Galina Zhigalova

Amarin

We simply attempt to be fearful when others are greedy and to be greedy only when others are fearful. – Warren Buffett

Author’s Note: This article is an abridged version of an article originally published for members of the Integrated BioSci Investing marketplace on October 13, 2022.

When you invest in biotech, you have to know what type of company you are holding. More importantly, you need to know which business model the company is employing. Those information gives you the risks and returns profile for your stock. Empowering with that market intelligence, you can make more prudent investment decisions. Of various types of stock, turnaround equity is extremely risky yet it has tremendous return potential.

That being said, I’d like to revisit a turnaround stock dubbed Amarin Corporation (NASDAQ:AMRN). I used to follow Amarin but dropped the company back in early 2021 due to a key management departure. In the subsequent years, the stock tumbled and lost most of its value. With the new Board, Amarin is trying to right the ship. Interestingly, the activist investor titan (Alex Denner of Sarissa Capital) is flexing his muscles to rattle Amarin’s Board. In this research, I’ll feature a fundamental analysis of Amarin and share with you my expectations for this intriguing growth equity.

StockCharts

Figure 1: Amarin chart

About The Company

As usual, I’ll present a brief corporate overview for new investors. If you are familiar with the firm, I recommend that you skip to the next section. Operating out of Bridgewater New Jersey and Dublin Ireland, Amarin is engaged in the innovation and commercialization of medicine to serve the strong unmet needs in cardiovascular health.

The company is commercializing a synthetic Omega-3 fatty acid known as icosapent ethyl: it is marketed as Vascepa in the US and Vazkepa in the EU. For the sake of simplicity, I will refer to both Vascepa and Vazkepa as Vascepa. Specifically, Vascepa is approved for hypertriglyceridemia (i.e., elevated blood lipid) and for the reduction of cardiovascular risk in high-risk patients.

Amarin

Figure 2: Therapeutic pipeline

Turnaround Strategy: Activism from Sarissa Capital

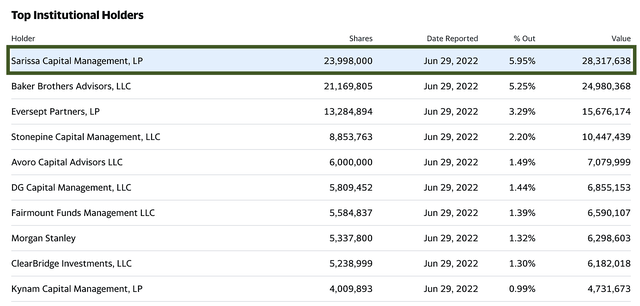

As you can appreciate, activist investing is crucial to the turnaround of your stock. From the figure below you can see that the healthcare/biotech-focused Sarrisa Capital currently owns 23.9M shares (i.e., 5.9% of all shares outstanding). As such, their total holding is worth roughly $28.3M. Being a significant shareholder of Amarin, the Chief Investment Officer and Founder of Sarissa (i.e., Alex Denner, Ph.D.) and his team can make changes to the Board and thereby exert influences on corporate operations.

Yahoo

Figure 3: Institutional ownership

Now, when I read up on the Sarissa CIO ( Alex Denner), I realized that he is the turnaround catalyst needed for Amarin. If there is anyone who can turn around this ship, you can bet that’s Mr. Denner. Leading Sarissa, Mr. Denner is laser-beam focused on improving the strategies of companies to unlock shareholder value. That made sense because he was a senior managing director at Icahn Capital — a firm where Carl Icahn himself conducts his investment activities.

Sarissa

Figure 4: Sarissa Capital

As you can see, Carl Icahn is into taking a large stake in companies and enhancing the shareholder value either by breaking subsidiaries apart or executing other sophisticated corporate strategies. Given that Mr. Denner refined his crafts at Ichan’s, you can anticipate that he would execute sophisticated guidance for Amarin. Simply put, I don’t see Mr. Denner letting the Amarin ship sinks. After all, he holds a portfolio of highly concentrated positions (i.e., 12 companies for roughly $1B assets under management).

CNBC

Figure 5: Alex Denner

Back on June 03, Sarrisa stated that it would seek representation on Amarin’s Board of Directors. Accordingly, Sarissa believes that Amarin is unable to navigate the changing market for Vascepa. Moreover, Sarissa believes that Amarin is significantly undervalued and thereby acquired more shares.

Turnaround Strategy: Board Improvement

As you’d expect, Amarin recently issued their responses to Sarissa. Essentially, the company is saying that it is interviewing potential board members. I believe that Amarin is playing a strategic and defensive approach to Sarissa. Nevertheless, you can bet that Sarissa will get its final saying. According to Amarin,

The Amarin Board of Directors is committed to best-in-class corporate governance. To this end, identifying and recommending new members for Amarin’s Board is a process we take seriously. Consistent with our ongoing Board refreshment process and our good-faith engagement with Sarissa, the Board has a defined and tailored list of skillsets that we believe are necessary to help guide the Company forward, and we rigorously evaluate any potential candidates’ commitment and contributions they might bring to the Board and the Company. With this in mind, we have interviewed several highly qualified candidates and the Board is in final stages to appoint new independent directors. Throughout the Board’s consideration of these candidates, including Sarissa’s proposed nominees, we have kept Sarissa apprised of the Board’s refreshment process. This process remains ongoing.

From “reading the tea leaves,” you can expect new board members from Sarrisa soon. At the very least, there will be one new Board member from Sarrisa. As you can imagine, board members are like the DNA or blueprint of a company. As part of the top-level management, the Board can steer the company in the right direction. In a turnaround situation, the Board plays a crucial part. Pertaining to the company,

Over the past year, our Board, with the assistance of a renowned global search firm, has been executing a deliberate plan to refresh its composition and add directors with skills we believe are necessary to help guide the Company on its new strategic direction. In 2022 alone, this process resulted in the appointment of three independent directors. Our new directors add extensive global biotech, international pharmaceutical experience, as well as specific healthcare investment experience and expertise. We have also made significant changes to our Board leadership, including appointing a new Board Chair, naming new Chairs of the Audit and Remuneration Committees, and the retirement of two long-tenured directors.

More Turnaround Efforts: Increasing Market Presence

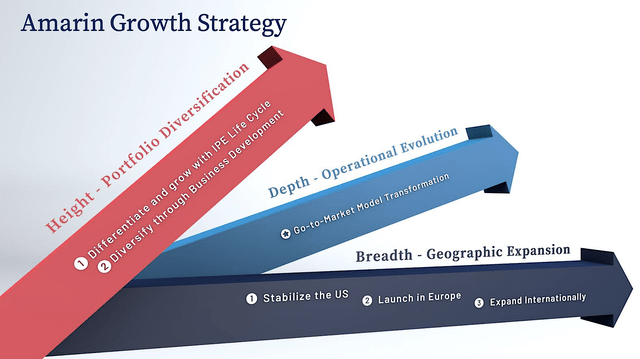

Aside from boosting its management, Amarin is scrambling to stabilize its product sales in the USA. Viewing the figure below, you can see that the company is focused on three approaches to deliver growth (i.e., turning around): height, depth, and breadth. Essentially, these strategies are set to stabilize the product decline in the U.S. while gearing up for Vascepa’s launch internationally.

Amarin

Figure 6: Amarin growth/turnaround strategy

From the chart above, you can also appreciate that Amarin should in-license other drugs to diversify beyond Vascepa. Over the decades, I noticed a company rarely survives on one molecule. Something like the generic debacle would happen. And in that case (as you saw it with Amarin’s Vascepa), the stock would be devastated.

With the aforesaid risk in the background, it is crucial for you to have a deep portfolio. Now, I don’t mean deep as in the same definition as Amarin. I simply inferred more medicines or assets in the pipeline. The question is whether Amarin do that immediately while there is still a good amount of cash and adequate market capitalization for capital raise. Commenting on turnaround approaches, the firm reported,

As a Board, we are unified and supportive of Amarin’s new strategic direction, and the actions management has taken to position the Company for growth and value creation. The Board believes there is tremendous runway for growth as Amarin’s strategic focus shifts toward expanding the business in Europe and other international markets, and recent actions to stabilize our U.S. business materialize. Amarin continues to progress on its comprehensive cost reduction program and other cash preservation initiatives.

Latest Operating Results

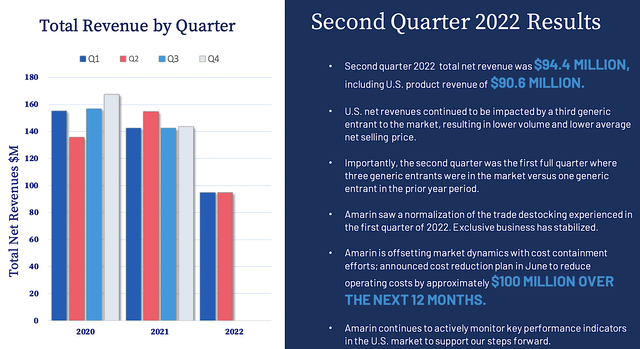

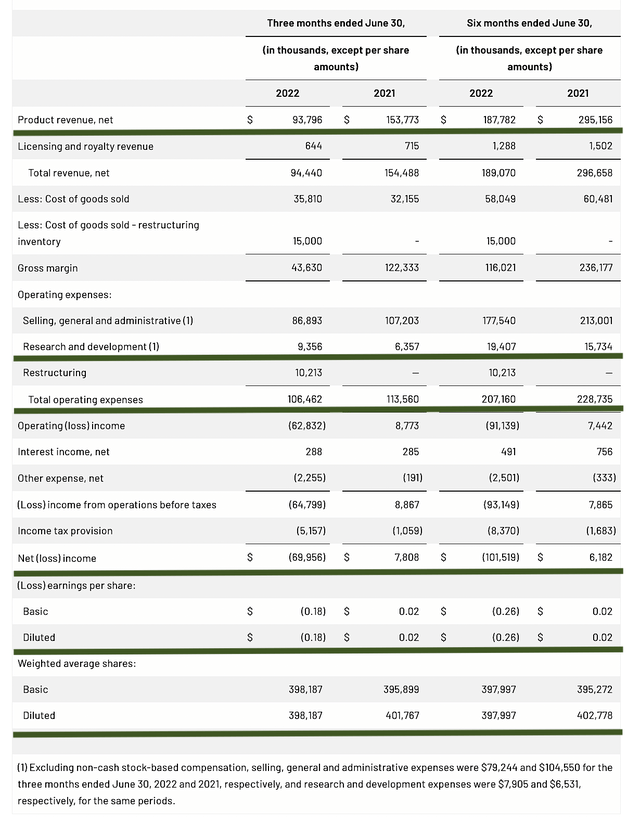

All of the turnaround efforts would be wasteful if they don’t lead to top and bottom-line improvement. On that note, you should check the latest quarterly highlights. As shown in the figure below, there are two trends that are important.

The first (i.e., the bad) is that Vascepa sales dropped substantially going from Fiscal 2021 to 2022. The second (i.e., the good) is that Q2 revenue registered at $94.4M (i.e., red line) which is essentially the same as Q1 revenue (i.e., blue line). That tells you, Amarin might have found a strategy to stabilize the generic onslaught on U.S. soil.

Amarin

Figure 7: Latest operating trends

Financial Assessment

Just as you would get an annual physical for your well-being, it’s important to check the financial health of your stock. For instance, your health is affected by “blood flow” as your stock’s viability is dependent on the “cash flow.” With that in mind, I’ll analyze the 2Q2022 earnings report for the period that concluded on June 30.

As follows, Amarin procured $93.7M in revenues compared to $153.7M for the same period a year prior. On a year-over-year basis, the topline decreased by 64.0%. As you know, the generic competition substantially cut into the market shares of Vascepa.

That aside, the research and development (i.e., R&D) tallied at $9.3M and $6.3M. I viewed the 47.6% R&D increase positively because the money invested today can turn into blockbuster results tomorrow. After all, you have to plant a tree to enjoy its fruits. Now, I strongly believe that more R&D has to go into developing new drugs beyond Vascepa. Else, there are no long-term catalysts to power growth.

Additionally, there were $69.9M ($0.18 per share) net losses compared to $7.8M ($0.02 per share) net gains for the same comparison. As you can see, the bottom line substantially depreciated. The wider losses were due to higher stock-based executive compensation and restructuring expenses. Here, you can see that the company is doing a subpar job of reducing expenses while boosting executive compensation.

Amarin

Figure 8: Key financial metrics

About the balance sheet, there were $324.6M in cash and investments. Against the $105.4M quarterly OpEx and on top of the $93.7M in quarterly revenue, there should be adequate capital to fund operations for years without worrying about cash flow constraints (provided that the revenue would be stabilized).

While on the balance sheet, you should check to see if Amarin is a “serial diluter.” After all, a company that is serially diluted will render your investment essentially worthless. Given that the shares outstanding decreased from 401.7M to 398.1M, it’s a promising sign that the company is reducing the share count. That made sense because there was previously no need for raising capital.

Potential Risks

Since investment research is an imperfect science, there are always risks associated with your stock regardless of its fundamental strengths. More importantly, the risks are “growth-cycle dependent.” At this point in its life cycle, the main concern for Amarin is whether the company stabilizes Vascepa’s sales decline in the USA. There is also a concern that Amarin won’t be able to ramp up Vascepa’s worldwide sales. That aside, a turnaround stock is extremely risky. That is to say, the management might not be able to reduce the burn rate and if revenue drops, that’ll burn into the cash reserve.

Conclusion

In all, I recommend a hold on Amarin with the 3.8/5 stars rating. Amarin could have been a great stock without the unfortunate/unexpected generic infringement. Nevertheless, you can never account for bad luck. As an investor, you should continually focus on investing trends and hone your skills. In early 2021, when John Thero left, my intuition told me that Amarin is facing an insurmountable problem. That reinforces my belief: whenever the CEO suddenly leaves (and for whatever reason), the stock usually tumbles in the coming months and years. As you know, I made my recommendation to sell out and dropped Amarin from our M7 portfolio/coverage after Mr. Thero left.

That aside, Amarin reinforces another great lesson for me. Specifically, most companies with a narrow pipeline (i.e., relying on one drug) for a single indication put the stock in a precarious position. Unfortunate events are bound to happen to the drug. You saw that with the generic infringement that decimated Vascepa’s value. As such, you want to focus on companies with a deep and extensive pipeline to hold for the long haul. If one or a few indications do not work out, there are others to give you multiple shots on the goal of getting a blockbuster.

In its turnaround efforts, the management is showing an eagerness to make a comeback. First, they stabilized the revenue decline in the USA from Q1 to Q2. Whether they can maintain the trend in the next few quarters is crucial to the survival of Amarin. On the international front, they’re pushing for marketing expansion. With Sarissa exerting pressure on the Board, surprising things can happen.

Be the first to comment