andriano_cz/iStock via Getty Images

Investment thesis

Recent trading has shown that Alteryx (NYSE:AYX) is demonstrating some stabilization in key metrics such as annual recurring revenue growth and dollar-based net expansion rate. However, this is coming at a cost with record-high spending in sales and marketing, with no evidence of sustainable underlying growth. With the shares not looking undervalued, we reiterate our neutral rating on the shares.

Quick primer

Alteryx is a provider of data preparation software called Designer, sold as packaged software on desktop PCs for individual licenses and servers for multi-users, and a cloud version released in 2022. The product is targeted primarily at ‘citizen’ data scientists, as opposed to highly skilled analytics experts. Current CEO Mark Anderson was appointed in October 2020, replacing co-founder Dean Stoecker who was made chairman. Peers include Power BI from Microsoft (MSFT), Tableau (CRM), and Domo (DOMO).

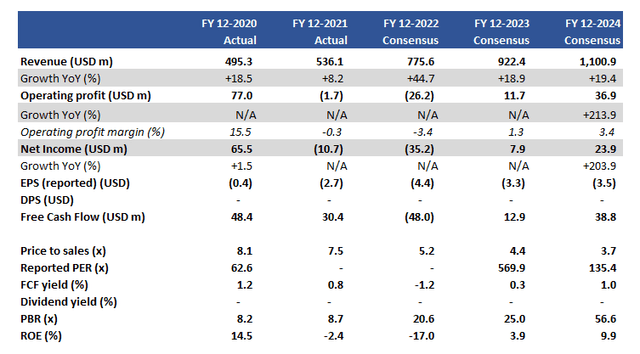

Key financials including consensus forecasts

Key financials including consensus estimates (Company, Refinitiv)

Our objectives

With CEO Mark Anderson approaching the second anniversary of his appointment, we want to see how much progress has been made to turn the business around. We are updating our view after our neutral rating from April 2022, where we felt that Q4 FY12/2021 results highlighted an unconvincing set of key performance metrics, with the Trifacta deal looking expensive and likely not to be a significant game-changer.

A very mixed picture

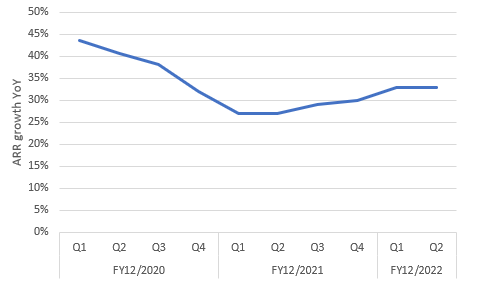

Q2 FY12/2022 results received a positive reaction from the market. The key factors appeared to be a stabilizing trend in growth metrics, chiefly for annual recurring revenue [ARR] growth YoY and dollar-based net expansion rate. ARR gives an indication of future revenue growth (although the timing is impacted by revenue recognition policies), and net expansion rate (more commonly referred to as net revenue retention or NRR) provides a metric of customer success with existing customers.

Alteryx has seen ARR growth stabilize for the last two quarters. This is positive, but not exactly a major turnaround.

Quarterly ARR Growth YoY Trend

Quarterly ARR growth YoY (Company)

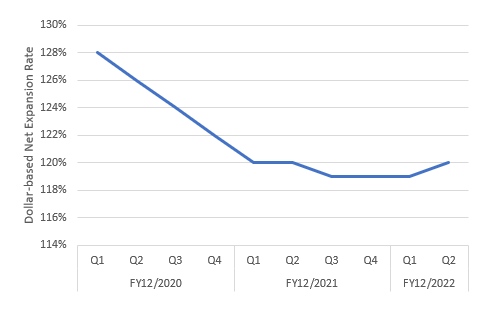

We also see that the Dollar-Based Net Expansion Rate saw an improvement QoQ. This metric compares sales growth YoY from the same cohort of customers, thereby only showing the upgrade/downgrade behavior of existing customers (as opposed to new ones as well). The conclusion is that customer success is performing better – although not a huge change QoQ and flat YoY.

Quarterly Dollar-Based Net Expansion Rate Growth YoY Trend

Quarterly Dollar-Based Net Expansion Rate Growth YoY Trend (Company)

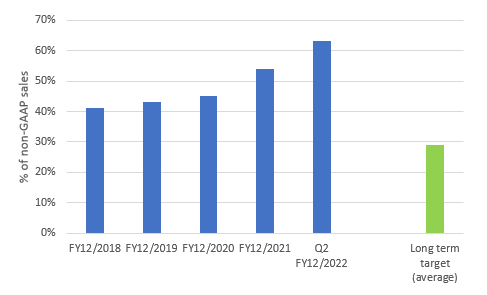

The key question we ask is how this improvement has been achieved. The earnings call talked about focusing on government and enterprise customers, a new sales channel with professional services firm BDO, providing unified cloud deals and integration with technology partners. However, the financials also highlight that sales and marketing costs have increased significantly to 63% of non-GAPP Q2 FY12/2022 sales. Alteryx is spending aggressively to invest in growth, spending double the planned proportion of its long-term target average.

Sales and marketing expense as % of non-GAAP sales

Sales and marketing expense as % of non-GAAP sales (Company, Karreta Advisors)

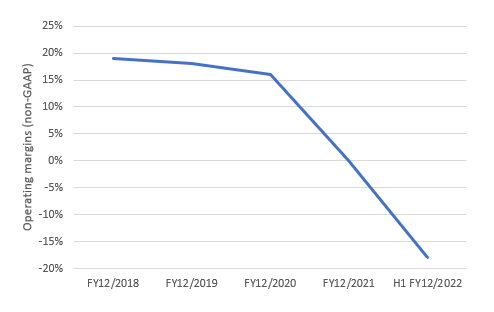

As a result, even non-GAAP operating margins have collapsed, with H1 FY12/2022 recording a -18% level.

Non-GAAP operating margin trend

Non-GAAP operating margin trend (Company)

To conclude, as investors we would expect to see a better return on performance metrics with this level of sales and marketing spend. Potentially, the benefits will materialize after a couple more quarters, but the company remains way off the benchmark SaaS ‘Rule of 40’ where the combination of revenue growth (+50% YoY for Q2 FY12/2022) and operating profit margin (-18%) equates to 40%, seen as a sustainable level of performance.

One should also add that no one should really be that excited about Alteryx booking 50% revenue growth YoY, as mechanics of ASC 606 (page 34) means major upfront recognition of contract values effectively misrepresent the real underlying growth of the business. The fact that Alteryx has decided to book approximately 50% of the total contract value in FY2022 from 35%-40% in FY2021 means that we are also not comparing apples to apples.

Valuation

On current consensus forecasts (see Key financials table above), the shares are trading on Price to Sales FY12/2023 4.4x, and a free cash flow yield of 0.3%. The former multiple looks relatively low for a subscription-type business, but Alteryx is no longer a high-growth business in our view. For a relatively mature business, we believe valuations remain fair and not vastly cheap.

Risks

One scenario for upside risk is that Alteryx management is successful in finding a suitor. A premium to the current market price is inevitable when such a deal is announced. Given its relatively lackluster performance, we do not see this risk as being high.

Customer success metrics could turn around, particularly for ARR growth as new mandates are won which could bode well for future earnings. However, the sustainability of growth will depend on how management controls sales and marketing spending to generate profits.

Downside risk comes from management embarking on a sustained sales and marketing campaign into FY12/2023 to drive ARR growth, resulting in continued operating losses. If customers decide that Alteryx tools are not high-priority investments in a recessionary environment, we could see NRR drop which indicates falling customer success.

Conclusion

Alteryx remains work-in-progress as a turnaround project in our view. Whilst its technology serves its customers well, it still does not appear to be the must-have office tool despite its lengthy presence in the market. Fundamentals remain unconvincing, and we believe the near-term outlook is to operate in a challenging recessionary environment despite management’s comments on current benign conditions. With valuations not looking undervalued, we reiterate our neutral rating on the shares.

Be the first to comment