onurdongel/E+ via Getty Images

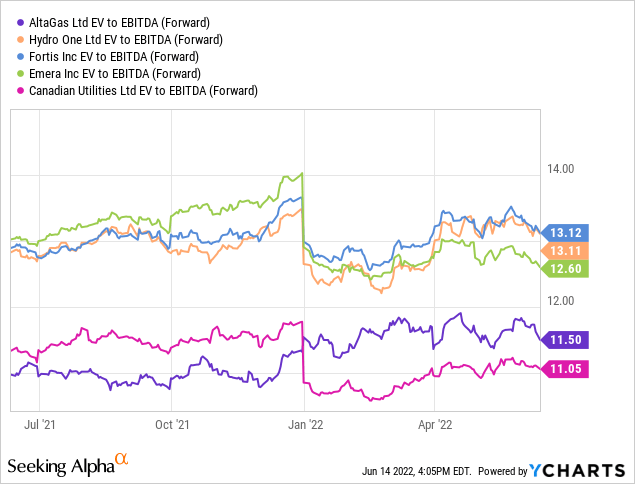

AltaGas (OTCPK:ATGFF), a diversified energy infrastructure company operating across midstream, power generation, and utilities in North America, recently agreed to sell its utility assets in Alaska for ~$800m in cash to privately held TriSummit Utilities. The sale itself will come as little surprise to shareholders given a possible transaction had long been rumored to be in the works, but the ~$800m price tag is a positive surprise, particularly in the current market backdrop. Over the coming months, the sale proceeds provide capital allocation optionality to the company – this could help to accelerate AltaGas’ deleveraging efforts or be used for growth reinvestments across the remainder of the utilities rate base and the midstream platform. The stock is currently trading at ~12x fwd EV/EBITDA – a discount to its utilities peers Hydro One (OTC:HRNNF), Fortis (FTS), and Emera (OTCPK:EMRAF). Further regulatory progress on the Mountain Valley Pipeline (‘MVP’) as well as accretive capital deployment should support a re-rating in the coming months.

Realizing C$1.0bn from Alaskan Utilities

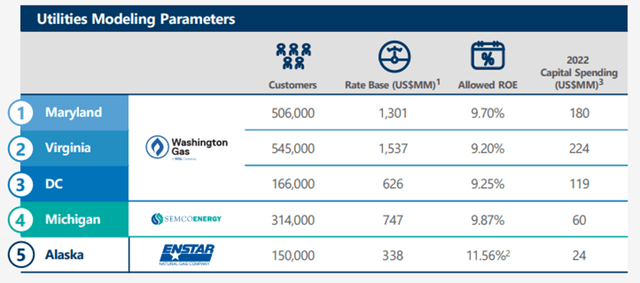

AltaGas has announced an agreement to dispose of its Alaskan utilities for total proceeds of $800m (equivalent to ~C$1.0bn) to TriSummit Utilities Inc. The run-rate transaction multiple stands at ~29x earnings and ~17x EV/EBITDA, signaling an accretive outcome relative to AltaGas’ fwd trading multiple of ~12x EBITDA. As part of the deal, AltaGas will sell its entire interest in ENSTAR Natural Gas, the largest local natural gas distributor in the state with ~150k customers, Alaska Pipeline Company, a transmission and distribution pipeline operator, as well as its 65% stake in Cook Inlet Natural Gas Storage Alaska (CINGSA). This means that post-transaction, AltaGas will have a concentrated utility operation in the Eastern US region. In turn, the more focused geographic exposure should allow the company a strong rate base growth runway over the coming years, supported by infrastructure investments through accelerated replacement programs. Per the press release, the transaction is set to close around Q1 2023, subject to various regulatory approvals, most notably the Regulatory Commission of Alaska.

Private Market Valuations Buoy Gas Utility Asset Sale

Given their relatively small contribution at ~ $350m rate base and relatively muted growth in recent years, AltaGas’ Alaskan assets fall neatly into the non-core bucket. These were good quality assets, though – the allowed common equity % for ENSTAR hit ~52%, and ROE was at ~12%, while CINGSA sustained a similarly strong ~53% allowed common equity % and ~10% ROE over the last year.

Still, the ~$0.8bn purchase price was a surprisingly high valuation for a lower growth utility, implying a ~29x multiple on trailing allowed earnings and ~2x trailing rate base. In essence, the TriSummit transaction is a testament to robust private market valuations for gas utility assets, in my view. Earlier this year, for instance, South Jersey Industries (SJI) received a lofty ~20x P/E (1.8x EV /rate base) takeout offer, while the acquisition of Dominion Energy’s (D) Hope Gas by Ullico came in at an even loftier ~26x earnings multiple (~2x rate base). Should these private market bids for gas utility assets sustain, public gas utilities should stay resilient through the year.

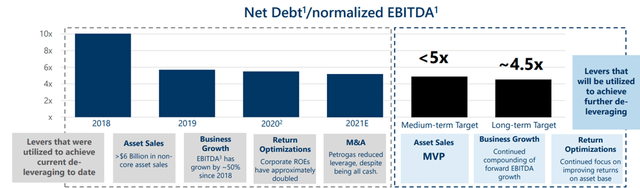

Accelerating the Deleveraging Path

The announced sale also demonstrates AltaGas’ commitment to monetizing its non-core assets and recycling capital into accretive opportunities, in my view. On an after-tax basis, the company pegs net proceeds at C$985m to be allocated toward debt pay down and funding the capital plan. This implies a ~0.4x reduction in debt/EBITDA upon the closing of the transaction, and with that, the company could achieve its near-term <5x debt/EBITDA target (excluding hybrid securities) sooner than expected. In turn, the accelerated deleveraging opens up opportunities to support the company’s growth opportunities across the Utilities and Midstream platforms or initiate a larger capital return down the line.

AltaGas (Investor Day 2021 Deck)

Given the stock price rally following the sale announcement, expect further upside if the company continues to monetize additional non-core assets. In the coming months, progress on Mountain Valley Pipeline will be key – while MVP has long been talked about as an asset sale candidate, the process has been hampered by regulatory challenges this year, and thus, any positive news here could lift the stock. With midstream valuations still favorable in the current market environment, though, the company could tap into various options available to initiate a monetization event going forward, which includes significantly reducing leverage at MVP.

Crystallizing Shareholder Value with Alaskan Utilities Sale

Net, this pending transaction is a positive for AltaGas – it crystallizes shareholder value from non-core assets, accelerates the balance sheet deleveraging, and demonstrates management’s commitment to accretively recycling capital. Fundamentally, near-term guidance numbers and the relatively high mid-term utility rate base outlook remain intact, while the midstream business continues to offer differentiated access to Liquefied Petroleum Gases (LPG) exports off the west coast. In essence, AltaGas provides investors diversified energy infrastructure exposure and above utility average potential returns at a relative discount. The stock currently trades at ~12x fwd EBITDA, a discount to its utilities peers, but should re-rate as the sale of the Mountain Valley Pipeline and other utility assets materialize over time.

Be the first to comment