da-kuk

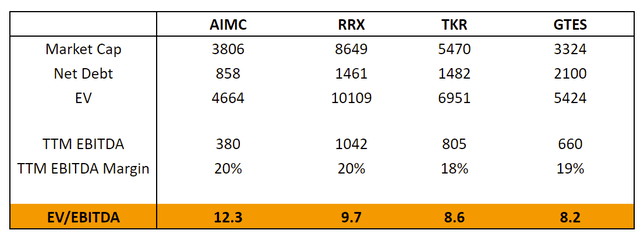

There’s a merger in the industrial component manufacturing industry. A producer of powertrain transmission components Altra Industrial Motion Corp (NASDAQ:AIMC) is getting acquired by a larger peer Regal Rexnord (NYSE:RRX) at $62/share in cash. The transaction will expand RRX’s power transmission products catalog (bearings, shaft locks, motors) with AIMC’s clutch and brake components. Shareholder approval seems likely considering the sizeable transaction premium to the unaffected price (54%) as well as the offer valuing AIMC at 12.3x TTM EBITDA – significantly above similar-profile comps TKR (8.6x) and GTES (8.2x). Approvals from regulators of multiple countries, including China, will be required. Closing is expected in H1’23. The spread used to stand at 4% reflecting minimal closing risks. However, the spread widened to as much as 9% recently before settling at the current level of 6%. This coincided with the termination of DuPont de Nemours (DD)-Rogers (ROG) merger after the companies were unable to obtain timely regulatory clearance from China. While Chinese regulatory approval is by no means guaranteed, several points suggest that the current spread might be overblown:

- DD/ROG merger was in a much more strategically sensitive industry – semiconductors. As of 2021, DD generated $2.1bn (17% of total) in revenues from semiconductor-related materials. Meanwhile, ROG produces circuits and other materials some of which are used in semiconductor applications. The previous large US merger to fall apart due to Chinese regulators was also in the semiconductor space – Qualcomm and NXP back in 2018. In contrast, AIMC and RRX operate in a completely different, much less strategically sensitive power transmission component industry. Moreover, AIMC/RRX has much less revenue exposure in China – around 12% vs 34%-40% for ROG and DD.

- Earlier in the year, AIMC completed the sale of the Jacobs Vehicle Systems (JVS) segment to Cummins for $325m – the divestiture received Chinese regulatory approval. Though the transaction size was much tinier, the buyer Cummins was a much larger company – $34bn market cap versus $8bn of RRX.

Other regulatory approvals seem likely. Horizontal overlap in the power transmission segment (around 50% of sales for both companies) is minimal. Moreover, the powertrain component industry is highly fragmented, with many smaller competitors in the market. The combined company would have only 11% of the power transmission component market share globally. Industrial powertrain component space has also seen similar acquisitions recently. In Jul’21, RRX’s peer RBC acquired ABB’s mechanical power transmission division in a $2.9bn merger. Both companies had overlapping product offerings, including industrial bearings. Another notable transaction is the combination of Regal Beloit and Rexnord’s spun-off Process and Motion Control (‘PMC’) segment to form the present-day RRX in 2021. The $3.7bn transaction, which combined two powertrain component portfolios, closed in 8 months. Chinese approval was also required.

The remaining half of AIMC revenues is mostly in the automation segment. Overlap in the automation segment is minimal as RRX’s automation business is in its early stages with only $200m in annual revenue compared to $900m at AIMC.

Strategic Rationale

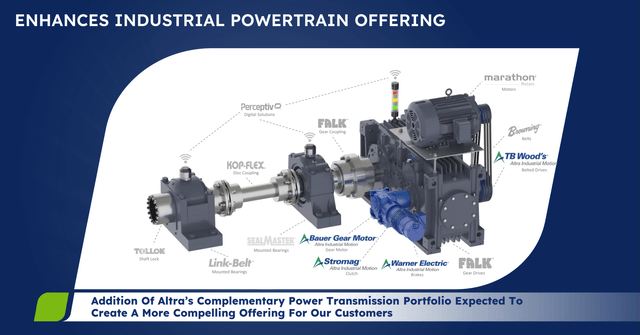

The transaction seems be highly strategic for the acquirer RRX. AIMC designs and manufactures industrial powertrain components (49% of revenues) and provides industrial automation solutions (51%). RRX has been clear about adding AIMC’s automation business to its portfolio given that the segment largely serves markets (70% of sales) which RRX expects to benefit from secular growth tailwinds, such as factory automation, medical and aerospace, amid a tight labor market. Meanwhile, target’s industrial powertrain offerings will enhance RRX’s powertrain offering with critical clutch and brake components. Given complementary portfolios and overlapping end-markets – with 54% and 73% of revenues generated in North America for AIMC and RRX respectively – the companies expect significant cost synergies. Cost savings are expected to reach $160m annually compared to $1.4bn in combined TTM EBITDA and would come from corporate overhead, procurement, distribution and footprint efficiencies.

Acquisition Investor Presentation, October 27, 2022

Relative Valuation

AIMC’s peers TKR and GTES are trading significantly below on a TTM EBITDA basis. Notably, these peers, while slightly more levered than AIMC, have boasted similar EBITDA margins of 18% and 19% versus 20% for AIMC. This suggests that the transaction is highly likely to receive AIMC’s shareholder approval.

Risks

Notably, with the acquisition the acquirer RRX is undertaking a significant amount of leverage, with combined company net debt-to-EBITDA ratio expected to reach 3.9x upon closing before an expected decrease to 2.5x-3x by 2024. In this light, the ongoing macroeconomic turbulence might be a risk given its impact on the end markets AIMC currently serves. However, RRX’s CEO explicitly addressed this during a merger-related conference call, stating that RRX has made an acquisition decision after conducting the required sensitivity analyses around the company’s earnings and debt:

Lastly, I want to be candid and acknowledge rising concerns among investors about a weakening global macro outlook. This dynamic was also on our minds as we evaluated this opportunity. So as part of our diligence, we conducted a number of sensitivity analyses around EBITDA reduction and further interest rate hikes to stress test our ability to service the debt. And we came away highly confident that the debt we are planning to take on to fund this acquisition is manageable, aided by the strength of cash flows in the underlying businesses, and the fact that in a downturn, free cash flow at both businesses tends to get a boost from lower working capital requirements. In addition, the sizable backlog at both businesses provides us some added revenue visibility in the near-term.

AIMC

AIMC produces highly engineered industrial components, owning a portfolio of 26 brands, including Bauer Gear Motor, Boston Gear and Warner Electric. Since 2019, the company has made several strategic acquisitions/divestitures, including acquiring A&S business in 2018 ($3bn), buying Nook Industries, manufacturer of motion control and power transmission components, in Dec’21 and divesting of Jacobs Vehicle Systems (JVS) business ($325m).

Financially, the business has generated stable revenues EBITDA in recent years, with $720m in FCF since 2018. Solid and stable performance coupled with JVS segment divestiture has allowed AIMC to significantly strengthen the balance sheet, with net debt-to-EBITDA decrease from 3.8x in 2019 to 2.3x as of Jul’22.

Conclusion

The AIMC-RRX merger seems to have a high likelihood of closing, indicating that 4% spread used to assess merger-related risks accurately. Recent spread widening to 6% seems unjustified, presenting an interesting merger arb opportunity with a 13% annualized return.

Be the first to comment