georgeclerk

Thesis

I was cautious going into Amazon.com, Inc.’s (NASDAQ:AMZN) Q3 results, as I didn’t like the negative implications of an additional Prime Day. And the e-commerce giant’s reporting indeed disappointed: revenues for the September quarter missed consensus by about $370 million. But what was even more negative, given “uncharted waters” for consumer spending, Amazon now expects FY 2022 sales to be between $140 billion and $148 billion – versus analysts’ expectations at around $155 billion.

AMZN stock has lost as much as 14% following Q3 (pre-market reference). But I argue the stock can go even lower.

Amazon suffers from depressed economic sentiment, which should contrast sharply to the belief that Amazon’s business model would be recession-proof. This, paired with a rich valuation, I remain pessimistic about Amazon’s near-/mid-term outlook. I reiterate “Sell,” and I lower my base case target price to $83.37.

Amazon’s Q3 Quarter

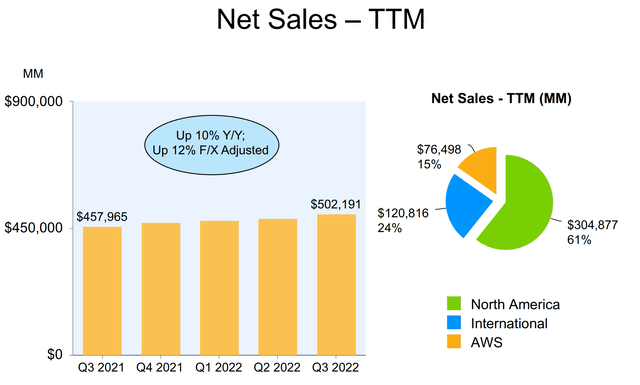

From July to the end of September, Amazon generated total revenues of about $127.1 billion, which compares to $110.8 billion for the same period one year earlier, representing a 15% year-over-year increase. Analysts, however, have expected sales to be around $127.4 – thus, Amazon missed by about $300 million.

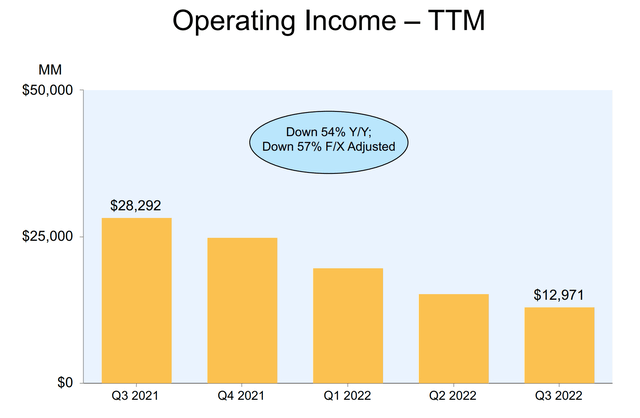

Amazon’s net income came in at $2.9 billion, versus $3.2 billion in the same period a year ago. Moreover, net income decreased despite accounting for a $1.1 billion non-operating gain from re-valuing the Rivian Automotive (RIVN) stake. Operating income for TTM decreased to $12.97 billion.

North America segment operating loss was $0.4 billion, compared with operating income of $0.9 billion in third quarter 2021.

International segment operating loss was $2.5 billion, compared with operating loss of $0.9 billion in third quarter 2021.

AWS segment operating income was $5.4 billion, compared with operating income of $4.9 billion in third quarter 2021.

Honestly speaking, such an anemic profit is very disappointing for a +$1 trillion business. I understand that markets do not focus on Amazon’s profitability. But perhaps they should.

Outlook Disappoints

Like Alphabet Inc. (GOOG, GOOGL) (“Google”), Microsoft (MSFT) and Apple (AAPL), Amazon warned of a clouded outlook, saying that the current economic environment:

is uncharted waters for a lot of consumers’ budgets.

FY 2022 sales guidance was accordingly disappointing: Amazon now expects revenues for 2022 to be between $140 billion and $148 billion, which is as much as $15 billion lower than the median analyst estimates of $155 billion.

Operating income for Q4 is estimated at around $4 billion, versus analyst consensus of about $5 billion.

Amazon’s disappointing quarter was driven by a depressed performance from the e-commerce business. But also “cloud” failed to convince. Sales from the cloud business increased by “only” 28% year-over-year, to $20.54 billion. Arguably, the buy-side was hoping to see growth at about/above 30%.

Still Expensive – Downgrade Target Price

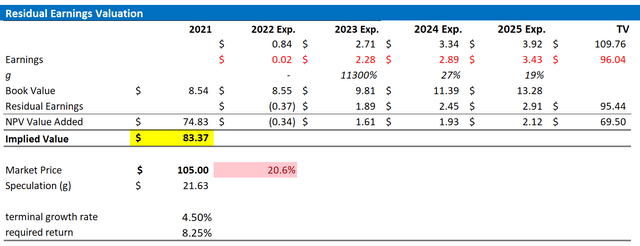

Following a disappointing Q3 from Amazon, I upgrade my residual earnings model to account for lower earnings in late 2022, as well as 2023. However, I keep the cost of capital relatively low, at 8.25, and the terminal growth rate relatively high, at 4.5%(almost 2 percentage points above expected nominal GDP growth).

Given the EPS downgrades as highlighted below, I now calculate a fair implied share price of $83.37, versus about $84.55 prior.

Analyst Consensus; Author’s Calculation

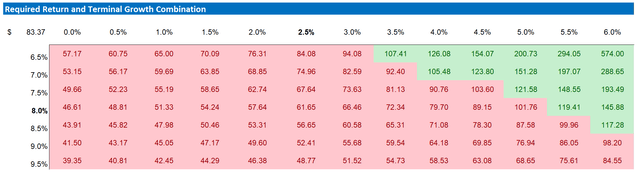

Below is also the updated sensitivity table.

Analyst Consensus; Author’s Calculation

Conclusion

To be fair, Amazon is not the only FAANG that disappointed: Google dropped 10% following Q3, Meta Platforms (META) dropped 25%, and Microsoft fell as much as 7%. I believe, however, that Amazon is in a unique situation as compared to Big Tech peers – the company’s profitability is much, much lower, and the valuation much, much richer. Accordingly, I personally would be worried about holding AMZN stock at above $100/share.

The key point for my thesis is that I expect sentiment to change. For a long time, investors did not really care about AMZN’s profitability. In fact, as I understand it, it has for a long time been a meaningless metric for Amazon, as the company almost appeared proud of the fact when they recorded negative earnings. Investors have been conditioned to accept it. But as recessionary conditions are biting, and investors will undoubtedly demand more discipline, Amazon’s lack of profitability focus may prompt a repricing of the stock – lower.

Following a disappointing Q3, I reiterate a “Sell” rating for Amazon stock and I lower my base case target price to $83.37 from $84.55 prior.

Be the first to comment