Oakozhan/iStock via Getty Images

It has been a long time since I covered Amarin (NASDAQ:AMRN), who has been on a rough road since an unfavorable IP ruling in the United States for their flagship product, Vascepa. The market crushed AMRN’s share price following the company’s failed attempts at appealing the ruling in anticipation that generics will quickly flood the market. Luckily, Amarin has been able to defend Vascepa’s IP in Europe (Vazkepa) and the company is making significant headway in commercialization. Unfortunately, there is a huge disparity between the company’s progress and the share price’s performance. It appears as if the generic launches in the U.S. have throttled all attempts at a rally. As a result, I cannot rely on the structure of my previous AMRN thesis and will have to construct a new one.

I intend to briefly review my old thesis and will discuss why I need to hit the reset button. In addition, I will take a look at the company’s recent earnings to assemble a new thesis. Finally, I discuss my plan for my “house money” AMRN position.

Review of My Old Thesis

My AMRN thesis was primarily centered on Vascepa’s clinical and commercial potential as an adjunct to statins to reduce the risk of myocardial infarction, stroke, coronary revascularization, and unstable angina requiring hospitalization in adult patients with elevated triglycerides. Cardiovascular disease is the number one cause of death in the world and is responsible for 1 of every 19 deaths in the United States. Considering the cardiovascular disease and diabetes mellitus trends in the United States, I was convinced Vascepa was going to rapidly cross the $1B revenue mark in only a few years and could be one of the leading cardiovascular drugs in an endlessly expanding market. This thesis was strengthened prior to approval as the company revealed that providers were prescribing Vascepa off-label following the REDUCE-IT trial results. The earnings were surging ahead of approval despite the company “going it alone” in commercialization. It looked as if Amarin was going to quickly transition from a speculative ticker to a growth stock in a couple of quarters. What is more, the company was moving closer to approval in the EU, which would only accelerate growth.

Following the unfavorable ruling in their patent lawsuit against generics Dr. Reddy’s (RDY) and Hikma (OTCPK:HKMPF) in a U.S. District Court. The market has crushed AMRN’s share price and my original bull thesis was broken. It was apparent that Amarin was not going to be able to fend off generics and it was only a matter of time before growth in the U.S. market stalled. So, my original thesis was crushed once Judge Miranda Du found Vascepa’s patents to be obvious, so they were invalid. Then, the Supreme Court overruled Vascepa’s action to resuscitate their patents. Accordingly, Amarin reduced its US salesforce by more than 50% and decided to center their U.S. efforts on digital marketing which will allow them to increase their number of target prescribers.

It was obvious the company and the market has conceded that the U.S. was essentially a lost cause and so was my original thesis.

Time To Hit The Reset Button

Despite the major blow to the AMRN bull thesis, I still had hope that the company was going to find success in the EU and that they would have better chances of defending their IP across the pond as well as in China and Egypt. What is more, Amarin has amassed supplementary data that bolsters Vascepa’s CV benefit including its use for peripheral artery disease. As a result, I was willing to hold onto my “house money” AMRN position in anticipation of the company’s success will justify a higher valuation.

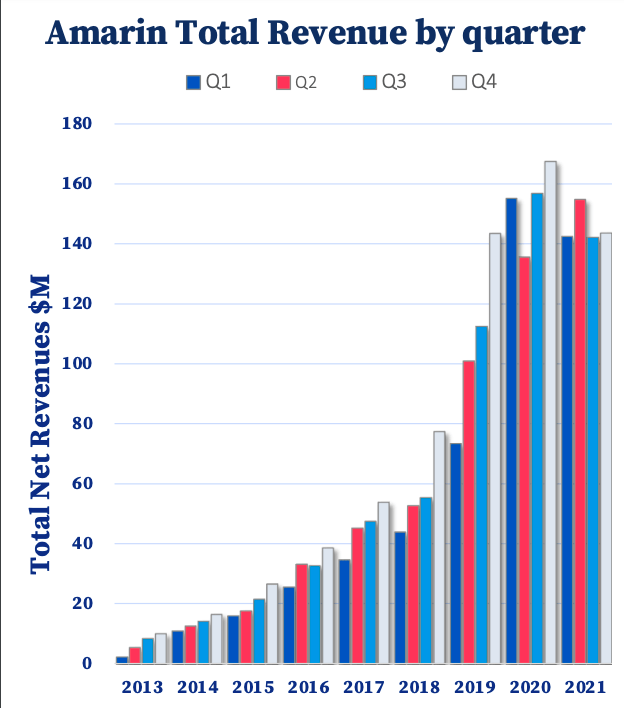

Looking at the company’s 2021 revenue, we can see that the company took a step back in 2021 vs. 2020.

Amarin Quarterly Total Net Revenue (Amarin Corp)

Amarin made $614M in 2020 but fell short in 2021 with only $580M. The company put the blame on COVID-19, however, there is the fact that Hikma’s and Dr. Reddy’s generics have launched and are starting to intrude Vascepa’s market.

However, these generics might not completely erode Vascepa’s market since they are only labeled for the triglyceride reduction indication and do not include the CV reduction, which could help Vascepa defend its position. What is more, Amarin has a strong supply chain that they have established over the past decade that could be more reliable than generics. I believe this is evident in the fact that other generics have FDA approval, but have yet to launch in the United States. So, it is possible that the limited label and fragile supply chains might impede generic saturation for an extended period of time.

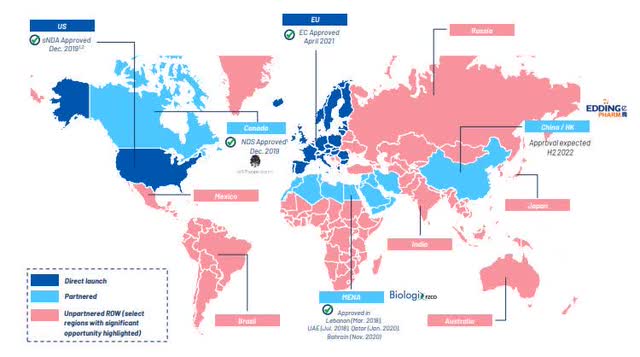

Luckily, Amarin’s launch in Europe has better prospects thanks to a 10+ year market exclusivity. The company has already bolstered its commercial presence in Europe with around a 150 headcount salesforce in Germany alone. What is more, the company has partnered in Canada, the Middle East, North Africa, and China and still has numerous other opportunities to expand Vascepa around the globe.

Amarin Partnerships (Amarin Corp)

Considering the points above, I believe it is safe to say that AMRN deserves a renovated bull thesis. I see AMRN’s bull thesis to be based on diminished U.S. generic encroachment and underappreciated potential revenues from European and other ex-U.S. territories.

AMRN Revenue Estimates (Seeking Alpha)

In fact, it appears that the market has discounted the company’s near-term and long-term revenue growth. Looking at the Street’s revenue estimates for Amarin, we can see the stock is trading around a 2x forward price-to-sales for 2022, which is significantly under the industry’s average of 5x. Obviously, we have to expect that multiple will improve in the coming years as the company launches in Europe. If the company is able to hit these revenue estimates, they should be starting to report a positive EPS next year. Obviously, a positive EPS and revenue growth should translate into the share price. Moreover, the company had just under $500M in cash, which should be more than adequate to get the company to break even. Considering, AMRN’s market cap is only around $1.3B, we can say AMRN is trading at a notable discount for its potential future performance and price-to-book.

So, the thesis is essentially being significantly undervalued for its potential earnings growth. However, there is a contrarian aspect to this thesis that is considering the likelihood that U.S. generics are not going to quickly erode Vascepa’s market share, which will help support the company until the European market can take the helm.

Downside Risks

Indeed, there are several risks that could derail this thesis, including the possibility generics will quickly claim Vascepa’s market in the U.S. and the European market will be underwhelming. Clearly, shrinking U.S. sales and lackluster European sales could prevent the company from breaking even. Amarin is still relying entirely on Vascepa, so it is likely the share price is going to the point where the current sales are heading. As a result, investors need to accept the fact that AMRN could be a volatile ticker until there is no doubt that the company is profitable. Even then, investors need to accept the possibility that AMRN will never trade at a high premium as long Vascepa is the sole breadwinner. Consequently, AMRN will remain in the Compounding Healthcare “Bio Boom” speculative portfolio at this point in time.

My Plan

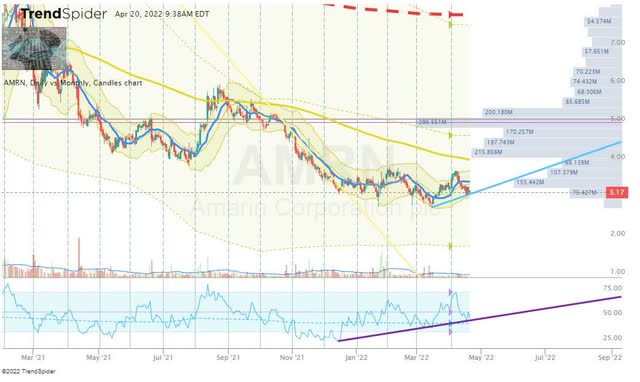

I haven’t considered touching my AMRN for over a year, but I believe it is time to start keeping a closer eye on the ticker as we move deeper into the European launch and more countries approve Vascepa.

Once I start to see an uptick in quarterly revenue, I will start a dollar-cost-average “DCA” strategy until I get my fill. Admittedly, I don’t plan on amassing the same-sized position I had prior to the U.S. CV approval. In addition, I will be looking to book some profits on spikes in the share price in order to regain a “house money” state.

AMRN Daily Chart (Trendspider)

AMRN Daily Chart Enhanced View (Trendspider)

Long-term, I expect to hold an AMRN position for at least five more years in anticipation the company can be successful in Europe and bring the company to profitability.

Be the first to comment