Sundry Photography

Investment Thesis

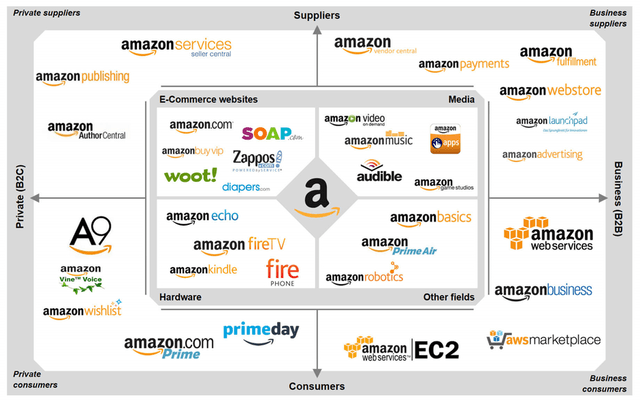

Amazon (NASDAQ:AMZN) is a global business operating in a whole host of industries, from ecommerce and logistics to game streaming and audiobooks. It is most well known for its Amazon ecommerce marketplace, and in particular the Amazon Prime subscription which gives members access to next-day (or even same-day) delivery, access to the Prime Video streaming service, and other benefits depending on your region.

Yet my investment thesis for Amazon doesn’t centre on any of these things – it is mainly focused on Amazon Web Services, or AWS.

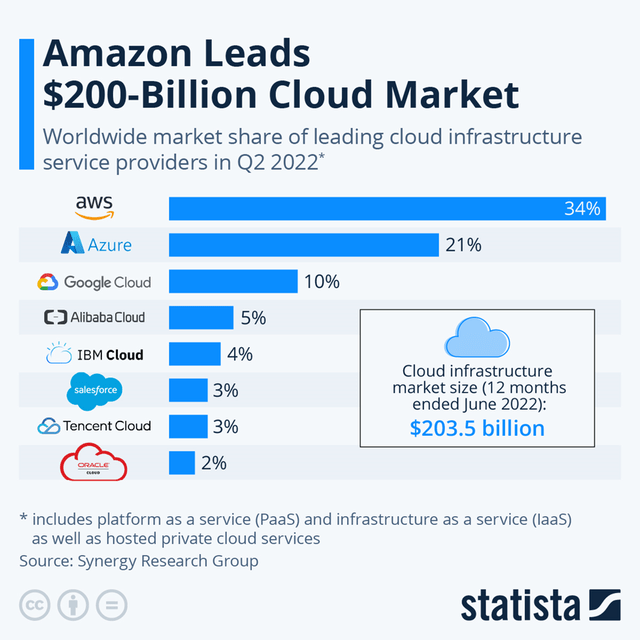

Launched in 2006, AWS is Amazon’s industry-leading cloud storage offering. It powers hundreds of thousands of businesses in 190 countries across the globe, with cloud-based solutions that include application hosting, website hosting, enterprise IT application hosting, backup and storage, content delivery, and database solutions – AWS does it all. It has also been Amazon’s fastest growing operating segment over the past five years, and now makes up 17% of Amazon’s revenue. In fact, the only year it wasn’t the fastest growing segment was in 2020, when everyone was shopping for everything on Amazon due to lockdowns.

Not only is AWS the fastest growing segment for Amazon, but it is also the most profitable by far. We are also still in the early innings of a global cloud transformation, and despite AWS bringing in revenue of $72B over the past year, it’s still got a long road of growth ahead of it.

So my investment thesis is this: AWS is a fast growing, highly profitable business with powerful moats as outlined in a previous article. This should propel Amazon to new heights, and I think AWS would be a great standalone business in its own right. The additional bonus with Amazon is everything else; this is a company with innovation running through its veins, and there’s no telling which of their next avenues could create the next AWS for the business. Amazon also has plenty of potential to expand on its retail margins, which will provide an additional boost to the bottom line in the future.

Whilst AWS shone when Amazon released its Q2’22 results, investing is a forward-looking game. Here’s what I’ll be looking at when Q3 earnings are released to assess whether or not my investment thesis for Amazon is on track, or better yet, strengthening.

Latest Expectations

Amazon is set to report its Q3’22 earnings on Thursday 27th October, and there are several key items that investors should keep their eyes on.

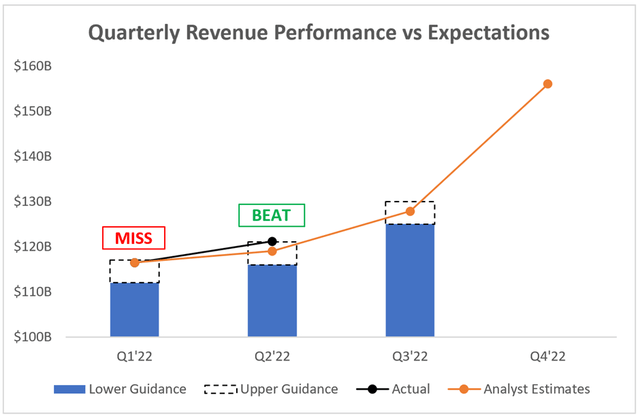

Starting with the headline numbers, and analysts are expecting Q3’22 revenue of $127.84B, representing YoY growth of ~15%. Given that Amazon achieved growth rates of ~7% in both Q1 and Q2, this would at least imply a return to double-digit growth, which is a little bit of good news.

Investors should not forget the context of the last two years; lockdowns and economic measures gave businesses such as Amazon a huge boost during the pandemic, so comparing against these quarters was always going to be difficult, especially now in a tough economic climate. This was especially obvious in the first half of 2022, but fortunately Amazon faces some slightly easier YoY comparisons in Q3 and Q4.

Investing.com / Amazon / Excel

As usual, analysts are expecting a boost in Q4 thanks to holiday spending, with current full year revenue estimates for Amazon sitting at ~$521.5B.

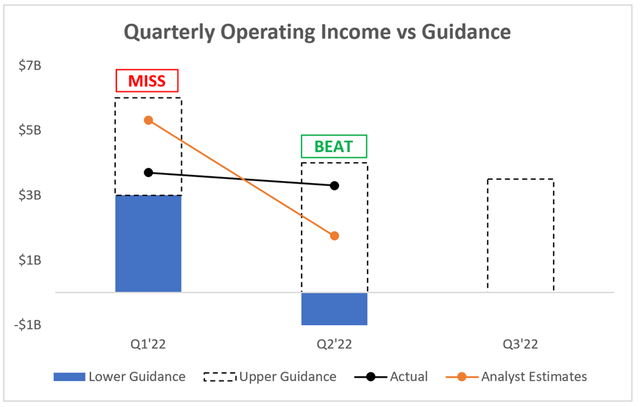

Yet in retail (which still generates most of Amazon’s revenue), it is quite easy to come up with big revenue figures; the problem is that the margins are often razor thin. This is part of the reason why AWS is so integral to improving the overall profitability of Amazon, and it was AWS that helped to deliver a strong beat against analysts’ expectations for operating income in Q2.

Consensus Gurus / Amazon / Excel

Looking ahead to Q3, and Amazon’s management has guided to operating income between $0-$3B, and once again it is a two-sided equation: how much will AWS make, and how much will retail lose?

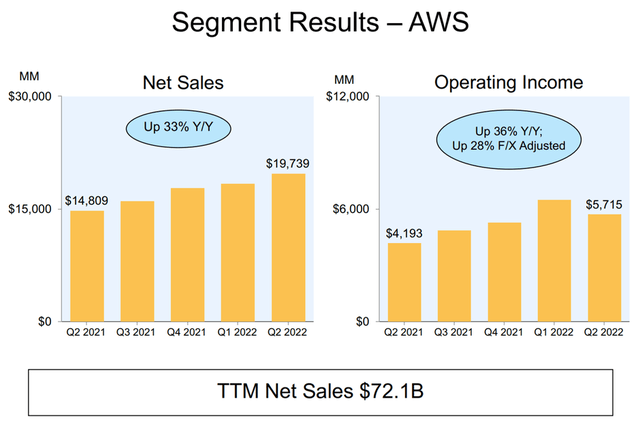

AWS Expected To Shine Yet Again

When the Q3 earnings come out, it’s no surprise that the first place I’ll look is AWS’ results. Firstly, the growth rates themselves will be crucial; I assume AWS to be a fairly recession resistant business, and whilst companies may be cutting costs in some areas of their businesses, I doubt many are skimping out on cloud transformation. This is part of the reason why AWS has seen resilient 35% YoY growth in the first half of 2022, compared to growth of just 3% for Amazon’s non-AWS business.

Amazon Q2’22 Earnings Presentation

It’s also worth highlighting that operating income growth for AWS slightly outpaced its revenue growth, and this is a trend that I’d like to see continue (although operating income can be a bit lumpy quarter to quarter). It means that AWS is continuing to improve margins with scale (as a cloud hosting business should), and I think this trend should continue for years to come.

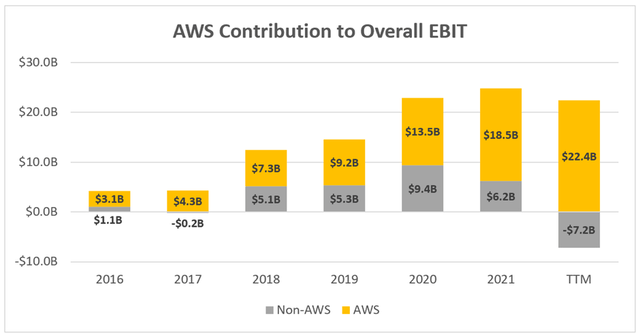

We can see just how much of an impact AWS has on Amazon’s overall operating income below, and it is quite staggering.

Back in 2016, AWS was still boosting Amazon’s annual EBIT by $3.1B, despite being a sideshow to the retail business. Fast forward five and a half years, and AWS has contributed a whopping $22.4B to Amazon’s EBIT over the past twelve months – which has been much needed, since the rest of Amazon has been burning cash for fun, driven substantially by inflationary pressures felt across the entirety of Amazon’s ecommerce and fulfilment network.

The question now is, exactly how much pressure will be felt on the cost side by the rest of Amazon in Q3, and will it continue to drag down the overall performance?

Easing Cost Pressures Might Be A Catalyst

In the first half of 2022, Amazon was hit incredibly hard by the impact of inflation on fuel, energy, and transportation costs due to the sheer size of its delivery and fulfilment network. In Q1’22, Amazon saw approximately $6B in incremental costs YoY driven by inflation, fulfilment network productivity, and fixed cost deleveraging.

CFO Brian Olsavsky gave the following update in Amazon’s Q2 earnings call:

For the second quarter, incremental costs were in line with our expectations at approximately $4 billion when compared to Q2 2021. Inflationary pressures remained at elevated levels in Q2, similar to what we saw in Q1. These include pressures from higher fuel, trucking, air and ocean shipping rates, which we expect will continue into Q3.

It would appear as though Amazon did not see any signs of these pressures easing up by Q3, although it’s worth noting that the incremental costs in Q2 were $4B compared to $6B in Q1, so at least the trend is heading in the right direction.

I wonder if we could be in for a pleasant surprise when Q3 earnings come around. Whilst this is not something I am banking on (I cannot predict the future sadly), there are plenty of reasons to be optimistic about lower prices – thanks in part to this monster Twitter thread by Ophir Gottlieb, from which I have taken the latest view from September on various costs that would be impacting Amazon. I have highlighted Q3’22 in white.

@OphirGottlieb on Twitter / My Personal Edits

As you can see, certain costs that were sky high in H1’22 have started to fall off a cliff. The largest drop offs have occurred in shipping rates and the manufacturing index, implying that the cost to ship internationally and the input costs for goods have fallen substantially. Yet virtually all costs are down from Q2’22, especially gasoline prices. All of these macroeconomic changes are green shoots for investors in Amazon, because they are likely to lead to a reduction in the incremental costs seen in the first half of this year.

Put all that together, and I think Amazon could be set up for a turnaround in the losses made by its retail division. This potential turnaround, if combined with continued strength for AWS, could lead to a really impressive quarter.

That said, there is uncertainty surrounding the economy as a whole, and also the waning strength of consumers. Whilst costs may be falling, Amazon’s retail business might be facing pressures from another place. If people are truly starting to feel the pinch courtesy of a tough economy, then consumer spending could certainly be down, and that is not going to help the retail side of Amazon. Combine that with a strengthening dollar, and it’s easy to make a case for a poor top-line showing in Q3.

In short, even though my investment thesis doesn’t revolve around retail, there is so much to watch for in this division due to the number of moving parts. I personally think a lot of negativity is already baked in, so any potential upsides (such as reduced cost pressures) could end up being an unforeseen catalyst when Q3 earnings are released.

An Enticing Valuation

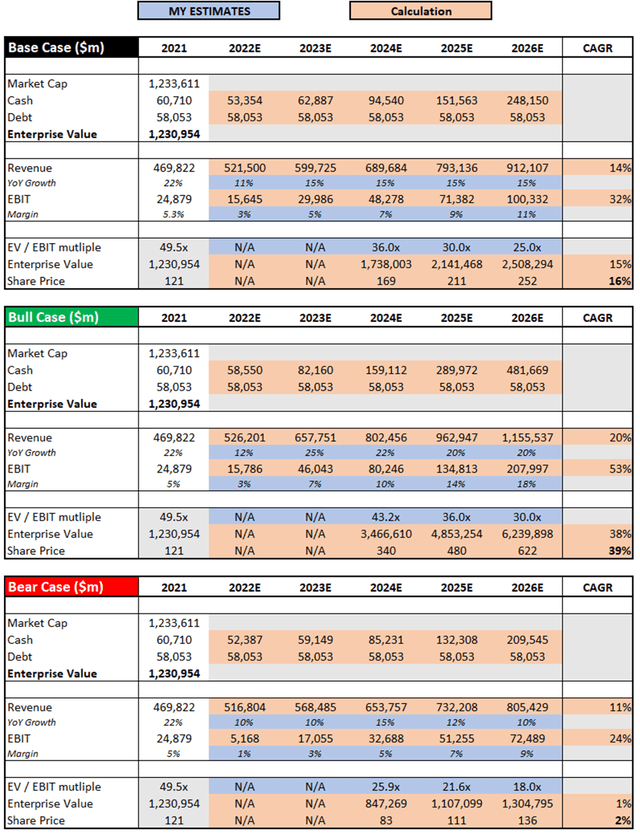

As with all high growth, innovative companies, valuation is tough. I believe that my approach will give me an idea about whether Amazon is insanely overvalued or undervalued, but valuation is the final thing I look at – the quality of the business itself is far more important in the long run.

I have changed my valuation approach slightly since my previous article, in order to better show the potential upside and downside in my bull and bear case scenarios. My base case scenario remains similar to my previous article in terms of assumptions; the main change is using a higher EV / EBIT multiple, as I feel it is appropriate given the potential future growth and margin expansion for Amazon from 2026 onward.

My bull case scenario assumes that Amazon can continue impressive revenue growth, achieving a 20% revenue CAGR through to 2026, with more and more driven by AWS as it continues to contribute to a larger portion of overall sales. This shift in revenue mix will be accompanied by stronger EBIT margins, which makes sense considering AWS has EBIT margins of 31% over the past 12 months, and it still has room to scale and expand these margins further.

My bear case scenario assumes firstly that Amazon gets hit hard over the next couple of years by a difficult economy, and that the company never truly recovers. AWS will still perform better than retail, but not by enough to have a huge impact on margins, especially as retail loses steam.

Put all that together, and I can see Amazon shares achieving a CAGR through to 2026 of 2%, 16%, and 39% in my respective bear, base, and bull case scenarios.

Bottom Line

Once again, my eyes will be firmly fixed on AWS in Q3 to see if it is continuing to grow in excess of 30%, and if it can continue to do so with strong margins. I expect this to happen, so my attention will then move to the rest of the business; specifically, whether retail can stop being a drag on the overall business and can start boosting performance alongside AWS.

I believe that the current share price offers a very attractive risk/reward, and with quite a lot of negativity baked in, I believe that Q3 results will be a happy occasion for shareholders. Given the fall in Amazon’s share price and the potential upside I think this business has, I am upgrading my rating on Amazon from a ‘Buy’ to a ‘Strong Buy’.

Oh and one more thing.

Rings Of Power has been great so far!

Be the first to comment