Scott Olson/Getty Images News

Altria (NYSE:MO) has made plenty of headlines over the past 12 months giving investors plenty of developments to mull over. Make no mistake, this is a company in transition, and while not everyone may be comfortable with the risk profile, I believe it is one where investors may be rewarded over the long run. In this article, I highlight the most recent development, and why I believe it’s a long-term positive for Altria.

Why MO?

Altria made headlines this week, as it was recently announced that Philip Morris International (PM) is mutually ending its IQOS partnership agreement, opting instead to either go it alone, or through Swedish Match (OTCPK:SWMAF) should Elliot Management and the rest of the shareholders agree to its recently upped bid.

The introduction of iQOS has been troubled from the start, as Altria introduced it to the U.S. market shortly before the pandemic hit. Then, competitor British American Tobacco (BTI) successfully sued PM on grounds of patent infringement, resulting in an import ban. This meant that PM would have to build its own iQOS manufacturing facility on U.S. shores to be able to sell the product. Adding salt to the wound, PMI and Altria were also at odds over whether Altria met its contractual obligations in the marketing of IQOS.

While IQOS is indeed a product that has resonated with consumers around the world, the agreement between the two companies carried an element of uncertainty. That’s because the partnership was not a perpetual one, with periodic milestones to be met in 5 years. Should Altria fail to live up to PM’s expectations, PM could pull the plug, and all of the efforts had made would have been for nothing. More importantly, Altria would have lost valuable time in the development and marketing of a heat-not-burn product of its own.

As with people, it’s important for companies to own their own destinies, and the iQOS severance payment from PM gives Altria plenty of capital to develop its own product. This was highlighted by Morningstar in its recent analyst report:

The news that Altria and PMI are going their separate ways with regard to iQOS is not a surprise, in light of PMI’s bid to acquire Swedish Match, and confirmation of the terms of the separation provide visibility into the cash flow impact of the separation for the next two years. Altria has already been paid $1 billion and will receive the remaining $1.7 billion by early in the second half of next year. Management was vague about how it will use the proceeds, but we believe the proceeds are enough to develop its own heated tobacco brand and increase returns to shareholders over the next few years.

Using PMI’s spending as a benchmark, we estimate a dedicated heated tobacco manufacturing facility to serve the U.S. market could cost around $400 million, and doubling research and development expenses as a percentage of sales to 1.8%, similar to PMI’s spending when it was ramping up iQOS distribution in Europe and Asia, and increasing advertising expenses to 1% of sales from a negligible amount, has no impact on our valuation of Altria and leaves around $1 billion in after-tax proceeds for shareholder distributions.

While time will tell how successful Altria’s HnB product will be, I believe the lessons learned from PM’s IQOS playbook serves as a valuable handbook in the development of a new product. Furthermore, I also view Altria’s recent decision to end its noncompete agreement with JUUL as being a net positive.

That’s because Altria only had a 30% stake in JUUL, and there was no telling when, if ever, JUUL would distribute cash to its investors. Given the amount of regulatory oversight and scrutiny on vaping from the FDA, this segment is starting to mature, and fits well with Altria’s experience of working within a regulatory framework.

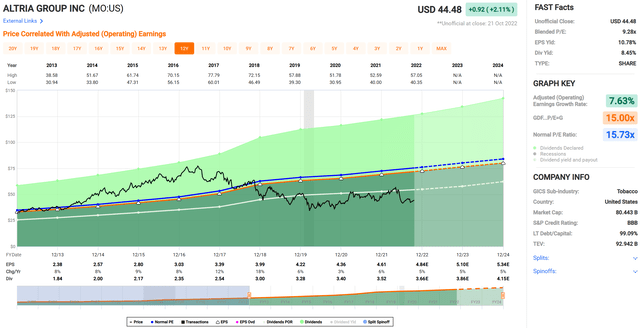

Meanwhile, near-term uncertainty is great for value investors, as Altria is attractively priced at $44.48 with a blended PE of 9.3, sitting below its normal PE of 15.7 over the past 10 years. Furthermore, it has a BBB rated balance sheet and pays a historically high 8.5% yield that’s well covered by a 77% payout ratio. Notably, MO is also a Dividend King with 52 consecutive years of dividend raises under its belt.

Investor Takeaway

While the ending of the iQOS partnership with Philip Morris International may be viewed as a negative, I believe it is a long-term positive for Altria, as it gives the company more control over its destiny. Furthermore, it also provides Altria with the opportunity to use the proceeds to develop its own heated tobacco product and increase shareholder value in the process. Meanwhile, negative investor sentiment has pushed up the dividend yield to the high end of MO’s historical range, setting it up for potentially rewarding long-term returns.

Be the first to comment