Alex Wong/Getty Images News

The Thesis

Amazon (NASDAQ:AMZN) has been an outstanding investment over the past decade, operating with huge industry tailwinds and a brilliant CEO. However, the margin of safety has dissipated, and Jeff Bezos is selling shares. We argue growth may disappoint investors, resulting in returns of just 4% per annum over the next decade.

An Inflationary Squeeze

Amazon was a COVID-19 beneficiary. A bunch of consumers trapped at home with nothing to do but shop online turned out to be a boon for business. Low oil prices and low employee wages also helped Amazon to report record profits.

Unfortunately for Amazon, high oil prices and higher employee wages are having just the opposite effect. On top of these expenses, Amazon is also investing in commercial vans, cargo planes, and streaming content. The latter is especially strange. Amazon Prime customers probably like their Prime Video content, if they even know it is there. But, the company spent $13 billion of investors’ money on new streaming content in 2021. The company’s also been buying depreciating assets (Vans and planes) at an alarming rate. Sure, this may increase the speed of e-commerce delivery, but it is also burning shareholder cash.

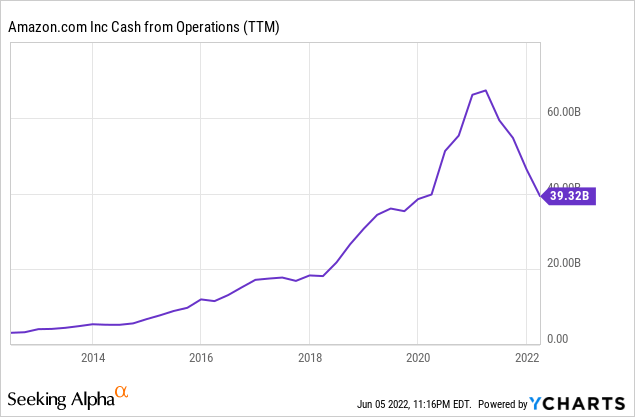

As a result, Amazon’s operating cash flows have fallen off a cliff:

Long-Term Value Creation

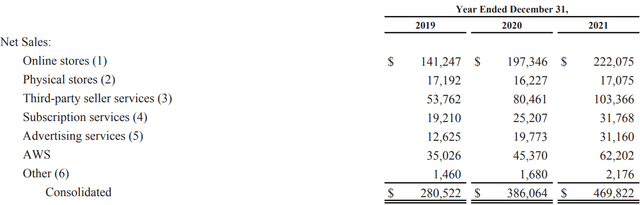

Amazon’s Revenue Streams (Annual Report)

Amazon is made up of two core businesses, e-commerce and cloud. Within e-commerce, you have several different parts like Amazon Prime, advertising, 3rd party services, and online stores. Apart from these core businesses, you have a huge collection of other subsidiaries such as Audible, IMDb, Alexa, MGM, and Whole Foods.

AWS has really saved Amazon. The cloud segment accounted for nearly 75% of Amazon’s operating income in 2021. AWS is exceptionally profitable. This has allowed Amazon to continue to invest in e-commerce, which has much lower margins, but a long runway. Almost no one saw AWS coming a decade ago, which is why AMZN stock has made such tremendous gains since. With the enormous profit margins enjoyed by AWS and Microsoft Azure, you may ask, “Where’s the price competition?” It would be reasonable to assume that capitalism will eventually rear its ugly head again, and cause competition to increase in this fast growing, high profit business.

E-commerce is a promising business, despite how capital intensive Amazon has made it of late. Amazon has focused more on its moat than its profitability for a long time and the strategy has worked. The company has a tremendous e-commerce market share in North America and globally. In 2020, Amazon accounted for 13% of the e-commerce goods transacted globally, trailing only Alibaba (BABA) at 25%. In the very long-term, one can imagine e-commerce being much more efficient than it is today. With innovations in artificial intelligence and battery technology, there could one day be self-driving, unmanned, electric vehicles delivering packages right to your doorstep.

Amazon’s Future Growth

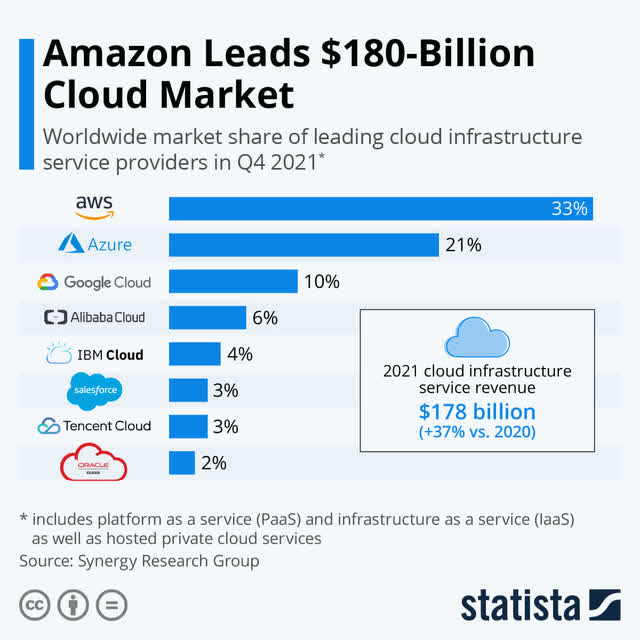

The global cloud computing industry is expected to grow at 15.7% per annum until 2030. It’s hard to imagine Amazon increasing its cloud market share from here. Amazon holds a 33% market share in global cloud.

Global Cloud Market Share (Statista)

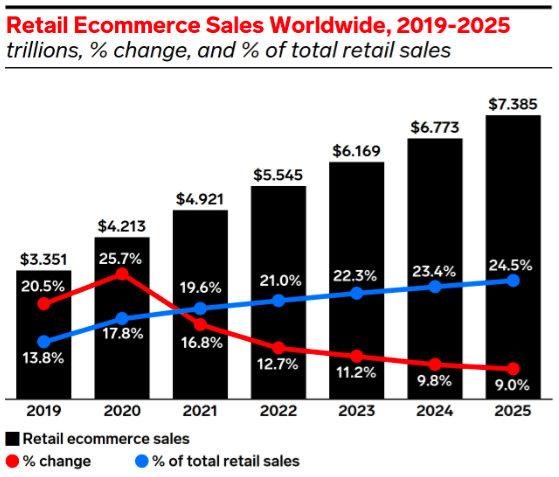

Globally, retail e-commerce sales are expect to continue to grow, albeit at a slower clip of about 10.7%, stretching out to 2025. However, Amazon could outgrow this industry as it expands globally and improves margins.

Global Retail E-Commerce Sales

Speaking of margins, AWS had an operating margin of 30% in 2021. But, excluding AWS, Amazon’s operating margin was only 1.5%.

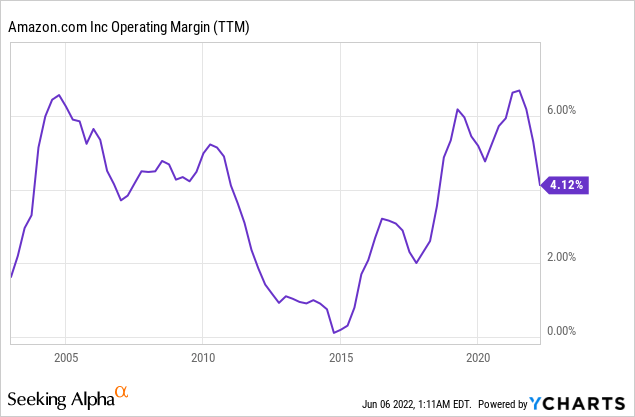

Below are Amazon’s margins from 2003-2022:

In ten years’ time, we expect lower margins for AWS. Cloud has been a fantastic place to be, but in capitalism, large profits attract competitors. It should prove difficult to have an enduring moat in cloud computing. We would compare the industry to that of semiconductors, where you need to have a technological edge to stay ahead. The industry should also prove to be cyclical in the long-run as price competition enters.

In Amazon’s e-commerce business, on the other hand, we see margins increasing. Amazon has clear competitive advantages in e-commerce including its brand, scale, delivery, and ecosystem. Not only will technological advances help the margins of this business, but Amazon’s subscriptions, advertising, and 3rd party services should grow organically with little capital investment.

Putting all of this information together, we are projecting Amazon to grow its trailing 12 month net income at 16% annualized over the next decade. This means the company should have a 2032 profit of $94 billion.

The Valuation

Our 2032 price target for AMZN is $185 per share, implying a return of just 4% per annum. Amazon has no working capital on its balance sheet and will need to continue to invest to engender its growth. Shares outstanding should remain around the same level in 2032, at 10.17 billion. With $94 billion of profit, we get earnings per share of $9.24. We have assigned a terminal multiple of 20 for what will be a more mature business in a decades’ time.

Conclusion

Amazon is an outstanding business and will be for many years to come. However, a stretched valuation, increased competition, and slowing growth are clouds on the horizon.

Warren Buffett’s early mentor, Benjamin Graham once advised, “Invest with a margin of safety.” We have a “sell” rating on AMZN and prefer it at a price of $85 per share, implying a return of 8% per annum.

Be the first to comment