Tristan Fewings/Getty Images Entertainment

Merger Rationale

MGM’s Multi-year Attempts to Sell The Company

To understand MGM’s longstanding attempts to sell the company, you would first need to understand the history of the company. MGM’s history has been fraught with challenges to say the least. In 2010, MGM filed for bankruptcy, with many activist hedge funds that took positions in the company via debt prior to the bankruptcy given the chance to restructure the company as they deem fit post-bankruptcy. This included stakes taken by major activist players such as Carl Icahn who pushed hard for a merger with rival Lions Gate which never came to fruition.

You can see that all along, MGM was something of a legacy company, with financial issues that largely became the target of investors trying to make a quick profit from it. This mindset was also adopted by the management team and never seemed to change from its early post-bankruptcy days up till today. Notably in 2018, then CEO Gary Barber secretly tried to sell the company to Apple without the board’s approval and was promptly sacked.

With the Covid-19 pandemic, the rush for streaming content and the systemic drop in demand for in-person cinemas created an opportunity for MGM to once again put up its impressive portfolio of Hollywood movies up for sale to the highest bidder, which in this case turned out to be Amazon (NASDAQ:AMZN).

Amazon’s Foray Into The Streaming Wars

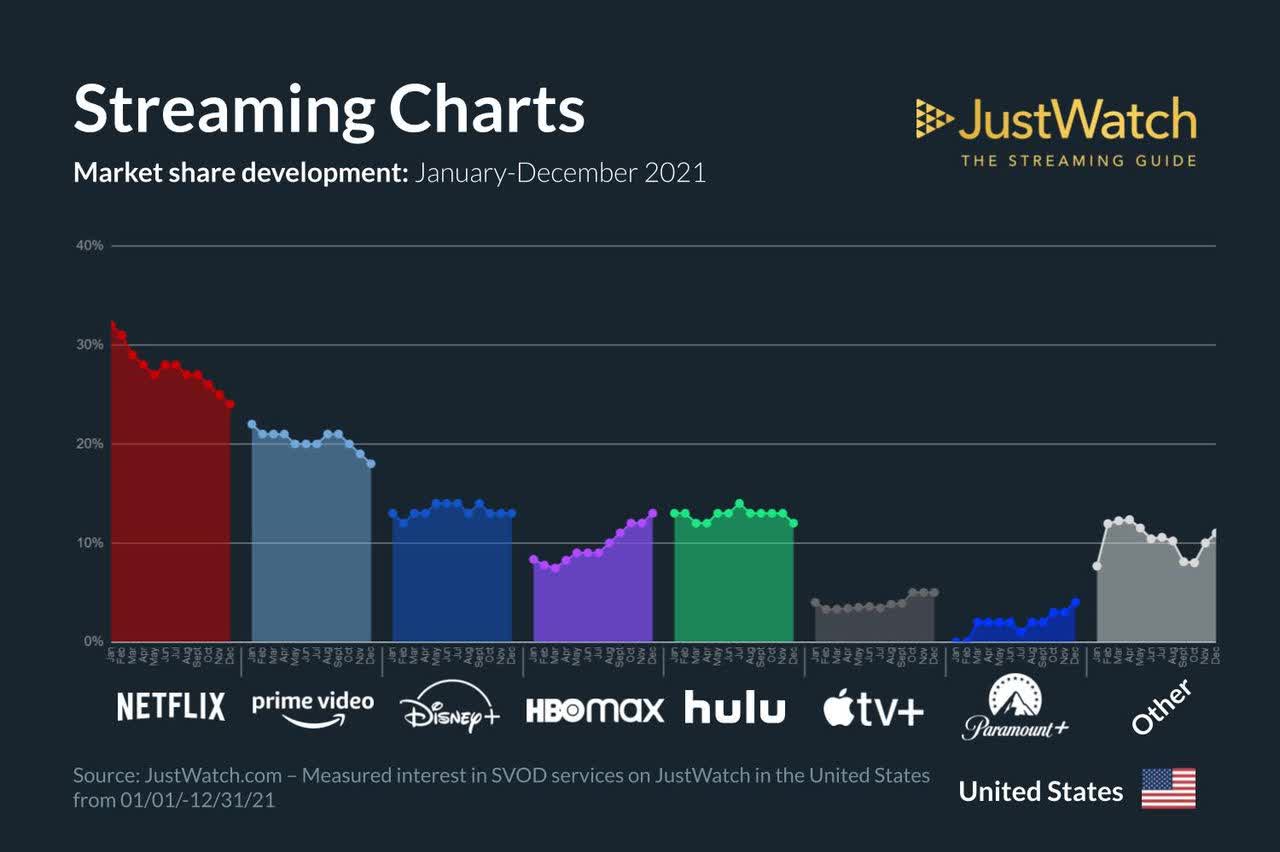

JustWatch.com

From Amazon’s point of view, there is a strategic reason to acquire MGM: to gain a greater market share in the streaming industry. With the rise of Disney+ and Apple TV in the recent years, Amazon Prime has been looking for an avenue of inorganic growth, and the MGM acquisition fits into their objectives.

MGM’s Value Proposition

From a bird’s eye view, MGM’s portfolio spans more than 4000 film titles, 17,000 TV episodes, 180 Academy Awards and 100 Emmys. Their largest franchise and source of revenue by far is the entire 25 film James Bond Franchise. Among its other notable movies are Robocop, Rocky, The Pink Panther, Tomb Raider, as well as several TV series, among which the most famous are Vikings and Fargo.

It is obvious that Amazon Prime now has access to Hollywood classics which traditionally have been difficult to obtain for its rivals such as Netflix (NFLX). I will go into further detail how Amazon can execute its strategy post acquisition under the Risks section, as there are a couple of options Amazon can take with regard to the content on MGM, which will have significant implications for Prime and the industry overall.

Financials

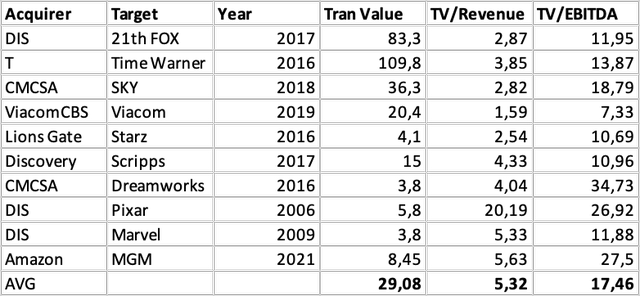

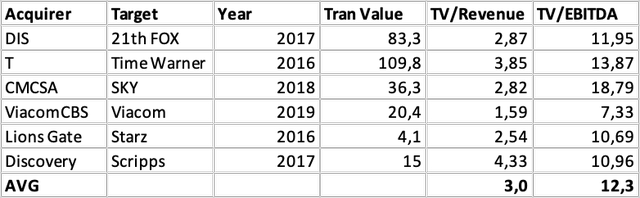

When it comes to historical acquisition multiples in the media sector, it is clear that on paper, Amazon has more or less overpaid for MGM, the second picture removed any outliers, leaving an average TV (Transaction Value) / Revenue and TV/EBITDA of 3.00x and 12.30x respectively. In the case of the Amazon MGM acquisition, the multiples are 5.32x and 17.46x respectively.

If you were to use the 3.0x revenue multiple and apply it to MGM, it should have an annual revenue of roughly $2.8 billion. By stark contrast, its 2020 annual revenue was only $1.5 billion, highlighting how Amazon has overpaid for MGM.

Risks

MGM’s Debt

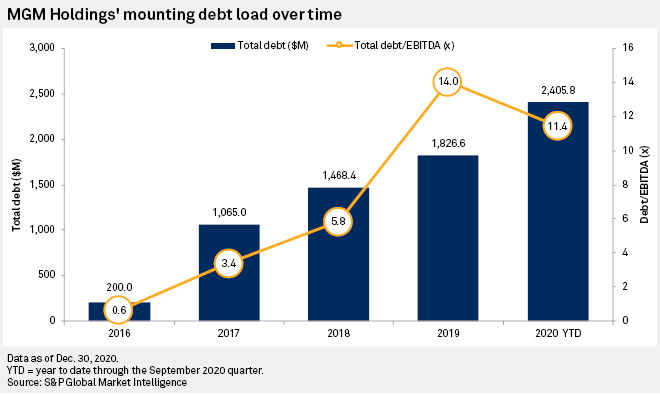

S&P Global

MGM’s rising debt pre-acquisition were driven by 2 main causes. Firstly, its acquisition of streaming platform EPIX in 2017 (as can be seen from the spike in debt in 2017) and secondly its investments in content as it attempted to increase the number of shows and episodes in its portfolio. Between 2017 and 2019, the company increased the number of shows it delivered from 21 to 41, or 496 episodes to 792 episodes.

While it is unknown as to the composition of the acquisition in terms of the debt and stock mix, Amazon certainly will need to curtail MGM’s debt in the coming years. This can come in the form of selling off lesser known franchises which likely do not have prospects for popularity or continuation.

Scalability of MGM’s Film Franchises

An excellent example of how a film or series franchise can be scaled is the Marvel Cinematic Universe, bringing in a total revenue of $22 billion. Even though the revenue split to cinemas and to the parent company (Marvel) is roughly 50-50, it is still an excellent business decision, considering that Disney (DIS) acquired Marvel for only $3.8 billion in 2009.

In the case of MGM’s franchises however, it seems that its franchises are likely much harder to scale. This is because in the case of James Bond, for example, there are extremely limited licensing right given to other companies to push out merchandise or games for example. In fact the franchise with the most promise under MGM is Tomb Raider, with a fairly successful game series on top of the film franchise. This brings me to the next risk.

Execution Post-acquisition

The issue of licensing and exclusivity of content is a crucial issue that Amazon needs to decide on post acquisition. The dilemma is fairly simple. Should it continue to sign MGM’s licensing contracts to sacrifice exclusivity and the core competitiveness of the Amazon Prime platform itself for the revenue brought in by licensing, or should it keep all of MGM’s content exclusive to sacrifice the licensing revenue for a possible increase in Prime subscribers?

These are extremely tough decisions with no obvious answers. Even if Amazon does decide to go with one of the options, whether or not the option will have its intended consequences will only become clear in many years’ time.

Industry and Acquisition Outlook

The streaming industry is currently at a watershed moment, as many players contemplate a shift towards profitability after years of prioritising market share over profitability. This has resulted in interesting business models going forward, with companies such as Disney+ contemplating lower cost subscriptions coupled with ads on its platform. At the moment, Netflix has ruled out advertising on its platform, likely sticking to its price hikes of the subscription plans.

As for the acquisition’s implications for Amazon, only time will tell if MGM’s integration into Prime will bear dividends for shareholders. Given the savvy nature of Amazon’s past acquisitions, it is unlikely that Amazon will overpay by that much if it does not have a proper execution strategy regarding the dilemma over licensing. Shareholders should keep a look out for any guidance with regard to this in the coming earnings calls.

Be the first to comment