Jonathan Kitchen

It’s been about three months since I posted my latest cautious piece about Altair Engineering Inc. (NASDAQ:ALTR) and in that time the shares are up about 5.5% against a gain of 5.6% for the S&P 500. The company has posted earnings since, so I thought I’d look at the name yet again. I want to see if there’s any reason to think there’s now a positive relationship between sales and earnings. Given the new financial picture at the firm, I want to see if the valuation is as stretched as it was when I last reviewed this name. Finally, I recommended calls in lieu of shares to those who insisted on staying long, and I want to write briefly about how that trade worked out.

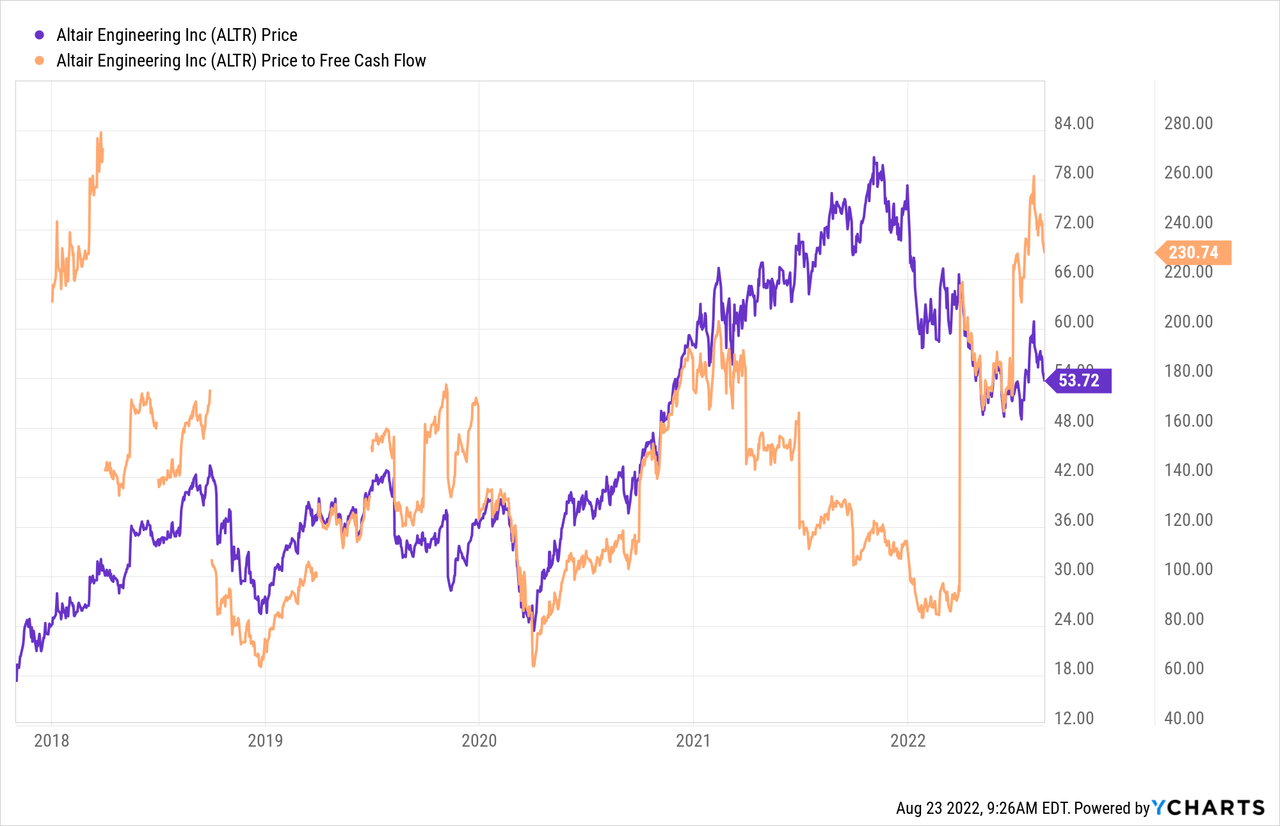

It’s a busy old world and for that reason I’m assuming that you’ve got much more important things to do than wade through yet another 1,800 word article from me. Given that, I have chosen to express my magnanimity by giving you the high points of my article in a pithy “thesis statement” paragraph so you won’t have to wade through the rest of this. You’re welcome. The troublesome relationship between revenue and net income persists, and the shares are now trading at price to free cash flow level of over 230 times. That is excessive for a profit machine, which this company certainly is not. For those who insist on staying long, I continue to recommend buying calls in lieu of shares. These offer most of any upside these shares will enjoy, at a fraction of the risk. While there’s a chance that these will lose their value if the stock drops in price or grinds along at current levels, held down by valuations, that risk is acceptable in my view. For one thing, the investor will free up capital that can be deployed in safer investments. Additionally, I think there’s a value to not keeping capital tied up in inferior stocks for years. The limited lifespan of a call option forces the investor to rethink their thesis in a way that stocks unfortunately don’t.

Financial Snapshot

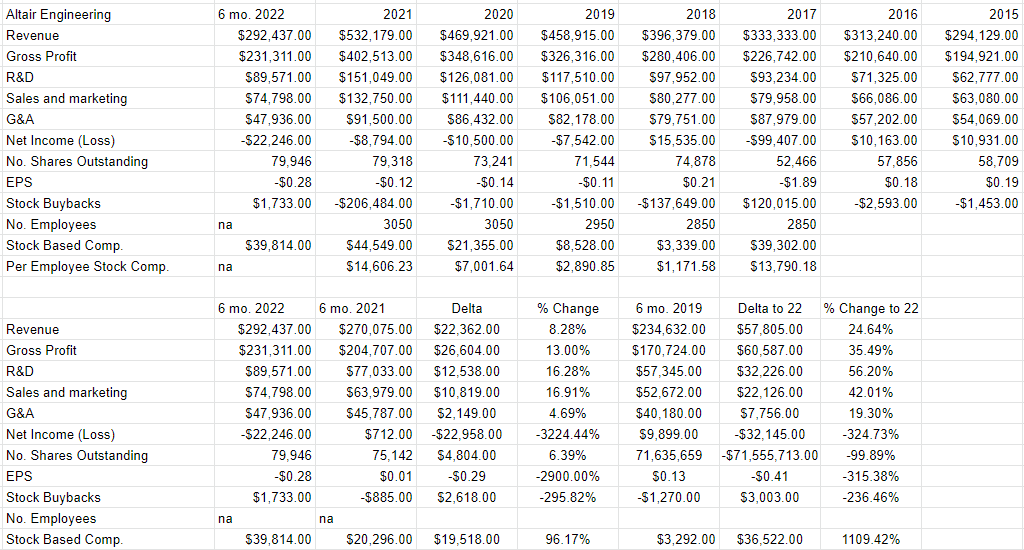

I think the problems I cited earlier linger. Specifically, the more this company sells, the more it seems to lose. For example, in spite of the fact that revenue during the first six months of 2022 rose 8.28% relative to the same period in 2021, net income collapsed from a small gain in 2021 to a loss of $22.25 million during the current year. It’s worth noting that net income fell largely as a result of an “other expense” of $23.975 million for the first half of 2022. While that may explain this year, to paraphrase my dearly departed father “there’s always something.” Net income has been negative every year since 2018 in spite of a massive uptick in revenue. This prompts the very obvious question: if growing sales doesn’t cause growing net income, what will?

The obvious problem is that expenses of various types are growing at either the same or greater rate than revenue. For instance, while revenue grew by 8.3% during the first six months of this year, R&D, Sales and Marketing, and G&A expenses climbed by 16.3%, 16.9%, and 4.7% respectively.

When we look past a simple comparison between 2022 and 2021, the same story re-emerges. For instance, revenue in 2022 is nearly 25% greater than it was in 2019, yet net income is about $32 million lower. This is a very relevant question in light of the fact that net income is the source of all investor returns.

Finally, I wouldn’t be me if I didn’t point out that one group that seems to be doing well are employees. Stock based compensation is about 96% higher in 2022 than it was in 2021, and is up ~1100% relative to the same period in 2019. This gives me some comfort. Also, knowing what I know about the modern corporation, I have some faith that this stock based compensation is distributed very fairly and reasonably at the firm.

Anyway, given the persistent disconnect between sales and profits, I’d want to see the stock trading at a very reasonable valuation before I considered buying it.

Altair Engineering Financials (Altair Engineering investor relations)

The Stock

If you’ve read any of my articles you know that I am of the view that a given business and the stock that supposedly represents it are very different things, and as such, we need to consider each of them separately when making a buy or sell decision. I’m of the view that a reasonably strong company can be a terrible investment at the wrong price, while a struggling company like Altair can be a decent investment if you pick it up at a sufficient discount to intrinsic value.

Another way to conceive of this idea is that business is an organization that buys a number of inputs, performs value-adding activities to those, and sells the results at a profit. The stock, on the other hand, is a traded instrument that reflects the crowd’s aggregate belief about the long-term prospects for a given company. If you have any experience investing at all, you may have noticed that the crowd can be capricious and has a tendency to drive prices up and down relatively frequently. Added to that is the volatility induced by the crowd’s views about a given sector. A stock can be affected by the pronouncements of some analyst or other. Additionally, a company’s stock can be buffeted by our collective view about “stocks” as an asset class. All of this together adds up to the fact that the stock is often a poor proxy for what’s going on at the firm. This is frustrating in some ways, but it also represents opportunity for us. If we can spot discrepancies between the price and likely future results, we’ll do well over time. It’s typically the case that the lower the price paid for a given stock, the greater the investor’s future returns. The greater the price paid, the worse the returns. In order to buy at these cheap prices, you need to buy when the crowd is feeling particularly down in the dumps about a given name. In my world, “down in the dumps” means “cheap.” You can tell when the crowd is down in the dumps about a stock when it’s trading at a very low valuation.

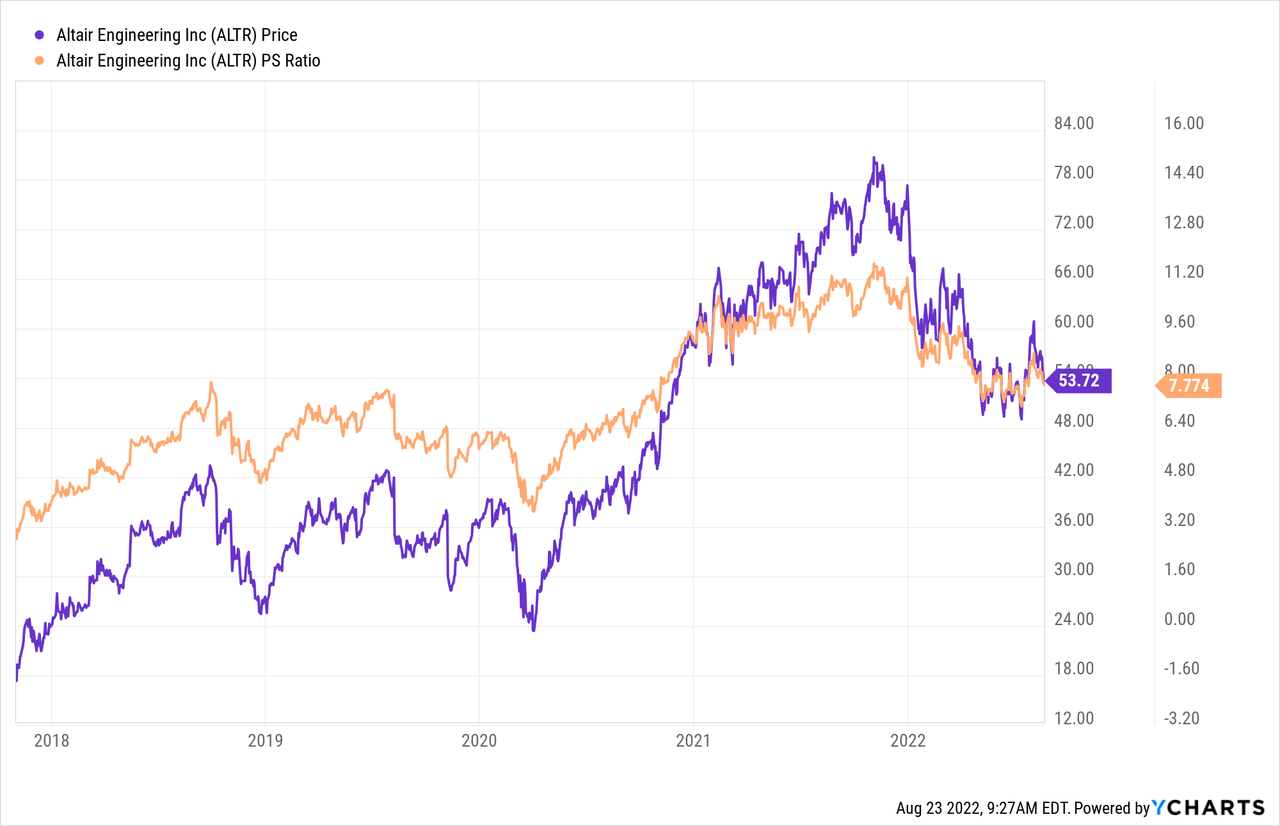

Those who read my stuff regularly also know that I measure the cheapness of a stock in a few ways, ranging from the simple to the more complicated. On the simple side, I track multiples of price to some measure of economic value, like earnings, free cash flow, book value, and the like. Ideally, I want to see a company trading at a discount to both the overall market and its own history. When I last reviewed Altair, I blanched at the fact that the price to free cash flow and price to sales were at 176.2 and 7.64 times respectively. The market for these shares was very optimistic, and I considered that to be a very bad sign. Fast forward a few months and here’s the current state of this investment.

While the shares are about 30% more expensive than they were when I last reviewed this name, they’re only ~1.3% more expensive on a price to sales basis, per the following:

In addition to looking at simple ratios, I actually use a large number of other, more complex valuation measures, one of which involves trying to understand the assumptions currently embedded in price. If you read me regularly, you know that I rely on the work of Professor Stephen Penman, and increasingly Mauboussin and Rappaport to do this. This approach uses stock price itself as a source of information. It involves “reverse engineering” the assumptions that cause the current price, and when I applied it to Altair previously, it seemed that the market forecasted a growth rate of ~11% for this company. I considered that to be massively optimistic, and thus risky. Fast forward to the present, and the assumptions for growth are at about 9.75% at the moment. It’s a bit better, but still very optimistically priced in my view. Given all of the above, I must recommend continuing to avoid this name.

Options Update

In the missive before last on this name, I suggested that people who insisted on staying long this name express that perspective with the October calls with a strike of $60. In my previous missive on this name, I bragged that the calls had lost only about $3.20 per share relative to the $8.40 per share that stockholders lost.

These are now bid at $1, which is a problem on some level. In my view, it’s still the preferred way to “play” an investment in this “profits light” business. The call buyer loses their capital over time, and that’s troublesome, obviously. In my view, though, it’s preferable to the circumstance where capital is tied up for years at a time, not earning anything in the vain hope that some stock is “going to come back.”

Given that, if someone insists on staying long this very expensive, profits free company, I think calls still represent the best option available. They would capture most of any upside in the stock, while risking much less capital. In terms of specifics, I think the April 2023 calls with a strike of $50 make the most sense, because they’re asked at only $9.70 each. Note that this asking price is only $0.70 greater than the January $50s. So, for about 19% of the capital at risk, the investor will capture any upside on this stock between now and the third Friday of April 2023. That means that they’re free to invest 81% of the capital in something much safer.

If the shares drop from current levels, the call buyer will suffer obviously, but may suffer far less than the stockholder. Additionally, the return from the capital not tied up in these shares minimizes the risk to the capital.

Conclusion

I think price and value can remain unmoored for some time, and I think that sooner or later the shares of a company that has growing losses will drop from current prices. I don’t think a company of this sort is worth over 200 times free cash flow. Given that, I recommend avoiding the name completely. For people who insist on going long, though, I think the calls represent the best value here. They offer much of the upside over the next eight months at a fraction of the capital at risk. Most of the (upside) flavour at a fraction of the (downside) calories sounds like a decent trade, so “switch to calls” would be my recommendation to those who like this company.

Be the first to comment