hapabapa

While everyone is worrying about macroeconomics and whether the Fed would ease the quantitative tightening and adopt a more dovish stance on the interest rate issue, Amazon.com, Inc. (NASDAQ:AMZN) is quietly building a digital advertising empire. This could pose a strategic threat to the duopoly of Google (GOOG, GOOGL) and Meta Platforms (META).

Due to its size, Amazon is more than likely to weather the upcoming macroeconomic challenges with relative ease, which gives it enough time to seize the opportunities and make its marketplace the major destination for advertisers. Add to this the fact that the company is expanding its advertising business at a time when its competitors either are failing to adapt to the changing digital advertising environment or are under regulatory scrutiny and it becomes obvious that Amazon could disrupt the business for good in the foreseeable future.

A New Contender For The Top Spot

More than a decade ago, both Google and Meta formed an informal duopoly in the digital advertising market simply because the overall ROAS on their respective platforms was significantly higher in comparison to other platforms or other forms of advertisement. This made advertisers choose Google’s and Meta’s advertising tools to improve their own conversion rates, drive sales, and scale their businesses. However, that could change soon.

Amazon’s latest earnings report for Q3 showed that in the foreseeable future the company could disrupt the current duopoly. Its advertising business has been aggressively growing in recent months despite the turbulent macroeconomic environment that already led to the decrease in the overall global advertising spending. From July to September, Amazon’s advertising revenues alone increased by 25% Y/Y to $9.55 billion.

For comparison, Google’s overall advertising revenue in Q3 of $54.48 billion was up only by 2.5% Y/Y, while Meta’s Q3 advertising revenue of $27.74 billion was even down 3.7% Y/Y. While the advertising businesses of both of those companies are more mature and, therefore, it’s harder to generate record returns time and time again, the aggressive double-digit growth of Amazon’s advertising business in Q3 indicates that it has a decent shot of becoming a strategic threat to both of its major competitors.

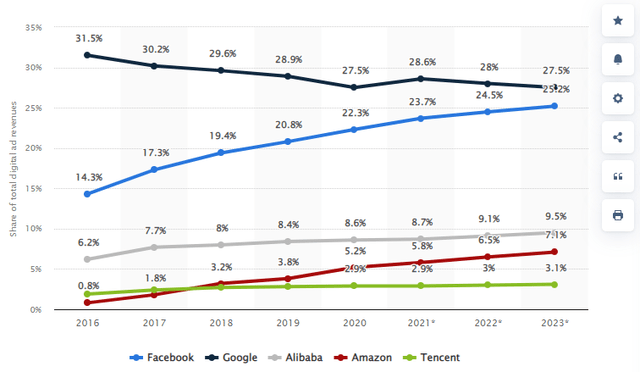

Statista believes that in 2023, Amazon’s advertising business would be responsible for 7.1% of total digital advertising revenues among the biggest advertising platforms and would continue to have one of the greatest annual growth rates amongst others.

Net Digital Advertising Revenue Share of Major Ad-Selling Online Companies (Statista)

Leveraging The Closed Ecosystem Advantage

One of the major things that Amazon’s advertising business has going for it is the ability to operate unanimously within Amazon’s own ever-growing marketplaces and online stores. By having an in-house advertising business that operates within the closed ecosystem of various popular eCommerce platforms such as amazon.com, the company as a whole is able to better track the behavior of its users, deliver greater ROAS for advertisers, improve its overall performance, and avoid having its business model being disrupted by third parties.

Let’s not forget that Apple’s (AAPL) decision to release an iOS 14.5 update that limits the tracking capabilities of iPhone users is already forecasted to cost Meta $10 billion in lost revenues this year alone. At the same time, there’s a risk that the effectiveness of Meta’s advertising tools won’t justify the cost of running ads on the company’s platforms in the first place due to the change in Apple’s privacy policy. This could force advertisers to look for alternatives such as Amazon to grow their sales and scale their businesses.

By operating within its own closed ecosystem, Amazon avoids the possibility of having its business model disrupted by others, which results in better tracking capabilities and more effective advertising tools. As Amazon’s CFO Brian Olsavsky said during the company’s latest conference call:

Advertisers are looking for effective advertising. And our advertising is at the point where consumers are ready to spend. So we have a lot of advantages that we feel that will help both consumers and also our partners like sellers and advertisers

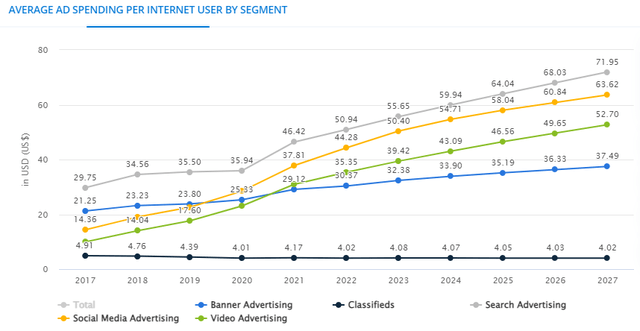

At the same time, another major upside of Amazon’s advertising business is the fact that it provides mostly search-based tools for advertisers. To date, this is one of the most effective forms of digital advertisement due to the ability of algorithms to understand with high certainty the user intent and efficiently match it with the product that the customer is looking for. In the current environment, the search-based advertising segment remains to be the most resilient and is in a way recession-proof in comparison to others, which could explain the aggressive growth of Amazon’s advertising business during the recent quarter.

On top of that, the latest forecasts indicate that search advertising would continue to have the greatest ad spending per user in comparison to other segments. Thanks to this, it’s safe to assume that Amazon’s advertising business is likely to continue to generate record returns mostly due to the fact that it would be able to avoid any disruptions by operating within an ever-growing closed ecosystem in which it would continue to provide the most efficient advertising tools for advertisers for years to come.

Average Ad Spending per Internet User by Segment (Statista)

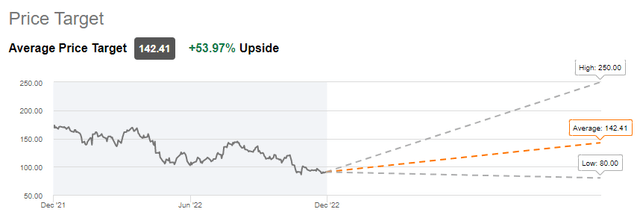

Considering all of this, it’s safe to say that Amazon’s advertising business could pose a strategic threat to the informal duopoly of Google and Meta within the digital advertising market. This in the end could lead to additional revenues and a subsequent appreciation of Amazon’s stock, as the company starts to play a greater role within the advertising industry. Therefore, it’s safe to assume that the over 50% upside to Amazon’s stock is justified at this stage given the amount of market share that the company could take away from its biggest competitors.

Amazon’s Consensus Price Target (Seeking Alpha)

At the same time, let’s not forget that even in the current environment, Amazon is expected to grow its revenues by nearly 9%, while in the following years the growth rate is forecasted to be in double-digits, which should help the company to reach $1 trillion in annual revenues by the end of the current decade. This unlikely would’ve been possible without Amazon’s entrance into the advertising business, which so far experienced one of the greatest growth rates among other parts of the company’s ecosystem of products and services.

The Major Downside

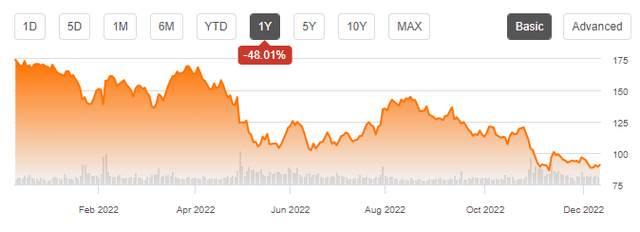

Here’s the problem with Amazon. Although its eCommerce and advertising businesses are growing at a double-digit rate in the current environment, the market nevertheless doesn’t hold growth stocks in high regard at this stage.

As a result, Amazon’s shares have already depreciated by nearly 50% in the last 12 months and no amount of positive developments such as the successful growth of the company’s advertising business are likely to improve the situation until the macroeconomic picture improves. Therefore, even though search-based advertising appears to be the most recession-proof form of advertisement, Amazon’s shares are likely to trade at the current distressed levels for a while.

1-Year Performance of Amazon’s Share Price (Seeking Alpha)

The Bottom Line

Amazon’s latest earnings results indicate that the company is about to become an even greater force to be reckoned with in the digital advertising space. Thanks to already having a dominant position in the eCommerce business, it can leverage its competitive advantages even more and accelerate the growth of its advertising business in the near future.

While Amazon’s stock nevertheless could continue to trade at the current levels due to the turbulent macroeconomic environment, the company is highly unlikely to face a similar situation that Meta faced when the 14.5 iOS update came out and diminished its growth capabilities in the short term. Thanks to this, Amazon could disrupt the digital advertising business in the next couple of years, improve the efficiency of its ads even more, and attract additional advertisers. In the end, this could result in the improvement of Amazon’s overall performance and the appreciation of its stock in the long run.

Be the first to comment