David Ryder

Merger arbitrage

This is the latest in a series on the golden age of merger arbitrage with many wide spreads on deals that are likely to close. It’s a new deal – a quick pick to add to that broader basket of securities. In weakening credit environments, it’s optimal to focus on strategic as opposed to strictly financial deals. Within the universe of strategics, it tends to be easier to close deals where much bigger companies are buying much smaller ones. This is a perfect example. I will add subsequent examples as deals are announced (and update their progress on StW).

Who?

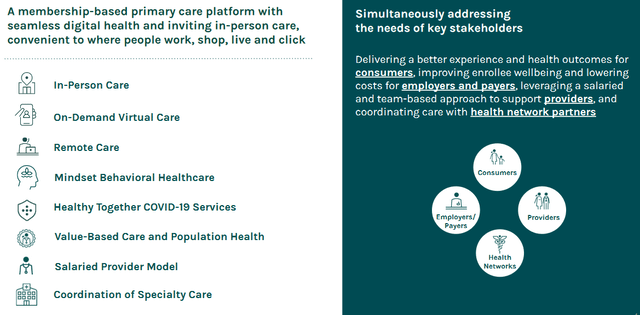

One Medical (ONEM) is a membership-based primary care platform. It’s backed by the Carlyle Group (CG).

What?

Amazon (NASDAQ:AMZN) is buying One Medical for $18 per share in cash. There were other interested bidders, including CVS (CVS). The buyer has been a successful acquirer in the past, buying public companies including Audible in 2008 and Whole Foods in 2017.

When?

The deal was announced yesterday and will probably close by the end of the fourth quarter.

Where?

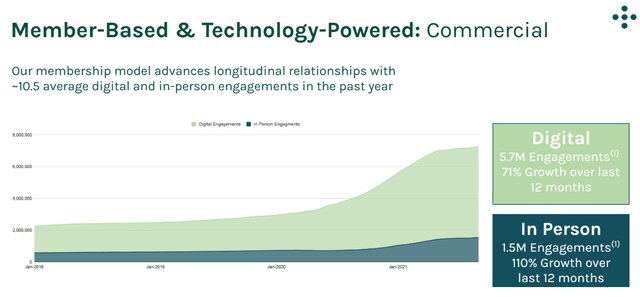

One Medical is headquartered in California. It operates throughout the US.

Why?

The $0.74 net spread offers a 10% IRR if the deal closes by year-end. That’s an attractive yield for a deal requiring only HSR and the target’s shareholder approval. It’s not conditioned upon financing, which obviously wouldn’t be an issue in any event. As far as antitrust, this combination faces vigorous competition from UnitedHealth (UNH), Handspring Health, CVS and VillageMD at Walgreens (WBA).

Caveat

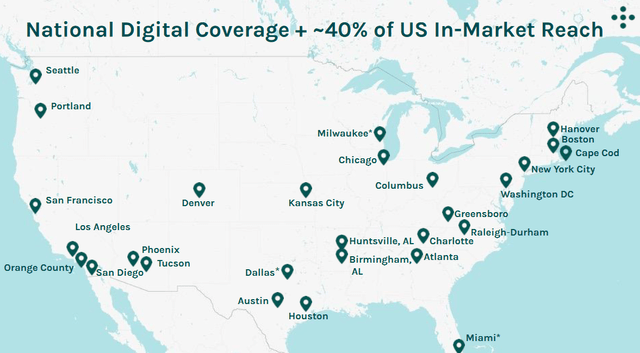

The US antitrust authorities are generally aggressive and specifically interested in Amazon. They could delay this deal in order to use the HSR review as a fishing expedition into the buyer. There’s no legitimate antitrust issue with this deal, but it could easily fall victim to politicization. With lightning-fast reflexes, politicians have already started to weigh in:

Amy Klobuchar

Sen. Klobuchar has a sympathetic audience in the radical chairman of the Federal Trade Commission, Lina Khan. Speaking of Amazon’s move into healthcare last month, she said that,

Our current approach to thinking about mergers still has more work to do to fully understand what it means for these businesses to enter into all these other markets and industries.

So this could easily get a second request no matter how little one is justified. The merger agreement does not require any fix or divestiture to comply with the antitrust authorities but does require both companies to litigate but only until the outside date of July 20, 2023.

Conclusion

Nothing special, just a sensible way to make a double-digit annualized return for the remainder of this year.

TL; DR

Buy ONEM.

Be the first to comment