditures take some time to scale back as guided by the management then. Especially during these uncertain economic conditions.

On the other hand, keen investors would be well advised to closely monitor AMZN’s utilization of debts, which has been growing at an alarming rate thus far. By FQ3’22, it reported long-term debts of $65.62B with $2.15B in annual interest expenses, indicating a notable YoY increase of 17.47% and 23.56%, respectively. While the company clearly can pay off much of its debts with a robust cash and equivalents of $35.18B on the balance sheet, its growing total debt/ EBITDA ratio of 2.59x is one to look out for as well. Fortunately, these debt maturities are remarkably well-staggered through 2062, lending its liquidity the much-needed strength through the potential recession ahead.

The growing FUDs have obviously also decimated Mr. Market’s hopes of accelerated growth ahead, since AMZN’s top and bottom lines have been drastically downgraded by -10.97% and -47.06%, respectively. These have resulted in a tempered CAGR of 11.6% and 7.4%, respectively, against pre-pandemic levels of 27.3%/69.7% and hyper-pandemic levels of 29.4%/69.6%. Then again, its EPS of $4.05 remains a massive improvement from FY2019 levels of $1.15 and FY2021 levels of $3.24. Please do not forget that the COVID-19 pandemic growth is abnormal and, therefore, does not represent the best yard stick for comparison.

In addition, investors must note the sustained improvement in AMZN’s profitability, from EBIT/ net income/ FCF margins of 5.2%/4.1%/7.7% in FY2019, to 5.3%/7.1%/-3.1% in FY2021, and finally to the projected 7.7%/6.1%/7.5% by FY2025. Its net debt situation would also eventually improve from -$31.6B in FY2019, -$19.69B in FY2022, and finally to $109.54B by FY2025. Thereby, indicating the company’s massive cash on the balance sheet then. Why so glum over a short-term recession?

In the meantime, we encourage you to read our previous article on AMZN, which would help you better understand its position and market opportunities.

- Amazon: One Ring To Rule Them All – Improved Profitability Ahead

- Amazon Is Growing At All Cost While Being A Jack Of All Trades

So, Is AMZN Stock A Buy, Sell, or Hold?

AMZN 5Y EV/Revenue and P/E Valuations

AMZN is currently trading at an EV/NTM Revenue of 1.90x and NTM P/E of 64.47x, lower than its 5Y mean of 3.23x and 88.67x, respectively. The stock is also trading at $92.12, down -51.02% from its 52 weeks high of $188.11, nearing its 52 weeks low of $92.01. Nonetheless, consensus estimates remain bullish about AMZN’s prospects, given their price target of $143.58 and a 55.86% upside from current prices.

If anyone needs more encouragement any more than those stated above, we would also throw in the fact that the AMZN stock is trading way below its 50, 100, and 200-day moving averages. Assuming a minimal retracement ahead, we could also potentially witness AMZN stock at the $80s, bringing the stock amazingly to 2018 levels of dirt cheap.

Many have said that past performance does not guarantee forward results, as seen by the market-wide destruction witnessed thus far. However, it is also important to note that we are in the midst of a bear market, probably in the midst of a recession already. The stock had previously plummeted by -57.11% from $4.36 to $1.87 between August to November 2008 during the peak recessionary fears, before recovering all of those losses by April 2009 and recording a massive bull run through 2018 to $98.30. It is evident that we are getting a gift that only comes every 15 years or so. Even then, only for opportunistic investors with moderate risk tolerance and very long-term trajectory, who dare to invest at a time of maximum pain.

Therefore, we rate AMZN stock as a Buy. Load up for your retirement. No better time than these rock bottom levels.

Be the first to comment